self billing agreement

advertisement

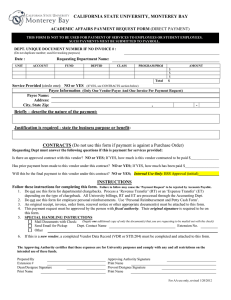

January 2015 Dear Valued Supplier Cargill is in the midst of a multi-year SAP implementation that will establish common processes and technology across all Cargill business units. The goals of this initiative are to enable increased operational effectiveness and drive enhanced partner collaboration while maintaining the exceptional level of service and solutions our customers enjoy. This packet contains details you will need to know about the SAP implementation that is affecting locations serving Cargill Case Ready in Hazleton, PA and Cargill Case Ready in Marshall, MO effective March 1, 2015. It is very important that you thoroughly read the enclosed information, and make the necessary changes as a failure to do so will result in delayed payment. Please cascade this communication to key individuals within your organization who support these facilities. Thank you, in advance, for your full engagement in responding to our requests and adoption of new processes required supporting this critical initiative. This Packet Includes: Summary of Changes 1. Evaluated Receipt Settlement (ERS)………………………. 2. Remittance Changes………………………………………… 3. Materials Numbers & Descriptions………………………… 4. Payments……………………………………………………… 5. Purchase Orders……………………………………………… Sample of New Forms……………………………………………… Evaluated Receipt Settlement (ERS) Forms & Instructions…….. Page 2 Page 2 Page 3 Page 3 Page 4 Page 5 & 6 Page 7 - 13 If you have any questions, please contact your Cargill representative or email your questions to: FSC_SupplierRelations@cargill.com . We have also set up a website with supplier related information for your reference. The website link is: http://www.cargill.com/authorization-forms/index.jsp Best Regards Cargill Case Ready 1 SUMMARY OF CHANGES Beginning March 1, 2015 the following changes will apply to your transactions with the affected locations: 1.) Evaluated Receipt Settlement (ERS) You have been identified as a supplier currently settling with Cargill via the self-billing method (two way match). Also known as evaluated receipt settlement, self-billing eliminates invoicing activities by automatically settling payments to you, our supplier, based on the purchase order price and goods receipt quantity and/or service receipt. To ensure continued settling through the self-billing process where you will not need to send invoices to Cargill for the Case Ready Hazleton, PA and Case Ready Marshall, MO locations upon the deployment of SAP, please complete the action required below by February 2, 2015. Once the completed forms are received, we will provide a signed copy for your records. Action Required: 1. Please Complete the ERS Self Billing Agreement forms on page 12-14 Instructions for completing the forms are included on page 7-11 2. Mail two signed copies of the ERS Self Billing Agreements to the address listed below. Please note, electronic copies of the form will not be accepted. Cargill Meats Solution Corporation Attn: Case Ready Purchasing Department 151 North Main 5th Floor Wichita, Kansas 67202 2) Remittance Changes Remittance advice notifications will contain more detail. Payments will be made from the Cargill legal entity, so you will see a consolidation of invoice payments. See the enclosed sample of the new Remittance Statement form for more details. 2 3) Material Numbers & Descriptions Cargill material numbers and descriptions will change. These new material numbers will be present on the purchase order form. If you have any questions regarding the new material numbers, please reach out to the PO Contact shown on the purchase order form. 4) Payment We have set up new banks and bank accounts. You will notice that your payment from Cargill is coming from a different bank and/or bank account. If Cargill is paying you via paper check, you will also notice a difference in the appearance of the check and the paper statement. ACH is also known as Electronic Funds Transfer (EFT). Payment will deposit into your bank account the day due, eliminating use of checks. Remittance advice will be provided by fax or email, one day prior to payment. ACH provides great savings over conventional payment methods, offering an alternative to paper checks. It costs nothing to enroll and affords you the following advantages: 1. Greater level of detail for cash application process that is available in the ACH remittance advice. 