FIN 101 - Kuhle - California State University, Sacramento

advertisement

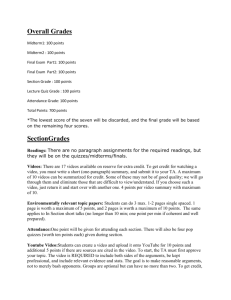

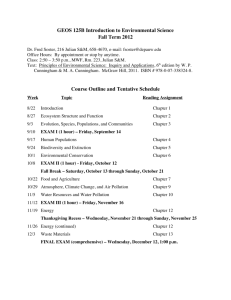

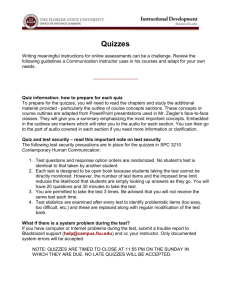

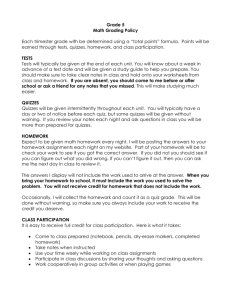

CALIFORNIA STATE UNIVERSITY, SACRAMENTO SCHOOL OF BUSINESS ADMINISTRATION FINANCE 101-SPRING 2013 http://www.csus.edu/indiv/k/kuhlej/ COURSE SYLLABUS PROFESSOR: Dr. James Kuhle OFFICE: Business 2040 OFFICE PHONE: 278-7058 OFFICE HOURS: 07:30-09:00 MW; by appointment COURSE OBJECTIVE AND GOALS: The GOALS AND OBJECTIVES of this course are based on the following topics I intend to cover and make the CORE of this class. If you successfully pass this class you should have a basic understanding of all the topics that are listed here. A. Overview of Financial Management 1. Identify the main areas of finance including financial management, investments and financial markets, and the types of decisions that are made in each area. 2. Compare the goal of wealth maximization with income and earnings maximization. 3. Identify the forms of business organization and their advantages and disadvantages. 4. Describe the agency problem as it relates to wealth maximization. B. Financial Statements and Taxes 1. Quick Review of the following accounting statements and concepts: a. Income Statement, b. Balance Sheet, c. concepts: liquidity, financial leverage, assets, liabilities, equities, revenues, expenses, profits, d. relationships between profits and dividends and retained earnings, e. distinguish between the tax treatment of interest and dividend and the difference between, marginal and average tax rates, f. various cash flow measures from the financial statements C. Analysis of Financial Statements 1. Define and compute the major ratios utilized to evaluate liquidity, asset management, debt management, profitability and market value. 2. Use the Dupont Identity to deconstruct ROE in to is component parts 3. Identify various problems that may be revealed with a ratio analysis. 4. Perform a ratio analysis on financial statements to identify possible problems with liquidity, asset management, leverage, and profitability. D. Time Value of Money and Single Cash Flows 1. Distinguish between the present and future values of single sums. 2. Identify the objective the problem is asking you to calculate. 3. Calculate present value and future values of single sums 4. Find the rate of return of single sums. 5. Understand how differences in discount rates, time to maturity, and compounding periods affect the present value and future values of single sums. 6. Distinguish between the annual percentage rate [APR] and the effective annual yield.[EAR]. E. Time Value of Money Multiple Cash Flows 1. Distinguish between the present and future values of multiples cash flows, single sums and annuities. 2. Understand how differences in timing of cash flows, discount rates, and compounding periods affect the present value and future values of cash flows 3. Identify the objective the problem is asking you to calculate. 4. Solve numerous problems involving present values, future values, annuities, perpetuities, annual and non-annual periods of time, and discount rate of cash flows. 5. Distinguish between the annual percentage rate and the effective annual yield on the rate of return of an annuity. 6. Relate problems to various kinds of investment and financing decisions. 7. Construct an amortization table. F. Bonds and Their Valuation 1. Understand the present value of expected future cash flows to be the basis for valuation of all financial securities. 2. Define basic terms associated with bonds including par value, indenture, debenture, coupon rate, yield-to-maturity, bond ratings, zero coupon bonds, junk bonds, income bonds, municipals, convertible bonds, and callable bonds. 3. Compute the bond price of a bond using both annual and semi-annual discounting. 4. Describe the relationship between yield-to-maturity, time to maturity, and bond price. 5. Explain the effect of inflation, interest rate risk, default risk, taxability, and liquidity on a bond’s yield to maturity. G. Stocks and Their Valuation 1. Define basic terms associated with common stock including par value, classes of common stock, voting procedures, and rights. 2. Compute rates of return and/or common stock prices as the present value of the expected future dividends. 3. Understand the assumptions used in the constant growth rate model Compute common stock price using a constant growth rate model and non constant growth models. 4. Critique the efficient market hypothesis as it relates to undervalued and overvalued securities. 5. Define basic terms associated with preferred stock included priority in earnings, convertible preferred and cumulative preferred. 6. Using the perpetuity approach, compute the rate of return and/or stock price of preferred stock. H. Investment Criteria 1. Calculate the payback period, net present value, profitability index, and internal rate of return. 2. Explain the strength and weaknesses of each investment criterion used to evaluate independent and mutually exclusive projects. 3. Explain why NPV is considered to be conceptually the superior rule, and why other criteria are often used in conjunction with NPV. 4. Explain under what circumstances that applying the IRR and the NPV criteria result in identical results and under what circumstances results may conflict. I. Capital Budgeting 1. Describe the concept incremental cash flows typically associated with a project in the capital budgeting process. 