Modeling Market Failure

advertisement

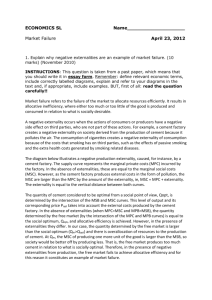

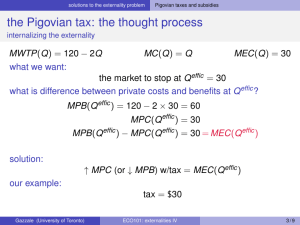

ENV 536: Environmental Economics and Policy (Lecture 4) Modeling Market Failure Asst.Prof. Dr. Sasitorn Suwannathep School of Liberal Arts King Mongkut’s University of Technology Thonburi 1 Market Failure Based on the materials balance model, we know that economic activities generate residuals that can damage natural resources. Why dose pollution persist. Why is the market unable to respond to environmental pollution, or can it? The answer is due to market failure. Market failure occurs because the assumption of perfect competition failed to fully function. 2 Analytical Tools to Understand Market Failure Environmental quality as a public good the theory of public good Environmental damage as a externality the theory of externality 3 Environmental Quality: A Public Good A public good: a commodity that is nonrival in consumption and yields benefit that are nonexcludable. – Nonrivalness: the characteristic of indivisible benefits of consumption: one person consumption does not preclude another. – Nonexcludability: the characteristic of impossibility to prevent other from sharing the benefits of consumption. 4 Environmental Quality: A Public Good (con’t) the nonrivalness and nonexcludability characteristics of public goods prevent natural market incentives from achieving an allocative efficient outcome. 5 A Case Study of Public Good: Air Quality * Air quality can be defined as “an acceptable level of pollution abatement” some percentage reduction in sulfur dioxide (SO2) emission. * For details see Callan and Thomas Ch. 4 p. 58-64 6 A Case Study of Public Good: Air Quality (con’t) Market Supply for Air Quality The producers are willing and able to supply various reductions in SO2 at different price level. the aggregation of these production decisions gives rise to market supply. Market supply: P = 4 + 0.75 Qs Qs: a percentage of SO2 abatement 7 A Case Study of Public Good: Air Quality (con’t) Market Demand for Air Quality Market demand for a public good is different from a private good. Once the public good is provided, it is available at the same quantity to all consumers (nonrivalness characteristic). 8 A Case Study of Public Good: Air Quality (con’t) Private good – What quantity of this good would you consume at each of following prices? – Horizontally summing – At given price level, sum quantities of each consumer Public good – What price would you be willing to pay for each quantity? – Vertically summing – At given quantity level, sum prices of each consumer 9 A Case Study of Public Good: Air Quality (con’t) In the public good theory, each consumer should express a unique “willingness to pay (WTP)” for the public good based on the benefits each expects to derive consumption Demand for consumer 1: p1 = 10 – 0.12 QD Demand for consumer 2: p2 = 10 – 0.18 QD Market demand: p1 + p2 = 25 – 0.3 QD A critical assumption is that consumers would reveal their willingness to 10 pay for SO2 abatement. Source: Callan, S. J. and Thomas, J. M. 2007. Environmental Economics and Management: Theory, Policy, and Applications. 11 Equilibrium in the Air Quality Market Equilibrium in the air quality market comes from the combination of market demand and market supply. At equilibrium: Market Supply = Market Demand 4 + 0.75 Qs = 25 – 0.3 QD Since Qs = QD, 1.05Q = 21 , then Q = 20 percent At Q = 20, P = 4 + 0.75 (20) or 25 – 0.3 (20) then P = 19 Source: Callan, S. J. and Thomas, J. M. 2007. Environmental Economics and Management: Theory, Policy, and Applications. 12 QE represents the efficient or optimal level of abatement measure from left to right and implicitly the optimal level of pollution measured from right to left. Source: Callan, S. J. and Thomas, J. M. 2007. Environmental Economics and Management: Theory, Policy, and Applications. 13 Assessing the Implication Regarding the air quality market, the optimal level is not necessarily zero. Abating at the 100 percent level to reduce pollution to zero involves prohibitive opportunity costs. 14 Market Failure of Public Good Market An allocatively efficient outcome in a public good depends on the identification of welldefined demand and supply functions. In a public good market, there is no incentive for a rational consumer to volunteer a WTP for the good that she can consume without paying for it. – Nonrevelation of preferences – Free-ridership Even if consumers could be induced to express their WTP for a public good, it is highly likely that the resulting demand price would underestimate the true benefits. 15 Market Failure of Public Good Market (con’t) In many public goods markets, consumer are not fully aware of the benefits associated with consumption. Market forces alone cannot provide an allocatively efficient level of a public good, then intervention by third party (the government) is required. – A direct provision of public goods – Political procedures and voting rules. 16 Environmental Problems: Externalities This approach specifies the relevant market as the good whose production or consumption generates environmental damage outside the market transaction. Price fails to capture all the benefits and costs of a market transaction. Market fail. A third party is affected by the production or consumption of commodity. Externality A negative externality: generates cost to a third party A positive externality: generates benefit to a third party 17 Environmental Problems: Externalities (con’t) If the consumption generates external benefits, the market price undervalues the good, too little of production. If there is a negative externality, the market does not reflect the external costs, and too much of the commodity is produced. 