VICTORIA CHEMICALS plc (A)

advertisement

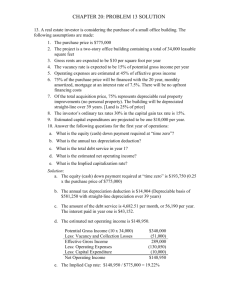

VICTORIA CHEMICALS plc (A) Presented by Group 2 : Aldy Rifianto, Dedy Mardianto Floriana Nataly, Hiralalitya Lextro Kristiano Concorda Natallia Winata, Wita Puspadilla Yosua Bangun THE MERSEYSIDE PROJECT SUMMARY PROBLEM IDENTIFICATION ALTERNATIVE SOLUTION RECOMENDATION SUMMARY • Victoria Chemicals, a major competitor in the Worldwide chemicals industry, was a leading producer of polypropylene, a polymer used in an extremely wide variety of products SUMMARY Victoria Chemicals was under pressure from investors to improve its financial performance because of the accumulation of the firm’s common shares by a well known corporate raider. The Earnings was fallen to 180 pence per share at the end of 2007 from around 250 pence per share at the end of 2006. SUMMARY Lucy Morris was plant Manager of Victoria Chemicals Merseyside Works in Liverpool, England. Her Controller Frank Greystock was discussing a capital project that Morris wanted to propose to senior management. The Project Consisted of a (British Pounds) GBP 12 Million expenditure to renovate and rationalize the polypropylene production line at the Merseyside plant in order to make up for deferred maintenance and to exploit opportunities to achieve increased production efficiency. SUMMARY • Beside The Polypropylene plant at Merseyside also has Etylene Propylene Copolymer rubber (EPC). • EPC remainded a relatively small product in the European chemical Industry. • Victoria, the Largest supplier of EPC, Produced the entire volume at Merseyside. • EPC had been only marginally profitable to Victoria because of the entry by compatitors and the development of competing synthetic-rubber compounds over the past five years SUMMARY • • • • The Merseyside project would be in the engineering-efficiency category : Impact on earning per share = had to be positive. Payback = maximum six years. Discounted cash flow = had to be positive. Internal rate of return had to be greater than 10%. PROBLEM INDENTIFICATION • Victoria Chemicals must improve its Financial Performance and raise the Earnings per share • The Merseyside Production process was constructed in 1967. • The Price of Polypropylene very competitive • There is 7 Major Competitors manufactured polypropylene with various cost Level. PROBLEM INDENTIFICATION Company CBTG A.G Victoria Chem. Victoria Chem. Hosche A.G Montecassino SpA Saone-Poulet S.A Vaysol S.A Next 10 Largest Plants Plant Built In Location Saarbrun Liverpool Rotterdam Hamburg Genoa Merseille Antwerp 1981 1967 1967 1977 1961 1972 1976 Production Plant Annual Cost per Ton output (indexed to low (metric tons) cost producer) 350.000 250.000 250.000 300.000 120.000 175.000 220.000 450.000 1,00 1,09 1,09 1,02 1,11 1,07 1,06 1,19 PROBLEM INDENTIFICATION • The Director of sales analysis that the industry of Polypropylene is in a downturn and it lookslike a oversupply is in the works. This