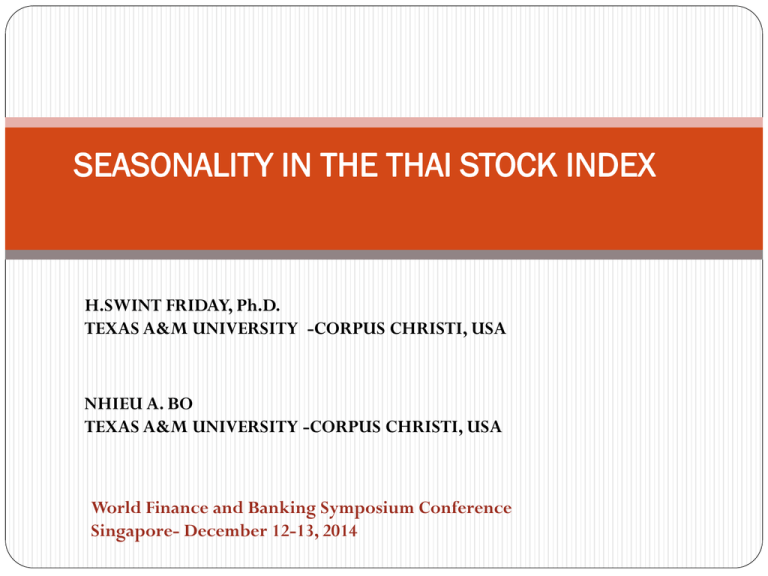

Singapore Conference - Texas A&M University Corpus Christi

advertisement

SEASONALITY IN THE THAI STOCK INDEX H.SWINT FRIDAY, Ph.D. TEXAS A&M UNIVERSITY -CORPUS CHRISTI, USA NHIEU A. BO TEXAS A&M UNIVERSITY -CORPUS CHRISTI, USA World Finance and Banking Symposium Conference Singapore- December 12-13, 2014 INTRODUCTION/ABSTRACT The paper examines seasonality in returns for the Stock Exchange of Thailand (SET).We use historical returns on SET composite and SET50 since the stock market was established to December 2013 to examine whether the weather has generated abnormal returns and seasonal effects on the two indices. In our previous study, we found that “Halloween effect” or “Go away in May come back Halloween Day” in theVietnam stock index (VN-index) were statistically attached to the rainy season during the observed period from 2000-2010 inclusively.We find that Sell in May or Halloween effect presents in both SET composite and SET 50 indices even though the results are not statistically significant. Also, we find significant returns for December and January so-called turn-of-the-month effects.We conclude that Halloween effect is actually December and January effect in disguise. LITERATURE REVIEW I. • The Stock Exchange of Thailand II. • Study of Seasonality in Stock Index III. • Data and Methodology Thailand Insight and SET Index Figure: GDP Growth (Annual %) of Thailand and East Asia Pacific Source: World Bank Data Thai Stock Market Performance Lehman Brother Crisis Floods Figure 1: Thai stock index (SET) performance from 1987-2014 Source: Trading Economic SET Index Series SET Index ( Composite): • Capitalization-weighted price index • Calculated from the prices of all common stocks (with certain exceptions) • Adjustment: in line with changing of the values of stocks and number of stocks • Base value: 100 points • Base date: April 30, 1975 SET 50 Index (Large-cap Index) • Capitalization-weighted price index • Calculated from the prices of 50 selected SET stocks • Adjustment: in line with changing of the values of stocks and number of stocks • Base value: 100 points • Base date: April 30, 1995 Source: The Stock Exchange of Thailand Figure 1: Stock selection for SET 50 Study of Seasonality in Stock Index Literature Reviews: • Bouman and Jacobsen (2002) found evidences for Halloween effects across 36 stock markets in the total of 37 observed countries includingThailand. • Maberly and Pierce (2003) documented Halloween effect in Japanese equity market over prior years of the mid1980s.This effect was strongly evident over bull market observed in the data set. • Gultekin M. and Gultekin B. (1983) documented that significantly large mean returns were found at the turn of tax year in stock markets observed in 18 countries. Remarkably, January was the month with significantly high return. • Fountas and Segredakis (2002) tested eighteen emerging stock markets for the period 1987-1995 including Thailand and found that January effect and tax-loss selling hypothesis were not statistically supported in stock markets being observed. In the other words, the result supported the existence of EMH those stock markets. • In previous study, we found “Halloween effect” in VN-index during the