PPT_Retail_Internationalization_1.3

advertisement

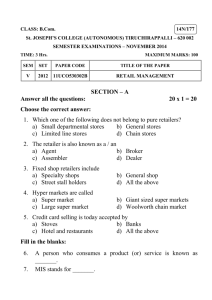

David F. Miller Center For Retailing Education and Research International Retailing Education and Training (IRET ) Retail Internationalization Chuanyi Tang, Ph. D. Post Doctoral Associate Hough Graduate School of Business Warrington College of Business Administration University of Florida Objectives Identify Major International Retailers Analyze the Motivation of Retail Internationalization Gain Insights into Foreign Market Entry Decisions Identify the Specific Opportunities and Challenges for International Retailers Understand the Concept of Divestment and Retail Divestment in China Location Module David F. Miller Center for Retailing Education and Research page 2 Outline International Retailers Motivation for Retail Internationalization Retail Internationalization Opportunities Foreign Retail Entries in China Retail Divestment in China Location Module David F. Miller Center for Retailing Education and Research page 3 Top 20 Retailers in the World Information source: GMID, Euromonitor Ranking Retailer Country of origin 2009 Sales Type ($millions) # of countries of operation 1 Wal-Mart Stores, Inc USA 163,532.00 International 15 % of sales in foreign countries 13.9% 2 3 Carrefour Group The Kroger Co FRA USA 52,196.10 45,352.00 40 1 37.70% 0.00% 4 5 6 Metro AG The Home Depot, Inc Albertson’s, Inc GER USA USA 44,163.37 38,434.00 37,478.00 35 5 1 40.00% 3.70% 0.00% 7 8 36,762.45 36,728.00 10 3 36.00% 10.60% 9 ITM Enterprises SA FRA Sears, Roebuck and USA CO Kmart Corporation USA International Single Country International International Single Country International International 1 0.00% 10 Target Corporation USA 33,702.00 1 0.00% 11 JC Penney USA 31,503.50 1 0.00% 12 13 14 15 16 17 18 19 Royal Ahold Safeway Inc. Rewe-Gruppe Tesco plc Ito-Yokado Co, Ltd Edeka-Gruppe Costco Companies, Inc Tengelmann Warenhande The Daiei, Inc NET USA GER UK JPN GER USA GER 31,222.15 30,801.80 30,567.69 30,404.40 30,237.57 30,002.57 26,976.45 26,509.12 Single Country Single Country Single Country International International International International International International International International 12 8 18 14 2 2 8 15 76.40% 10.80% 19.70% 10.00% 29.80% 2.40% 18.40% 47.90% JPN 26,486.11 Single country 1 0.00% 20 Location Module 35,925.00 David F. Miller Center for Retailing Education and Research page 4 Global Map of Tesco UK R.O. Ireland France Czech Republic Russia Poland Slovakia Hungary S Korea USA Greece China Turkey Japan Taiwan Thailand Malaysia Information Source: www.planetretail.net Location Module David F. Miller Center for Retailing Education and Research page 5 Oversea Market of Tesco 25 Market Share % 20 21.8 2004 19.1 18.1 2008 19.4 14.8 15 10 18.6 18.1 17.7 6.6 5.8 5.5 4.9 13.5 10.9 5 4.9 0 1.6 1.6 UK ROI Hu Thl Slv CR 4.3 SKr 3.9 Po 1.9 Mal 0.7 Tky 0.5 0.6 Tw 0.2 China 0.1 0.1 Jp Information Source: www.planetretail.net Location Module David F. Miller Center for Retailing Education and Research page 6 Oversea Market of Tesco (Cont.) 4,366 4,500 4,000 2004 3,390 2008 3,500 2,599 EUR mn 3,000 2,523 2,489 2,139 2,500 2,000 2,375 1,158 2,080 1,500 855 1,598 1,000 1,535 Skr ROI Hu Thl Po 487 499 1,190 500 0 724 396 694 547 425 329 195 167 136 CR Slv China Jp Tky Tw Mal Information Source: www.planetretail.net Location Module David F. Miller Center for Retailing Education and Research page 7 Oversea Market of Tesco (Cont.) Europe +25% Asia +122% 2004 Europe 90% 2008 Europe 84% Asia 10% Asia 16% 8 Location Module Information Source: www.planetretail.net David F. Miller Center for Retailing Education and Research page 8 Motivation for Retail Internationalization Overview Two Major Drives Push factors Negative aspects of the domestic market Pull factors Attractive aspects of either the retail offer or the foreign market Location Module David F. Miller Center for Retailing Education and Research page 9 Motivation for Retail Internationalization Push Factors Saturated home market and low growth potential Intense competition at home Diversify investment Expansion at home blocked by legislation Economic downturn at home Location Module David F. Miller Center for Retailing Education and Research page 10 Motivation for Retail Internationalization Pull Factors Market size and growth Improved channel of distribution, advertising, and transportation De-regulation for foreign retail entry Great potential for some mature