means that we will probably have to shift capacity away from Rotterdam toward Merseyside in order to move the added volume. Is this a really a gain for Victoria Chemicals? Why spend money just so one plant can cannibalize another? PROBLEM INDENTIFICATION • EPC Plant at Meyerside also need to renovation to keep produce the Etylene Propylene Copolymer. • If EPC Project calculate seperately from Polypropylene Project it was negative NPV and the company ignore it. • If EPC Plant never do Renovation, Victoria Company will have to exit the EPC business during in 3 years. ALTERNATIF SOLUTION The Proposed Capital Program • Morris proposed an expenditure of GBP 12 Million on this Program. • The Entire Polymerization line would need to be shut down for 45 days. • Will Loss the customer during shut down can not supply to customer. • greystock.xlsx ALTERNATIVE SOLUTION • The Condition of Calculation was : Assumptions : Annual Output (metric tons) Output Gain/Original Output Price/ton (pounds sterling) Inflation Rate (prices and costs) Gross Margin (ex. Deprec.) Old Gross Margin Tax Rate Energy Savings/Sales Yr. 1-5 Yr. 6-10 Yr. 11-15 250.000 7,0% 675 0,0% 12,50% 11,50% 30,0% 1,25% 0,80% 0,00% Investment Outlay (mill.) Discount rate Depreciable Life (years) Overhead/Investment Salvage Value WIP Inventory/Cost of Goods Months Downtime, Construction After-tax Scrap Proceeds Preliminary Engineering Costs 12,00 10% 15 3,50% 0 3% 1,5 0 0,5 Lampiran 1 GREYSTOCK'S MERSEYSIDE PROJECT (Financial values in millions of British Pounds) Assumptions : Annual Output (metric tons) Output Gain/Original Output Price/ton (pounds sterling) Inflation Rate (prices and costs) Gross Margin (ex. Deprec.) Old Gross Margin Tax Rate Energy Savings/Sales 1 Year Estimate of Incremental Gross Profit New Output (tons) Lost Output--Construction New Sales (Millions) New Gross Margin New Gross Profit Yr. 1-5 Yr. 6-10 Yr. 11-15 Now Old Output Old Sales Old Gross Profit Incremental Gross Profit 2 3 4 5 6 7 8 9 10 Estimate of Incremental WIP Inventory New WIP Inventory Old WIP Inventory Incremental WIP Inventory Estimate of Incremental Depreciation New Depreciation Overhead Prelim. Engineering Costs Pretax Incremental Profit Tax Expense After-tax Profit Cash Flow Adjustments Less Capital Expenditures Add back Depreciation Less Added WIP inventory Free Cash Flow AVG Annual Add to EPS PAYBACK (years) NPV IRR 250.000 7,0% 675 0,0% 12,50% 11,50% 30,0% 1,25% 0,80% 0,00% 1 2008 Investment Outlay (mill.) Discount rate Depreciable Life (years) Overhead/Investment Salvage Value WIP Inventory/Cost of Goods Months Downtime, Construction After-tax Scrap Proceeds Preliminary Engineering Costs 12,00 10% 15 3,50% 0 3% 1,5 0 0,5 2 2009 3 2010 4 2011 5 2012 6 2013 7 2014 8 2015 9 2016 10 2017 11 2018 12 2019 13 2020 14 2021 15 2022 267.500 (33.438) 157,99 13,75% 21,72 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 250.000 168,75 19,41 2,32 250.000 168,75 19,41 5,42 250.000 168,75 