2. Better cash forecasting - accelerated funds availability – certainty of delivery 3. Provides available funds to our suppliers immediately 4. Establishment of excellent payment and credit records 5. Reduced operating costs through the elimination of paper check handling, check depositing and reduction of clerical costs; increased human resource efficiencies 6. Eliminating the possibility of stolen checks and associated cost 7. Reduction of bank service charges and check fraud 8. Being part of “Going Green” by reducing paper Action Required: No action is required if you are currently enrolled. If you are not receiving payment via ACH/EFT, Please submit an enrollment form o Link to form and instructions: http://www.cargill.com/authorization-forms/index.jsp 3 5) Purchase Orders Cargill’s primary method is to require a purchase order for all materials and services. To ensure prompt payment, your invoice must match Cargill’s purchase order. Failure to provide a timely purchase order confirmation per the instructions below will result in a delay of payment. Purchase Order Confirmations: All purchase orders will require written confirmation from our suppliers (via fax, e-mail, etc.) within one business day (24 hours) of receipt of a purchase order. Please send PO confirmations directly to the PO contact name listed on the purchase order form. You will be required to confirm the following details: – Date when delivery will be received by Cargill plant If delivery is Cargill planned transportation, date when material will be available for pickup and a pickup number – Material – Quantity – Price stated on the purchase order – Currency – Confirmation of accurate tax amounts – Any additional costs that are not part of the per unit cost need to be included in the confirmation (i.e. freight, handling, pallets, etc.) – Ship-from address (also known as the goods supplier address) You will need to review this address on each purchase order you receive, to ensure the address is the correct location that the product is shipping from, as it impacts tax determination. If the material is being shipped from outside the country, please notify the PO contact before it is shipped. – Note: there may be other special instructions listed on the PO Purchase Order Form Changes: The look of the purchase order form will change as it is output from SAP. See the enclosed sample of the new Purchase Order form, which highlights changes to the purchase order form and purchase order processes. Changes to Existing Purchase Orders: When purchase order content has been modified (added to, changed, or deleted), you will receive a new copy of the purchase order, in which the heading will read “Purchase Order Change.” Please use the most current purchase order only. Purchase order changes are indicated by bolding the typeset of components that have been added to or changed on the existing purchase order. If a line item has been cancelled, the line item will be crossed out. Cargill will not be liable to the supplier for any duplicate orders submitted to us in error. The supplier shall be liable for any and all costs, including all return costs to supplier, for deliveries placed in error. ACTION REQUIRED: If you have any type of pricing arrangement (formal contract, price letter, etc.) with Cargill for the goods or services you provide, and you intend to amend this pricing, please submit a copy of the new pricing to GBS_ContractMaintenance@cargill.com to ensure SAP pricing is updated correctly. 4 SAMPLE of the new SAP Purchase Order form: 5 Sample of new SAP Electronic Remittance statement: Test 6 Instructions to Complete ERS Self Billing Agreement Self-Billing: Frequently Asked Questions Note: This is intended for suppliers who use self-billing — also known as Evaluated Receipt Settlement (ERS) — in doing business with Cargill. Keep this handy to help provide clarity around Cargill’s self-billing process as we migrate to new business processes in a multi-year, company-wide initiative called Tartan. Cargill businesses that have been implemented include Cargill Deicing Technology, Cargill Salt, Cargill Food Distribution, and Cargill Health & Nutrition. What is Cargill’s self-billing approach? In general, our self-billing approach is designed to streamline the process of payments sent to you, our suppliers. Once the purchase order is confirmed by you, our supplier, and the goods are received by Cargill, we will create a voucher and pay you per the received goods, thus eliminating the need for you to create and submit an invoice. Please explain the self-billing process. Cargill will create a purchase order which will need to be confirmed by you, our supplier, validating that all data on the purchase order is accurate. Cargill will then pay you based on the purchase order after receiving the goods and related receiving documents (e.g. sales order, bill of lading, etc.) This process eliminates the need for you to create and send an invoice