retail formats from developed countries Undeveloped retail industry and less intensive competition Location Module David F. Miller Center for Retailing Education and Research page 11 Motivation for Retail Internationalization Challenges for International Retailers Increased competition Look like a single market, but is not Additional layers of governmental complexity Cultural differences Internal coordination and transfer of knowledge Location Module David F. Miller Center for Retailing Education and Research page 12 International Expansion Opportunities Criteria for Selecting a Country Macro-Marketing Factors (Sternquist, 2007; Alexander and Doherty, 2009) Economic Environment Market size Market growth Governmental Environment Trade barriers Regulations on foreign retailers Social and Cultural Environment Cultural proximity Technological Environment Retail information system Retail Structure and Competition Environment Market concentration and competition Location Module David F. Miller Center for Retailing Education and Research page 13 International Expansion Opportunities Information source: GMID, Euromonitor Location Module David F. Miller Center for Retailing Education and Research page 14 International Expansion Opportunities Comparison among BRIC (Brazil, Russia, India and China) Market Size Market Growth Market Concentration Country Risk Location Module David F. Miller Center for Retailing Education and Research page 15 International Expansion Opportunities Market Size 2005 2006 2007 2008 2009 2010 Brazil 118,687.00 146,325.60 181,181.60 216,101.10 215,774.10 266,813.50 Russia 160,472.40 201,493.10 259,254.20 319,682.20 258,717.70 305,312.90 India 174,688.20 185,528.50 220,980.70 227,851.00 216,107.00 229,944.00 China 520,599.70 609,339.10 723,108.50 886,776.50 985,138.70 1,072,255.70 Information source: GMID, Euromonitor Location Module David F. Miller Center for Retailing Education and Research page 16 International Expansion Opportunities Market Growth 2006 2007 2008 2009 2010 Brazil 10.2 10.8 12.3 8.9 12.8 Russia 20.7 21 19.8 3.4 10.5 India 9.1 8.7 8.5 5.5 7.6 China 13.9 13.2 12 9.2 10.9 Information source: GMID, Euromonitor Location Module David F. Miller Center for Retailing Education and Research page 17 International Expansion Opportunities Market Concentration Information source: GMID, Euromonitor Location Module David F. Miller Center for Retailing Education and Research page 18 International Expansion Opportunities Market Concentration (Cont.) Information source: GMID, Euromonitor Location Module David F. Miller Center for Retailing Education and Research page 19 Country Risk (Euromoney) Country Overall Score Political Risk Economic Performance Structures Debt Indicators Credit Rating Access to bank finance/capit al market 100 30 30 10 5 10 10 Sep 10 Mar. 10 1 1 Norway 93.33 28.19 26.89 8.25 10.00 10.00 10.00 2 3 Switzerland 90.22 26.80 24.99 8.44 10.00 10.00 10.00 3 6 Sweden 88.93 28.04 22.65 8.24 10.00 10.00 10.00 9 16 Hong Kong 87.18 25.25 24.87 8.10 10.00 8.96 10.00 17 13 United States 82.10 26.26 17.91 7.92 10.00 10.00 10.00 36 43 China 72.60 17.37 22.31 6.81 9.95 7.50 8.67 42 51 Brazil 69.57 18.84 20.73 6.62 9.01 4.38 10.00 49 52 India 62.80 16.92 18.04 5.35 9.44 4.38 8.67 52 54 Russia 61.48 14.66 18.46 5.35 9.30 5.21 8.50 Location Module David F. Miller Center for Retailing Education and Research page 20 2010 Global Retail Development Index (A.T. Kearney) Location Module David F. Miller Center for Retailing Education and Research page 21 2010 Global Retail Development Index (A.T. Kearney) Location Module David F. Miller Center for Retailing Education and Research page 22 International Expansion Opportunities Why China? Economic Factors The Largest Market Size The market size of China is the sum of the other three BIRC countries in 2010. Stable High Market Growth China has continued a double digit growth rate from 2005 to 2010. Location Module David F. Miller Center for Retailing Education and Research page 23 International Expansion Opportunities Why China? (Cont.) Industry Structure The market is largely fragmented. Chinese retailers are regional. The sizes of Chinese retailers are relatively small. Huge opportunities for foreign retailers. Location Module David F. Miller Center for Retailing Education and Research page 24 International Expansion Opportunities Why China? (Cont.) Political Environment Socialist market economy with Chinese characteristics Focus on reforms