in 2011? - The Griffith Foundation

advertisement

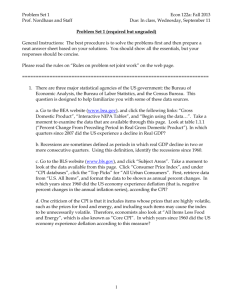

Emerging Issues and Trends Affecting Commercial P/C Insurance Seminar for State Committee Chairs & Legislators Griffith Foundation Columbus, OH August 21, 2011 Steven N. Weisbart, Ph.D., CLU, Senior Vice President & Chief Economist Insurance Information Institute 110 William Street New York, NY 10038 Tel: 212.346.5540 Cell: 917.494.5945 stevenw@iii.org www.iii.org Profitability How Can Commercial Insurers be Profitable When… •Premiums/Rates are Flat or Declining, •Investment Income is Low and Declining •Losses (especially from CATs) are Increasing 2 Profitability Peaks & Troughs in the P/C Insurance Industry, 1975 – 2011* ROE 25% 1977:19.0% 1987:17.3% 20% History suggests next ROE peak will be in 2016-2017 2007:12.3% 1997:11.6% 2011: 6.1%* 15% 10 Years 10% 5% 0% 1975: 2.4% 1984: 1.8% 1992: 4.5% 2001: -1.2% 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11* -5% *Profitability = P/C insurer ROEs are I.I.I. estimates. 2011 figure is an estimate based on annualized ROAS for Q1 data. Note: Data for 2008-2011 exclude mortgage and financial guaranty insurers. Source: Insurance Information Institute; NAIC, ISO, A.M. Best. P/C Commercial Insurance Direct Premiums Written by Line, 2009 $ Billions $50 $44.71 2009 Total: $467.8 billion $39.89 $40 $33.33 $31.02 $30 $24.19 $22.81 $20 $12.99 $10.69 $8.47 $10 $5.41 $0 Other Liability* Workers Comp Comm'l Multiple Peril Comm'l Fire & Allied Inland Auto Lines Marine Medical Multiple Mortgage Malpractice Peril Crop Guaranty *Includes General Liability, Products Liability, D&O, Professional Malpractice (except Medical) etc. Sources: SNL Financial, Insurance Information Institute All Other P/C Commercial Insurance Market Shares by Direct Premiums Written, 2009 10.0% Top Ten Insurance Groups 9.1% Combined, the top 10 have less than 45% market share 8.0% 6.4% 6.0% 6.0% 5.7% 4.0% 3.2% 3.1% 3.0% 2.9% 2.1% 2.1% 2.0% 0.0% AIG Travelers Liberty Mutual Zurich Sources: SNL Financial, Insurance Information Institute CNA Financial ACE Chubb Hartford Nationwide Financial Mutual Services Allianz Growth of Commercial Lines Direct Written Premium vs. GDP, U.S., 2001-2010 0.2% 4.9% 1.9% 2003 2004 2005 2006 2007 2008 4.2% 5.4% 6.0% 2002 3.3% 6.5% 2001 4.5% 6.4% 5% 3.5% 10% 3.4% 15% 4.7% 11.4% 15.3% 25% 20% From 2004 on, the economy grew faster than commercial insurance premium volume US nominal GDP change 19.0% US DWP: Comm. Lines -10% -2.5% -5% -7.3% -2.5% -1.2% 0% 2009 2010 -15% Sources: SNL Financial; I.I.I. 6 Calendar Year Combined Ratio, Commercial Insurance, 2008-2011F 90 91.1 93.6 95 98.9 100 102.0 102.5 105 103.8 105.4 106.0 110 115 112.3 110.2 111.1 In the last dozen years, the only profitable years were years of very low CATs 110.0 110.0 120 122.3 125 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010P 2011F 2012F Overall deterioration in 2011 underwriting performance is due to expected return to normal catastrophe activity plus deteriorating underwriting performance related to the prolonged commercial soft market Sources: A.M. Best . Insurance Information Institute. 