19,41 5,42 250.000 168,75 19,41 5,42 250.000 168,75 19,41 5,42 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 4,67 4,48 0,19 4,67 4,48 0,19 4,67 4,48 0,19 4,67 4,48 0,19 4,67 4,48 0,19 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 1,60 0,42 0,50 -0,20 -0,06 -0,14 1,39 0,42 1,20 0,42 1,04 0,42 0,90 0,42 0,78 0,42 0,68 0,42 0,59 0,42 0,32 0,42 0,32 0,42 0,32 0,42 0,32 0,42 0,32 0,42 0,32 0,42 0,32 0,42 3,61 1,08 2,53 3,80 1,14 2,66 3,96 1,19 2,77 4,10 1,23 2,87 3,41 1,02 2,38 3,51 1,05 2,46 3,60 1,08 2,52 3,87 1,16 2,71 3,87 1,16 2,71 2,42 0,73 1,70 2,42 0,73 1,70 2,42 0,73 1,70 2,42 0,73 1,70 2,42 0,73 1,70 1,60 -0,19 1,39 0,00 1,20 0,00 1,04 0,00 0,90 0,00 0,78 -0,03 0,68 0,00 0,59 0,00 0,32 0,00 0,32 0,00 0,32 -0,04 0,32 0,00 0,32 0,00 0,32 0,00 0,32 0,00 1,27 3,92 3,86 3,81 3,77 3,14 3,14 3,11 3,03 3,03 1,97 2,02 2,02 2,02 2,02 180,56 13,75% 24,83 180,56 13,75% 24,83 180,56 13,75% 24,83 180,56 13,75% 24,83 180,56 13,30% 24,01 180,56 13,30% 24,01 180,56 13,30% 24,01 180,56 13,30% 24,01 180,56 13,30% 24,01 180,56 12,50% 22,57 180,56 12,50% 22,57 180,56 12,50% 22,57 180,56 12,50% 22,57 180,56 12,50% 22,57 -12,00 -12,00 = = = = 0,023 3,80 10,45 24,08% Lampiran 2 MERSEYSIDE PROJECT (Financial values in millions of British Pounds) Assumptions : Annual Output (metric tons) Output Gain/Original Output Price/ton (pounds sterling) Inflation Rate (prices and costs) Gross Margin (ex. Deprec.) Old Gross Margin Tax Rate Energy Savings/Sales 1 Year Estimate of Incremental Gross Profit New Output (tons) Lost Output--Construction New Sales (Millions) New Gross Margin New Gross Profit Yr. 1-5 Yr. 6-10 Yr. 11-15 Now 3 4 5 6 7 8 9 10 Estimate of Incremental WIP Inventory New WIP Inventory Old WIP Inventory Incremental WIP Inventory Estimate of Incremental Depreciation New Depreciation Overhead Prelim. Engineering Costs Pretax Incremental Profit Tax Expense After-tax Profit Cash Flow Adjustments Less Capital Expenditures Add back Depreciation Less Added WIP inventory Free Cash Flow AVG Annual Additio to EPS PAYBACK (years) NPV IRR 1 2008 Investment Outlay (mill.) Discount rate Depreciable Life (years) Overhead/Investment Salvage Value WIP Inventory/Cost of Goods Months Downtime, Construction After-tax Scrap Proceeds Preliminary Engineering Costs 2 2009 3 2010 4 2011 5 2012 12,00 10% 15 3,50% 0 3% 1,5 0 0,5 6 2013 7 2014 8 2015 9 2016 10 2017 11 2018 12 2019 13 2020 14 2021 15 2022 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 (33.438) 157,99 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 13,75% 13,75% 13,75% 13,75% 13,75% 13,30% 13,30% 13,30% 13,30% 13,30% 12,50% 12,50% 12,50% 12,50% 12,50% 21,72 24,83 24,83 24,83 24,83 24,01 24,01 24,01 24,01 24,01 22,57 22,57 22,57 22,57 22,57 Old Output Old Sales Old Gross Profit Incremental Gross Profit 2 250.000 7,0% 675 0,0% 12,50% 11,50% 30,0% 1,25% 0,80% 0,00% 250.000 168,75 19,41 2,32 250.000 168,75 19,41 5,42 250.000 168,75 19,41 5,42 250.000 168,75 19,41 5,42 250.000 