Introduction

advertisement

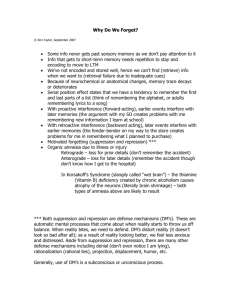

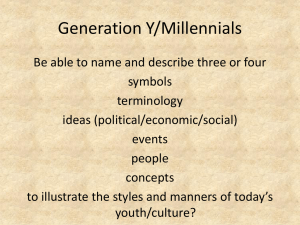

Norkina Olga, 2nd year student Academic Supervisor: Sergey Pekarski, Ph.D “Is there is a case for optimal financial repression?” Introduction When growth prospects are dim, fiscal austerity plans are hard to implement and default on the government debt is unacceptable at this point, then so called financial repression measures come. As has been seen in the recent debt crisis, central banks and the government may shift their policy priority from price stability and public goods provision to government debt reduction. Policy makers try to reduce these vast volumes of internal government debt implementing financial repression policy. The term financial repression was introduced by Shaw (1973) and McKinnon (1973) and, subsequently, this term became a way of describing emerging market financial system before the financial liberalization o 1980s. In the past, methods of financial repression were widely used by both developing and advanced countries in an effort to reduce the stock of government debt1. More precisely financial repression can be defined as regulatory measures taken by the government and the central bank, to reduce government debt service costs in the case when restructuring is inadmissible and the government cannot rely on budget surpluses. Some historical and modern examples of financial repression will be given below. However, despite some justification for using this policy for debt reduction, its impact on economic growth was found to be detrimental (see literature review below for evidence). My thesis aims to explore an area where the existing theoretical and empirical literature does not provide a full account: possible trade-off between growth promoting and debt sustainability in case of non-benevolent government and possible unusual interrelationship between financial repression measures as indirect taxes and simple direct taxes in OLG framework2. 1 Reinhart (2011) However, debt unsustainability depresses economic growth too as financial repression does. Using financial repression measures government does not allow decrease in GDP due to debt unsustainability. So there is a question which fall in GDP is greater: due to financial repression or due to the increasing government debt. The evidence shows that financial repression is widely used during the debt crisis, so it seems that GDP loss due to increasing debt is higher. 2 1 This possible trade-off between keeping the debt sustainable and stimulating growth raises the question of optimal financial repression design and factors influencing on it in situation when the government strives two aims simultaneously. Optimal design of financial repression in our model means the value of particular repression instrument as a function of model variables, which minimizes policy maker’s loss, resulted from the abovementioned trade-off (compared to the benchmark case where the government is benevolent and to the case of social planner). Concerning the second issue, the working hypothesis is that the direct taxes such as capital tax and indirect taxes such as financial repression measures are not perfect substitutes as in the literature concerning optimal taxation. In order to fill this gap in the existing literature on financial repression I will theoretically address the two following questions: What are the factors, which determine optimal financial repression, when the government faces a trade-off between debt outstanding reduction and increase in output? Optimality can be understood in the sense of minimizing non-benevolent policy maker’s losses resulted from the trade-off. Financial repression in the model will be captured by the requirement for the pension fund to hold some part of resources in government bonds. There is also a question if optimal financial repression is zero especially when interest on bonds and capital are equal. What is the relation between capital tax rate and financial repression measures (indirect taxes) in the OLG framework? The first question is important because today some advanced countries were at risk of default on the debt during the recent financial crisis and had to implement government regulation trying to escape it, while their economies are contracting. Providing that the negative correlation between financial repression and economic growth is well documented in the literature (though mostly for emerging economies) these measures can lead to the substantial loss in GDP and even deep recession. The mechanism works as follows: fall in GDP will lead to the fall in household’s