Vol. 1 - November 2012

advertisement

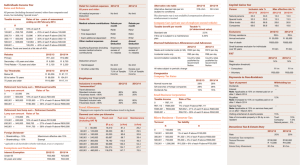

Vol, 1, November 2012 PERSONAL TAX DEADLINE LOOMING – 23 • NOVEMBER 2012 Have you taken into consideration all claimable allowances? The deadline for manual personal tax submissions passed on 30 September DO YOU WANT TO TAKE YOUR BUSINESS 2012, but if you have registered to submit your taxes via e-Filing, your TO THE NEXT LEVEL? tax submissions need to be in by no later than There 23 November 2012 (for all non provisional businesses today which prevent them tax payers). from achieving the success they deserve. While the South African Revenue Services (SARS) advertisements will have you believe that you can be “good at tax”, the are many obstacles that face You probably have a couple in mind as you read these words which are affecting your business right now. We can help! fact is that you will be even better with a The root cause of most business problems little professional help. Our expert advice lies in how its finances are managed. At will help you to take advantage of possible Ariston Financial Services we help our tax breaks that you never knew existed. clients manage their finances using both SARS won’t complain if you pay more tax tried and tested management principles, than you should, but we are sure that you and some outside-the-box thinking. Here would prefer not to. We can help you with are just some of the ways in which we can that! enrich your bottom line: The following are questions you need to • ask yourself: helped many clients to sort out their tax problems. Whether its outstanding • Have you registered for e-Filing? • If you are a director or owner of a returns, a refund that SARS won’t pay, resolving a dispute or savings on tax company, did you know you could through clever tax planning, we’ve got register as a provisional tax payer, instead of paying PAYE? • Have you filed your Income Tax Return the solution. • (ITR12) for 2012? • Tax problems? No problem – We have Do you get a Travel Allowance? If yes, do you have a log book? No money? Let’s get you the money – We help our clients raise capital for their businesses. If you need working capital to grow your business, or project finance for that big tender 1|Page you’re about to land, or simply need While there may be nothing to these start-up capital to get your business claims, this does serve as a wakeup call to off the ground, we can help you by all taxpayers that it is important to keep putting a business plan together and one’s taxes up to date. approaching the banks for you. • Don’t have a handle on your business? We give you the tools to get to grips YOU SAID VAT ??!! with it. We do everything from simply keeping the books up to date, to filing The new Tax Administration Act (effective your returns, to providing you with 1 October 2012) has caused an un- management accounts with an analysis intended change in practice with respect of your business, to drafting your to VAT. The previous allowance given to Annual Financial Statements. those submitting their VAT returns via eFiling to do so by the last working day of the month has been repealed by the new act. Until such time as SARS issues a WAKEUP CALL FOR PROPERTY SELLERS? notice stating otherwise, all VAT returns Recently, Berry Everitt of Chas Everitt have to be submitted by the 25th of the Properties reported on the Moneyweb month in which they are due. website, that SARS had introduced a new system with effect from 1 October 2012 with respect to the handling of property CONTACT US transfers, which would result in delays in any property transfer “unless all parties – Call us today about these or any other including the estate agency – have their pressing issues at (011) 056 4906, or e- tax affairs in order.” He also stated that mail us on info@aristonfs.co.za. SARS had the power to deduct any outstanding taxes on the part of the seller from the proceeds of a sale of a property, and that, in some cases, SARS could even stop a sale if the esate agency did not have its taxes up to date. Mark Kingon, GM for operations support at SARS, when asked to respond to these claims, said this is "a storm in the tea cup. Yes we ask for tax numbers but we don't stop transactions pending a person's affairs being in order on transfer duty.” 2|Page