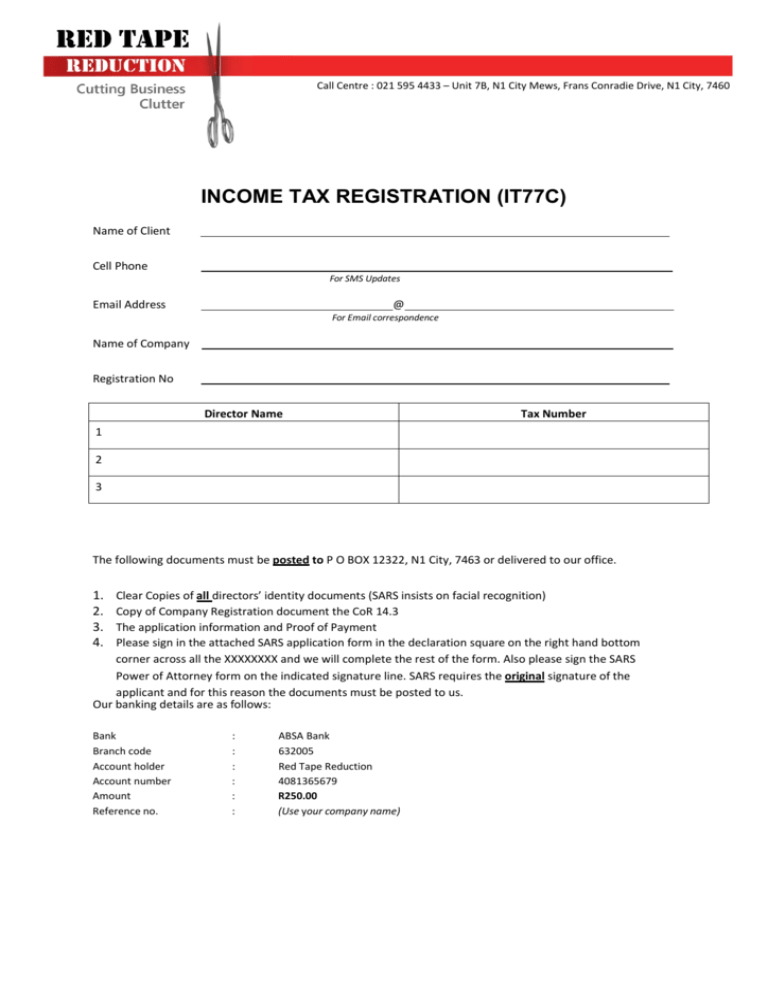

income tax registration (it77c)

advertisement

Call Centre : 021 595 4433 – Unit 7B, N1 City Mews, Frans Conradie Drive, N1 City, 7460 INCOME TAX REGISTRATION (IT77C) Name of Client Cell Phone For SMS Updates Email Address @ For Email correspondence Name of Company Registration No Director Name Tax Number 1 2 3 The following documents must be posted to P O BOX 12322, N1 City, 7463 or delivered to our office. 1. 2. 3. 4. Clear Copies of all directors’ identity documents (SARS insists on facial recognition) Copy of Company Registration document the CoR 14.3 The application information and Proof of Payment Please sign in the attached SARS application form in the declaration square on the right hand bottom corner across all the XXXXXXXX and we will complete the rest of the form. Also please sign the SARS Power of Attorney form on the indicated signature line. SARS requires the original signature of the applicant and for this reason the documents must be posted to us. Our banking details are as follows: Bank Branch code Account holder Account number Amount Reference no. : : : : : : ABSA Bank 632005 Red Tape Reduction 4081365679 R250.00 (Use your company name) Application for registration as a Taxpayer or Changing of Registered Particulars: Company IT77C TPINF01 Information Taxpayer ref. no. Where registered details have changed, the applicant must only fill in the taxpayer reference number and the details that have changed Area code Use capital letters and where applicable, mark with an “X” Details Registered Name Trading Name Registration No. Registration date (CCYYMMDD) Bus Tel No. Turnover Fax No. , R Cell No. Email address Nature of Business Programme Address Unit No. Complex Is this registration made in respect of a VDP agreement with SARS? Street No. Street / Farm name VDP Application No. (if applicable) Y N Suburb / District City / Town Country code (e.g. South Africa = ZA) Postal Code I declare that the information furnished in this application is true, correct and complete. XXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXX Address Mark here with an “X” if same as above or complete your Postal Address Please ensure you sign over the 2 lines of “X”s above Date (CCYYMMDD) Country code (e.g. South Africa = ZA) For enquiries go to www.sars.gov.za or call 0800 00 SARS (7277) Postal Code IT77C Version: v2012.0.5 Page 1 of 6 Updated on: 1/23/2013 Income Tax Registration NB: No tax registrations will be applied for, without proof of payment. What you must do Post all the documents requested on the Application form, with the application and proof of payment to us. What we will do 1) We make an appointment with SARS. The appointment date and time are provided by SARS. 2) When the application is handed in at SARS, the follow up is done within 2 – 3 weeks. 3) You will be notified via e-mail or text as soon as the tax reference number is received. 4) SARS posts the IT150 document reflecting the tax number directly to the client. Future things you will need to do after you are registered 1) You will need to submit all outstanding tax returns. This applies even if you have not used your company to run a business. Company Tax returns are called IT14’s and personal tax returns IRP6’s. Even companies registered in this year may have to submit a tax return. 2) You will need to update your banking details with SARS as they require certain company documents. 3) Once all tax returns are updated with SARS you are eligible to apply for the Tax Clearance Certificate. A Tax Clearance Certificate will only be granted if ALL the above have been complied with.