wages, which will in turn reduce amount of savings and capital-to-labor ratio, and this will finally results in the further fall in GDP and need to use financial repression because of tax base reduction (in case if government purchases can not be reduced). So here policy makers have to choose some degree of financial repression that minimizes their losses resultant from the tradeoff. The second question is significant due to the fact that OLG models with government sector document that different taxes (labor tax, capital tax, consumption tax) are perfect substitutes, so 2 there is no sense of introducing new tax, just to change the existing. However, in case of financial repression measures it can be not true, as it is indirect taxation and change stimulus to save. So financial repression measures can be more effective channel of increasing public goods provision than direct taxes. The literature on financial repression mostly deals with developing countries; as well as, the literature does not account for possible trade-off between promoting growth and internal government debt reduction and possible non-standard interrelationship between direct taxes and financial repression measures. In this thesis I will model financial repression in order to address the two abovementioned questions and fill the gap in the literature on financial repression in advanced countries. For this purpose I will extend the Diamond (1965) OLG model developed to the case of financial repression. To account for the fact of financial repression I will assume the fully-funded pension system in the OLG framework, where households pay some part of their wage to the pension fund and pension fund invest some part of these resources in the government bonds. These shares are both parameters of financial repression policy and are determined by the fiscal authorities. Some definitions and the evidence: financial repression in the 21st century The most relevant literature concerning research questions is linked to the impact of financial repression on financial development and economic growth and its mechanisms. However it is necessary to emphasize the aim of repressing the financial sector and provide the evidence that financial repression policy has returned as a policy in advanced countries. If the existing government debt can not be placed in the bond’s market with the market mechanism and/or interest on government bonds is so high that the debt to GDP ratio grows exponentially, then the government can use regulation (use of captive audiences such as commercial banks or pension funds/ interest rate ceilings) in order to place the internal debt in the market or drive the interest rate down. This can be done in a number of ways. For example: Purchase of government bonds by the central bank, which drives the price of bonds up and lowers their yield. Official regulation that requires commercial banks to hold government debt, so that there is an increase in demand for bonds and their price and, as a result, a decrease in the nominal interest rate (example: Basel 3). Enforcement of a requirement that pension 3 funds hold government debt by changing the law that also lowers bond yields, which is considered in the paper. When the government places the debt in captive domestic institutions, lowers yield on bonds (so that government’s interest expenses are reduced for the given stock of debt) and reduces the threat of default, then next task is to keep nominal interest rates low enough in order to produce negative real interest rates (nominal interest rate should be lower than inflation rate) and this liquidate existing debt. More financial repression instruments include explicit or implicit caps on interest rates (mostly deposit rate), regulation of capital flows, high reserve requirements, direct lending to the government by captive domestic audiences (pension funds, commercial banks), placement of nonmarketable government debt on the balances of captive domestic institutions and so on. Financial repression was widely used in advanced economies during the period 1945-1980 which is known as “financial repression era”. Repressive policy enabled them to liquidate vast amounts of government debt. Reinhart and Sbrancia (2011) estimated the “liquidation effect” on a sample of ten advanced and emerging economies in the WWII period. They found evidence, that real interest rates tended to be negative during this period so that redistribution from lenders to borrowers (government) occurs – which is the repression tax. For the US and the UK the annual liquidation of government debt via negative interest rates amounted from around 3 to 4% of