CAC Act to PGPA Act

advertisement

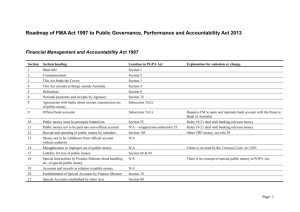

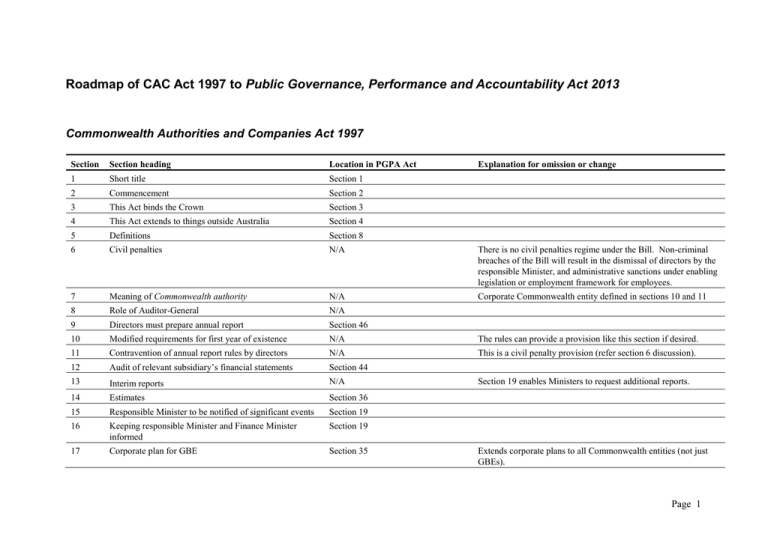

Roadmap of CAC Act 1997 to Public Governance, Performance and Accountability Act 2013 Commonwealth Authorities and Companies Act 1997 Section Section heading Location in PGPA Act Explanation for omission or change 1 Short title Section 1 2 Commencement Section 2 3 This Act binds the Crown Section 3 4 This Act extends to things outside Australia Section 4 5 Definitions Section 8 6 Civil penalties N/A There is no civil penalties regime under the Bill. Non-criminal breaches of the Bill will result in the dismissal of directors by the responsible Minister, and administrative sanctions under enabling legislation or employment framework for employees. 7 Meaning of Commonwealth authority N/A Corporate Commonwealth entity defined in sections 10 and 11 8 Role of Auditor-General N/A 9 Directors must prepare annual report Section 46 10 Modified requirements for first year of existence N/A The rules can provide a provision like this section if desired. 11 Contravention of annual report rules by directors N/A This is a civil penalty provision (refer section 6 discussion). 12 Audit of relevant subsidiary’s financial statements Section 44 13 Interim reports N/A 14 Estimates Section 36 15 Responsible Minister to be notified of significant events Section 19 16 Keeping responsible Minister and Finance Minister informed Section 19 17 Corporate plan for GBE Section 35 Section 19 enables Ministers to request additional reports. Extends corporate plans to all Commonwealth entities (not just GBEs). Page 1 Section Section heading Location in PGPA Act Explanation for omission or change 18 Banking and investment (authorities other than GBEs and SMAs) Sections 54 & 55 (banking) and 59 (investments) 19 Banking and investment (GBEs and SMAs) Sections 54 & 55 (banking) and 59 (investments) 20 Accounting records Section 41 21 Background to duties of directors, other officers and employees N/A Section 21 of CAC Act was only guide to directors’ duties, not a substantive provision. 22 Care and diligence—civil obligation only Section 25 Applies duties to all officials (not just officers) 23 Good faith—civil obligations Section 26 Applies duties to all officials (not just officers) 24 Use of position—civil obligations Section 27 25 Use of information—civil obligations Section 28 26 Good faith, use of position and use of information— criminal offences N/A 27A Compliance with statutory and other duties N/A 27B Interaction of sections 22 to 26 with other laws etc. Section 31 27C Disqualification order for contravention of civil penalty provision N/A 27D Reliance on information or advice provided by others N/A This relates to the civil penalty regime (refer section 6 discussion). Not needed given civil penalties have been removed 27E Responsibility for actions of directors delegate N/A Not needed given civil penalties have been removed 27F Material personal interest—director’s duty to disclose Section 29 Simplifies duties around material personal interests. Additional details will be included in the rules where necessary. 27G Director may give other directors standing notice about an interest Section 29 Refer section 27F of the CAC Act 27H Interaction of sections 27F and 27G with other laws etc. Section 29 Refer section 27F of the CAC Act 27J Restrictions on voting Section 29 Refer section 27F of the CAC Act 27K Minister’s power to make declarations and class orders Section 29 Refer section 27F of the CAC Act 27L Right of access to authority’s books N/A The rules can provide a provision like this section if desired. 27M Indemnification and exemption of officer Section 61 27N Insurance for certain liabilities of officers Section 62 Crime is covered by the Criminal Code Act 1995. . Page 2 Section Section heading Location in PGPA Act Explanation for omission or change 27P Certain indemnities, exemptions, payments and agreements not authorised and certain documents void Section 61 28 Compliance with General Policy Orders Section 22 28A Credit cards and credit vouchers Section 57 28B Misuse of credit cards or credit vouchers—criminal offence N/A 29 Activities of subsidiaries Section 86 30 Aligning accounting periods of subsidiaries N/A The rules can provide a provision like this section if desired. 