and economic development Technological Environment China has better infrastructure than other developing countries. Chinese government encourages retailers to adopt advanced information system Location Module David F. Miller Center for Retailing Education and Research page 25 International Expansion Opportunities Interview with the CEO of Wal-Mart, China (Ed Chan) http://www.mckinseyquarterly.com/Retail_Consumer_Good s/Sectors_Regions/Chinas_retail_revolution_An_interview_ with_Wal-Marts_Ed_Chan_2459 Location Module David F. Miller Center for Retailing Education and Research page 26 Foreign Retail Entry Decisions Entry Mode Location Time Format Location Module David F. Miller Center for Retailing Education and Research page 27 Foreign Retail Entry Decisions Entry Mode Contract Licensing Join Export Management Franchising Venture Wholly owned Risk, Control, and Resource Location Module David F. Miller Center for Retailing Education and Research page 28 Foreign Retail Entry in China Entry Mode Franchising MacDonald and Sogo Contract Management Parkson Joint Venture Carrefour Solely Owned Tesco (Merger and Acquisition) Best Buy (Green field) Increased after 2004 Foreign Manufacturer’s Specialty Store Pierre Cardin and Play Boy Location Module David F. Miller Center for Retailing Education and Research page 29 Foreign Retail Entry in China Entry Format Department Store Ito Yokada Hypermarket/supercenter Carrefour, Wal-mart, Tesco, Auchan Foreign retailers have 70% market share Warehouse Metro Specialty/ specialist Store Ikea, B&Q, Best Buy Convenience Store 7-11 Location Module David F. Miller Center for Retailing Education and Research page 30 Foreign Retail Entry in China Locations Their first entries are in Beijing, Shanghai, Guangzhou and Shenzhen, and their headquarters are mainly in these four cities. Eastern China has a much higher density than Western China. Yangzi river delta, Pearl river delta and Bohai Circle have the greatest density. Sichuan and Chongqing are emerging areas. Foreign retailers have entered most of the provinces and all the major economic cities. Foreign retailers are conducting large-scale expansion into lower tier cities. Location Module David F. Miller Center for Retailing Education and Research page 31 Geographic Areas Location Module David F. Miller Center for Retailing Education and Research page 32 Foreign Retail Entries in China (Li and Wang, 2006) Retailer Country City Format Retailer Country City Format Yaohan Japan Shenzhen (1991) Department store Ahold Holland Shanghai (1997) Hypermarket 7-11 Japan Shanghai (1992) Convenience store Locus Thailand Shanghai (1997) Hypermarket Parkson Malaysia Qingdao (1993) Department store Trust Mart Taiwan Guangzhou (1997) Hypermarket Carrefour France Beijing (1995) Hypermarket Ito-Yokada Japan Beijing (1998) Supermarket Daiei Japan Tianjin (1995) Supermarket Ikea Sweden Shanghai (1998) Specialty Jusco Japan Guangzhou (1995) Department Store Rt-Mart Taiwan Shanghai (1998) Hypermarket Metro Germany Shanghai (1996) Warehouse Auchan France Shanghai (1999) Hypermarket Makro Netherland Guangzhou (1996) Warehouse B&Q U. K. Shanghai (1999) Specialty Wal-mart U.S.A Shenzhen (1996) Shopping center/ Sam’s club/ neighborhood store OBI Germany Wuxi (2000) Specialty Lawson Japan Shanghai (1996) Convenience store Otto Germany Shanghai (2000) Specialty Home Depot U.S.A Tianjin (2006) Specialty Best Buy U.S. A Shanghai (2006) Specialty Location Module David F. Miller Center for Retailing Education and Research page 33 Leading Retailers in China (CCFA, 2010) Ranking Retailer 2009 Sales(10,000 ¥) Growth (%) # of stores Growth (%) 1 Suning 11,700,267 14.3 941 15.9 2 Gome 10,680,165 2.1 1,170 -14.1 3 Bailian 9,791,537 3.8 6,153 -4.1 4 Dashang 7,053,590 12.8 160 6.7 5 China Resources Vanguard 6,800,000 6.6 2,926 8.5 6 RT-Mart 4,043,169 20.5 121 19.8 7 Carrefour 3,660,000 8.2 156 16.4 8 Anhui Huishang 3,437,883 13.5 2,884 15.5 9 Wal-Mart 3,400,000 22.2 175 45.8 10 Wu-mart 3,270,000 6.7 2,333 16.1 Location Module David F. Miller Center for Retailing Education and Research page 34 Foreign Retailers in China Ranking Retailer Sales(10,000 ¥) Growth (%) # of stores Growth (%) 13 Yum! 2,880,000 15 Best Buy 2,570,000 20 Trust-mart 1,650,000 0.6 104 0.0 27 Tesco 1,330,000 15.7 79 29.5 29 Locus 1,300,000 0.0 77 1.3 30 Parkson 1,237,000 15.7 44 10.0 31 Metro 1,202,277 -4.9 42 10.5 39 Auchan 986,000 21.0 35 12.9 45 Intime 758,659 34.9 22 46.7 50 MacDonald 650,000 6.6 1,100 10.0 62 Ito Yokada 351,380 21.9 3 0.0 68 IKEA 312,000 15.6 7 16.7 100 Home Depot 160,000 4.6 12 0.0 Location Module David F. Miller Center for Retailing Education and Research 9.9 3,200 18.5 262 page 35 Foreign Retail Entry in China Expansion of Carrefour in China In 1995, they entered China in Shanghai. They expanded aggressively and tried to avoid the government’s regulations. They entered major cities 2-3 years sooner than Wal-mart and Metro. In 1999, they had 28 stores in 17 cities. They are currently the No. 1 foreign retailer in China. 