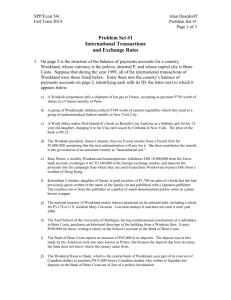

PPTX

advertisement

Econ 340 Lecture 16 Fixed versus Floating Exchange Rates Outline: International Macroeconomics • Recall Macro from Econ 102 – Aggregate Supply and Demand – Policies • Effects ON the Exchange Market – Expansion – Interest Rate • Effects OF the Exchange Market – Depreciation via Trade – Depreciation via Net Wealth • Effects THOUGH the Exchange Market Econ 340, Deardorff, Lecture 15: Int Macro 2 Effects THROUGH the Exchange Market • The issue here: – Do macroeconomic effects get transmitted to other countries, and if so how? – i.e., does an expansion, for example, in one country cause an expansion or a contraction in other countries? Econ 340, Deardorff, Lecture 15: Int Macro 3 Effects THROUGH the Exchange Market – The answer: Although many exceptions are possible, it is usually true that changes in one country cause changes in the same direction in others: • Expansion here → expansion there • Inflation here → inflation there • High interest rates here → high interest rates there Econ 340, Deardorff, Lecture 15: Int Macro 4 Effects THROUGH the Exchange Market • Example: How a recession in US can cause recession Canada – Fall in aggregate demand in US (due to nonmonetary contraction such as a fall in investment) leads to • Fall in US income, leads to • Fall in Canadian exports to US, leads to • Fall in Canadian income – To see these links in more detail… Econ 340, Deardorff, Lecture 15: Int Macro 5 US Investment Falls US Income Falls US Imports Fall US Interest Rate Falls US Dollar Depreciates US Imports Fall More Canadian Exports Fall Canadian AD Falls Canadian Income Falls Econ 340, Deardorff, Lecture 15: Int Macro 6 Effects THROUGH the Exchange Market • We’ve seen some of this dramatically during the last few years: – Crisis started in US – Effects were transmitted to the world – Exception: US dollar did not depreciate immediately; it appreciated at first. (Due to flight to safety.) Econ 340, Deardorff, Lecture 15: Int Macro 7 Outline: Fixed versus Floating Exchange Rates • Both Systems Are Used • What the “Experts” Recommend • Pros and Cons of Floating – Disruption When Rates Move – Automatic Adjustment • Pros and Cons of Pegging – Stability – Instability • Alternatives – Crawling Peg – Monetary Unification • The Problem of Undervalued Currencies Econ 340, Deardorff, Lecture 16: Fixed/Float 8 Who Uses Fixed and Float • Lessons from the list of exchange arrangements (below) – Floating rates are used by many countries • Rich & poor • Large & small • All over the world – Pegged rates are used today mostly by small countries – Many countries are between fixed and floating (Source of table below: IMF, “Annual Report on Exchange Arrangements and Exchange Restrictions 2014”) Econ 340, Deardorff, Lecture 16: Fixed/Float 9 Exchange Arrangements of Sample Countries, as of 2014 Floating Exchange Rates Australia Canada 47 countries + euro 18 Mexico Sweden India United Kingdom Japan United States Pegged Exchange Rates Belize Morocco Denmark Nepal Jordan Saudi Arabia Econ 340, Deardorff, Lecture 16: Fixed/Float 44 countries 10 Exchange Arrangements of Sample Countries, as of 2014 Between Floating and Pegged: 57 countries Stabilized Arrangement 21 countries Iraq Singapore Lebanon Vietnam Crawling Peg or Crawl-like Arrangement Nicaragua China Other Managed Arrangement Bangladesh Russia Malaysia Switzerland Econ 340, Deardorff, Lecture 16: Fixed/Float 17 countries 19 countries 11 Exchange Arrangements of Sample Countries, as of 2014 More Fixed than Pegged: Currency Board Hong Kong Lithuania No Separate Legal Tender Ecuador ($) 12 countries 12 countries Montenegro (€) • Currency Board – Peg to another currency – Vary money supply automatically with changes in international reserves (= forced nonsterilization) Econ 340, Deardorff, Lecture 16: Fixed/Float 12 Country Distribution of Currency Arrangements 2014 Pegged Float More Fixed 0% None 20% Cur. Board More Flexible 40% Pegged 60% Stabilized 80% Crawl Econ 340, Deardorff, Lecture 16: Fixed/Float Managed 100% Float 13 Outline: Fixed versus Floating Exchange Rates • Both Systems Are Used • What the “Experts” Recommend • Pros and Cons of Floating – Disruption