18 Negative Externality: A Case of Refined Petroleum Products Assume the private market for refined petroleum is competitive and no external benefits. Supply: P = 10.0 + 0.75 Q Demand: P = 42.0 - 0.125 Q Where Q: thousands of barrels per day P: the price per barrel 19 Negative Externality: A Case of Refined Petroleum Products Supply represents the marginal cost of production (or marginal private cost: MPC) and demand represents the marginal benefit of consumption (or marginal private benefit: MPB). MPC = 10.0 + 0.075 Q MPB = 42.0 - 0.125 Q 20 Source: Callan, S. J. and Thomas, J. M. 2007. Environmental Economics and Management: Theory, Policy, and Applications. 21 Inefficiency of the Competitive Equilibrium At the equilibrium, we ignore the external costs to society of contaminated water supplies caused by the refined petroleum production. The costs of water pollution are external to the market exchange and consequently are not factored into private market decisions. The MPC undervalues the opportunity costs of production, and resulting output level is too high. The economists have identified and monetized external costs and applied in the analysis. Marginal external cost (MEC) 22 Marginal Social Costs (MSC) Marginal Social Costs (MSC) = MPC + MEC Where, MPC MEC = 10.0 + 0.075 Q = 0.05 Q Then MSC = 10.0 + 0.125 Q The marginal social cost (MSC) captures all costs of producing refined petroleum. 23 Marginal Social Benefit (MSB) The marginal social benefit (MSB) is the sum of the MPB and any marginal external benefit (MEB). MSB = MPB + MEB If there is no the MEB, then the MPB equals the MSB. Efficient equilibrium MSB = MSC MPB + MEB = MPS + MEC 24 Efficient Equilibrium P Competitive equilibrium with a negative externality, overallocation of resource No MEB, then MSB = MPB Q Source: Callan, S. J. and Thomas, J. M. 2007. Environmental Economics and Management: Theory, Policy, and Applications. 25 Welfare Gain to Society Based on the refined petroleum production, if the output were reduced from Qc to QE (32,000 barrels a day), the social’s welfare is higher. From the firm perspective, the reduction in output causes profit loss (at QE, MPB > MPC). 26 Profit loss of firm: area WYZ Society gain: area WXYZ Area under MEC curve above MPC But the net gain area WXY Source: Callan, S. J. and Thomas, J. M. 2007. Environmental Economics and Management: Theory, Policy, and Applications. 27 Implication on the Refined Petroleum Production Petroleum refineries are motivated by private gain, not by social gain. The firms may be aware of the environmental damage associated with their production, there is no incentive for them to absorb these costs due to negative affect to their profits even it is good for the society as a whole. 28 The Absence of Property Rights The externality is a public good if it affected a broad segment of society. The environmental good is no property right, the market dose not exist. Property rights are the set of valid claims to a good or resource that permits its use and the transfer of its ownership through sale. 29 The Coase Theorem Nobel laureate, Ronald Coase, proposed that the assignment of property rights alone can provide for an efficient solution even in the presence of an externality. Coase Theorem with two assumptions – Transaction costs are costless – Damages are accessible and measurable. The assignment of property rights to any good will allow bargaining between the affected parties such that an efficient solution can be obtained, no matter which part holds the rights. 30 Property Rights Belong to the Refineries Refineries have the right to pollute the river as part of their production processes. They prefer to produce up to the level that maximizes profit, which will cause negative impact to the recreational users. The negotiation between these two parties will be occurred. 31 Property Rights Belong to the Refineries (con’t) Recreational users: Willing to offer a payment () such that < (MSC-MPC) Refineries: Willing to accept a payment () such that > (MPB-MPC) Note: (MSC – MPC) is MEC (MPB – MPC) is M The bargaining between two groups should continue as long as the payment is greater than refineries’ loss in profit but less than the recreational users’ damage. (MSC – MPC) > > (MPB-MPC) or equivalently, MEC > > M 32 Recreational users Bargaining will start at Q0 until (MPB – MPC) = (MSC – MPC) If the refineries hold the right, the bargaining will start at Qc to reduce output until (MSC – MPC) = (MPB – MPC) Source: Callan, S. J. and Thomas, J. M. 2007. Environmental Economics and Management: Theory, Policy, and Applications. 33 Property Rights Belong to the Recreational Users Refineries: Willing to offer a payment () such that < (MPB-MPC) Recreational users: Willing to accept a payment () such that <(MSC-MPC) (MPB-MPC) > > (MSC – MPC) or equivalently, M > > MEC 34 Limitations of the Coase Theorem The application of the Coase Theorem depends on two assumptions. – Transaction costs are costless – Damages are accessible and measurable It will be practical if there is a case which few individuals are involved on each side of the market. 35 Common Property Resource The resources that property rights are shared by some group of individual. – Common property resources are not accessible to everyone, some excludability. – The rights extend to more than one individual (co-owner makes decision about using resources based only on private costs and benefits ignoring the impact of other owners). The solution: The government would have to make this determination as well as enforce limitations on the rights for the good of society. 36