7 P/C Combined Ratios, Selected Commercial Lines, 2008-2010P Line of Business 2008 2009 2010P Other Liability (incl. Prod Liab) Workers Compensation Commercial Multi Peril 95 101 104 105 110.5 97 110 115 101 Commercial Auto 96.8 99.5 98 Fire & Allied Lines (incl. EQ) 99 80 83 All Other Lines 113 96 101 Sources: All lines except WC for 2008-09, A.M. Best; Worker Comp., NCCI; 2010P data, ISO. Private carriers only. 85 103.0 101.0 94.2 98.6 97.6 95.1 89.8 105.4 83.8 90 93.8 89.0 95 101.9 97.7 100 108.0 116.1 116.2 121.0 117.0 115.0 115.0 122.4 113.1 104.9 105 97.3 110 100.7 115 125.0 115.3 120 119.0 125 119.8 116.8 130 108.5 113.6 Commercial Multi-Peril Combined Ratio: 1995–2011P 80 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10E* 11P* Commercial Multi-Peril Underwriting Performance is Expected to Deteriorate Modestly *2010Eand 2011P figures are for the combined liability and non-liability components. Sources: A.M. Best; Insurance Information Institute. 05 06 96.8 92.4 04 94.2 92.1 95.2 95 92.9 102.7 100 100.0 01 105 98.0 00 110 99.5 97 116.2 96 115.7 95 118.1 113.0 115 112.0 120 112.1 125 115.9 Commercial Auto Combined Ratio: 1993–2011P 90 85 80 98 99 02 03 07 08 09 Commercial Auto Underwriting Performance is Expected to Deteriorate Modestly Sources: A.M. Best; Insurance Information Institute. 10E 11P Inland Marine Combined Ratio: 1999–2011P 105 101.9 100.2 100 95 93.2 92.8 89.9 90 83.8 85 80.8 94.5 94.5 10E 11P 89.3 82.5 79.5 80 77.3 75 70 99 00 01 02 03 04 05 06 07 08 09 Inland Marine is Expected to Remain Among the Most Profitable of All Lines Sources: A.M. Best; Insurance Information Institute. 117.5 115.0 110.5 101.0 103.5 03 98.4 02 102.7 97 107.0 96 110.0 101.0 100 100.0 105 97.0 110 102.0 115 107.0 120 110.9 115.3 125 118.2 130 121.7 Workers Compensation Combined Ratio: 1994–2011P 95 90 85 80 94 95 98 99 00 01 04 05 06 07 08 09 10E 11P Workers Comp underwriting results are deteriorating markedly and are the worst they have been in a decade Sources: A.M. Best (1994-2009); NCCI (2010E); Insurance Information Institute (2011P). P/C Reserve Development, 1992–2011E $25 $20 Impact on Combined Ratio (Points) $15 $10 $5 23.2 13.7 11.7 2.3 9.9 7.3 1 -2.1 -$10 -2.6 -4.1 -6.6 -8.3 -5 -6.7 -9.5 -9.9 -9.8 -$15 -2 -6 11E 10E 09 07 06 05 04 03 02 01 00 99 98 97 96 95 94 -$20 93 4 -4 -14.6-16 -15 92 6 0 $0 -$5 8 2 08 Prior Yr. Reserve Release ($B) Prior Yr. Reserve Development ($B) Impact on Combined Ratio (Points) $30 Prior year reserve releases totaled $8.8 billion in the first half of 2010, up from $7.1 billion in the first half of 2009 Reserve releases remained strong in 2010 but should taper off in 2011 Note: 2005 reserve development excludes a $6 billion loss portfolio transfer between American Re and Munich Re. Including this transaction, total prior year adverse development in 2005 was $7 billion. The data from 2000 and subsequent years excludes development from financial guaranty and mortgage insurance. Sources: Barclay’s Capital; A.M. Best. 