GDP, for Australia and Italy it was even more than 5%. Today governments and central banks try to create or expand demand for government debt by the following means of regulation: Limited ECB bond purchases of debt between May 2010 and March 2011. Adoption of Basel 3, which provides for the preferential treatment of government debt in bank balance sheets. Interest rate ceiling on the deposit rate in Spain in April 2010. There is also the evidence that some European countries have used their pension funds in order to shift some of their resources in favor of the government budget. For example, Polish Parliament has adopted the new pension reform in March 2012. The government transferred 121 billion zlotys (36,99 billion $) in bonds held by private pension funds to the state pension fund and then cancel them. This measure enables to cut the public debt by 8%. Hungary has nationalized its pre-funded pension schemes and excluded the cost of the reforms from their 4 public debt figures. The Bulgarian government has come up with the similar measure, but after trade unions protests only 20% of the original resources were transferred to the state. In Oreland pension fund’s resources were used to recapitalize banks. The new 2010 law directed the fund to invest in sovereign bonds. Portugal Telecom transferred almost 3 billion $ to the country’s treasury. Literature review Financial repression and growth When the debt crisis hits the economy the government can choose means of fighting with it. Among them are toughening of the government budget, default on the debt, reliance on the economic growth. However there are some limitations of the abovementioned methods. What is bad about tax adjustment is that governments are reluctant to implement frequent changes in taxation because they produce distortions (Barro, 1979), moreover politicians may resist to increase taxes or cut spending. In relation to the modern debt problems in advanced countries, some argue that increase in tax rate is almost useless as countries have reached the peak of their Laffer curves (Trabandt, Uhlig, 2009 ). While default or debt monetization are popular measures in emerging markets, it can be costly to financial intermediaries, when banks hold a large proportion of their assets in the form of government debt as in Argentina (Kumhof, 2004). Every mean of fiscal crisis negotiation has its cost to the economy, the question is only in the magnitude of the costs produced and in the ability of the particular government to use these different measures. Kumhof (2004) shows that when there is a trade-off for the government between distortionary taxation and distortionary unanticipated inflation in times of fiscal crisis permanent spending shocks should be financed via tax increases, while temporary – through a surge in inflation. As some advanced countries today experience problems with debt sustainability, their governments have to choose, which debt reduction measure or combination of measures to use. Instead of increasing taxes, debt devaluation or explicit default, some countries are applying to the more gradual type of debt restructuring which takes the form of financial repression (Reinhart, Sbrancia, 2011). However financial repression has its own costs, which is demonstrated below. The literature on financial repression confirms that the government revenue extracted from banking sector by financial repression policy is quite significant. That supports the view that 5 governments use repression policy to finance their spending. Giovannini and De Melo (1993) provide empirical evidence of revenue received by the governments of 25 countries from 1972 to 1987. Revenue from financial repression ranges from zero to 6% of GDP (Mexico and Zimbabwe); it constitutes about 40% of government revenue in Mexico, 20% in India and Pakistan. As a consequence, financial liberalization would generate a substantial loss in government revenue. As soon as government liabilities are held by financial intermediaries (especially deposit money banks) these artificially low nominal rates under repression are offset by paying much lower rates on time deposits and household savings. In this case liberalization can lead to the bankruptcy of financial intermediaries. Roubini and Sala-i-Martin (1995) also show that in countries where tax evasion is large the government would offset these losses by repressing the financial sector in order to receive inflation tax, therefore lowering the rate of economic growth. However there are no such estimates for advanced countries. Despite that revenue from financial repression seems to be a significant share of GDP