168,75 19,41 5,42 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 4,09 4,48 -0,39 4,67 4,48 0,19 4,67 4,48 0,19 4,67 4,48 0,19 4,67 4,48 0,19 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 1,60 0,42 0,50 -0,20 -0,06 -0,14 1,39 0,42 1,20 0,42 1,04 0,42 0,90 0,42 0,78 0,42 0,68 0,42 0,59 0,42 0,32 0,42 0,32 0,42 0,32 0,42 0,32 0,42 0,32 0,42 0,32 0,42 0,32 0,42 3,61 1,08 2,53 3,80 1,14 2,66 3,96 1,19 2,77 4,10 1,23 2,87 3,41 1,02 2,38 3,51 1,05 2,46 3,60 1,08 2,52 3,87 1,16 2,71 3,87 1,16 2,71 2,42 0,73 1,70 2,42 0,73 1,70 2,42 0,73 1,70 2,42 0,73 1,70 2,42 0,73 1,70 1,60 0,39 1,39 -0,58 1,20 0,00 1,04 0,00 0,90 0,00 0,78 -0,02 0,68 0,00 0,59 0,00 0,32 0,00 0,32 0,00 0,32 -0,04 0,32 0,00 0,32 0,00 0,32 0,00 0,32 0,00 1,85 3,33 3,86 3,81 3,77 3,14 3,14 3,11 3,03 3,03 1,97 2,02 2,02 2,02 2,02 -12,00 -12,00 = = = = 0,023 3,80 10,50 24,30% ALTERNATIVE SOLUTION Concern of The Transport Division : • Will Need a New Tank Car to anticipated growth of the firm in other areas because of increased throughtput of the machine. • The Investment of a New Tank Car estimated to be GBP 2 million in 2010 • The New Tank Car would have a depreciable life of 10 years using DDB Depreciation for the first 8 years and straight-line depreciation for the last two years. Tank car.xlsx MERSEYSIDE PROJECT (With a New Tank Car Investment) (Financial values in millions of British Pounds) Assumptions : Annual Output (metric tons) Output Gain/Original Output Price/ton (pounds sterling) Inflation (prices and costs) Gross Margin (ex. Deprec.) Old Gross Margin Tax Rate Energy Savings/Sales 1 Year Estimate of Incremental Gross Profit New Output Lost Output--Construction New Sales (Millions) New Gross Margin New Gross Profit Yr. 1-5 Yr. 6-10 Yr. 11-15 0 Now 2 Estimate of Incremental WIP Inventory New WIP Inventory Old WIP Inventory Incremental WIP Inventory 3 Estimate of Incremental Depreciation + New Depreciation-Plant + New Depreciation, Tank Cars Total Change in Depreciation 4 Overhead 5 Prelim. Engineering Costs 6 Pretax Incremental Profit 7 Tax Expense 8 After-tax Profit Free 10 Cash Flow AVG Annual Additio to EPS PAYBACK (years) NPV IRR 1 2008 Investment Outlay (mill.) - Plant Investment in Tank Cars Discount rate Depreciable Life (years) Plant Depreciable Life (yrs.) Tank Cars Overhead/Investment Salvage Value WIP Inventory/Cost of Goods Sold Months Downtime, Construction Preliminary Engineering Costs 2 2009 3 2010 4 2011 5 2012 12 2 10% 15 10 3,50% 0% 3% 1,50 0,50 6 2013 7 2014 8 2015 9 2016 10 2017 11 2018 12 2019 13 2020 14 2021 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 (33.438) 157,99 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 180,56 13,75% 13,75% 13,75% 13,75% 13,75% 13,30% 13,30% 13,30% 13,30% 13,30% 12,50% 12,50% 12,50% 12,50% 21,72 24,83 24,83 24,83 24,83 24,01 24,01 24,01 24,01 24,01 22,57 22,57 22,57 22,57 Old Output Old Sales Old Gross Profit Incremental Gross Profit 9 Cash Flow Adjustments Add back