13 A 100 Combined Ratio Isn’t What It Once Was: Investment Impact on ROEs A combined ratio of about 100 generated ~7.5% ROE in 2009/10, 10% in 2005 and 16% in 1979 Combined Ratio / ROE 110 105 15.9% 14.3% 100.6 100 100.1 97.5 100.7 12.7% 101.0 99.3 100.8 102.2 7.4% 92.6 15% 12% 9.6% 95 18% 7.5% 8.9% 6.5% 9% 6% 90 4.4% 85 3% 0% 80 1978 1979 2003 2005 2006 Combined Ratio 2008* 2009* 2010* 2011* ROE* Combined Ratios Must Be Lower in Today’s Depressed Investment Environment to Generate Risk Appropriate ROEs * 2009 and 2010 figures are return on average statutory surplus. 2008 -2011 figures exclude mortgage and financial guaranty insurers Source: Insurance Information Institute from A.M. Best and ISO data. Catastrophe Loss Developments and Trends 2011 and 2010 Are Rewriting Catastrophe Loss and Insurance History 15 81 59 63 48 52 56 45 45 49 There have been 2,013* federal disaster declarations since 1953. Note that 2005 was a relatively low year for number of disaster declarations in the 1996-2010 period, but that year included Hurricanes Katrina, Rita, and Wilma. *Through August 12, 2011. Sources: Federal Emergency Management Administration at http://www.fema.gov/news/disaster_totals_annual.fema ; Insurance Information Institute. 11* 09 07 03 01 99 97 95 93 91 89 87 85 83 81 79 77 75 73 71 69 67 65 63 61 59 57 55 53 69 65 32 36 32 38 31 11 15 44 43 45 23 22 25 27 28 23 34 38 29 17 17 19 11 11 The number of federal disaster declarations could set a new record in 2011. 7 7 10 12 12 13 17 18 16 16 22 20 25 25 30 30 40 0 42 48 46 46 50 20 50 60 24 21 70 The average number from 1972-1995 was 31.7. 05 From 1953-71, the average number of declarations per year was 16.5. 80 75 90 75 The average number from 19962010 was 58.4. 63 Number of Federal Disaster Declarations, 1953-2011* Worldwide Natural Disasters, 1980 – 2011* Number of Events Already 355 events through the first 6 months of 2011 600 500 400 300 200 100 1980 1982 1984 1986 Geophysical events (Earthquake, tsunami, volcanic eruption) *2011 figure is through June 30. Source: MR NatCatSERVICE 1988 1990 1992 1994 Meteorological events (Storm) 1996 1998 2000 2002 Hydrological events (Flood, mass movement) 2004 2006 2008 2010 Climatological events (Extreme temperature, drought, forest fire) 17 Worldwide Natural Disasters 1980–2011, Overall and Insured Losses* First Half 2011 Overall Losses: $265 Bill 300 Insured Losses: $60 Bill 250 US$bn 200 150 100 50 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2002 2004 2006 2008 2010 Insured losses (in 2011 values) Overall losses (in 2011 values) *2011 figure is through June 30. Source: MR NatCatSERVICE 2000 © 2011 Munich Re 18 Residual Markets 19 U.S. Residual Market Exposure to Loss ($ Billions) ($ Billions) $900 Katrina, Rita and Wilma $800 $700 4 Florida Hurricanes $600 $500 $400 $281.8 $221.3 $200 $100 $656.7 $703.0 $696.4 $757.9 $430.5 $419.5 $372.3 Hurricane Andrew $300 $771.9 $292.0 $244.2 $150.0 $54.7 $0 1990 1995 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 In the 21-year period between 1990 and 2010, total exposure to loss in the residual market (FAIR & Beach/Windstorm) Plans has surged from $54.7 billion in 1990 to $757.9 billion in 2010. Source: PIPSO; Insurance Information Institute (I.I.I.); http://www.iii.org/pr/last-resort-2010. 