and government revenue its impact on macroeconomic performance of the country found to be detrimental. Shaw and McKinnon (1973) reject the abovementioned rationale for financial repression and provide a theoretical framework for the analysis of financial developmenteconomic growth relation. According to their view, a regulated financial sector impedes both saving and investment because the rates of return of the repressed sector are lower than that could be obtained in a competitive financial market. So in such a framework, financial intermediaries cannot function at full capacity and fail to channel saving into investment efficiently, that results in slower economic growth. Fry (1980) presents an empirical estimate of financial repression cost in developing countries, which supports the theoretical findings of Shaw and McKinnon (1973). Financial repression was captured by deviations of the real deposit rate from its market equilibrium rate. Assume that the real deposit rate is less than its equilibrium level, while there is no financial repression in relation to the loan rate of interest. In this case the volume of investment and savings is determined only by supply conditions (the real deposit rate). Under disequilibrium real deposit rate, there is a decline in real money demand and in real credit supply, which in turn leads to underinvestment and to the fall in the growth rate. Fry documents that for every 1 p.p. by which real deposit rate is set below its equilibrium rate around one half p.p in economic growth is foregone. There is also no paper that evaluates the loss in growth rate due to repression policy in advanced countries. 6 Espinosa and Yip (1996) develop a dynamic general equilibrium model where they verify that limited liquidity provision is growth depressing. It was also shown that there exists a unique optimal degree of financial repression (optimal level of reserve requirements) so that all financial intermediation is done through formal channels. This means that there is a budget deficit threshold after which curb market emerges. Despite that the impact of financial repression policy on economic growth is negative, this policy is still used by the governments of both developing and advanced countries. The reason for this policy is it’s effectiveness in government’s debt reduction when other instruments become ineffective of infeasible. And recent European debt crisis is the evidence for that. So governments of the countries involved in the crisis face trade-off between keeping stable growth and reducing the debt. Therefore, the question of optimal design of financial repression arises here. Optimal taxation in the OLG framework Ordover and Phelps (1975) used the simplified version of the Diamond’s model and studied the optimal mix of linear taxes of wealth and wages that maximize the social welfare function. In their economy the government can change the lump-sum transfers between the young and the old. Their main result is that if each worker’s utility is weakly separable between consumption in both periods and in leisure, then the optimal capital income tax is zero. Atkinson and Sandmo (1980) discussed optimal linear taxes when individuals are identical and the population grows at a constant rate, while the government chooses taxes that affect only one generation. They found that if no lump-sum transfers are allowed and utility is additively separable and logarithmic, then, if the steady state obeys the Modified Golden Rule, the capital income tax is zero in that steady state/ or if the modified golden rule cannot be reached, capital income may be taxed or subsidized in the steady state. Park (1991) studies the steady-state level of the optimal mix of direct and indirect taxes incorporating a consumption tax, taxes on wage and interest earnings, a wealth tax, and a payroll tax in combination with a lump-sum transfer in an overlapping-generations setting with heterogeneous agents. The results are the following: with identical logarithmic preferences the optimum capital income tax is zero in steady state (time endowments are different)/with identical time endowments the optimum capital income tax is zero in steady state/ if individuals 7 differ in preferences and time endowments it may be any. Moreover, if there are significant differences in the preferences for first-period consumption, then this can lead to low levels of consumption tax and wage-income tax and to a high level of interest-income tax. However, if preferences for second-period consumption vary significantly, the result would be a low level of wage-income tax and a high level of interest-income