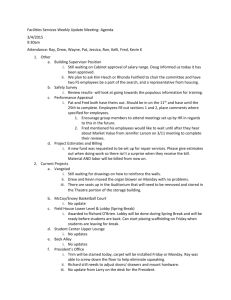

Beneficiaries

advertisement