The Current Economic Situation or How Did We Get Here?

advertisement

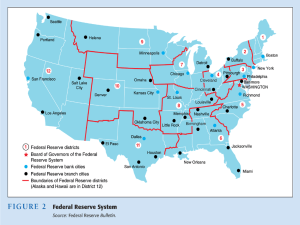

The Current Economic Situation or How Did We Get Here? Fed Challenge 2008 Orientation Program Federal Reserve Bank of New York Raymond Stone Stone & McCarthy Research Associates December 14, 2007 From October 31 FOMC Meeting Too Easy for Too Long? (2003/2005) Taylor’s Estimated Trajectory of Housing Starts Low Funds Rate Induced Low ARM Rates Not Surprisingly Applications for ARMs Surged Now After the Funds Rate Has Been “Normalized” These ARMs are Resetting At Higher Rates Meanwhile Builders Constructed More New Homes Than Were Being Sold The Inventory of New Unsold Homes Reached a New Record The Bloated Inventories of Both New and Existing Homes on the Market Put Downward Pressure on Home Prices FOMC Has Maintained Focus on Mandated Dual Objectives • Maximum Sustainable Growth & Employment • Price Stability Arguably Growth Has Been Close to Potential, or Maximum Sustainable And Most Gauges of Resource Utilization Remained Tight The Core PCE Deflator Tucked Into an Acceptable Zone—But Can It Stay in This Zone? Inflation Issues for the FOMC • The Persistence of High Energy Prices Risks Higher Core Inflation • Weak Dollar Has Been Associated With Sharp Gains in Import Prices • Food Prices Have Been Rising Quickly • The Key to Sustainable Price Stability is Well-Anchored “Inflationary Expectations” Is the Fed Responsible for Fueling Speculative Excesses in Housing? • John Taylor (Taylor Rule) feels that the Fed kept rates too low for too long. Had the Fed followed the Taylor Rule during the 2003/2005 the housing boom and burst would have been more contained. • Both Greenspan and Bernanke regard the improbable but corrosive effects of the deflationary risks in 2003 as justification for taking the funds rate down to 1%, and for keeping rates low for a “considerable period”. • Greenspan and Bernanke note that long term rates failed to rise as the Fed began raising the funds target, and that this fostered stronger housing activity than otherwise. So Who Is To Blame? • Taylor blames the Fed for keeping rates too low for too long • Regulators should have been more proactive • Securitization of mortgages, shifting risk from direct lenders to a broad spectrum of investors • Rating Agencies • Risky mortgage instruments, and little discipline on the part of mortgage brokers • Naïve Public—”If a bank is willing to make me a loan, they must think I will be able to repay” No Matter Who Is To Blame—The Resulting Credit Market Strains Represent Downside Risks to the Economy • Subprime related losses have diminished bank capital, and have rendered banks more restrictive in lending policies • Money market conditions have become strained increasing costs to borrowers • Credit market difficulties have turned borrowers away from the CP market, to banks, resulting in some unusual and potentially problematic issues for the inter-bank funding markets Money Market Funds Stopped Buying ABCP Issuers of ABCP (Including the so-called SIVs) Turned to Banks for Funding Banks Faced with Increased Credit Demand, Are Aggressively Attempting to Fund this Demand Inter-Bank Term Funding Costs Have Increased What Has the Fed Done In Response to These Developments? • Provided Liquidity as needed via Open Market Operations • Extended term of discount window advances up to 30days, and reduced the spread between the Discount Rate and Funds Rate Target to 50bps from 100 bps previously • Lowered the Funds Rate Target to contain the “real side” dislocations stemming from credit market turmoil. • Announced intentions to auction discount window credit to banks