tax. Blackorby and Brett (2004) found that a tax on capital is required at almost all Pareto optima and that there are no restrictions on preferences or technology that render these taxes unnecessary. Heijdra and Ligthart (1998) studied the dynamic effects of the different taxes in the BlanchardYaari type model with endogenous labor supply. Their main result is that labor and capital taxes both depress the long-run capital stock, while consumption tax may work in the other direction if labor supply is inelastic. Renstrom (2000) studied optimal taxation in an overlapping generations economy, assuming different degrees of commitment (full (which is the second best), no, partial (when next periods’ taxes are chosen today)). It was shown that the capital income tax is zero in steady state if the social welfare function is recursively separable across generations under the full commitment. In the case of no commitment case the optimal capital income tax was generally not zero. In the case of partial commitment the capital income tax was not zero, but the steady state was always the Modified Golden Rule (obtained under the assumption of logarithmic utility function) relatively to the second case. Garriga (2001) provided an evidence of why the observed taxes on capital returns are larger than what the standard theory predicts (that is zero capital tax). He stated that when heterogeneity is due to an intergenerational factor, we should expect taxes on capital returns to be different from zero. He found that if the government can use only proportional taxes across generations, the model can account for the observed positive capital and labor income taxes. And if the government can use specific taxes for each generation, then the model implies subsidizing asset returns of the younger generations and taxing at higher rates the asset returns of the older ones. However the question concerning the relation between capital tax and indirect taxes such as financial repression taxes is still open and this is the issue of the present paper. So there are still some gaps in this literature which can be filled. My research will concentrate on the two particular: optimality of financial repression in the presence of the trade-off faced by policy makers in modern advanced countries and the nature of interrelationship between financial repression and direct taxes (tax on capital, particulary). The model 8 The following model is the extension of the Diamond (1965) model for the case of financial repression. We introduce the fully-funded pension system in the Diamond’s model and allow the government to place it’s debt in the fund. The state pension fund is the only buyer of the sovereign debt, while households do not have an opportunity to invest in government securities. They can only save part of income and invest it in the capital, which is the subject of direct taxation. However, households are obliged to transfer part of their income to the pension fund. So financial repression is captured by the two parameters: the share of household’s income invested in the pension fund and the share of fund’s resources placed in the government bonds. Financial repression acts here as an indirect tax on household’s savings. First, let us find and analyze the properties of the competitive equilibrium and then we will turn to the problems of the government (both benevolent, as a benchmark case, and non-benevolent) and the social planner. Competitive equilibrium Households Household lives for two periods t and t 1 . Generations are overlapping. In the period 𝑡 there are N t young agents and N t 1 old ones. Population rises with the growth rate of 𝑛, so that 𝑁𝑡 = 𝑁0 (1 + 𝑛)𝑡 , 𝑛 > −1. In the first period the agent is employed in the productive sector of the economy, where his real income is equal to the real wage received – wt (labor supply is absolutely inelastic and equal to one). Share 𝛾 of his real income household pays to the pension fund. The parameter 𝛾 is determined by the government. First period agent’s disposable income is divided between first period consumption c1,t and savings s t . Household’s savings are invested in productive capital. So in the second period household receives pension ℎ𝑡+1 and return on savings (1 + 𝑟𝑡+1 )𝑠𝑡 . However, the capital income is subject to taxation with the rate 𝜏𝑘 . So in the second period household’s consumption is equal to c2,t 1 1 1 k rr 1 st ht 1 . Let be the rate of intertemporal preferences and u (c j ,t i ) is the function of instantaneous utility. For the simplicity we will assume that u (c j ,t i ) is logarithmic. Each agent maximizes the lifetime utility, which depends on the consumption in both periods. We assume that the representative agent do not leave any inheritance and do not accomplish any transfers in favor of next generations. 