to Cargill. Please note that should there be any discrepancies that arise throughout the self-billing process (i.e. during purchase order, receipt of goods, or payment phase), these issues should be resolved through direct contact with your Cargill relationship manager. Should we continue to submit credit memos to Cargill in cases where product is returned? Credit memos can also be created using self-billing. If an invoice has already been posted for a goods receipt — and goods have since been returned to you — the self-billing system on its own generates a credit memo for the returned quantity. Therefore, no credit memo document is needed from you. What does the "Jurisdiction(s)" field mean? Jurisdiction refers to all of the states (i.e. jurisdictions) in which your transaction(s) with Cargill will require data entry for assessing and collecting taxes. For example, if you are a supplier located in California and plan to ship goods to a Cargill facility in Pennsylvania -- and could be assessed tax in each of these states-- you will need to populate the jurisdiction field with the state tax ID number for both California and Pennsylvania. What does the "Tax Type" field mean? Cargill has already populated this field on the Self-Billing Agreement form as a sales tax. In the adjacent column (“Tax Identification Number”), please enter the tax ID number(s) as it relates to sales. What should I enter in the tax fields if taxes are not assessed in a state? If you do not assess tax in any state you do business in or ship to, then you should enter “None” in the tax info field. What number will be referenced with my payment remittance? A number from the receiving documents will be noted in the system — such as a sales order or bill of lading number — depending on the documents Cargill receives with the goods. As a supplier, you must be capable of applying payment with this reference information, as no invoice number reference will be available or provided on the remittance. How will the purchase order number be listed on the remittance? The supplier must provide the purchase order number on the bill of lading/receiving documents. Otherwise, if Cargill does not have that information at the time of receiving, we will not be able to provide the purchase order number on the remittance. I am a broker and I do not handle invoices to customers. How should I proceed with this request? At this time, your company may not be a good candidate for the self-billing process, as it could be difficult to know how much will be charged. Please disregard this communication and the Self-Billing Agreement form. 7 Print & fill out the enclosed duplicate Self-Billing Agreement forms and mail both completed forms by 02/02/2015 to: Cargill Meats Solutions SELF-BILLING AGREEMENT Attn: Case Ready Purchasing Dept 151 North Main 5th Floor This is an agreement to a self-billing procedure between Wichita, Kansas 67202 We will then mail you back one of the original forms for your records, once we have signed it. Customer: __________________________ [Legal Name of Cargill Entity] Self-Billing Agreement Form Instructions and Add your organization’s legal name here. Vendor: __________________________ [Legal Name of Vendor] Customer agrees: 1. 2. 3. 4. 5. 6. To issue self-billed invoices, in the name of and on behalf of the Vendor, for all goods and services provided by Vendor to Customer from the date of this Agreement until the Expiration Date (defined below). That the self-billed invoices will be issued in the form attached as Exhibit A showing the Vendor’s name, address, relevant tax number(s) and other relevant data set forth in Exhibit A so as to constitute a valid invoice for all tax purposes. To retain a copy of the self-billed invoice and send a copy (via electronic, fax or hard copy) to the Vendor when required by law. To make a new self-billing agreement (or amend this agreement) in the event: a. any changes are needed to the form of Exhibit A to comply with relevant laws; or b. of any change to Vendor’s name, address and/or relevant tax number(s) set forth in Exhibit A To inform the Vendor if the issuance of self-billed invoices will be outsourced to a third party. The Termination Date shall mean 30-days after the date that one party notifies the other party that it wishes to terminate this Self-billing Agreement. Vendor agrees: 1. Until the Expiration Date, to accept invoices issued by the Customer in Vendor’s name and on Vendor’s behalf. 2. Self-billed invoices in the form and containing the information required in Exhibit A will meet all applicable invoicing, tax documentation and other legal requirements. 3. Not to issue sales invoices for the transactions covered by this agreement. 