When Rates Move – Automatic Adjustment • Pros and Cons of Pegging – Stability – Instability • Alternatives – Crawling Peg – Monetary Unification • The Problem of Undervalued Currencies Econ 340, Deardorff, Lecture 16: Fixed/Float 14 What “Experts” Recommend • Some favor freely floating rates – Let exchange rate adjust to fix imbalances – “Let the market work” • Others favor perfectly fixed rates – Define currency rigidly in terms of something you can’t control • Gold • Foreign currency (“Currency Board”) – AND give up control of the money supply • Let flows of money fix imbalances i.e., do not sterilize! Econ 340, Deardorff, Lecture 16: Fixed/Float 15 What “Experts” Recommend • Advocates of floating rates – Milton Friedman (Nobel Prize 1976): “A country that enters into a hard-fixed rate bears an economic cost. The cost is discarding a means—a flexible exchange rate—of adjusting to external forces that impinge on it differently than on the other country or countries whose currency it shares.” Econ 340, Deardorff, Lecture 16: Fixed/Float 16 What “Experts” Recommend • Advocates of floating rates – Jeffrey Sachs: “Once reserves are gone, investors panic. The worst mistake is for countries to wait too long to float their currencies.” Econ 340, Deardorff, Lecture 16: Fixed/Float 17 What “Experts” Recommend • Advocates of fixed rates – Robert Mundell (Nobel Prize 1999): “A world currency of some sort has existed for most of the past 2,500 years. Two thousand years ago, in the age of Caesar Augustus, it was the Roman aureus... A hundred years ago it was the gold sovereign. Less than thirty years ago it was the 1944 gold dollar. The world has been without a universal currency for only a tiny fraction of its history.” Econ 340, Deardorff, Lecture 16: Fixed/Float 18 What “Experts” Recommend – Milton Friedman: “If [over the last 30 years] the Canadian dollar had been rigidly tied to the US dollar, those differences would have required Canada to deflate relative to the United States, with unfortunate consequences for Canada that would have strained, to put it mildly, the trade relations between the two countries, and have put strong pressure on Canada to devalue or float.” Econ 340, Deardorff, Lecture 16: Fixed/Float 19 What “Experts” Recommend – Robert Mundell: “Exchange rate uncertainty imposes a cost of trade much like a tariff ... If Canada and the United States shared a stable common currency or an irrevocably fixed exchange rate, Canada’s real income would soar, closing a large part of the gap between the two countries’ GDP per capita.” Econ 340, Deardorff, Lecture 16: Fixed/Float 20 What “Experts” Recommend • “Bradford DeLong, an economic historian at the University of California at Berkeley, explains the debate to his students this way: To Mr. Friedman, an exchange rate is a price; therefore, it is an infringement on human freedom to peg it. To Mr. Mundell, an exchange rate is a promise; to change it is to default on a commitment. ” (WSJ) Econ 340, Deardorff, Lecture 16: Fixed/Float 21 What “Experts” Recommend • Allan Meltzer (Carnegie-Mellon): “The best you can say of what economic research has produced is: – You can make a case for freely floating exchange rates if you’re willing to live with the consequences. – You can make a case for fixed exchange rates if you’re willing to live with the consequences. – You can’t make much of a case for anything in between.” (WSJ) Econ 340, Deardorff, Lecture 16: Fixed/Float 22 What “Experts” Recommend • Where they agree: An “adjustable peg” is worse than both fixed and floating rates – Friedman: “The reasons why a pegged exchange rate is a ticking bomb are well known.” – Mundell: “I have never nor ever would advocate a general system of “pegged” rates. Pegged rate systems always break down.” Econ 340, Deardorff, Lecture 16: Fixed/Float 23 Outline: Fixed versus Floating Exchange Rates • Both Systems Are Used • What the “Experts” Recommend • Pros and Cons of Floating – Disruption When Rates Move – Automatic Adjustment • Pros and Cons of Pegging – Stability – Instability • Alternatives – Crawling Peg – Monetary Unification • The Problem of Undervalued Currencies Econ 340, Deardorff, Lecture 16: Fixed/Float 24 Pros