Boundless Study Slides

advertisement

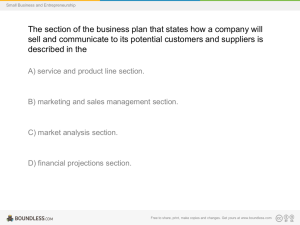

Boundless Lecture Slides Available on the Boundless Teaching Platform Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless Teaching Platform Boundless empowers educators to engage their students with affordable, customizable textbooks and intuitive teaching tools. The free Boundless Teaching Platform gives educators the ability to customize textbooks in more than 20 subjects that align to hundreds of popular titles. Get started by using high quality Boundless books, or make switching to our platform easier by building from Boundless content pre-organized to match the assigned textbook. This platform gives educators the tools they need to assign readings and assessments, monitor student activity, and lead their classes with pre-made teaching resources. Using Boundless Presentations The Appendix The appendix is for you to use to add depth and breadth to your lectures. You can simply drag and drop slides from the appendix into the main presentation to make for a richer lecture experience. Get started now at: http://boundless.com/teaching-platform Free to edit, share, and copy Feel free to edit, share, and make as many copies of the Boundless presentations as you like. We encourage you to take these presentations and make them your own. If you have any questions or problems please email: educators@boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com About Boundless Boundless is an innovative technology company making education more affordable and accessible for students everywhere. The company creates the world’s best open educational content in 20+ subjects that align to more than 1,000 popular college textbooks. Boundless integrates learning technology into all its premium books to help students study more efficiently at a fraction of the cost of traditional textbooks. The company also empowers educators to engage their students more effectively through customizable books and intuitive teaching tools as part of the Boundless Teaching Platform. More than 2 million learners access Boundless free and premium content each month across the company’s wide distribution platforms, including its website, iOS apps, Kindle books, and iBooks. To get started learning or teaching with Boundless, visit boundless.com. Free to share, print, make copies and changes. Get yours at www.boundless.com Obtaining Capital: Methods of Long-Term Financing > Leasing Leasing • Capital Leases vs. Operating Leases • Impact of Leasing on the Income Statement • Advantages of Leasing Free to share, print, make copies and changes. Get yours at www.boundless.com www.boundless.com/finance?campaign_content=book_192_section_109&campaign_term=Finance&utm_campaign=powerpoint&utm_medium=di rect&utm_source=boundless Obtaining Capital: Methods of Long-Term Financing > Leasing Capital Leases vs. Operating Leases • The finance company is the legal owner of the asset during duration of the lease. However the lessee has control over the asset providing them the benefits and risks of (economic) ownership. • An operating lease is a lease whose term is short compared to the useful life of the asset or piece of equipment (an airliner, a ship, etc. ) being leased. • Unlike a Financial Lease or Finance lease, at the end of the operating lease the title to the asset does not pass to the lessee, but remains with the lessor. Lease View on Boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com www.boundless.com/finance/textbooks/boundless-finance-textbook/obtaining-capital-methods-of-long-term-financing-14/leasing-109/capitalleases-vs-operating-leases-462- Obtaining Capital: Methods of Long-Term Financing > Leasing Impact of Leasing on the Income Statement • Lessees can often benefit from comprehensive maintenance programs offered by lessors while still paying a discounted premium due to the fact that the asset is being leased, not purchased. • The costs of leases on the income statement depend on the duration and type of lease. • EBITDA coverage ratio will improve if using operating leases. • Leasing will influence depreciation expenses, maintenance expenses, other costs and ratios on income statement. Leasing impact View on Boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com www.boundless.com/finance/textbooks/boundless-finance-textbook/obtaining-capital-methods-of-long-term-financing-14/leasing-109/impact-ofleasing-on-the-income-statement-463- Obtaining Capital: Methods of Long-Term Financing > Leasing Advantages of Leasing • Leasing is a process by which a firm can obtain the use of a certain fixed asset for which it must pay a series of contractual, periodic, tax deductible payments. • Capital assets may fluctuate in value. Leasing shifts risks to the lessor, but if the property market has shown steady growth over time, a business that depends on leased property is sacrificing capital gains. • Depreciation of capital assets has different tax and financial reporting treatment from ordinary business expenses. • Leasing may provide more flexibility to a business which expects to grow or move in the relatively short term, because a lessee is not usually obliged to renew a lease at the end of its term. View on Boundless.com Free to share, print, make copies and changes. Get yours at www.boundless.com www.boundless.com/finance/textbooks/boundless-finance-textbook/obtaining-capital-methods-of-long-term-financing-14/leasing-109/advantagesof-leasing-464- Appendix