Depreciation Added WIP inventory Capital Investment 250.000 7% 675 0,00% 12,50% 11,50% 30% 1,25% 0,80% 0,00% 250.000 168,75 19,41 2,32 250.000 168,75 19,41 5,42 250.000 168,75 19,41 5,42 250.000 168,75 19,41 5,42 250.000 168,75 19,41 5,42 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 4,61 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 250.000 168,75 19,41 3,16 4,09 4,48 -0,39 4,67 4,48 0,19 4,67 4,48 0,19 4,67 4,48 0,19 4,67 4,48 0,19 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 1,60 1,39 1,60 0,42 0,50 -0,20 -0,06 -0,14 1,39 0,42 1,20 0,40 1,60 0,42 1,04 0,32 1,36 0,42 0,90 0,26 1,16 0,42 0,78 0,20 0,99 0,42 0,68 0,16 0,84 0,42 0,59 0,13 0,72 0,42 0,32 0,10 0,42 0,42 0,32 0,08 0,40 0,42 0,32 0,17 0,49 0,42 0,32 0,17 0,49 0,42 0,32 0,00 0,32 0,42 0,32 0,00 0,32 0,42 3,61 1,08 2,53 3,40 1,02 2,38 3,64 1,09 2,55 3,84 1,15 2,69 3,20 0,96 2,24 3,35 1,00 2,34 3,47 1,04 2,43 3,76 1,13 2,63 3,78 1,14 2,65 2,26 0,68 1,58 2,26 0,68 1,58 2,42 0,73 1,70 2,42 0,73 1,70 1,60 -0,39 1,39 -0,58 1,60 0,00 -2,00 1,36 0,00 1,16 0,00 0,99 -0,02 0,84 0,00 0,72 0,00 0,42 0,00 0,40 0,00 0,49 -0,04 0,49 0,00 0,32 0,00 0,32 0,00 1,07 3,33 1,98 3,91 3,85 3,20 3,18 3,15 3,06 3,05 2,02 2,07 2,02 2,02 -12,00 -12,00 = = = = 0,022 4,40 8,62 21,03% ALTERNATIVE SOLUTION Concern of The Marketing Department : • With a new project will reduce the cost at Merseyside and Victoria Chemicals might be able to take business from the plants of competitors such as Saone-Poulet or Vaysol. • Cannibalize business at Rotterdam in his preliminary analysis of the Merseyside Project. • Morris still wanted to review Greystock’s analysis in detail the potential loss of business volume at rotterdam • Loss Rotterdam.xlsx (Loss of business volume at Rotterdam) (Financial values in millions of British Pounds) Assumptions Annual Output (metric tons) Output Gain/Original Output Price/ton (pounds sterling) Inflation (prices and costs) Gross Margin (ex. Deprec.) Old Gross Margin Tax Rate Energy Savings/Sales Yr. 1-5 Yr. 6-10 Yr. 11-15 Year 1 Now Estimate of Incremental Gross Profit New Output Lost Output--Construction New Sales (Millions) New Gross Margin New Gross Profit Old Output Old Sales Old Gross Profit Lost Rotterdam Output (MT) Lost Revenue Lost Rotterdam Gross Profit Incremental Gross Profit 2 3 4 5 6 7 8 9 Estimate of Incremental WIP Inventory New WIP Inventory Old WIP Inventory Incremental WIP Inventory Estimate of Incremental Depreciation + New Depreciation, Plant + New Depreciation,Tank Cars Total Change in Depreciation Overhead Prelim. Engineering Costs Pretax Incremental Profit Tax Expense After-tax Profit Cash Flow Adjustments Add back Depreciation Change in WIP Inventory At Merseyside At Rotterdam Capital Investment 10 Free Cash Flow AVG Annual Add to EPS PAYBACK (years) NPV IRR 250.000 7% 675 0% 12,50% 11,50% 30% 1,25% 0,8% 0,0% Investment Outlay (mill.) - Plant Investment in Tank Cars Discount rate Depreciable Life (years) Plant Depreciable