Structure of Central Banks and the Federal Reserve System

advertisement

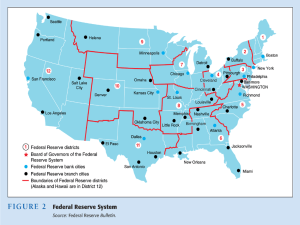

Structure of Central Banks and the Federal Reserve System Origins of the Federal Reserve System The Fed is different from all other central banks. This is due to the nature of politics in the U.S. People in the U.S. historically have had a fear of centralized power. A central bank was perceived to be a source of centralized power. There was also a good deal of antagonism between agricultural interests and business (city) interests. The lack of a central bank meant that there was no agency that might be able to prevent a bank panic. There were a number of such panics in the U.S occurring about every 20 years. The panic of 1907 caused so many bank failures and loss of depositors’ funds that the resistance to a central bank was overcome. It was politically necessary to create a central bank that did not look like a central bank. The result was 12 regional Federal Reserve banks. Structure of the Fed Federal Reserve Banks Each of the 12 Fed district banks has a main bank. It is interesting to note that Missouri has two Fed district main banks. There is some thought that this was because the head of the Senate committee that created the Fed was chaired by a senior Senator from Missouri. Each of the district banks is a quasi public institution. Each bank that chooses to join the Fed is required to purchase stock in the Fed district bank. The member banks earns an annual 6% dividend. The member banks elect six of the nine directors of each of the district banks. These nine directors appoint the president of the district bank (if the Board of Governors approve). The functions (tasks) of the district banks Clear checks Issue new currency Withdraw damaged currency from circulation Administer and make discount loans to member banks Evaluate proposed mergers and applicatons for banks to expand their activities Act a liaisons between the business community and the Fed Examine bank holding companies and state—chartered banks Collect data on local business conditions Conduct research relating to monetary policy. The district banks and monetary policy The directors determine the discount rate at which they loan to member banks. They determine who can receive discount loans. The directors select one commercial banker from the district to serve on the Federal Advisory Council which advises the Board of Governors. Five of the 12 district presidents serve on the Federal Open Market Committee (FOMC) (the president of the New York Fed is always on this committee). Member banks All national banks are required to belong to the Fed. State banks can choose to belong (about 33% of all commercial banks belong to the Fed, about 49% belonged in 1947). Before 1980 only member banks had to keep reserves at the Fed. The decline in Fed membership and reserve requirements raised concerns about the Fed’s ability to conduct monetary policy. The Fed pressured Congress to require all depository institutions to meet the same reserve requirements. All depository institutions were allowed to apply for discount loans and to use the Fed’s check clearing facilities. The Board of Governors (where the real power lies)(Note how the board is structured to try to prevent centralized power). There are seven members of the Board of Governors o Each member appointed by the President for one nonrenewable 14--year term. o One members term expires every other January. This means no President can appoint a majority of member (save for a freak number of resignations or deaths). o Each appointee must be approved by the Senate. o The governors must be from different districts. o The chair is chosen from the seven governors and serves a four year term (the term does not coincide with President’s term). o All seven governors are member of the Federal Open Market Committee (FOMC). o The chair advises the President and testifies before Congress and meets with the press. o The Board reviews and revises the discount rate set by the district banks. o The Board has legislative responsibility for the conduct of monetary policy. The Federal Open Market Committee (FOMC) o Open market operations (OMOs) are the chief monetary policy tool o Meets eight times a year o The voting members consist of the seven governors plus five presidents of district banks. The presidents of the other district banks attend. o While the Chair of the Board of Governors does not have the power to make decisions by tradition he usually gets what he wants. He has the power to set the agenda for FOMC meetings. Set agenda for all Fed meetings of the Board of Governors. The informal structure of the Fed The initial intent of the legislation used to form the Fed was to have a decentralized structure of the 12 regional banks. The initial aim of the legislature was an organization to prevent bank panics. It was not considered an organization with the responsibility to stabilize the economy. There are three monetary policy tools. 