2. Explain the correct treatment of opportunity costs, sunk costs, side effects, changes in net working capital and financing cost in determining the relevant project cash flows/ 3. Determine expected project income and total project cash flow. 4. Evaluate a capital budgeting propels using the criteria of payback, net present value, profitability index, and IRR 5. Explain the strength and weaknesses of each investment criterion used to evaluate independent and mutually exclusive projects. PREREQUISITE: See current catalog REQUIRED TEXT: FOR THE TEXTBOOK: textbookmedia.com Download the Gallagher and Andrew Text, 5th edition. Cost is $25? FOR THE OVERHEADS: Your power points will now be available on my website and they have the same material I use for each of the four quizzes and all lectures. You should download these overheads and bring them to class for note taking purposes or you can take notes directly on your laptop as we review the material. Bringing your laptop to class daily is encouraged so you can take notes on the overheads that are supplied. REQUIREMENTS: Quizzes There will be FOUR quizzes, one roughly every 2-3 weeks typically given on MONDAYS. Each quiz will be worth 100 points. The quizzes will consist of mostly true/false and multiple-choice questions. There is a cumulative final scheduled during finals week. There are no make-up quizzes for any reason. YOU MUST HAVE A VALID CSUS I.D. TO TAKE ANY QUIZ (no exceptions). If you miss a quiz you will receive a score which is equal to the lowest score that was recorded in the class for that quiz. Your final grade will be based on a total of 600 points. Quizzes will be announced at least one week before the actual quiz. You will be allowed to prepare a “crib sheet” for each quiz. One page front and back (8.5 x 11) will be allowed. Incompletes As a stated policy, there will be no incompletes granted in this course for any reason other than serious medical problems, which must be accompanied by an attending doctor's report (not a slip from the health center). No other reasons are acceptable. Attendance and Participation In order to successfully complete this course you must attend the majority (90%) of classes. Participation means preparation. If you read the assignment prior to class then our experience together will be much more rewarding. Attendance will be taken every day during the first two weeks of class and periodically (once per week) thereafter. I reserve the right to drop anyone who misses two classes during the first two weeks of the semester. Extra credit will be given for attendance. One point will be awarded for attending class; one point will be deducted for an absence. You will have 3 (three) free absences according to my records. If you miss four classes your overall class grade will be reduced by 1/3 of a letter grade. If you miss five classes your grade will be reduced by one full letter grade in addition to the 1/3 previously deducted. If you miss more than five classes I reserve the right to assign a grade of “F” as your final grade in the course. DO NOT take my class if you plan on missing more than three classes, go and find another instructor where attendance is not a high priority. You must return to me a completed course agreement (found at the end of this document) before I will give you a name card for attendance purposes. There is a direct correlation between attendance and how well you will do in this class. Attendance points will be reflected on name cards that will be given during the second week of class. Do not lose your name card; do not pickup or return at the end of the period anyone else’s name card. You are responsible for picking up and returning each period your own name card. If you lose your name card, you will lose all extra credit points recorded on the card. I insist that you take ownership of your mistakes. Instead of blaming others, you must take charge of correcting your mistakes; the sooner you do, the better off you'll be. Classroom Etiquette In a class this size, the basic rules of classroom etiquette apply in this course. There is no talking out of turn or during lectures and quizzes unless called upon to answer a question. If you have a question you will be given every opportunity to ask your question after I call on you. You are encouraged to ask questions since extra credit may be given for thoughtful questions. If you continually talk during class, I will ask you and your talking partner to leave. Failure to leave when asked will result in the loss of all bonus points accumulated to date. If you have a need to leave early please make arrangements with me before class begins. If you have a learning or physical disability every effort will be made to accommodate your needs. Please see me immediately after the first class so we can discuss those needs. General - Laptop and cell phone regulation: Please turn off all cell phones during lecture. No texting during class lectures. If you or your electronic devices become a distraction I will ask you to leave the room. If you refuse to leave the room you will have ALL bonus attendance points accumulated to date subtracted from your name card. - Attendance: attendance is handled with your name card. You and ONLY you are responsible for picking up YOUR name card at the beginning of