FMA Act to PGPA Act

advertisement

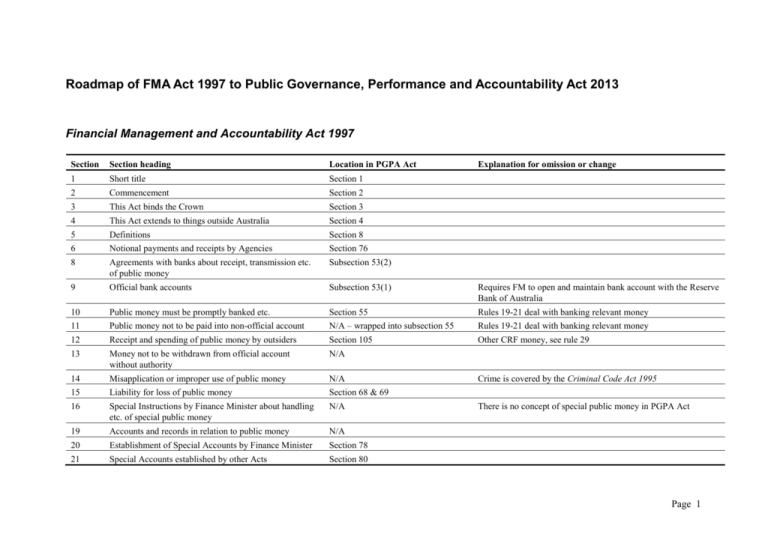

Roadmap of FMA Act 1997 to Public Governance, Performance and Accountability Act 2013 Financial Management and Accountability Act 1997 Section Section heading Location in PGPA Act Explanation for omission or change 1 Short title Section 1 2 Commencement Section 2 3 This Act binds the Crown Section 3 4 This Act extends to things outside Australia Section 4 5 Definitions Section 8 6 Notional payments and receipts by Agencies Section 76 8 Agreements with banks about receipt, transmission etc. of public money Subsection 53(2) 9 Official bank accounts Subsection 53(1) Requires FM to open and maintain bank account with the Reserve Bank of Australia 10 Public money must be promptly banked etc. Section 55 Rules 19-21 deal with banking relevant money 11 Public money not to be paid into non-official account N/A – wrapped into subsection 55 Rules 19-21 deal with banking relevant money 12 Receipt and spending of public money by outsiders Section 105 Other CRF money, see rule 29 13 Money not to be withdrawn from official account without authority N/A 14 Misapplication or improper use of public money N/A 15 Liability for loss of public money Section 68 & 69 16 Special Instructions by Finance Minister about handling etc. of special public money N/A 19 Accounts and records in relation to public money N/A 20 Establishment of Special Accounts by Finance Minister Section 78 21 Special Accounts established by other Acts Section 80 Crime is covered by the Criminal Code Act 1995 There is no concept of special public money in PGPA Act Page 1 Section Section heading Location in PGPA Act Explanation for omission or change 22 Disallowance of determinations relating to Special Accounts Section 79 26 Drawing rights required for payment etc. of public money N/A – replaced by section 51 Drawing rights replaced by a system whereby the FM can determine how much and when appropriation amounts are paid to entities. 27 Issue of drawing rights N/A – replaced by section 51 Drawing rights replaced by a system whereby the FM can determine how much and when appropriation amounts are paid to entities. 28 Repayments by the Commonwealth Section 77 30 Repayments to the Commonwealth N/A Covered by section 74 (retained prescribed receipts). 30A Appropriations to take account of recoverable GST N/A Amendment proposed to PGPA Act to establish special appropriation to cover GST related component of a payment. 31 Retaining prescribed receipts Section 74 Rule 27 prescribes receipts (which do not include GST) 32 Transfer of Agency functions Section 75 32A Recording of amounts in accounts and records N/A – split between sections 74, 78 and 80 Split to ensure a simpler reading of provisions. 32B Supplementary powers to make commitments to spend public money etc. N/A Authority to be retained in a reduced renamed FMA Act. 32C Terms and conditions for grants N/A Authority to be retained in a reduced renamed FMA Act. 32D Delegation by a Minister N/A Authority to be retained in a reduced renamed FMA Act. 32E Executive power of the Commonwealth N/A Authority to be retained in a reduced renamed FMA Act. 33 Finance Minister may approve act of grace payments Section 65 34 Finance Minister may waive debts etc. Section 63 35 Set off Section 64 36 Presiding Officers may approve expenditure Section 71 37 Unauthorised borrowing agreements are invalid Subsection 56(1) 38 Finance Minister may borrow for short periods Subsection 56(2) 39 Investment of public money Section 58 39A Minister must inform Parliament of involvement in a company by the Commonwealth or a prescribed body Section 72 Page 2 Section Section heading Location in PGPA Act Explanation for omission or change 39B Supplementary powers to form companies etc. N/A Authority to be retained in a reduced renamed FMA Act. 40 Custody etc. of securities N/A The rules can provide a provision like this section if desired. 41 Misapplication or improper use of public property N/A Crime is covered by the Criminal Code Act 1995. 42 Liability for loss etc. of public property Section 68 43 Gifts of public property Section 66 43A Interjurisdictional agencies Sections 82 and 83 44 Promoting proper use of Commonwealth resources Section 15 44A Keeping responsible Minister and Finance Minister informed Section 19 45 Fraud control plan N/A 46 Audit committee Section 45 47 Recovery of debts N/A 48 Accounts and records Section 41 49 Annual financial statements Section 42 50 Additional financial statements Section 19 Enables Ministers to request additional financial statements 51 Reporting requirements if Agency ceases to exist or Agency functions are transferred N/A Rules may be made under clause 103. 52 Chief Executive’s instructions N/A Amendment proposed to PGPA Act to clarify power of accountable authority to issue instructions. 53 Chief Executive may delegate powers Section 110 54 Finance Minister must publish monthly financial statements Section 47 55 Preparation of annual statements by Finance Minister Section 48 56 Audit of Finance Minister’s annual financial statements Section 49 57 Audit of annual financial statements of Agency Section 43 58 Modifications of Act for intelligence or security agency or prescribed law enforcement agency Section 104 60 Misuse of Commonwealth credit card N/A Rule 10 provides for the prevention, detection and dealing with fraud. Rule 11 provides for the recovery of debts. Crime is covered by the Criminal Code Act 1995. Page 3 Section Section heading Location in PGPA Act Explanation for omission or change 62 Finance Minister may delegate powers Section 107 62A Treasurer may delegate powers Section 108 63 Finance Minister’s Orders N/A No power in the PGPA Act to make orders. Additional legal requirements will be set out in rules - sections 101, 102 and 103. 64 Guidelines by Ministers N/A If guidelines cover matters of better practice, they can be issued without legislative authority. If guidelines involve compulsion, they can be issued as rules (section 101). 65 Regulations Sections 101, 102 and 103 Additional legal requirements will be set out in rules. Page 4 Page 5

![Garneau english[2]](http://s3.studylib.net/store/data/009055680_1-3b43eff1d74ac67cb0b4b7fdc09def98-300x300.png)

![Resource Management Guide No. 204 [JULY 2014]](http://s2.studylib.net/store/data/017793533_1-cb53d646af4993bbbf08dc58d1d8e8eb-300x300.png)