20 U.S. Residual Market: Policies In-Force as Percent of Housing Units, 2000-2009 Katrina, Rita, and Wilma 2.5% 2.20% 2.22% 2.03% 2.0% 1.80% 1.5% 1.38% 1.91% 1.77% 1.44% 1.25% 1.02% 1.0% 0.5% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Between 2000 and 2009, the number of housing units in the U.S. grew by 13.7 million (up 12%) but policies in-force in the residual market (FAIR & Beach/Windstorm Plans) grew by 70%. Sources: U.S. Census Bureau at http://www.census.gov/popest/housing/HU-EST2009.html PIPSO; Insurance Information Institute; http://www.iii.org/pr/last-resort-2010. 22 Pricing Is There Evidence of a Broad and Sustained Shift in Pricing? 23 Soft Market Persisted in 2010 but Growth Returned: More in 2011? (Percent) 1975-78 1984-87 25% 2000-03 Net Written Premiums Fell 0.7% in 2007 (First Decline Since 1943) by 2.0% in 2008, and 4.2% in 2009, the First 3Year Decline Since 1930-33. 20% 2011:Q1 growth was +3.5%; First Q1 growth since 2007 15% 10% 5% 0% NWP was up 0.9% in 2010 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11* -5% *2011 figure is an estimate based on Q1 data. Shaded areas denote “hard market” periods Sources: A.M. Best (historical and forecast), ISO, Insurance Information Institute. 24 5% 0% -5% -10% Sources: ISO, Insurance Information Institute. 2011:Q1 2010:Q4 2010:Q3 2010:Q2 2010:Q1 2009:Q4 2009:Q3 2009:Q2 2009:Q1 2008:Q4 2008:Q3 2008:Q2 2008:Q1 2007:Q4 2007:Q3 2007:Q2 2007:Q1 2006:Q4 2006:Q3 2006:Q2 2006:Q1 2005:Q1 -1.8% -0.7% -4.4% -3.7% -5.3% -5.2% -1.4% -1.3% -1.9% -1.6% -4.6% 2005:Q2 -4.1% 2005:Q3 -5.8% 2005:Q4 -1.6% 2004:Q4 2004:Q3 2004:Q2 2004:Q1 2003:Q4 2003:Q3 2003:Q2 2003:Q1 2002:Q4 2002:Q3 1.3% 2.3% 1.3% 3.5% 0.5% 2.1% 0.0% 10.3% 10.2% 13.4% 6.6% 15.1% 16.8% 16.7% 12.5% 10.1% 9.7% 7.8% 7.2% 5.6% 2.9% 5.5% 10% 2002:Q2 15% 10.2% 20% 2002:Q1 P/C Net Premiums Written: % Change, Quarter vs. Year-Prior Quarter The long-awaited uptick. In 2011:Q1 occurring in personal lines predominating cos. (+3.8%) and commercial lines predominating cos. (+3.5%) Finally! Back-to-back quarters of net written premium growth (vs. the same quarter, prior year) 25 Average Commercial Rate Change, All Lines, (1Q:2004–2Q:2011) -10% -12% -14% KRW Effect -16% -0.1% -6.4% -5.1% -4.9% -5.8% -5.6% -5.3% -6.4% -5.2% -5.4% -2.9% Pricing is flat for the first time in more than 7 years -9.6% -11.3% -11.8% -13.3% -12.0% -13.5% -12.9% -11.0% -8% -4.6% -2.7% -3.0% -5.3% -6% -9.4% -9.7% -8.2% -4% -5.9% -7.0% -2% -3.2% 0% -0.1% 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05 3Q05 4Q05 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 (Percent) Source: Council of Insurance Agents & Brokers; Insurance Information Institute Q2 2011 decreases were the smallest since 2004, perhaps signaling a market firming 26 Cumulative Qtrly. Commercial Rate Changes, by Account Size: 1999:Q4 to 2011:Q2 1999:Q4 = 100 Pricing today is where is was in Q3:2000 (pre-9/11) Downward pricing pressure is most pronounced for larger risks Source: Council of Insurance Agents and Brokers; Insurance Information Institute. 