and Cons of Floating • Con: Exchange rates DO MOVE; And when they do, they cause – Macro effects (as we saw last time) • Depreciation – Stimulates aggregate demand, but not necessarily when needed: may just cause inflation – Changes values of assets and liabilities • Appreciation – Reduces aggregate demand, may cause recession or deflaton Econ 340, Deardorff, Lecture 16: Fixed/Float 25 Pros and Cons of Floating • Con: Exchange rates DO MOVE; when they do, they cause – Micro effects: exports and imports subject to • Uncertainty • Instability Costly for traders Like trade barrier Reduces trade Econ 340, Deardorff, Lecture 16: Fixed/Float 26 Pros and Cons of Floating • Example: The US dollar rose 50% during 19801985 Trade Weighted Dollar Index - Real 140 120 100 80 60 40 Econ 340, Deardorff, Lecture 16: Fixed/Float Jan-05 Jan-03 Jan-01 Jan-99 Jan-97 Jan-95 Jan-93 Jan-91 Jan-89 Jan-87 Jan-85 Jan-83 Jan-81 Jan-79 Jan-77 Jan-75 20 0 Jan-73 – Caused US auto and other industries to contract – Major dislocation in middle US – Ended in 1985 when in “Plaza Accord” major central banks agreed to intervene 27 Pros and Cons of Floating • Pro: Exchange rate provides efficient and automatic across-the-board adjustment – Suppose that, due to inflation, our prices are too high, causing our imports to rise and exports to fall • Exchange depreciation fixes this for all sectors • With fixed rates, individual prices and wages would have to fall to become competitive: much more painful – That’s what Greece and other weak countries in the EU have had to do recently. – Called “internal devaluation” – Floating Permits countries to have independent monetary policies to deal with macroeconomic shocks Econ 340, Deardorff, Lecture 16: Fixed/Float 28 Pros and Cons of Floating • Experience with exchange rates in the 1930s (not really floating, but they moved a lot) made governments prefer fixed rates • After WWII, IMF was created, based on Pegged Exchange Rates – Most currencies pegged to US $ – IMF helped countries manage this – When in trouble, countries devalued Econ 340, Deardorff, Lecture 16: Fixed/Float 29 Outline: Fixed versus Floating Exchange Rates • Both Systems Are Used • What the “Experts” Recommend • Pros and Cons of Floating – Disruption When Rates Move – Automatic Adjustment • Pros and Cons of Pegging – Stability – Instability • Alternatives – Crawling Peg – Monetary Unification • The Problem of Undervalued Currencies Econ 340, Deardorff, Lecture 16: Fixed/Float 30 Pros and Cons of Pegging • Pro: If it succeeds, exchange rate is stable, avoiding disruptions • Con: If it fails, – devaluation causes instability, – just like floating rates, only worse • The Problem: Pegged Rates are Prone to Crisis Econ 340, Deardorff, Lecture 16: Fixed/Float 31 Pros and Cons of Pegging • Why Crisis? – Pegged rate does not respond to market changes – Some currencies become undervalued, others overvalued • Inevitable unless all countries have exactly the same rate of inflation – Crisis eventually erupts for overvalued currencies Econ 340, Deardorff, Lecture 16: Fixed/Float 32 Pros and Cons of Pegging • Why Crisis for Overvalued Currency? $/€ – Central bank must sell foreign currency – Since reserves E0 are finite, they eventually run out E* – Market knows that when they do… Econ 340, Deardorff, Lecture 16: Fixed/Float S€ Fed sells € D€ Q€ 33 Pros and Cons of Pegging • Why Crisis for Overvalued Currency $/€ – Intervention will stop – Currency will depreciate E0 – Knowing this, people don’t want E* to hold the overvalued currency, so… Econ 340, Deardorff, Lecture 16: Fixed/Float S€ D€ Q€ 34 Pros and Cons of Pegging • Why Crisis for Overvalued Currency – Before reserves $/€ run out, capital outflow increases demand – And reserves fall E0 faster E* – “Speculative Attack” S€ Fed sells more € D€ D€1 Q€ Econ 340, Deardorff, Lecture 16: Fixed/Float 35 Pros and Cons of Pegging • Pegged rates offer speculators a “one-way bet” – Once they see that reserves are falling… – … they bet on a devaluation by selling the country’s currency • If they are right, they win • If they are wrong, they break even (since the exchange rate doesn’t change) – They can’t lose, so they bet a lot Econ 340, Deardorff, Lecture 