File

advertisement

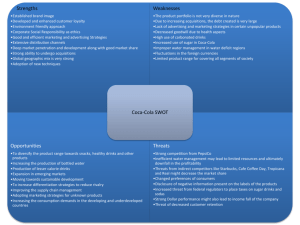

Tropicana (Pepsi) v Innocent (Coke) On the shelf it’s Tropicana v Innocent. Behind the scenes it’s one of the world’s great business battles: PepsiCo v Coca-Cola. Long before health concerns bit into sales of cola drinks PepsiCo bought a prominent position in the market for orange juice. It paid $3 billion in cash for Tropicana in 1998 and built the brand brilliantly in the U.S., Britain and elsewhere. Coca-Cola’s dominance of the fizzy drinks market made it harder for the company to admit the trend away from ‘carbonates’, but in 2009 it bought ownership and – later – control of Innocent Drinks. Although it was buying the U.K.’s Number 1 smoothie brand Coca-Cola soon turned Innocent’s focus onto the much bigger market for fruit juice. It had already tried – and failed – to break Tropicana’s UK dominance with its major juice brand Minute Maid. Now Innocent would take on PepsiCo. In 2011 Innocent launched a juice range in direct competition with Tropicana. With the Coca-Cola distribution machine behind it, by 2013 Innocent Juice had sales of £113 million in the UK alone. This was in part down to CocaCola’s investment of £2 million into a UK TV campaign, outspending PepsiCo’s Tropicana. Coca-Cola chose to focus Innocent’s advertising on the slogan: ‘Tastes good … Does good’, highlighting Innocent’s traditional commitment to devote 10% of profits to charitable causes. This might help keep consumers believing that Innocent is still a quirky independent business instead of a small part of a vast multinational. The impact of Coca-Cola’s efforts with Innocent can be seen in the graph below. If nothing else, PepsiCo’s success with Tropicana has been halted for now. Yet while Innocent has been denting PepsiCo’s juice sales in Britain, its high £ms value-added sales of smoothies have been 320 Source: The Grocer magazine 300 flagging. In the 52 weeks to January 4th 280 2014, sales of smoothies fell by 10%, 260 240 while Innocent smoothie volumes fell by 220 200 15%. This decline was attributed to 180 160 greater consumer concerns about the 140 Tropicana 120 sugar level in fruit drinks, plus a decline in 100 Innocent the number of retail price promotions 80 60 used to support the smoothie category. In 40 20 response to this, in March 2014 Innocent 0 announced the launch of a range of 2010 2011 2012 2013 ‘super-smoothies’: so-called ‘functional’ products that are supposed to have specific benefits for the consumer. The range will offer the consumer three options: ‘Defence’, ‘Antioxidise’ and ‘Energise’ – all of which will carry higher price tags than Innocent’s regular smoothie products. Coca-Cola will be hoping that they halt the sales slide in Innocent’s original product range. At £2.35 for 200ml (40p above regular Innocent smoothies), these new products will have to offer consumers a convincing sales message. UK annual sales of Juice and Smoothies Innocent’s description of these products: Energise Defence: Antioxidant Strawberries, cherries, guarana, flax seeds and vitamin B6, C and niacin – these help release energy from food Mango, pumpkin, Echinacea, flax seeds and vitamin C; D3 and zinc to keep immune system functioning properly Kiwi, lime, wheatgrass, flax seeds and 3 antioxidant vitamins: C, E and selenium Questions (26 marks; 30 minutes) 1. Based on its pricing decision for the new functional smoothies, analyse Coca-Cola’s probable view of the price elasticity of this new product range. (6) 2. Discuss the possible factors that may determine whether Innocent’s new range of ‘functional’ smoothies proves a success. (13) 3. Use the Boston Matrix to help analyse why Coca-Cola bought Innocent Drinks. (7) 1. Based on its pricing decision for the new functional smoothies, analyse Coca-Cola’s probable view of the price elasticity of this new product range. (6) Pricing some 20% higher than regular smoothies implies a belief that consumers will be willing to pay the price premium and therefore that the price elasticity of the new products will be relatively low; the lower the price elasticity, the lower the responsiveness of demand to changes in price This is understandable looking at the ingredients’ list, which looks impressive; the list, plus the ‘Innocent’ name (which probably raises none of the scepticism that consumers might feel towards Coca-Cola) might help to keep the PED low 2. Discuss the possible factors that may determine whether Innocent’s new range of ‘functional’ smoothies proves a success. (13) The first must be consumer credibility; will people believe that this new range will be better for them than other, comparable smoothies, i.e. fulfil the claimed function; that will depend on the credibility of the Innocent name and the effectiveness of the brand communication A second issue will be the reaction of competitors; PepsiCo, in particular, may choose to launch their own ‘me-too’ drinks offering the same functions (it’s hard to believe that anyone could trademark such common words as ‘energise’ and ‘antioxidant’ so copycat action could be quite effective) A key factor for most product launches will not be a variable in this case; the Innocent brand name backed by the Coca-Cola marketing machine will ensure very high distribution levels for the new product range; so the ultimate test will be consumer taste, not retailer decision-making And ultimately the long-term success of the product surely rests upon consumer reactions to the ‘function’ and the taste of the products; even though Red Bull has proven (in my view) that a vile-tasting product can become a $billion brand, the underlying reasons for success are still rational: clear function and a strong image; Innocent super-smoothies will have to have some real consumer benefits to sustain long-term viability 3. Use the Boston Matrix to help analyse why Coca-Cola bought Innocent Drinks. (7) The Boston matrix is a two-dimensional grid on which a company’s product portfolio can be organised into rising stars, cash cows, problem children and dogs Perhaps the purchase of Innocent proves that Coca-Cola was struggling to see where its next rising star was to come from; ultimately the joy of owning a cash cow such as Coca-Cola is being able to provide the milk/cash for the next generation; as Coca-Cola couldn’t see where the new star was to come from it bought Innocent to get an instant rising star – and a brand with the strength to take on Tropicana 4. To what extent may Innocent’s competitiveness in the UK fruit drinks market be affected by the support it now has from Coca-Cola. (14) Competitiveness is the extent to which a business can sustain a long-term position of profitability despite the efforts of rivals. It boils down into two main possibilities: cost competitiveness enabling the business to sustain a position that Michael Porter would describe as cost leadership (think Aldi, Primark or Ryanair); the other possibility is competitiveness based on a differentiated position that makes people willing to pay a price premium (think Ted Baker or Apple) Coca-Cola can probably help from both viewpoints. If Innocent is buying orange juice backed by Coca-Cola, the huge size of Minute Maid in the US probably means that Innocent can buy juice at the highest possible level of discount, e.g. 30% below the cost that would be paid by an independent company Ultimately, though, Coca-Cola wants Innocent to be a brand that adds value rather than cuts costs; here again Coca-Cola can help; it will have access to the top advertising agencies, the best packaging designers and so on; therefore it should be in a strong position to create a positive, differentiated position; no less important is Coca-Cola’s financial muscle – allowing Innocent to outspend Tropicana In general there seems every reason to see positives in the support of Coca-Cola. All that might be undermined, however, if the public were to become clear that Innocent = Coca-Cola, ie Innocent is just a part of an American multinational company