1. Open market operations. When the Fed was originally formed it had not occurred to anyone to try open market operations. The Fed later developed this tools as an innovation. 2. Reserve requirement. The legislation creating the Fed initially fixed the reserve requirements. So the Fed was prohibited from using this tool. 3. Discount loans. The Fed was permitted the control of discount loans to member banks. This tool was to be controlled by the joint decision of the district banks and the Federal Reserve Board (later the Board of Governors). Legislation resulting from the Great Depression gave the Fed more authority to manage the economy. The Banking Act of 1933 created the FOMC and gave the Board of Governors the majority vote on the FOMC. This act also gave the Board of Governors control of reserve requirements. So while the original intent was to have a non—centralized central bank, eventually power has become concentrated in the Board of Governors. The member banks have no practical authority. Unlike a private bank they cannon fire the management. You text suggests that the Fed now is like a central bank with 12 branches. While the chairman of the Board of Governors does not have any particular legislated authority, in particular he usually sets the agenda for the Fed. Usually the chairman is someone with a good deal of personal moral authority. Central Bank Independence Factors making Fed independent 1. Members of Board have long terms 2. Fed is financially independent: This is most important Factors making Fed dependent 1. Congress can amend Fed legislation and could eliminate the Fed. 2. President appoints Chairmen and Board members and can influence legislation Overall: Fed is quite independent Other Central Banks 1. Bank of England least independent: Govt. makes policy decisions Until 1977 the Chancellor of the Exchequer (equivalent to the U.S. Treasury) set interest rates. The Bank of England’s (the central bank) job was to implement the Exchequers policy. In 1977 the Bank of England was given responsibility of setting interest rates. The Exchequer could overrule the Bank, but this would have to be done very publicly—leaving the Exchequer vulnerable for any mistakes. 2. European Central Bank: most independent—price stability primary goal This will be Europe’s central bank. By the treaty of Maastricht it can set monetary policy independent of any European government. It makeup can only be changed if all 11 signers of the treaty agree—almost impossible. 3. Bank of Canada and Japan: fair degree of independence, but not all on paper The Canadian government has ultimate responsibility for monetary policy. In practice this is left to the Bank of Canada. The government can overrule the Bank only if the minister of finance issues a written directive to the Bank. This leaves a clear paper trail that will attach clear blame to the minister if anything goes wrong. Just the sort of thing a bureaucrat really hates. 4. Trend to greater independence: New Zealand, European nations Explaining central bank behavior One view of bureaucratic behavior is that they operate in the public interest. Another view is that the operate to further the bureaus interest. There is probably some of both going on. It may be the bureaucrats feel that the two are the same. Evidence that the Fed may be operating as a self interested bureaucracy o It will vigorously preserve its autonomy. It has organized lobbying groups of bankers and businesses to support its interests in Congress. o It will avoid conflict with other powerful groups when possible. Some people believe that the Fed has been reluctant to raise interest rates particularly near election time. o It will try to gain additional power. The Fed has continuously sought more control over financial institutions. For example, the Fed now control the reserve requirements of all banks. Should the Fed be independent? Churchill once said that democracy was the worst possible form of government except for all the alternatives. What are the tradeoffs—if not the Fed, who? The case against independence. o The President and Congress are held accountable for the economy. Because they are going to get the blame they may as well have the power. o The Fed may pursue monetary policy that conflicts with the fiscal policy of the Administration. o The Fed has often failed to perform successfully as was the case in the Great Depression. o Because it is a bureaucracy it may operate in its interest rather than that of the public. The case for independence o Who will get control of the money supply? The Executive branch or the legislative? o Politicians will pursue inflationary policies. They will tend to stimulate the economy at election time. This tendency is called a political business cycle. There are short term gains paid for with inflation after the election. o The government would be tempted to fund government deficits by printing money. o It may be the case that some politicians prefer to have the Fed as an agency they can blame when things go wrong.