When the impact on the third party is an additional (external or

advertisement

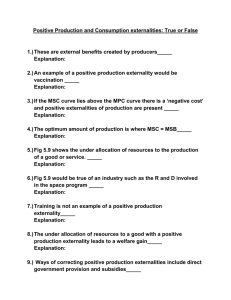

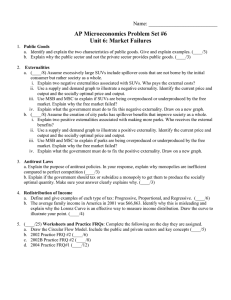

Market Failure & Externalities When production or consumption of a good or service affects (impacts) ‘third parties’ (people other than the buyers and sellers of the good), these ‘side-effects’ or ‘spillover-effects’ created are called externalities. Positive and Negative Externalities When the impact on the third party is an additional (external or spillover) cost, the externality is called a negative externality (i.e. is harmful to others when produced or consumed) When the impact on the third party is an additional (external or spillover) benefit, the externality is called a positive externality (i.e. provides some benefit to others when produced or consumed) Private and Social Costs e.g. cigarette smoking Social Costs Private = + Costs External Costs Private and Social Benefits e.g. using public transport Social = Private + External Benefit Benefit Benefit NEGATIVE EXTERNALITIES OF PRODUCTION Negative Externality of Production e.g. Pollution From a Power Station MSC MC,MB, P MPC = S Ps Pm External Cost = Tax MPB = D Qs Qm Quantity POSITIVE EXTERNALITIES OF PRODUCTION Positive Externality of Production e.g. Planting a Forest MC,MB, P MPC = S MSC Pm External Benefit = Subsidy Ps MPB = D Qm Qs Quantity POSITIVE EXTERNALITIES OF CONSUMPTION Positive Externality of Consumption e.g. Using Public Transport MC,MB, P MPC = S External Benefit = Subsidy Pm Ps MSB MPB = D Qm Qs Quantity NEGATIVE EXTERNALITIES OF CONSUMPTION Negative Externality of Consumption e.g. Drink Driving MC,MB, P MPC = S Ps External Cost = Tax Pm MPB = D MSB Qs Qm Quantity Public Goods The problem with a public good is that the market will fail to produce them at all. Public Goods are :• Non-Rival - where the consumption of a good or service by one person will not prevent others from enjoying it. It can be used at the same time by many people. •Non-Excludable - Once the good or service is provided it is not possible to stop others from enjoying it too. If you cannot prevent people from using the good or service then it will be impossible to charge a price for using it. Creates the “free rider” problem. • Non-Depletable - No additional resources are required when additional people use the good or service. Therefore MC = 0 Collective Good - provided by the government and paid for by taxes. Merit Goods Demerit Goods Merit Goods - goods and services that the government considers to be beneficial or good for us. The government feels that people ought to consume these goods. Consumers do not have enough information to make an informed decision about the use of these goods. Demerit Goods - goods and services that the government considers to be harmful or bad for us. The government feels that people ought not to consume these goods. People over-consume demerit goods as the do not have enough information to make an informed decision. The government can use:- - Taxes - Subsidies - Education - Regulations (Laws) - Public Provision (provided free)