observed period from July 2000 to December 2010. The effect primarily occurred between 2000 and 2007. In addition, January has highest average return over the period 2000-2010, which supports for the January effect. (“Seasonality in the Vietnam Stock Index”). Is Thai stock market efficient?? Research Data and Methodology • Examine the SET Composite and SET 50 since the stock exchanges was established in May 1975 to December 31st, 2013 inclusively. • SET monthly returns are calculated from daily returns using the following equation: Methodology In this paper, we use Brauer and Chang’s (1990) model: Where: • 𝑅jt is the return on j index in month tth • Dit is a dummy variable which takes value of 1 if the month is tth and zero otherwise • αt: represents the coefficient for the month tth The second model we use in our examination to test Halloween effect comes from Lucey and Zhao’s (2008) model: 𝐑jt = α + β Wt + µt Where: • Rjt is the return on index j in the month tth • Wt is dummies for Halloween indicator, which takes value 1 if the month falls from November to April and zero otherwise • β: represents the coefficient for Halloween indicator TABLE I Mean Monthly Returns for SET and SET 50 Index (%) Aver. Monthly* Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec May-Oct HPR Nov-Apr HPR SET50 (1996-2013) 2.54 1.85 -0.70 0.13 -0.65 -0.13 -0.46 -2.19 2.07 -1.11 -0.08 4.20 SET (1996-2013) 2.47 0.58 -0.41 1.47 0.27 1.25 1.23 0.16 0.34 1.34 -0.38 3.02 0.98 1.04 1.08 1.07 *Average monthly returns across the years being observed Source: Quandl Dataset Initial Evidences: • Higher mean returns for Jan and Dec. • “Halloween” effect might be present in this market. TABLE II Mean and Standard Deviation for SET More volatile and SET50 Index Index Full Sample (12 month HPR) November-April HPR** Mean Std. Dev Mean % Positive Std. Dev Mean % Positive Std. Dev SET (1975-2013) 15.36% 6.86%* 63.16% 17.19% 5.84%* 50.00% 29.30% SET 50 (1995-2013) 8.53% 42.70% 7.41%* 66.67% 18.36% (3.16%)* 38.89% 25.58% 8.90% 87.50% 10.80% 50% 30.78% SET100 (2006-2013) 44.5 May-October HPR 3.81% ** November-April Holding Period Return (HPR) is calculated the months within the calendar year for tax purposes. • 63.16% of positive returns for Nov-Apr as compared to 50% positive returns for MayOct for SET Index. • Similarly, 66.67% of positive returns as compared to only 38.89% for SET50 Index. • Significantly, 87.5% and 50% respectively for SET100 Index. TABLE III The Test of Seasonal Effects for SET Indices SET Index (1975-2013) SET50 Index (1995-2013) Coefficients a,b Unstandardized Coefficients Std. B Error Standardized Coefficients Beta Unstandardized Coefficients Sig. .066 Standardized Coefficients B Std. Error Beta D1 4.748 2.410 .134 1.970 0.05* D1 2.473 1.344 .085 t 1.840 D2 .578 1.344 .020 .430 .667 D2 -.207 2.410 -.006 -.086 .932 D3 -.408 1.344 -.014 -.304 .761 D3 -1.412 2.410 -.040 -.586 .559 D4 1.469 1.344 .051 1.093 .275 D4 2.715 2.410 .077 1.126 .261 D5 .002 1.327 .000 .002 .999 D5 -2.231 2.410 -.063 -.926 .356 D6 1.263 1.327 .044 .952 .342 D6 -.462 2.410 -.013 -.192 .848 D7 1.372 1.327 .048 1.034 .302 D7 -.084 2.410 -.002 -.035 .972 D8 .170 1.327 .006 .128 .898 D8 -1.295 2.410 -.037 -.537 .592 D9 .170 1.327 .006 .128 .898 D9 .370 2.346 .011 .158 .875 D10 1.277 1.327 .045 .962 .336 D10 -.602 2.346 -.017 -.256 .798 D11 -.424 1.327 -.015 -.320 .749 D11 .926 2.346 .027 .395 .693 D12 2.801 1.327 .098 2.111 0.035* D12 2.772 2.346 .080 1.182 .239 Model 1 Coefficients a,b Model 1 a. Dependent Variable: Returns a. Dependent Variable: Returns b. Linear Regression through the Origin b. Linear Regression through the Origin t Sig. The results support for December effect (SET Index) and January effect (SET50 Index). TABLE IV Summary Statistics for Halloween Effect Adjusted with December Effect for SET Composite Index (1975-2013) Rt= α + β1 Wt-adj +β2Dect+ + µt (4) Coefficients a,b Model 4 Nov-Apr Adjusted Dec Unstandardized Standardized Coefficients Coefficients Std. B Error Beta .682 .590 .053 t 1.156 Sig. .248 2.801 1.322 .098 2.119 0.035* a. Dependent Variable: Returns b. Linear Regression through the Origin This suggest that Halloween effect is statistically explained by December effect TABLE V: Summary Statistics for Halloween Effect Adjusted with January Effect for SET 50Index (1995-2013) Rt= α + β1 Wt-adj +β2Jant + µt (5) Coefficients a,b Unstandardized Standardized Coefficients Coefficients Std. Model 5 Nov-Apr Adjusted Jan B Error Beta .978 1.050 .062 4.748 2.375 .134 t .931 Sig. .353 1.999 0.047* a. Dependent Variable: Returns b. Linear Regression through the Origin This result is consistent with findings of Bouman and Jacobsen (2001) when they found that in many countries including Thailand, Halloween effect is the January effect in disguise. January effect and Tax loss selling hypothesis To further explore the tax loss selling hypothesis associated with SET 50 Index, the following regression model is estimated: January return = f (prior years return, prior years standard deviation of returns). Tax loss selling in theory: • The coefficient of January returns and prior year returns should be negative. • Standard deviation of returns for prior years should be positive as the market is more volatile to generate more losses. TABLE VI Regression Analysis for January Returns SET 50 Index Explanatory Variables Coefficients a Unstandardized Coefficients Model Regression Intercept Analy sis Prior Year B S td. Error .004 .068 .616 S td. Dev. Prior year -.167 HPRs a. Dep endent Variable: January returns S tandardized Coefficients Beta t .066 S ig. .948 .673 .203 .915 .376 .071 -.520 -2.348 0.034* *Significant level of 5% R-Squa re : 0.63 F-Sta ti s ti c 4.151* D.F. Dependent Variable 16 The results support the tax-loss selling hypothesis when one would expect the negative coefficient for the previous year’s mean returns and a positive coefficient on the previous year’s standard deviation of returns. Conclusions Halloween effect on both SET Composite and SET50 are not strongly supported during the observed periods respectively. • December effect statistically explains for Halloween effect for SET Composite index. • Halloween effect for SET 50 is actually January effect in disguise. Results statistically support hypothesis of tax-loss selling for SET50 index as January effect exists in the SET market. Is rainfall negatively correlated with monthly returns? • Follow-up Research: “The Market Pricing of AnomalousWeather: Evidence from Thailand.” THANK YOU ! Questions ???