Life (yrs.) Tank Cars Overhead/Investment Salvage Value WIP Inventory/Cost of Goods Months Downtime, Construction 1 2008 2 2009 3 2010 4 2011 5 2012 6 2013 7 2014 8 2015 9 2016 10 2017 11 2018 12 2019 13 2020 14 2021 267.500 (33.438) 157,99 13,8% 21,72 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 250.000 168,75 19,41 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 17.500 11,81 1,36 0,96 4,06 4,06 4,06 4,06 3,25 3,25 3,25 3,25 3,25 1,81 1,81 1,81 1,81 4,09 4,48 -0,39 4,67 4,48 0,19 4,67 4,48 0,19 4,67 4,48 0,19 4,67 4,48 0,19 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,70 4,48 0,22 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 4,74 4,48 0,26 1,60 1,39 1,20 0,40 1,04 0,32 0,90 0,26 0,78 0,20 0,68 0,16 0,59 0,13 0,32 0,13 0,32 0,13 0,32 0,13 0,32 0,13 0,32 0,00 0,32 0,00 1,60 0,42 0,50 -1,56 -0,47 -1,09 1,39 0,42 1,60 0,42 1,36 0,42 1,16 0,42 0,99 0,42 0,84 0,42 0,72 0,42 0,45 0,42 0,45 0,42 0,45 0,42 0,45 0,42 0,32 0,42 0,32 0,42 2,26 0,68 1,58 2,04 0,61 1,43 2,28 0,68 1,60 2,48 0,75 1,74 1,84 0,55 1,29 1,99 0,60 1,39 2,11 0,63 1,48 2,38 0,71 1,67 2,38 0,71 1,67 0,94 0,28 0,65 0,94 0,28 0,65 1,07 0,32 0,75 1,07 0,32 0,75 1,60 1,39 1,60 1,36 1,16 0,99 0,84 0,72 0,45 0,45 0,45 0,45 0,32 0,32 0,39 -0,39 -0,19 0,19 -0,19 0,19 -2,00 -0,19 0,19 -0,19 0,19 -0,22 0,22 -0,22 0,22 -0,22 0,22 -0,22 0,22 -0,22 0,22 -0,26 0,26 -0,26 0,26 -0,26 0,26 -0,26 0,26 0,51 2,97 1,03 2,96 2,90 2,28 2,23 2,20 2,12 2,12 1,10 1,10 1,07 1,07 180,56 13,8% 24,83 -12,00 -12,00 = = = = 12 2 10% 15 10 3,5% 0 3,0% 1,50 0,012 5,70 2,26 13,32% 180,56 13,8% 24,83 180,56 13,8% 24,83 180,56 13,8% 24,83 180,56 13,3% 24,01 180,56 13,3% 24,01 180,56 13,3% 24,01 180,56 13,3% 24,01 180,56 13,3% 24,01 180,56 12,5% 22,57 180,56 12,5% 22,57 180,56 12,5% 22,57 180,56 12,5% 22,57 ALTERNATIVE SOLUTION Concern of The Treasury Staff: The Treasury staff think this impounds a long term inflation expectation of 3% per year and target rate of return is 7% • inflasi.xlsx MERSEYSIDE PROJECT (With Inflation) (Financial values in millions of British Pounds) Assumptions : Annual Output (metric tons) Output Gain/Original Output Price/ton (pounds sterling) Inflation (prices and costs) Gross Margin (ex. Deprec.) Old Gross Margin Tax Rate Energy Savings/Sales 1 Year Estimate of Incremental Gross Profit New Output Lost Output--Construction New Sales (Millions) New Gross Margin New Gross Profit Yr. 1-5 Yr. 6-10 Yr. 11-15 0 Now 2 Estimate of Incremental WIP Inventory New WIP Inventory Old WIP Inventory Incremental WIP Inventory 3 Estimate of Incremental Depreciation + New Depreciation-Plant + New Depreciation, Tank Cars Total Change in Depreciation 4 Overhead 5 Prelim. Engineering Costs 6 Pretax Incremental Profit 7 Tax Expense 8 After-tax Profit Free 10 Cash Flow AVG Annual Add to EPS PAYBACK (years) NPV IRR 1 2008 Investment Outlay (mill.) - Plant Investment in Tank Cars Discount rate Depreciable Life (years) Plant Depreciable Life (yrs.) Tank Cars