16: Fixed/Float 36 Pros and Cons of Pegging • Crisis even without Overvaluation – Crisis only requires expectation of devaluation • The expectation doesn’t have to be justified; it only has to be believed • Can happen even to a currency that is not overvalued – How? By “contagion”. • If one country has a crisis, for whatever reason • Other countries that are near it, or similar to it, may become suspect • That’s part of what happened in the Asian Crisis that started in 1997 • Some countries fear contagion today Econ 340, Deardorff, Lecture 16: Fixed/Float 37 Pros and Cons of Pegging • Result: “Pegged Rates” are not Fixed – In a world of pegged exchange rates, over time • Some currencies become undervalued • Other currencies become overvalued – Why? Many reasons (see Makin) • Bretton Woods: US inflation caused dollar to become overvalued • Europe in the 1990s: German tight money after reunification, caused others to become overvalued Econ 340, Deardorff, Lecture 16: Fixed/Float 38 Pros and Cons of Pegging • Result: “Pegged Rates” are not Fixed – Overvalued currencies are subject to speculative attacks – When they do devalue, they do it • Suddenly • By large amounts – This is just as disruptive as changes in a floating rate, perhaps more so Econ 340, Deardorff, Lecture 16: Fixed/Float 39 Pros and Cons of Pegging • The choice is not between fixed and floating: E Econ 340, Deardorff, Lecture 16: Fixed/Float Time 40 Pros and Cons of Pegging • The choice is between pegged and floating: E Which is more stable? Econ 340, Deardorff, Lecture 16: Fixed/Float Time 41 Outline: Fixed versus Floating Exchange Rates • Both Systems Are Used • What the “Experts” Recommend • Pros and Cons of Floating – Disruption When Rates Move – Automatic Adjustment • Pros and Cons of Pegging – Stability – Instability • Alternatives – Crawling Peg – Monetary Unification • The Problem of Undervalued Currencies Econ 340, Deardorff, Lecture 16: Fixed/Float 42 Alternatives • Mixtures of pegged and floating rates – Crawling peg • Change the pegged rate slowly and predictably in response to a fall or rise in reserves • Slow movement of the peg is supposed to stop the loss of reserves before crisis hits • Still subject to speculative attack Econ 340, Deardorff, Lecture 16: Fixed/Float 43 Alternatives • Mixtures of pegged and floating rates – Wider band • Let the rate move freely in a large band around the official pegged rate • Less intervention should be needed • Does not help if country has, say, higher inflation than others: crisis still inevitable Econ 340, Deardorff, Lecture 16: Fixed/Float 44 Alternatives • Truly Fixed Exchange Rate – Use another country’s currency “Dollarization” – Form a monetary union The Eurozone (we’ll look more at this next week) Econ 340, Deardorff, Lecture 16: Fixed/Float 45 Alternatives • Truly Fixed Exchange Rate – Currency Board • Peg to another currency • Replace central bank with “board” that automatically varies money supply one-for-one with international reserves – If reserves fall, so does money supply, forcing adjustment – This mimics the Gold Standard, where gold flowed among countries Econ 340, Deardorff, Lecture 16: Fixed/Float 46 Alternatives • Truly Fixed Exchange Rate – Currency Board • How it’s supposed to work – If exchange rate is over-valued (excess demand for foreign currency) » Currency board sells reserves » This reduces the domestic money supply 1-for-1 » Falling money causes falling income and prices » Imports fall, exports rise, and excess demand for foreign currency disappears – If exchange rate is under-valued: Opposite Econ 340, Deardorff, Lecture 16: Fixed/Float 47 Alternatives • Truly Fixed Exchange Rate – Currency Board • Didn’t work for Argentina, which had a crisis anyway – Must not have followed the rules Econ 340, Deardorff, Lecture 16: Fixed/Float 48 Alternatives • Pegged Rate with Capital Controls – Why did pegged rates work in the 1950s & 60s? • Most countries had capital controls • In spite of that, the system of pegged rates didn’t work perfectly: there were some crises – Capital controls prevent inflow and outflow of capital, and thus limit speculation – Today, most countries see capital controls as too costly • But