Free to share, print, make copies and changes. Get yours at www.boundless.com Obtaining Capital: Methods of Long-Term Financing Key terms • capital-intensive Capital intensity is the term for the amount of fixed or real capital present in relation to other factors of production, especially labor. • EBITDA Coverage Times interest earned (TIE) or interest coverage ratio is a measure of a company's ability to honor its debt payments. It may be calculated as either EBIT or EBITDA divided by the total interest payable. • present value Present value, also known as present discounted value, is the value on a given date of a payment or series of payments made at other times. Free to share, print, make copies and changes. Get yours at www.boundless.com Obtaining Capital: Methods of Long-Term Financing Leasing impact Leasing will improve the ratios of the income statement. Free to share, print, make copies and changes. Get yours at www.boundless.com Flickr. "All sizes | Operational Performance Improvement Delhi | Flickr - Photo Sharing!." CC BY http://www.flickr.com/photos/castoncorporateadvisory/5038323659/sizes/m/in/photostream/ View on Boundless.com Obtaining Capital: Methods of Long-Term Financing Lease Leasing is a good way to lower the costs of a company. Free to share, print, make copies and changes. Get yours at www.boundless.com Flickr. "All sizes | Leased - 090520081773 | Flickr - Photo Sharing!." CC BY http://www.flickr.com/photos/roland/2478229521/sizes/m/in/photostream/ View on Boundless.com Obtaining Capital: Methods of Long-Term Financing Which of the following is a characteristic of an operating lease? A) At the end of the lease, the company has the opportunity to purchase the asset at its market value. B) At the end of the lease, the lessee obtains ownership of the asset. C) The term of the lease is at least 75% of the asset's estimated useful life. D) The present value off the lease payments equals or exceeds 90% of the original cost of the asset. Free to share, print, make copies and changes. Get yours at www.boundless.com Obtaining Capital: Methods of Long-Term Financing Which of the following is a characteristic of an operating lease? A) At the end of the lease, the company has the opportunity to purchase the asset at its market value. B) At the end of the lease, the lessee obtains ownership of the asset. C) The term of the lease is at least 75% of the asset's estimated useful life. D) The present value off the lease payments equals or exceeds 90% of the original cost of the asset. Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless - LO. "Boundless." CC BY-SA 3.0 http://www.boundless.com/ Obtaining Capital: Methods of Long-Term Financing Which of the following is NOT an expense that can be decreased by a company through leasing? A) Depreciation expense. B) Interest expense. C) Maintenance expense. D) Acquisition costs. Free to share, print, make copies and changes. Get yours at www.boundless.com Obtaining Capital: Methods of Long-Term Financing Which of the following is NOT an expense that can be decreased by a company through leasing? A) Depreciation expense. B) Interest expense. C) Maintenance expense. D) Acquisition costs. Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless - LO. "Boundless." CC BY-SA 3.0 http://www.boundless.com/ Obtaining Capital: Methods of Long-Term Financing Which of the following is an advantage a company can obtain by leasing its equipment? A) All of these answers. B) A business can grow more rapidly by leasing property instead of purchasing it. C) Leasing shifts the risk of capital asset value fluctuations from the lessee to the lessor. D) Leasing provides flexibility to companies that expect to grow or move in the short term. Free to share, print, make copies and changes. Get yours at www.boundless.com Obtaining Capital: Methods of Long-Term Financing Which of the following is an advantage a company can obtain by leasing its equipment? A) All of these answers. B) A business can grow more rapidly by leasing property instead of purchasing it. C) Leasing shifts the risk of capital asset value fluctuations from the lessee to the lessor. D) Leasing provides flexibility to companies that expect to grow or move in the short term. Free to share, print, make copies and changes. Get yours at www.boundless.com Boundless - LO. "Boundless." CC BY-SA 3.0 http://www.boundless.com/ Obtaining Capital: Methods of Long-Term Financing Attribution • Wikipedia. "Finance lease." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Finance_lease • Wikipedia. "Operating lease." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Operating_lease • Wikipedia. "Present value." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Present_value • Wikipedia. "Leasing." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Leasing • College Cram. "EBITDA Coverage | Finance: Ratios of Debt Management | College-Cram.com." CC BY http://www.collegecram.com/study/finance/ratios-of-debt-management/ebitda-coverage/ • Wikipedia. "EBITDA Coverage." CC BY-SA 3.0 http://en.wikipedia.org/wiki/EBITDA%20Coverage • Wikipedia. "Leasing." CC BY-SA 3.0 http://en.wikipedia.org/wiki/Leasing • Wikipedia. "capital-intensive." CC BY-SA 3.0 http://en.wikipedia.org/wiki/capital-intensive Free to share, print, make copies and changes. Get yours at www.boundless.com