01-Title & Opinion Page

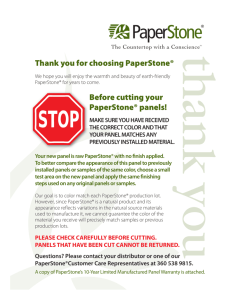

advertisement