9 We will also assume that households receive utility from government purchases 𝐺𝑡, 𝐺𝑡+1 in both periods of life treating them as exogenous (government chooses the levels of both 𝐺𝑡 𝑎𝑛𝑑 𝐺𝑡+1, not households). So the life-cycle u (c j ,t i , Gt , Gt 1 ) ln c1,t ln Gt utility is of the following form: 1 (ln c 2,t 1 ln Gt 1 ) . 1 Government purchases here are public goods. Households receive utility from public goods consumption both when young and old. Therefore the instantaneous utility function of the individual born at time t is as follows: U (c1,t , Gt , c 2,t 1 , Gt 1 ) (ln c1,t ln Gt ) 1 (ln c 2,t 1 ln Gt 1 ) , where 𝐺𝑡 и 𝐺𝑡+1 – are public 1 goods consumption at time 𝑡 and 𝑡 + 1, 𝜑 > 0. Parameter 𝜑 is not bounded from above by 1, which allows us to analyze the situation when individual gives more weight to the public goods than to the consumption of the private goods. So the benevolent government will have to increase public good provision and so to rise capital tax or levy more financial repression. Household’s problem: max u (c j ,t i , Gt , Gt 1 ) ln c1,t ln Gt 1 (ln c 2,t 1 ln Gt 1 ) c1t , c 2t 1 , st 1 (1) s.t. c1,t st wt (1 ) (2) c 2,t 1 1 1 k rr 1 st ht 1 (3) Firms In the productive sector of the economy only young agents work. There is a large number of perfectly competitive firms. Each firm’s production process is described by the same production function, which depends on the labor and capital only. No technological progress is assumed. We also assume the neoclassical production function for which it is true that: Y F ( K , N ) Nf (k ) , where k K — is capital-labor ratio. N Moreover, the function f (k ) satisfies Inada conditions (concavity and smoothness, f (0) 0 , f (0) , f () 0 ). For the simplicity we also assume that the depreciation rate is already accounted in the production function. Firm’s problem: 10 max F ( K t , N t ) rt K t wt N t K t 0, N t 0 , As the firm takes rt and wt as given, we receive the following first order condition with respect to kt : rt f (k t ) (4) wt f (k t ) rt k t (5) For the sake of simplicity we assume, that f (kt ) kt . Then conditions (4) and (5) are as follows: rt kt 1 and wt (1 )k t correspondingly. Moreover, we assume the full depreciation during the 30 years, which is to some extent empirically plausible. This enables us not to model how the capital passes from the old to the young households. Pension fund We assume the fully-funded pension system. The pension fund at time t receives wt from household’s income. The share is invested in the government bonds and the share (1 ) - in capital. Pension fund is the only agent who buys government debt in the economy. So it means, that the government debt at time t is equal to bt wt . At time t 1 the pension paid by the pension fund is as follows: ht 1 wt 1 r b 1 rt 1 . Capital income of the pension fund is not subject to taxation. The parameter can be interpreted as the parameter of financial repression, so do 𝛾. And share is also determined by the government. Government Let us consider the government’s finances at time 𝑡. Government collects capital taxes Tt N t 1 k rt st 1 , provides agents with government purchases Gt Nt gt , borrows from the pension fund (or from households indirectly) the following sum of bt 1 N twt and repays the 1 rb debt bt 1 r b N t 1wt 1 . The government is unable to place it’s debt anywhere except in the pension fund. This assumption reflects the real evidence when governments can not sell their debt to the households or firms so that they have to use captive domestic audiences. Dynamic government budget constraint: Gt Tt bt 1 bt or in the other terms Nt gt Nt 1 k rr st 1 Ntwt 1 r b Nt 1wt 1 b 1 r (6) 11 So government purchases are determined by the constraint (6). Moreover, the government debt is always sustainable by the construction. Here, the budget constraint reflects the political economy problems, for example: increase in tax on capital or parameters of financial repression lead to the fall in old people’s welfare, so there is a trade-off between increasing government purchases and taxes; the government wants to keep G at the specific level G* as to maximize the household’s welfare – there is a need to increase taxes; it is easier to use financial repression as indirect tax compared to the increase in tax on capital from political reasons; moreover, increase in tax rates lead to the fall of output and therefore household’s income and so of the tax base (Laffer curve emerges (the existence of the Laffer curve in the following model will be shown below)). Equilibrium The allocation c1,t , c2,t , st , kt , bt , rt , wt , k , rtb , Gt ,Tt , t 0... is an equilibrium trajectory if the following conditions are held: 1. (c1t , c2,t 1 , st ) — is the solution of consumer’s problem (1)-(3) for given rt , rtb and wt from equilibrium trajectory. 