Overhead/Investment Salvage Value WIP Inventory/Cost of Goods Sold Months Downtime, Construction Preliminary Engineering Costs 2 2009 3 2010 4 2011 5 2012 12 2 7% 15 10 3,50% 0% 3% 1,50 0,50 6 2013 7 2014 8 2015 9 2016 10 2017 11 2018 12 2019 13 2020 14 2021 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 (33.438) 157,99 185,98 191,56 197,31 203,22 209,32 215,60 222,07 228,73 235,59 242,66 249,94 257,44 265,16 13,75% 13,75% 13,75% 13,75% 13,75% 13,30% 13,30% 13,30% 13,30% 13,30% 12,50% 12,50% 12,50% 12,50% 21,72 25,57 26,34 27,13 27,94 27,84 28,67 29,54 30,42 31,33 30,33 31,24 32,18 33,15 Old Output Old Sales Old Gross Profit Incremental Gross Profit 9 Cash Flow Adjustments Add back Depreciation Added WIP inventory Capital Investment 250.000 7% 675 3,00% 12,50% 11,50% 30% 1,25% 0,80% 0,00% 250.000 168,75 19,41 2,32 250.000 173,81 19,99 5,58 250.000 179,03 20,59 5,75 250.000 184,40 21,21 5,92 250.000 189,93 21,84 6,10 250.000 195,63 22,50 5,34 250.000 201,50 23,17 5,50 250.000 207,54 23,87 5,67 250.000 213,77 24,58 5,84 250.000 220,18 25,32 6,01 250.000 226,79 26,08 4,25 250.000 233,59 26,86 4,38 250.000 240,60 27,67 4,51 250.000 247,82 28,50 4,65 4,09 4,48 -0,39 4,81 4,61 0,20 4,96 4,75 0,20 5,11 4,90 0,21 5,26 5,04 0,22 5,44 5,19 0,25 5,61 5,35 0,26 5,78 5,51 0,27 5,95 5,68 0,27 6,13 5,85 0,28 6,37 6,02 0,35 6,56 6,20 0,36 6,76 6,39 0,37 6,96 6,58 0,38 1,60 1,39 1,60 0,42 0,50 -0,20 -0,06 -0,14 1,39 0,42 1,20 0,40 1,60 0,42 1,04 0,32 1,36 0,42 0,90 0,26 1,16 0,42 0,78 0,20 0,99 0,42 0,68 0,16 0,84 0,42 0,59 0,13 0,72 0,42 0,32 0,10 0,42 0,42 0,32 0,08 0,40 0,42 0,32 0,17 0,49 0,42 0,32 0,17 0,49 0,42 0,32 0,00 0,32 0,42 0,32 0,00 0,32 0,42 3,78 1,13 2,64 3,73 1,12 2,61 4,14 1,24 2,90 4,52 1,36 3,17 3,94 1,18 2,75 4,24 1,27 2,97 4,53 1,36 3,17 4,99 1,50 3,50 5,19 1,56 3,63 3,34 1,00 2,34 3,47 1,04 2,43 3,77 1,13 2,64 3,91 1,17 2,73 1,60 -0,39 1,39 -0,59 1,60 -0,01 -2,00 1,36 -0,01 1,16 -0,01 0,99 -0,03 0,84 -0,01 0,72 -0,01 0,42 -0,01 0,40 -0,01 0,49 -0,07 0,49 -0,01 0,32 -0,01 0,32 -0,01 1,07 3,44 2,21 4,26 4,32 3,71 3,80 3,88 3,91 4,03 2,76 2,91 2,95 3,04 -12,00 -12,00 = = = = 0,029 4,30 17,55 24,10% RECOMENDATION • The Merseyside plant must to modernize the machine to increase the throughout and lower cost of energy. • The Transport Division need to purchase the new tank cars at Merseyside (estimate purchase GBP 2 Million in 2010). • Merseyside can save stock everymonth or transfer stock from Rotterdam • We Are not agree about Merseyside will oversupply and Cannibalize the Rotterdam supply. • Reasonable if the Treasury Staff concern about Inflation 3% per year and Rate of Return 7% per year. • Rejected EPC Project . • inflasi 2.xlsx Lampiran 5 MERSEYSIDE PROJECT (With Inflation) (Financial values in millions of British Pounds) Assumptions : Annual Output (metric tons) Output Gain/Original Output Price/ton (pounds sterling) Inflation (prices and costs) Gross Margin (ex. Deprec.) Old Gross Margin Tax Rate Energy