27 Price Index for Premiums for Commercial Multiple Peril Insurance, 1998–2011* Index June 1998 = 100 116 113 110 107 104 101 Jun-11 Dec-10 Jun-10 Dec-09 Jun-09 Dec-08 Jun-08 Dec-07 Jun-07 Dec-06 Jun-06 Dec-05 Jun-05 Dec-04 Jun-04 Dec-03 Jun-03 Dec-02 Jun-02 Dec-01 Jun-01 Dec-00 Jun-00 Dec-99 Jun-99 Dec-98 Jun-98 98 *As of July 2011; Not seasonally adjusted. Note: Recessions indicated by gray shaded columns. Sources: U.S. Bureau of Labor Statistics, Producer Price Index database; National Bureau of Economic Research (recession dates); Insurance Information Institute. 28 Price Index for Premiums for Non-auto Liability Insurance, 1998–2011* Index June 1998 = 100 116 113 110 107 104 101 Jun-11 Dec-10 Jun-10 Dec-09 Jun-09 Dec-08 Jun-08 Dec-07 Jun-07 Dec-06 Jun-06 Dec-05 Jun-05 Dec-04 Jun-04 Dec-03 Jun-03 Dec-02 Jun-02 Dec-01 Jun-01 Dec-00 Jun-00 Dec-99 Jun-99 Dec-98 Jun-98 98 *As of July 2011; Not seasonally adjusted. Note: Recessions indicated by gray shaded columns. Sources: U.S. Bureau of Labor Statistics, Producer Price Index database; National Bureau of Economic Research (recession dates); Insurance Information Institute. 29 Price Index for Premiums for Commercial Auto Insurance, 1998–2011* Index June 1998 = 100 116 113 110 107 104 Jun-11 Dec-10 Jun-10 Dec-09 Jun-09 Dec-08 Jun-08 Dec-07 Jun-07 Dec-06 Jun-06 Dec-05 Jun-05 Dec-04 Jun-04 Dec-03 Jun-03 Dec-02 Jun-02 Dec-01 Jun-01 Dec-00 Jun-00 Dec-99 Jun-99 Dec-98 98 Jun-98 101 *As of July 2011; Not seasonally adjusted. Note: Recessions indicated by gray shaded columns. Sources: U.S. Bureau of Labor Statistics, Producer Price Index database; National Bureau of Economic Research (recession dates); Insurance Information Institute. 30 INVESTMENTS: THE NEW REALITY Investment Performance is a Key Driver of Profitability Does It Influence Underwriting or Cyclicality? 31 Property/Casualty Insurance Industry Investment Gain: 1994–2011:Q11 ($ Billions) $70 $64.0 $58.0 $60 $52.3 $55.7 $51.9 $52.9 $48.9 $47.2 $50 $59.4 $56.9 $45.3 $44.4 $42.8 $40 $35.4 $39.2 $36.0 $31.7 $30 Investment gains in 2010 were the best since 2007 $20 $10 $13.5 $0 94 95 96 97 98 99 00 01 02 03 04 05* 06 07 08 09 10 11:Q1 Investment Gains Recovered Significantly in 2010 Due to Realized Investment Gains; The Financial Crisis Caused Investment Gains to Fall by 50% in 2008 1 Investment gains consist primarily of interest, stock dividends and realized capital gains and losses. * 2005 figure includes special one-time dividend of $3.2B. Sources: ISO; Insurance Information Institute. Treasury Yield Curves Before and After S&P Downgrade Treasury actually fell in the wake of the S&P downgrade, despite (theoretically) higher risk 5% 4% 4.27% 3.95% 4% 3.68% 3.00% 3.31% 3% 2.28% 3% 2.40% 2% 1.54% 2% 1.75% 0.68% 1% 1% 0% 0.41% 0.04% 0.02% 1M 0.04% 0.08% 1.11% July 2011 Yield Curve* Post-Downgrade (July 2007) 0.19% 0.05% 0.07% 0.12% 3M 6M 1Y 0.27% 2Y 0.45% 3Y 5Y 7Y 10Y 20Y 30Y The End of the Fed’s Quantitative Easing Is Unlikely to Push Interest Rates Up Substantially Given Ongoing Economic Weakness *Average of daily rates. Sources: Board of Governors of the United States Federal Reserve Bank; Insurance Information Institute. 