not all: China, Malaysia Econ 340, Deardorff, Lecture 16: Fixed/Float 49 Alternatives The Impossible Trinity Goal: Monetary Independence Policy: Pure Float Policy: Full Capital Controls Increased Capital Mobility See Frankel (This is the Missing Figure 3) Goal: Exchange Rate Stability Goal: Full Financial Integration Econ 340, Deardorff, Lecture 16: Fixed/Float Policy: Monetary Union 50 Exchange Rates Since 1945 • See reading by Buttonwood (column in The Economist) • Bretton-Woods System, 1945-1971 – Overseen by IMF – Currencies were pegged, mostly to US $ – Capital mobility was restricted, but gradually liberalized over time – Frequent crises, as currencies became overvalued due to inflation Econ 340, Deardorff, Lecture 16: Fixed/Float 51 Exchange Rates Since 1945 • August 15, 1971: – Nixon cut the link of US $ to gold, signaling the end of pegged rates – Countries stopped pegging, then restarted at different rates, but by 1973 they had given up Econ 340, Deardorff, Lecture 16: Fixed/Float 52 Exchange Rates Since 1945 • Since 1973, major currencies have floated – Exchange rates moved more than expected – Crises did not disappear – Monetary policy became more free: • “ ‘the Greenspan put’: the use of interest-rate cuts to rescue financial markets, in effect underwriting asset prices.” Econ 340, Deardorff, Lecture 16: Fixed/Float 53 Outline: Fixed versus Floating Exchange Rates • Both Systems Are Used • What the “Experts” Recommend • Pros and Cons of Floating – Disruption When Rates Move – Automatic Adjustment • Pros and Cons of Pegging – Stability – Instability • Alternatives – Crawling Peg – Monetary Unification • The Problem of Undervalued Currencies Econ 340, Deardorff, Lecture 16: Fixed/Float 54 The Problem of Undervalued Currencies • Overvalued currencies lead to crisis – In that sense they are self correcting, since countries are forced, eventually, to devalue or float • Undervalued currencies – Do not lead to crisis, but only to accumulation of reserves – May be viewed as harmful to trading partners Econ 340, Deardorff, Lecture 16: Fixed/Float 55 The Problem of Undervalued Currencies • Today, the Chinese yuan is considered undervalued – US administration puts pressure on China to appreciate – US Congress threatens to restrict imports Econ 340, Deardorff, Lecture 16: Fixed/Float 56 2000 Jan 2000 Aug 2001 Mar 2001 Oct 2002 May 2002 Dec 2003 Jul 2004 Feb 2004 Sep 2005 Apr 2005 Nov 2006 Jun 2007 Jan 2007 Aug 2008 Mar 2008 Oct 2009 May 2009 Dec 2010 Jul 2011 Feb 2011 Sep 2012 Apr 2012 Nov 2013 Jun 2014 Jan 2014 Aug 0.180 US$/yuan Exchange Rate 0.160 0.140 0.120 0.100 0.080 0.060 0.040 0.020 0.000 Econ 340, Deardorff, Lecture 14: Pegging 57 M1 2000 M9 2000 M5 2001 M1 2002 M9 2002 M5 2003 M1 2004 M9 2004 M5 2005 M1 2006 M9 2006 M5 2007 M1 2008 M9 2008 M5 2009 M1 2010 M9 2010 M5 2011 M1 2012 M9 2012 M5 2013 M1 2014 M9 2014 China Reserves, $bill. 4500 4000 3500 3000 2500 2000 1500 1000 500 0 Recent Pronouncements • Obama: "As I've said before, China moving to a more market-oriented exchange rate would make an essential contribution to that global rebalancing effort.” Recent Pronouncements • Wen Jiabao: – “The Chinese currency is not undervalued.” “We oppose all countries engaging in mutual fingerpointing or taking strong measures to force other nations to appreciate their currencies.” – “What I don’t understand is depreciating one’s own currency, and attempting to pressure others to appreciate, for the purpose of increasing exports. In my view, that is protectionism.” Krugman’s Argument (From NYT, Mar 15, 2010) • China’s current account surplus in 2010 will be over $450 billion • US should declare China a “currency manipulator” in next report, Apr 15 – (US did not, and hasn’t since.) • China does not have US “over a barrel.” We have China over a barrel. • We should repeat what we did in 1971: – Then Nixon used a 10% surcharge on imports, so as to prod Japan, Germany, and others to appreciate – We should use (or threaten) a 25% surcharge on Chinese exports. Next Time • The Euro – What is it? – History of European monetary integration – Pros and cons of currency unification – Effects on US – What happened? Econ 340, Deardorff, Lecture 16: Fixed/Float 62