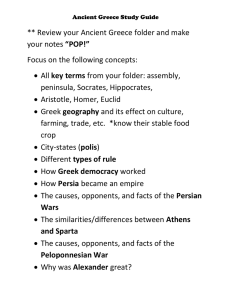

Case Study: Greek Prime Minister, George Papandreou Surprises

advertisement

Case Study: Greek Prime Minister, George Papandreou Surprises Financial Markets, October 31, 2011 Background: The following is the flash headline from FXStreet. Mon, Oct 31 2011, 18:18 GMT | FXstreet.com FXstreet.com (Córdoba) – The Prime Minister of Greece, George Papandreou called for a referendum to ask whether to accept the new bailout or not. He said he will call for a vote of confidence and rejected elections. Stocks, Euro Decline on Greek Referendum Bloomberg.com November 1, 2011 Stocks sank and the euro weakened, while a surge in German bunds sent yields down the most on record, amid concern Europe’s bailout of Greece will unravel. The dollar and U.S. Treasuries rallied. The MSCI All-Country World Index fell 3.4 percent at 4:32 p.m. in New York as gauges in Italy, France and Germany plunged at least 5 percent. The Standard & Poor’s 500 Index closed down 2.8 percent at 1,218.28. German 10-year yields fell as much as 29 basis points to 1.73 percent. Rates on 10-year Italian and French debt touched euro-era records above German debt. The euro fell 1.2 percent to $1.3696. Copper and oil paced losses in commodities after China’s manufacturing growth cooled. Greek Prime Minister George Papandreou’s grip on power weakened after his call for a referendum to approve the bailout provoked lawmaker defections from his party and fueled concern a default would undermine financial stability in the region. European leaders pressed Greece to uphold the terms of the bailout before a summit of Group of 20 leaders later this week. “It’s frustrating,” David Kelly, chief market strategist for JPMorgan Funds in New York, said in a telephone interview.“The danger of having a referendum is that it could be defeated, in which case Greece presumably would end up defaulting on its debt. Europe is not addressing the basic problem. They are not giving the peripheral countries a way out of a recession.” ‘Killing the Market’ The S&P 500 extended yesterday’s 2.5 percent retreat and is down 5.2 percent so far this week. The index surged 3.8 percent last week, capping a 17 percent rebound from a 13-month low on Oct. 3, after European officials planned to increase the region’s Page | 1 bailout fund to 1 trillion euros ($1.4 trillion) and investors agreed to a voluntary, 50 percent writedown on Greek debt. “This uncertainty over in Greece is really killing the market,” David Rovelli, managing director of U.S. equity trading at Canaccord Genuity Inc. in New York, said in a Bloomberg Television interview. “Every hedge-fund manager and fund manager that chased the market last week for performance is now looking at anywhere from 4 to 6 percent losses in 3 days. So, it’s not good and nobody knows what to do.” Gauges of financial, energy and industrial companies in the S&P 500 slid more than 3 percent today to lead losses among the index’s 10 main industry groups, all of which slid at least 1.6 percent. Banks Slump Bank of America Corp., JPMorgan Chase & Co., Cisco Systems Inc. and General Electric Co. lost more than 4 percent for the biggest declines in the Dow Jones Industrial Average. Jefferies Group Inc. fell 9.4 percent as investors renewed their focus on Europe’s financial crisis, prompting the investment bank to say it has “no meaningful exposure” to debt issued by Portugal, Italy, Ireland, Greece and Spain. Morgan Stanley tumbled 8 percent and Goldman Sachs Group Inc. fell 5.5 percent. MF Global Holdings Ltd. (MF)’s bankruptcy filing yesterday underscored the potential for more contagion from Europe’s sovereign debt crisis. The brokerage, which wagered $6.3 billion of its own money on European sovereign debt, violated requirements that it keep clients’ collateral separate from its own accounts, said Craig Donohue, chief executive officer of CME Group Inc., the world’s largest futures exchange. MF Global has accounted for all its assets, Kenneth Ziman, a lawyer for the firm, said at a bankruptcy court hearing today in New York. Transaction Tax Nasdaq OMX Group Inc. fell 2.8 percent and NYSE Euronext lost 6.8 percent after lawmakers said they will introduce measures to impose a transaction tax on financial firms that resembles a proposal released by the EU. Senator Tom Harkin, an Iowa Democrat, and Representative Peter DeFazio, an Oregon Democrat, will introduce the bills tomorrow. Transaction taxes are likely to be discussed at the G-20 summit this week in Cannes, France. Manufacturing in the U.S. expanded less than forecast in October as inventories shrank by the most in a year and production cooled. The Institute for Supply Management’s factory index dropped to 50.8 last month from 51.6 in September. A reading of 52 was Page | 2 the median forecast in a Bloomberg News survey of economists. Fifty is the dividing line between growth and contraction. Federal Reserve policy makers started a two-day meeting today to discuss monetary policy and the economy. Central bankers are considering buying mortgage-backed securities to push down borrowing costs and help homeowners refinance their debt. That would reduce monthly payments, freeing up cash for other purchases that could spur the economy and reduce unemployment, Fed