33 Inflation Is it a Threat to Claim Cost Severities? 34 Annual Inflation Rates, (CPI-U, %), 1990–2014F Annual Inflation Rates (%) The recession and the collapse of the commodity bubble reduced inflationary pressures in 2009/10 6.0 5.0 4.9 5.1 3.8 4.0 3.0 3.0 2.0 3.3 3.4 3.2 2.9 2.8 2.4 3.0 2.6 2.5 3.8 3.0 2.8 2.3 2.2 2.1 2.2 1.9 1.5 1.6 1.3 1.0 0.0 -0.4 -1.0 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11F 12F 13F 14F The slack in the U.S. economy suggests that inflation should not heat up before 2012, but other forces (commodity prices, inflation in countries from which we import, etc.), plus U.S. debt burden, remain longer-run concerns Sources: US Bureau of Labor Statistics; Blue Chip Economic Indicators, 3/11 and 8/11 (forecasts). 35 P/C Personal Insurance Claim Cost Drivers Grow Faster than the Overall CPI Suggests Price Changes in 2010 9% 8.8% 6% Excludes Food and Energy 6.1% 4.3% 3% 3.3% 4.3% 3.6% 3.1% 3.3% 1.6% 1.0% 0% Overall CPI "Core" CPI Inpatient Hospital Services Outpatient Physicians' Prescription Medical Care Legal Motor Vehicle Residential Hospital Services Drugs Commodities Services Parts & Maint. & Services Equipment Repair Healthcare costs are a major liability, med pay, and PIP claim cost driver. They are likely to grow faster than the CPI for the next few years, at least Source: Bureau of Labor Statistics; Insurance Information Institute. 36 WC Medical Severity Rising at Twice the Medical CPI Rate 15% Change in Medical CPI 13.5% Change Med Cost per Lost Time Claim 12% 10.6% 10.1% 8.3% 9% 7.4% 9.1% 8.8% 7.7% 7.3% 6.1% 6.1% 6% 5.4% 5.1% 4.5% 3% 3.5% 2.8% 3.2% 3.5% 4.1% 4.6% 4.7% 4.0% 5.0% 4.4% 4.2% 4.4% 4.0% 3.7% 5.4% 2.2% 3.2% 3.4% 0% 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 The average annual increase in WC medical severity from 1995 through 2009 was nearly twice the medical CPI (7.6% vs. 3.9%). Will healthcare reform affect this gap? Sources: Med CPI from US Bureau of Labor Statistics, WC med severity from NCCI based on NCCI states. P/C Commercial Property Insurance Claim Cost Drivers Grow Faster than the Overall CPI Suggests Price Changes in 2010 24% 22.0% 21.2% 18% An oil price spike in early 2011 will likely be reflected in higher prices for construction products that are based on oil, like asphalt and plastic pipe. 16.3% Excludes Food and Energy 12% 7.3% 6% 0% 1.6% 1.0% Overall CPI "Core" CPI 2.5% Waferboard Steel Mill Products Copper Brass & Mill Shapes Plastic Pipe Asphalt Paving & Roofing Materials Commercial liability and workers comp costs are also affected by the exploding cost of health care. Source: Bureau of Labor Statistics; Insurance Information Institute. 38 Insurance Information Institute Online: www.iii.org Thank you for your time and your attention!