31 Exemption from requirement to align accounting periods of subsidiaries N/A The rules can provide a provision like this section if desired. 32 Audit committee Section 45 33 Special rules for Commonwealth authorities established by regulation N/A 33A Interjurisdictional authorities Sections 82 and 83 34 Meaning of Commonwealth company, wholly-owned Commonwealth company and related terms Sections 89 and 90 35 Role of Auditor-General Section 98 36 Annual Report Section 97 37 Audit of relevant subsidiary’s financial statements Section 99 38 Interim reports N/A 39 Estimates Section 96 40 Responsible Minister to be notified of significant events Section 91 41 Keeping responsible Minister and Finance Minister informed Section 91 42 Corporate plan for GBE Section 95 43 Compliance with General Policy Orders Section 93 44 Audit committee Section 92 Crime is covered by the Criminal Code Act 1995. Section 33 has never been used because there are very few entities established by regulation. Section 19 enables Ministers to request additional reports. Section 95 applies to all Commonwealth companies (not just GBEs). Page 3 Section Section heading Location in PGPA Act Explanation for omission or change 46 Companies conducted for the purposes of intelligence or security agencies Section 104 47 Regulations may deal with how this Act applies if body stops being a Commonwealth authority N/A 47A Compliance with government procurement requirements N/A Section 47A CAC Act can be covered by a government policy order under section 22 or 93. 48 Finance Minister’s Orders N/A No power in the PGPA Act to make orders. Additional legal requirements will be set out in rules - sections 101 and 102 48A General Policy Orders Sections 22 & 93 48B Delegation by Minister N/A 49 Regulations Sections 101, 102 and 103 Additional legal requirements will be set out in rules Schedule 1—Annual report for Commonwealth Authority 1 Summary of contents Section 46 The rules can provide additional details if desired. 2 Financial statements Section 42 The rules can provide additional details if desired. 3 Whether the statements comply with the Finance Minister’s Orders Section 43 4 Proper accounting records not kept Section 43 5 Inadequate information and explanations Section 43 6 Subsidiaries’ financial statements N/A The rules can provide additional details if desired. 7 Deficiencies in consolidation N/A The rules can provide additional details if desired. Schedule 2—Civil consequences of contravening civil penalty provisions N/A There is no civil penalties regime under the Bill. Non-criminal breaches of the Bill may result in the dismissal of directors by the responsible Minister, and administrative sanctions under enabling legislation or employment framework for employees. 1 Declarations of contravention N/A 2 Declaration of contravention is conclusive evidence N/A 3 Pecuniary penalty orders N/A 4 Compensation orders N/A 5 Effect of clause 4 N/A Page 4 Section Section heading Location in PGPA Act 6 Who may apply for a declaration or order N/A 7 Time limit for application for a declaration or order N/A 8 Civil evidence and procedure rules for declarations of contravention and civil penalty orders N/A 9 Civil proceedings after criminal proceedings N/A 10 Criminal proceedings during civil proceedings N/A 11 Criminal proceedings after civil proceedings N/A 12 Evidence given in proceedings for penalty not admissible in criminal proceedings N/A 13 Finance Minister requiring person to assist N/A 14 Relief from liability for contravention of civil penalty provision N/A 15 Power to grant relief N/A Schedule 3—Application, transitional and savings provisions N/A 1 Meaning of commencement, new Law and old Law N/A 2 References to provisions of old Law in laws and other documents N/A 3 Conduct of officers N/A 4 Contraventions of, and offences against, civil penalty provisions N/A 5 Civil penalty orders made under old Law N/A Explanation for omission or change Schedule 3 is a transitional schedule inserted as part of the 1990s CLERP reforms to corporate law. Given the effluxion of time, the schedule does not appear relevant. If any contrary conclusion is reached, the schedule can be included in the future Transitional and Consequential Amendments Bill. Page 5