2. The solution of the firm’s problem satisfies the (4)-(5) conditions for given rt , rtb and wt from equilibrium trajectory. 3. Capital market balance is held: 𝑠𝑡 𝑁𝑡 + 𝛾𝑤𝑡 (1 − 𝛽)𝑁𝑡 = 𝑁𝑡+1 𝑘𝑡+1 4. Goods market clearing condition is satisfied: N t c1t N t 1c2t N t 1k t 1 Gt N t f (k t ) (7) (8) 6. At every instant t the government budget constraint (6) is fulfilled. Model’s solution The supply of capital resources is determined from the household’s problem and it is the following function st = (1−γ) wt 2+θ − (1+θ) (2+θ) γwt 𝒩 ℳ , where ℳ = (1 + rt+1 (1 − τk )) and 𝒩 = (1 + βr b + (1 − β)rt+1 ) the demand for capital resources is as follows: 𝑠𝑡 = (1 + 𝑛)𝑘𝑡+1 − 𝛾𝑤𝑡 (1 − 𝛽). So the equation of capital-to-labor ratio accumulation dynamics is the following: 1 А𝑘𝑡+1 = (1 )k t [𝐵 − C (1+βrb +(1−β) k t 1 1 (1+(1−τk ) k t 1 ) ] (9) ) 12 Where (2 + 𝜃)(1 + 𝑛) = 𝐴 and (2 + 𝜃)𝛾(1 − 𝛽) + (1 − γ) = B and (1 + θ)γ = C are constants. Let us show the dynamic of capital-to-labor ratio numerically. The following parameters values are considered assuming that one period lasts for 30 years: 𝛼 = 0.33, 𝛾 = 0.22, 𝛽 = 0.4, 𝑛 = 0.348, 𝜃 = 0.81, 𝑟 𝑏 = 0.03, 𝜏𝑘 = 0.05, (this combination of parameters guarantees that the On the picture below it can be seen that there are two equilibriums and one of them is positive and sustainable. So the modified model exhibits the properties of the standard one. Figure 1. Capital-to-labor ratio dynamics Steady state Stationarity requires the fulfillment of the following conditions: kt kt 1 k * and c1t c2t (1 n) c * (the aggregate consumption, redefinition is used for the simplicity). From (9) it comes that capital-labor ratio is equal to 𝑘 ∗(1−𝛼) = (1−𝛼)𝑌−𝐴𝛼(1−𝜏𝑘 )+√(𝐴𝛼(1−𝜏𝑘 )−(1−𝛼)𝑌)2 +4𝛼(1−𝛼)(2+𝜃)(1+𝑛)𝑋 2(2+𝜃)(1+𝑛) 𝐶(1 − 𝛽)𝑎𝑛𝑑 𝑌 = 𝐵 − 𝐶(1 + 𝛽𝑟 𝑏 ) are constants. , where 𝑋 = 𝐵(1 − 𝜏𝑘 ) − (10) 13 As 𝑘 ∗ = 𝑐𝑜𝑛𝑠𝑡, 𝑦 ∗ = 𝑐𝑜𝑛𝑠𝑡, 𝑐 ∗ = 𝑐𝑜𝑛𝑠𝑡 in the steady-state, then growth rates of 𝑘, 𝑦, 𝑐 are zero. However, population grows with the rate 𝑛, therefore output, consumption and capital grow with the equal rate 𝑛 in the steady-state: 𝑔𝐾 = 𝑔𝐶 = 𝑔𝑌 = 𝑛. Social optimum Let us consider the government as the social planner (SP). Social planner maximizes the utility of the following and future generations with the discount factor equal to the household’s one. The objective function of the social planner is the following: 1 1 −t−1 U = 1+θ u(c2,0 ) + ∑∞ (u(c1,t ) + 1+θ u(c2,t+1 )) t=0(1 + θ) (11) The resource constraint of the SP is given by the goods market equillibrium. Goods market balance is: (1 n)c1t c 2t (1 n) 2 k t 1t Gt (1 n) f (k t ) , where government spending are determined from the dynamic government constraint: Nt gt Nt 1 k rr st 1 Ntwt 1 r b Nt 1wt 1 . Savings are also given by the capital market equillibrium: 𝑠𝑡 = (1 + 𝑛)𝑘𝑡+1 − 𝛾𝑤𝑡 (1 − 𝛽), and capital interest rate and wage are determined by the conditions (4) and (5): rt kt 1 и wt (1 )kt . So the resource constraint of the social planner is given by: 2,𝑡 c1,t = 𝑘𝑡𝛼 − (1 + 𝑛)𝑘𝑡+1 − 1+𝑛 − 1+𝑛 [ k rr st 1 (1 n)wt 1 r b wt 1 ] 𝑐 1 Using 𝑠𝑡−1 = (1 + 𝑛)𝑘𝑡 − 𝛾𝑤𝑡−1 (1 − 𝛽) and wt 1 (1 )kt 1 the constraint looks like: c 2,t c1,t = k αt (1 − ατk + γ(1 − α)) − (1 + n)k t+1 − 1+n + αγτk (1−β)(1−α) (1+n) k α−1 k αt−1 − t (1+rb ) (1+n) k αt−1 (12) For technical purposes it is also convenient to determine 𝑐1,𝑡−1 : c1,t−1 = k αt−1 (1 − ατk + γ(1 − α)) − (1 + n)k t − c2,t−1 1+n + αγτk (1−β)(1−α) α−1 α k t−1 k t−2 (1+n) −− (1+rb ) (1+n) k αt−2 So the social planner’s problem is the following: max c1t ,c2t ,kt,γ,β,τk 1 1 −t−1 𝑈 = 1+θ u(c2,0 ) + ∑∞ (u(c1,t ) + 1+θ u(c2,t+1 )) t=0(1 + θ) (11) 14 Subject to: c 2,t c1,t = k αt (1 − ατk + γ(1 − α)) − (1 + n)k t+1 − 1+n + 1 αγτk (1−β)(1−α) (1+n) 1 k α−1 k αt−1 − t (1+rb ) (1+n) k αt−1 (12) 1 U = u(c1,t−1 ) + 1+θ u(c2,t ) + 1+θ (u(c1,t ) + ⋯ ) + ⋯ = 1+θ u(c2,t ) + u (k αt−1 (1 − ατk + γ(1 − α)) − (1 + n)k t − c2,t−1 1+n α)) − (1 + n)k t+1 − + c2,t−1 1+n αγτk (1−β)(1−α) (1+n) + α k α−1 t−1 k t−2 − αγτk (1−β)(1−α) (1+n) (1+rb ) (1+n) α k α−1 t k t−1 − 1 k αt−2 ) + 1+θ [u (k αt (1 − ατk + γ(1 − (1+rb ) (1+n) k αt−1 ) + ⋯ ] First order conditions: ∂U ∂c2t = 0: ′ 1 1+θ 1 ′ u′ (c2t ) − (1+n)(1+θ) u′ (c1t ) = 0 (13) This first order condition shows how the consumption levels of young and old are matched at time 𝑡. ∂U ∂kt = 0: 1 1+θ α−2 [αk α−1 ( t (1 − ατk + (1 − α)γ) + (α − 1)k t αγτk (1−β)(1−α) (1+n) ′ )k αt−1 ] u′ (c1t ) + ′ u′ (c1t−1 )[−(1 + n)] = 0 (14) Capital first order condition gives the intratemporal choice of one household, and this choice depends on the financial repression parameters (tax policy). We will analyze these conditions in the steady-state, for which it is true that: cit = cit−1 = c ∗ i and kt kt 1 k * . So it follows that u′ (c1t ) = u′ (c1t−1 ). From here we can find the interdependence of capital tax and financial repression as indirect tax: (𝟏 + 𝒏)(𝟏 + 𝜽) = 𝜶(1 − ατk + (1 − α)γ)k ∗α−1 − Where 𝑘 ∗(1−𝛼) = α(1−α)2 (1−β)γτk (1+n) k ∗2(α−1) (15) (1−𝛼)𝑌−𝐴𝛼(1−𝜏𝑘 )+√(𝐴𝛼(1−𝜏𝑘 )−(1−𝛼)𝑌)2 +4𝛼(1−𝛼)(2+𝜃)(1+𝑛)𝑋 2(2+𝜃)(1+𝑛) The picture below shows the relation between capital tax and financial repression measure (parameter 𝛽). 15 Figure 2. Tax on capital and financial repression relation. From the picture above it can be seen that financial repression measure and tax on capital are both positive and imperfect substitutes. Tax on capital here is approximately equal to the 0,1 share of pension fund’s resources in government bonds. It means that financial repression is more effective instrument than tax on capital for the government. Benevolent government Consider the benevolent government (BG), which chooses such tax policy (capital tax rate and financial repression parameters), that maximizes the discounted welfare of both the existing and next generations. In every period dynamic budget constraint of the government is fulfilled. Moreover, the optimal allocation of tax rates should belong to the variety of equilibrium allocations from the stationary trajectory. Let us also assume that the timing of the decisions is as follows: first, the benevolent government sets tax rates and then firms and households choose optimal levels of consumption, savings, capital and output taking tax rates as given. So we do not consider the dynamic inconsistency problem. 16 The objective function of the benevolent government is the discounted sum of every generation’s utility in the economy. Assume 𝜃𝑡 to be the each generation’s weight, which is equal to the individual time preference rate. The benevolent government maximizes the discounted utility of those households, who live at the same time, however young and old individuals are from the different generations. Population growth is also taken into account. Let us write down the utility function of the benevolent government beginning from time 𝑡: 1 𝑉(𝑐𝑗,𝑡+𝑖 , 𝐺𝑡+𝑖 ) = ⋯ 𝑁t−1 (lnc2t + φlnGt ) + Nt (lnc1t + φlnGt ) + 1+θ [Nt (lnc2t+1 + φlnGt+1 ) + 1 2 Nt+1 (lnc1t+1 + φlnGt+1 )] + (1+θ) [Nt+1 (lnc2t+2 + φlnGt+2 ) + Nt+2 (lnc1t+2 + φlnGt+2 )] + ⋯ As the government exists on the infinite time horizon, then the utilities are summarized from zero to infinity. We should also consider the steady-state for which it is true 𝑐2𝑡 = 𝑐2𝑡+1 = 𝑐2𝑡+𝑖 = 𝑐2 and 𝑐1𝑡 = 𝑐1𝑡+1 = 𝑐1𝑡+𝑖 = 𝑐1. The following identity is true for government purchases at time 𝑡 and 𝑡 + 1. So the objective function of the benevolent government can be written as: 1+θ ∗ ∗ V(ci,t+i , Gt+i ) = θ−n (lnc2 ∗ + φlnG + (1 + n)(lnc1 ∗ + φlnG)) (16) The government’s restriction is given by it’s dynamic budget constraint: Gt N t 1 ( k rt st 1 (1 n)wt 1 r b wt 1 ) , where the right-hand side determines the government spending as wage and capital interest rate (and so savings) are given. As optimal tax allocation belongs to the steady-state trajectory, so the benevolent government’s constraint is also written for the steady-state. Then 𝐺𝑡 = 𝑁𝑡−1 (𝜏𝑘 𝛼𝑘 ∗𝛼−1 [(1 + 𝑛)𝑘 ∗ − 𝛾(1 − 𝛽)(1 − 𝛼)𝑘 ∗𝛼 ] + (1 + 𝑛)𝛾(1 − 𝛼)𝑘 ∗𝛼 − (1 + 𝑟 𝑏 )𝛾(1 − 𝛼)𝑘 ∗𝛼 ), where 𝑠𝑡−1 = (1 + 𝑛)𝑘𝑡 − 𝛾(1 − 𝛽)𝑤𝑡−1 is taken from the capital market equillibrium. Benevolent government’s problem: 1+θ ∗ ∗ max V(ci,t+i , Gt+i ) = θ−n (lnc2 ∗ + φlnG + (1 + n)(lnc1 ∗ + φlnG)) γ,𝛽,𝜏𝑘 ≥0 (16) Subject to: 𝐺𝑡 = 𝑁𝑡−1( 𝜏𝑘 𝛼𝑘 ∗𝛼−1 [(1 + 𝑛)𝑘 ∗ − 𝛾(1 − 𝛽)(1 − 𝛼)𝑘 ∗𝛼 ] + (1 + 𝑛)𝛾(1 − 𝛼)𝑘 ∗𝛼 − (1 + 𝑟 𝑏 )𝛾(1 − 𝛼)𝑘 ∗𝛼 ) (17) 17 𝑘 ∗(1−𝛼) = (1−𝛼)𝑌−𝐴𝛼(1−𝜏𝑘 )+√(𝐴𝛼(1−𝜏𝑘 )−(1−𝛼)𝑌)2 +4𝛼(1−𝛼)(2+𝜃)(1+𝑛)𝑋 2(2+𝜃)(1+𝑛) 𝑐1∗ = (1 − 𝛾)(1 − 𝛼)𝑘 ∗𝛼 − (1−γ)(1−α)k∗α 2+θ 𝑐2∗ = (1 + (1 − 𝜏𝑘 )𝛼𝑘 ∗𝛼−1 ) ∗ [ (1+θ) + (2+θ) γ(1 − α)k ∗α (1−γ)(1−α)k∗α 2+θ (1+θ) 𝒩 (1 − β)αk ∗α−1 ) (18) ℳ − (2+θ) γ(1 − α)k ∗α (10) 𝒩 ℳ ] + γ(1 − α)k ∗α (1 + βr b + (19) First order conditions: ′ ∗′ 1+𝜃 𝑐2𝑘∗ 𝑘𝛽 𝜕𝑉 = 𝜃−𝑛 [ 𝜕𝛽 𝜕𝑉 𝜕𝛾 ′ 1+𝜃 𝑐2𝑘∗ 𝑘𝛾∗′ = 𝜃−𝑛 [ 𝜕𝑉 𝜕𝜏𝑘 𝜕𝑉 𝜕𝑟 𝑏 𝑐2∗ 𝑐2∗ + 𝜑(2 + 𝑛) + 𝜑(2 + 𝑛) ′ ∗′ 1+𝜃 𝑐2𝑘∗ 𝑘𝜏𝑘 = 𝜃−𝑛 [ 𝑐2∗ ′ ∗′ 1+𝜃 𝑐2𝑘∗ 𝑘𝑟𝑏 = 𝜃−𝑛 [ 𝑐2∗ ′ 𝐺𝑡𝛽 𝐺𝑡 ′ 𝐺𝑡𝛾 𝐺𝑡 + 𝜑(2 + 𝑛) + 𝜑(2 + 𝑛) + (1 + 𝑛) + (1 + 𝑛) ′ 𝐺𝑡𝜏 𝑘 𝐺𝑡 𝐺′ 𝑏 𝑡𝑟 𝐺𝑡 ′ ∗′ 𝑐1𝑘∗ 𝑘𝛽 𝑐1∗ ′ 𝑐1𝑘∗ 𝑘𝛾∗′ 𝑐1∗ + (1 + 𝑛) + (1 + 𝑛) ]=0 (20) ]=0 (21) ′ 𝑐1𝑘∗ 𝑘𝜏∗′𝑘 𝑐1∗ ]=0 ′ 𝑐1𝑘∗ 𝑘 ∗′𝑏 𝑟 𝑐1∗ ]=0 (22) (23) 18