4. That Vendor is not relieved from its tax and other legal obligations regarding invoicing and payment of any relevant taxes; and Vendor will pay all taxes set forth on each self-billed invoice to the appropriate taxing authorities on time. 5. To notify the Customer immediately if: a. Vendor’s name, address, relevant tax number(s) or other data set forth in Exhibit A change; b. Vendor ceases to be a tax registrant in the jurisdiction relevant to this agreement; c. Vendor sells all or any part of its business; d. Vendor does not receive a copy of a self-billed invoice; or e. Vendor identifies any errors on the invoice issued by Customer, including any error in tax rate(s) or taxes payable. 6. That the amounts in each self-billed invoice, including the determination of any tax rate and any tax payable, shall be deemed to be correct unless Vendor objects, in writing, to Customer within 10 days of its receipt of the self-billed invoice. Customer Vendor Your signature, title and date are required here on both agreement forms; Cargill will sign and return one of the originals to you. By ________________________ By: ________________________ Title: _______________________ Title: _______________________ Date _______________________ Date: _______________________ 8 A Cargill representative will fill in the Customer section once in receipt of both agreement forms. You must provide one, voided invoice with pertinent information (i.e. your organization’s name, address, relevant tax number(s), and any other data required to constitute a valid invoice for tax purposes). Exhibit A Invoice Form to be used for Self-Billing [Insert invoice form relevant for vendor and customer – must include vendor name, address relevant tax number(s) and any other data required to constitute a valid invoice for tax purposes] Input your organization’s unique tax identification number here. Insert your organization’s legal name here. Exhibit A Spreadsheet Vendor Legal Name John Doe Supply Company, Inc. Vendor Address Jurisdiction John Doe Co- St. Paul 123 Anywhere St. St. Paul, MN 55101 Minnesota, yes John Doe Co- Oakland 987 Busy St. Oakland, Calif. 94663 California, none Tax Type Tax Identification Number Sales tax 12-345-7899 Ohio, none John Doe Co- Akron XYZ Ave. North Akron, Ohio 99999 We have already populated this field for you as a sales tax. Input your organization’s ship-from address (if you ship from multiple locations, please provide all relevant addresses). Insert the state(s) in which your transaction(s) with Cargill will require data entry for tax purposes. For each jurisdiction, identify whether you collect sales tax or not by putting a “yes” or “none” after each jurisdiction. Note: As an alternative to completing the Exhibit A Spreadsheet above, you may provide a document on Company letterhead with the following details: Vendor Legal Name Vendor Legal Address Jurisdiction(s) Tax Type Tax Identification number(s) 9 SELF BILLING AGREEMENT This is an agreement to a self-billing procedure between Customer: _______________________________________ [Legal Name of Cargill Entity] and Vendor: ______________________________________ [Legal Name of Vendor] Customer agrees: 1. To issue self-billed invoices, in the name of and on behalf of the Vendor, for all goods and services provided by Vendor to Customer from the date of this Agreement until the Expiration Date (defined below). 2. That the self-billed invoices will be issued in the form attached as Exhibit A showing the Vendor’s name, address, relevant tax number(s) and other relevant data set forth in Exhibit A so as to constitute a valid invoice for all tax purposes. 3. To retain a copy of the self-billed invoice and send a copy (via electronic, fax or hard copy) to the Vendor when required by law. 4. To make a new self-billing agreement (or amend this agreement) in the event: a. any changes are needed to the form of Exhibit A to comply with relevant laws; or b. of any change to Vendor’s name, address and/or relevant tax number(s) set forth in Exhibit A 5. To inform the Vendor if the issuance of self-billed invoices will be outsourced to a third party. 6. The Termination Date shall mean 30-days after the date that one party notifies the other party that it wishes to terminate this Self-billing Agreement. Vendor agrees: 1. Until the Expiration Date, to accept invoices issued by the Customer in Vendor’s name and on Vendor’s behalf. 2. Self-billed invoices in the form and containing the information required in Exhibit A will meet all applicable invoicing, tax documentation and other legal requirements. 3. Not to issue sales invoices for the transactions covered by this agreement. 