169 Hypermarkets in China (as of November, 2010) Location Module David F. Miller Center for Retailing Education and Research page 36 Foreign Retail Entry in China Expansion of Wal-mart in China Entered China in 1996 Headquartered in Shenzhen Operates three formats in China: Supercenters, Sam’s Clubs, and neighborhood stores. 1996-2004 Slow Growth Wal-mart is not flexible and doesn’t adapt to the China market Underdeveloped Infrastructures and IT Systems in China 2004, Ranking 20, <1/2 Carrefour Location Module David F. Miller Center for Retailing Education and Research page 37 Foreign Retail Entry in China Expansion of Wal-mart in China (Cont.) After 2004, Fast Growth Adapted to Chinese Markets Worked with Intermediate Agents Decentralized Management Opened Stores in Urban Areas Established Unions and Communist Party Branch Adjusted Pricing Policies Government Policies Became More Open Significantly Improved Infrastructure in China Consumer Market Booming Location Module David F. Miller Center for Retailing Education and Research page 38 Foreign Retail Entry in China Expansion of Wal-mart in China (Cont.) No. 2 Foreign Retailer in China Three distribution centers in Shenzhen, Tianjin, and Jiaxing. (By 12/2008) 189 units in 101 cities in China (By August, 2010) Location Module David F. Miller Center for Retailing Education and Research page 39 Foreign Retail Entry in China Expansion of Wal-mart in China (Cont.) The 100th Wal-Mart store in China http://www.youtube.com/watch?v=x65efvLryqY 300 Wal-Mart stores in China http://www.youtube.com/watch?v=gGtQDL6OliI Location Module David F. Miller Center for Retailing Education and Research page 40 Retail Divestment in China Divestment It is not necessarily true that all international companies succeed or would like to stay in China. Divestment is defined as “Company actions resulting in a reduced presence in a foreign market” (Alexander, Quinn, and Cairns, 2005) Location Module David F. Miller Center for Retailing Education and Research page 41 Retail Divestment in China Divestment (Cont.) Some Retailers That Have Exited China (Li and Wang, 2006) Yaohan (Japanese Supermarket), 1999 Xiyou (Japanese Supermarket), 1999 Ahold (Netherland Hypermarket), 1999 PCD (Hong Kong Department Store), 2000 Jusco (Japanese Department Store), 2000 Daiei (Japanese Supermarket), 2004 Mykal (Japanese Department), 2003 OBI (German Home Improvement Store), 2005 Location Module David F. Miller Center for Retailing Education and Research page 42 Retail Divestment in China Store Closures in 2008-2009 (Wang, 2009) Retailer Store Format Reason Isetan Huating store in Shanghai Department store Net loss for two years Parkson Changsha store Department store Lease expired Tesco Jilin Store Hypermarket High operation cost Trust-mart Nanjing Qingliangmen store and Gulou store; Chengdu Daye store, Wuhan Minyi store, and Fuzhou stores Supermarket Bad performance B&Q Shekou store in Shenzhen; Fuzhou store Specialty store Bad performance HomeDepot Qingdao store Specialty store Broke up with the landlord Location Module David F. Miller Center for Retailing Education and Research page 43 Case Study Case Study Best Buy in China http://www.youtube.com/watch?v=zMABUmlOQdE Location Module David F. Miller Center for Retailing Education and Research page 44 References CCFA (2010), Report on Chain Store Retailers’ Performance in China (2009-2010). Li, Fei and Gao Wang (2006), The Development of the Retailing Industry in China (1981-2005), Social Sciences Academic Press, Beijing Wang, Qiang (2009), Report on China Retail Business Monitoring and Analysis, China Economic Publishing House, Beijing. Alexander, Nicholas, Barry Quinn, and Patricia Cairns (2005). International retail divestment activity, International Journal of Retail & Distribution Management, 33(1), 522 Location Module David F. Miller Center for Retailing Education and Research page 45