Jennifer McLaurin

Haley Zarbock

Target Financial Analysis of 2010 and 2011

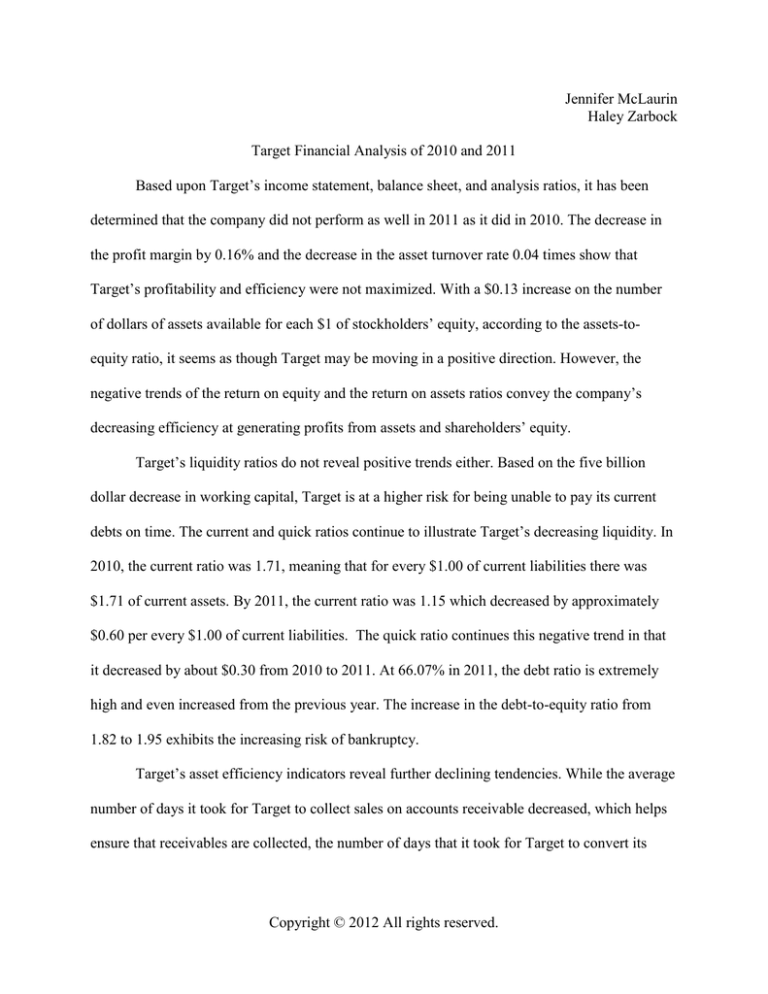

Based upon Target’s income statement, balance sheet, and analysis ratios, it has been

determined that the company did not perform as well in 2011 as it did in 2010. The decrease in

the profit margin by 0.16% and the decrease in the asset turnover rate 0.04 times show that

Target’s profitability and efficiency were not maximized. With a $0.13 increase on the number

of dollars of assets available for each $1 of stockholders’ equity, according to the assets-toequity ratio, it seems as though Target may be moving in a positive direction. However, the

negative trends of the return on equity and the return on assets ratios convey the company’s

decreasing efficiency at generating profits from assets and shareholders’ equity.

Target’s liquidity ratios do not reveal positive trends either. Based on the five billion

dollar decrease in working capital, Target is at a higher risk for being unable to pay its current

debts on time. The current and quick ratios continue to illustrate Target’s decreasing liquidity. In

2010, the current ratio was 1.71, meaning that for every $1.00 of current liabilities there was

$1.71 of current assets. By 2011, the current ratio was 1.15 which decreased by approximately

$0.60 per every $1.00 of current liabilities. The quick ratio continues this negative trend in that

it decreased by about $0.30 from 2010 to 2011. At 66.07% in 2011, the debt ratio is extremely

high and even increased from the previous year. The increase in the debt-to-equity ratio from

1.82 to 1.95 exhibits the increasing risk of bankruptcy.

Target’s asset efficiency indicators reveal further declining tendencies. While the average

number of days it took for Target to collect sales on accounts receivable decreased, which helps

ensure that receivables are collected, the number of days that it took for Target to convert its

Copyright © 2012 All rights reserved.

inventory into sales increased. Likewise, there was a decrease in the dollars of sales generated

from each $1.00 of fixed assets.

The cash flow to net income ratio proved to be double-sided. While the increase from

1.81 to 1.86 was beneficial to Target because cash flow was still higher than the net income, the

cash flow and the net income both drastically decreased. There was a 17.05% decrease in the net

income from 2010 to 2011. Similarly, the operating income decreased by 11.06%. Also, Target’s

ability to generate adequate cash flow was cut in half from 2010. After repaying debts and

paying cash dividends to stockholders, Target had $2,533,000,000 in free cash flow. By the end

of 2011, it had drastically decreased to $316,000,000. With the decrease in net income and

$2,217,000,000 decrease in free cash flow, Target is more likely to have lower quality earnings.

The earnings per share increased from $4.03 in 2010 to $4.31 in 2011, conveying that

Target should have increased its earnings performance. Similarly, the dividend payout increased

from 20.86% to 25.60%, indicating a higher amount of dividends were paid to shareholders in

2011. While normal price earnings ratios are in the range of 15 to 20, Target’s PE ratio was only

13.61 in 2010 and 11.61 in 2011. This portrays that there is little hope for Target’s stock in

future years. Even the financial market values Target lower at $33,498,111,096 in 2011

compared to $38,602,415,493 in 2010. Overall, Target has experienced a negative trend in

almost all aspects of its financial areas and certain ratios have illustrated that the negative trend

will more than likely continue in the following years.

Copyright © 2012 All rights reserved.