4. That Vendor is not relieved from its tax and other legal obligations regarding invoicing and payment of any relevant taxes; and Vendor will pay all taxes set forth on each self-billed invoice to the appropriate taxing authorities on time. 5. To notify the Customer immediately if: a. Vendor’s name, address, relevant tax number(s) or other data set forth in Exhibit A change; b. Vendor ceases to be a tax registrant in the jurisdiction relevant to this agreement; c. Vendor sells all or any part of its business; d. Vendor does not receive a copy of a self-billed invoice; or e. Vendor identifies any errors on the invoice issued by Customer, including any error in tax rate(s) or taxes payable. 6. That the amounts in each self-billed invoice, including the determination of any tax rate and any tax payable, shall be deemed to be correct unless Vendor objects, in writing, to Customer within 10 days of its receipt of the self-billed invoice. Customer Vendor By ________________________ By: ________________________ Title: _______________________ Title: _______________________ Date _______________________ Date: _______________________ 10 Exhibit A Invoice form to be used for Self-Billing [Insert invoice form relevant for vendor and customer – must include vendor name, address relevant tax number(s) and any other data required to constitute a valid invoice for tax purposes] Exhibit A Spreadsheet Vendor Legal Name Vendor Address Jurisdiction Tax Type Sales Tax 11 Tax Identification Number SELF-BILLING AGREEMENT This is an agreement to a self-billing procedure between Customer: _______________________________________ [Legal Name of Cargill Entity] and Vendor: ______________________________________ [Legal Name of Vendor] Customer agrees: 7. To issue self-billed invoices, in the name of and on behalf of the Vendor, for all goods and services provided by Vendor to Customer from the date of this Agreement until the Expiration Date (defined below). 8. That the self-billed invoices will be issued in the form attached as Exhibit A showing the Vendor’s name, address, relevant tax number(s) and other relevant data set forth in Exhibit A so as to constitute a valid invoice for all tax purposes. 9. To retain a copy of the self-billed invoice and send a copy (via electronic, fax or hard copy) to the Vendor when required by law. 10. To make a new self-billing agreement (or amend this agreement) in the event: a. any changes are needed to the form of Exhibit A to comply with relevant laws; or b. of any change to Vendor’s name, address and/or relevant tax number(s) set forth in Exhibit A 11. To inform the Vendor if the issuance of self-billed invoices will be outsourced to a third party. 12. The Termination Date shall mean 30-days after the date that one party notifies the other party that it wishes to terminate this Self-billing Agreement. Vendor agrees: 7. Until the Expiration Date, to accept invoices issued by the Customer in Vendor’s name and on Vendor’s behalf. 8. Self-billed invoices in the form and containing the information required in Exhibit A will meet all applicable invoicing, tax documentation and other legal requirements. 9. Not to issue sales invoices for the transactions covered by this agreement. 10. That Vendor is not relieved from its tax and other legal obligations regarding invoicing and payment of any relevant taxes; and Vendor will pay all taxes set forth on each self-billed invoice to the appropriate taxing authorities on time. 11. To notify the Customer immediately if: a. Vendor’s name, address, relevant tax number(s) or other data set forth in Exhibit A change; b. Vendor ceases to be a tax registrant in the jurisdiction relevant to this agreement; c. Vendor sells all or any part of its business; d. Vendor does not receive a copy of a self-billed invoice; or e. Vendor identifies any errors on the invoice issued by Customer, including any error in tax rate(s) or taxes payable. 12. That the amounts in each self-billed invoice, including the determination of any tax rate and any tax payable, shall be deemed to be correct unless Vendor objects, in writing, to Customer within 10 days of its receipt of the self-billed invoice. Customer Vendor By ________________________ By: ________________________ Title: _______________________ Title: _______________________ Date _______________________ Date: _______________________ 12 Exhibit A Invoice form to be used for Self-Billing [Insert invoice form relevant for vendor and customer – must include vendor name, address relevant tax number(s) and any other data required to constitute a valid invoice for tax purposes] Exhibit A Spreadsheet Vendor Legal Name Vendor Address Jurisdiction Tax Type Sales Tax 13 Tax Identification Number