Governor Daniel Tarullo said Oct. 20. European Stocks The Stoxx Europe 600 Index declined 3.5 percent, the biggest drop in almost six weeks. Greece’s ASE Index slid 6.9 percent, the most in three years. The National Bank of Greece SA, Banco Comercial Portugues SA and France’s Societe Generale SA and Credit Agricole SA tumbled more than 12 percent. Credit Suisse Group AG (CSGN) sank 8.2 percent after the Swiss bank reported earnings that missed analysts’ estimates. Yields on Italian 10-year debt surged to as much as 4.55 percentage points above German bunds, while French rates climbed to 1.23 percentage points above. The Belgian-German 10-year yield spread widened to a euro-era record 2.66 percentage points. Greek two-year note yields surged as much as 11 percentage points to a record 88.81 percent. The yield on Sweden’s 10-year bond dropped 24 basis points to 1.70 percent, and Norway’s yield slid 17 basis points to 2.53 percent. Sweden and Norway don’t use the euro currency. Treasuries Rally U.S. Treasuries rose, extending the biggest rally in 30-year bonds since March 2009. Thirty-year yields slid 14 basis points, or 0.14 percentage point, to 2.99 percent, after sinking 24 points yesterday. Ten-year yields fell 13 basis points at 1.99 percent. The euro depreciated 1 percent to 107.30 yen, while Japan’s currency slipped 0.2 percent to 78.31 per dollar. The Australian dollar weakened versus 14 of its 16 major peers, falling 1.8 percent to $1.0346. The Dollar Index, a gauge of the currency against six major peers, climbed 1.5 percent to 77.29 and is up 3 percent in two days, its biggest increase in almost three years. The cost of insuring against default on sovereign debt surged the most in almost four months with the Markit iTraxx SovX Western Europe Index of credit swaps linked to 15 Page | 3 governments jumping 31 basis points to 335 basis points. Contracts on Italy soared 73 to 519 basis points, France’s were up 16 at 192 and Germany’s climbed 11 to 95 basis points. Merkel, Sarkozy German Chancellor Angela Merkel and French President Nicolas Sarkozy called for the implementation of the European deal to write down Greece’s debt, saying that carrying out last week’s summit decisions is “more necessary than ever today. ”Merkel and Sarkozy will meet in Cannes tomorrow to discuss Greece before the G-20 summit on Nov. 3, Merkel’s chief spokesman Steffen Seibert said in an e-mailed statement. Papandreou will proceed with plans for a referendum on the Greek financing package, government spokesman Angelos Tolkas said in statements televised live on state-run NET TV. Tolkas said Papandreou would win a parliamentary confidence vote planned for later this week. Most of the 1,009 people surveyed in Greece on Oct. 27, the day the new bailout package was announced, said the accord should be put to a referendum, according to the results of a Kapa Research SA poll, published in To Vima newspaper. Forty-six percent said they’d oppose the plan at such a referendum. In the same poll, more than seven in 10 favored Greece remaining in the euro. ‘Disorderly Default’ Greece’s referendum poses a threat to financial stability in the euro region and increases the risk of a “disorderly” default, Fitch Ratings said. Papandreou’s grip on power weakened before a confidence vote on Nov. 4 as six senior members of the ruling party called on the prime minister to step down, state-run Athens News Agency reported, without citing anyone. “The risk of a Lehman-style disorderly default now looms a bit larger than before, including some residual risk that Greece may leave the euro zone if it rejects the offer of orderly debt relief in exchange for harsh new spending cuts and reforms,”Holger Schmieding, chief economist at Joh. Berenberg Gossler & Co. in London, wrote in a note. Emerging Markets The MSCI Emerging Markets Index declined 2.6 percent and is down 4.1 percent in two days. The Hang Seng China Enterprises Index slid 3.1 percent. Benchmark stock indexes fell at least 2.2 percent in Russia, Turkey, and the Czech Republic. The ruble weakened 1.3 percent against the dollar and South Africa’s rand slid 1.6 percent. Page | 4 Addendum: The following tables and charts show the impact of the Greek announcement on specific financial markets. Stock Markets (Tuesday, November 1, 2011) DJIA: - 297.05 (-2.48%) FTSE 100 (UK): - 122.65 (-2.21%) CAC 40 (France): - 174.51 (-5.38%) DAX (Germany): - 306.83 (-5.00%) Athens Index: - 55.93 (-6.92%) Nikkei 225 (Japan): - 195.10 (-2.21%)* *Wednesday, November 2, 2011 Credit Default Swap Market (Greek Government Bonds) Page | 5 Bond Markets Yields to Maturities on Outstanding Greek Government Bonds Friday, October 28, 2011 Maturity Date Coupon 05/2014 4.50% 6/2020 6.25% Yield to Maturity 60.32% 24.24% Wednesday, November 2, 2011 Maturity Date Coupon Yield to Maturity 05/2014 4.50% 73.51% 6/2020 6.25% 28.24% Basis Point Spreads of 10-Year Greek Government Bonds Over 10-Year Bunds and 10-Year Treasury Bond Friday, October 28, 2011 Spread over Bunds Spread over T-Bonds +2,205 +2,193 Wednesday, November 2, 2011 Spread over Bunds Spread over T-Bonds +2,658 +2,641 FX Markets (The following charts are all scaled to GMT) (Note: George Papandreou’s announcement at 18:18 GMT, October 31) EUR/USD Page | 6 USD/CHF EUR/JPY Page | 7