Savings/Sales 1 Year Estimate of Incremental Gross Profit New Output Lost Output--Construction New Sales (Millions) New Gross Margin New Gross Profit Yr. 1-5 Yr. 6-10 Yr. 11-15 0 Now 2 Estimate of Incremental WIP Inventory New WIP Inventory Old WIP Inventory Incremental WIP Inventory 3 Estimate of Incremental Depreciation + New Depreciation-Plant + New Depreciation, Tank Cars Total Change in Depreciation 4 Overhead 5 Prelim. Engineering Costs 6 Pretax Incremental Profit 7 Tax Expense 8 After-tax Profit Free 10 Cash Flow AVG Annual Add to EPS PAYBACK (years) NPV IRR Investment Outlay (mill.) - Plant Investment in Tank Cars Discount rate Depreciable Life (years) Plant Depreciable Life (yrs.) Tank Cars Overhead/Investment Salvage Value WIP Inventory/Cost of Goods Sold Months Downtime, Construction Preliminary Engineering Costs 2 2009 3 2010 4 2011 5 2012 6 2013 7 2014 8 2015 9 2016 10 2017 11 2018 12 2019 13 2020 14 2021 15 2022 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 267.500 185,98 13,75% 25,57 = = = = 191,56 13,75% 26,34 197,31 13,75% 27,13 203,22 13,75% 27,94 209,32 13,30% 27,84 215,60 13,30% 28,67 222,07 13,30% 29,54 228,73 13,30% 30,42 235,59 13,30% 31,33 242,66 12,50% 30,33 249,94 12,50% 31,24 257,44 12,50% 32,18 265,16 12,50% 33,15 273,12 12,50% 34,14 250.000 168,75 19,41 5,42 250.000 173,81 19,99 5,58 250.000 179,03 20,59 5,75 250.000 184,40 21,21 5,92 250.000 189,93 21,84 6,10 250.000 195,63 22,50 5,34 250.000 201,50 23,17 5,50 250.000 207,54 23,87 5,67 250.000 213,77 24,58 5,84 250.000 220,18 25,32 6,01 250.000 226,79 26,08 4,25 250.000 233,59 26,86 4,38 250.000 240,60 27,67 4,51 250.000 247,82 28,50 4,65 250.000 255,25 29,35 4,79 4,67 4,48 0,19 4,81 4,61 0,20 4,96 4,75 0,20 5,11 4,90 0,21 5,26 5,04 0,22 5,44 5,19 0,25 5,61 5,35 0,26 5,78 5,51 0,27 5,95 5,68 0,27 6,13 5,85 0,28 6,37 6,02 0,35 6,56 6,20 0,36 6,76 6,39 0,37 6,96 6,58 0,38 7,17 6,78 0,39 1,60 1,39 1,60 0,42 0,50 2,90 0,87 2,03 1,39 0,42 1,20 0,40 1,60 0,42 1,04 0,32 1,36 0,42 0,90 0,26 1,16 0,42 0,78 0,20 0,99 0,42 0,68 0,16 0,84 0,42 0,59 0,13 0,72 0,42 0,32 0,10 0,42 0,42 0,32 0,08 0,40 0,42 0,32 0,17 0,49 0,42 0,32 0,17 0,49 0,42 0,32 0,00 0,32 0,42 0,32 0,00 0,32 0,42 0,32 0,00 0,32 0,42 3,78 1,13 2,64 3,73 1,12 2,61 4,14 1,24 2,90 4,52 1,36 3,17 3,94 1,18 2,75 4,24 1,27 2,97 4,53 1,36 3,17 4,99 1,50 3,50 5,19 1,56 3,63 3,34 1,00 2,34 3,47 1,04 2,43 3,77 1,13 2,64 3,91 1,17 2,73 4,05 1,21 2,83 1,60 0,19 1,39 -0,01 1,60 -0,01 -2,00 1,36 -0,01 1,16 -0,01 0,99 -0,03 0,84 -0,01 0,72 -0,01 0,42 -0,01 0,40 -0,01 0,49 -0,07 0,49 -0,01 0,32 -0,01 0,32 -0,01 0,32 -0,01 3,82 4,02 2,21 4,26 4,32 3,71 3,80 3,88 3,91 4,03 2,76 2,91 2,95 3,04 3,14 -12,00 -12,00 12 2 7% 15 10 3,50% 0% 3% 1,50 0,50 1 2008 180,56 13,75% 24,83 Old Output Old Sales Old Gross Profit Incremental Gross Profit 9 Cash Flow Adjustments Add back Depreciation Added WIP inventory Capital Investment 250.000 7% 675 3,00% 12,50% 11,50% 30% 1,25% 0,80% 0,00% 0,030 3,50 20,63 30,01%