the period. Do not pick up anyone else’s name card. You will receive bonus points for attendance. The bonus points are summarized on the back of your name card. Please turn YOUR card (only) in at the end of the period as you leave. - If you have a disability and require special accommodations, you need to provide disability documentation to SSWD, Lassen Hall 1008, (916) 278-6955. Please discuss your accommodation needs with me after class or during my office hours early in the semester. Grading Grading will be done on a relative basis. That is you will be graded according to your performance with respect to the entire class. Quiz grades are not posted. Students are also responsible for supplying their own Scantron form #882. Evidence of cheating, if caught, will lead to an automatic "F" in the course and possible dismissal from the University. Total Points 1. 2. 2. 3. Four Quizzes Final Participation: Attendance: TOTAL 400 points 200 points + points _+ 600 Calculators Students are required to have a reputable financial calculator. The TI BA II Plus is required. Check the internet for the best price, the Bookstore is more expensive. Each student will be allowed use of their own calculator during quizzes. No borrowing of calculators will be permitted. Bring your calculator to class daily, as we will learn how to use them with various financial problems. Assignments You are encouraged to read, work, and understand the problems and questions from the Gallagher Text, as these are similar in format to quiz questions. There are no makeup quizzes. I do not accept late extra credit projects (if given) for any reason. GRADING SCALE: Grade A AB+ B BC+ C CD+ D DF Percentage 94-100 90-93.5 88-89.5 84-87.5 80-83.5 78-79.5 74-77.5 70-73.5 67-69.5 64-66.5 60-63.5 Below 60 KUHLE’S RULES Rule 1: Life is not fair - get used to it! Don’t expect to get a REAL A in this class unless you EARN it the old fashioned way. Rule 2: The world doesn't care about your self-esteem. Your success in this class is based on how hard you are willing to work, feeling good about hard work always improves self-esteem. Rule 3: You will NOT make $75,000 a year right out of college. You won't be a vice-president with a car until you earn both. You likely won’t earn an A in this course unless you really make a superior effort and score the requisite points. Rule 4: If you think I’m tough in this class, wait till you get a boss in the Real World (RW). Rule 5: Working hard is not beneath your dignity. Your Parents and Grandparents had a different word for it: they called it opportunity. You might want to try it out. Rule 6: If you mess up in this class, it's not my fault, so don't whine about your mistakes or try to blame anyone but yourself, take responsibility and learn from the mistake and ask for help, I can’t read your mind so I don’t know what you are or are not understanding. Rule 7: Before you were born, your parents weren't as boring as they are now. They got that way from paying your bills, cleaning your clothes and listening to you talk about how cool you thought you were. So before you save the rain forest from the parasites of your parent's generation, try delousing the closet in your own room. Rule 8: In some schools and classes, they have abolished failing grades and they'll give you as MANY TRIES as you want to get the right answer or a passing grade. This doesn't bear the slightest resemblance to ANYTHING in real life or in THIS CLASS. You have one chance to successfully pass this class, if you don’t, PLEASE don’t sign up for it again with me. Rule 9: Life is not divided into semesters even though school is. You don't get summers off and very few employers are interested in helping you FIND YOURSELF, do that on your own time. However, I am interested in finding the best Finance majors of the future. If I ask for your help it should be considered a privilege or honor and not an inconvenience or addition to your workload. Rule 10: Be nice to nerds, your classmates, other people, and especially your professors. You never know when you might end up working for one of them. COURSE AGREEMENT FOR FINANCE 101 – Professor Kuhle, Ph.D. I, _____________________________________________________ (PRINT YOUR NAME AND ENTER YOUR STUDENT I.D. NUMBER) agree to abide by all the rules and stipulations outlined in this syllabus. I realize it is my responsibility to arrive to class on time (no excuses) and miss no more than a total of 3 classes in order to preserve the grade I receive based on the results of my four quizzes taken in the course. I promise not to cheat on any assignments, quizzes, or extra credit given in this course understanding the penalty for such cheating is potentially an “F” in the course and dismissal from the School of Business and the University. I further understand that any bonus points given are at the discretion of Prof. Kuhle and are not guaranteed. I further agree to be courteous and polite to my fellow students and my Professor and agree to be civil in the classroom at all times. This means no talking, unless called upon, during lectures or quizzes and silencing and turning off all electronic devices (with the exception of laptops). I intend to give my best effort to successfully pass this class but also understand that there is no guarantee of a specific grade. __________________________________________________ SIGN YOUR NAME __________________________________________________ DATE