Ch 29 The Monetary System

advertisement

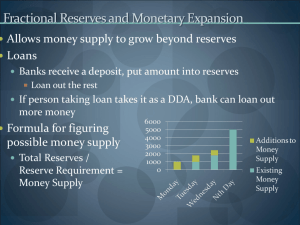

V MONEY AND PRICES IN THE LONG RUN 1 The Monetary System 11 THE MEANING OF MONEY • Money is the set of assets that people commonly use to buy things. THE MONETARY SYSTEM 3 The Functions of Money • Money has three functions in the economy: • Medium of exchange • Unit of account • Store of value THE MONETARY SYSTEM 4 Money Consists Of … • Currency: the paper bills and coins in the hands of the public • Demand deposits: balances in bank accounts that depositors can use as payment by writing a check. • And a few other less important things, such as travelers’ checks THE MONETARY SYSTEM 8 M1 and M2 in September 2012 $ Billions Currency 1068.5 + Traveler’s Checks 3.9 + Demand Deposits 878.7 + Other Checkable Deposits 431.5 = M1 2,382.6 + Savings Deposits 6,454.6 + Small-denomination Time Deposits 667.7 + Retail Money Market Mutual Funds 621.9 = M2 10,126.8 Source: http://www.federalreserve.gov/releases/h6/current/h6.htm THE MONETARY SYSTEM 10 THE FEDERAL RESERVE SYSTEM • The Federal Reserve (The Fed) serves as the central bank of the US. • It is designed to oversee the banking system. • It regulates the quantity of money in the economy. • This activity is called monetary policy. 11 The Fed: Helicopter and Vacuum Cleaner • You can think of the Fed as printing money and dropping it from helicopters, thereby adding to the quantity of money in the economy • Conversely, you can think of the Fed as a giant vacuum cleaner that sucks money out of people’s wallets, thereby reducing the quantity of money 15 The Fed: Helicopter and Vacuum Cleaner • The helicopter-and-vacuum view of the Fed is a bit too simple, however • The Fed really can increase or decrease the quantity of money • But it uses a process called open market operations to do so 16 The Fed: Helicopter and Vacuum Cleaner • When the Fed wishes to increase the quantity of money in the economy, it prints money and buys financial assets—such as government bonds—on the open market • That’s the Fed acting as a moneydropping helicopter 17 The Fed: Helicopter and Vacuum Cleaner • When the Fed wishes to decrease the quantity of money in the economy, it sells financial assets—such as the government bonds it may have bought in the past—on the open market, and burns the money it gets from the sale • That’s the Fed acting as a moneysucking vacuum 18 BANKS AND THE MONEY SUPPLY • Banks can also increase or decrease the economy’s quantity of money • That is, banks can also act like a money-dropping helicopter or a money-sucking vacuum 19 BANKS AND THE MONEY SUPPLY • Remember that the quantity of money consists of: • Currency: the paper bills and coins in the hands of the public • Demand deposits: balances in bank accounts that depositors can use as payment by writing a check. • Banks can control the quantity of money by controlling the quantity of money in demand deposits THE MONETARY SYSTEM 20 BANKS AND THE MONEY SUPPLY • When banks make new loans faster than borrowers are repaying old loans, the quantity of money in demand deposits increases and, therefore, the economy’s quantity of money increases • That is, banks can act like a money-dropping helicopter THE MONETARY SYSTEM 21 BANKS AND THE MONEY SUPPLY • When banks make new loans slower than borrowers are repaying old loans, the quantity of money in demand deposits decreases and, therefore, the economy’s quantity of money decreases • That is, banks can act like a money-sucking vacuum THE MONETARY SYSTEM 22 BANKS AND THE MONEY SUPPLY • Banks take deposits from people (depositors) and pay interest to the depositors • Some of the deposits may be given as loans to borrowers, who must repay the loans with interest • Reserves are deposits that banks have received but have not loaned out. • Deposits = Reserves + Loans THE MONETARY SYSTEM 23 100-Percent-Reserve Banking • Deposits = Reserves + Loans • In 100-percent-reserve banking, banks make no loans; they simply keep the deposits safe until the depositors turn up to withdraw their deposits • Therefore, Loans = 0 and Deposits = Reserves • In this system, banks have no effect on M1 • When someone makes (withdraws) a $100 deposit, currency decreases (increases) by $100 and demand deposits increase (decrease) by $100, leaving M1 unchanged THE MONETARY SYSTEM 24 Fractional-Reserve Banking • In a fractional-reserve banking system, banks hold a fraction of their deposits as reserves and lend out the rest. THE MONETARY SYSTEM 25 Money Creation with Fractional-Reserve Banking • When a bank makes a loan from its reserves, the money supply increases right away. • But further increases in the money supply follow. THE MONETARY SYSTEM 26 Money Creation with Fractional-Reserve Banking • When one bank loans money, that money generally ends up as a deposit in a second bank. • This creates more deposits and more reserves to be lent out by the second bank. • When the second bank makes a loan from its reserves, the money supply increases again. • And the process continues … THE MONETARY SYSTEM 27 The Money Multiplier • How much money is eventually created in this economy? THE MONETARY SYSTEM 28 The Money Multiplier • The money multiplier is the amount of money the banking system generates with each dollar of reserves. THE MONETARY SYSTEM 29 BANKS AND THE MONEY SUPPLY • Reserve Ratio • The reserve ratio is the fraction of total deposits that banks hold as reserves. • The fraction of its total deposits that a bank is required by the Fed to keep as reserves is called the required reserve ratio. • When banks hold reserves in excess of the required reserves, those reserves are called excess reserves. • Reserves = Required Reserves + Excess Reserves THE MONETARY SYSTEM 30 The Money Multiplier • The money multiplier is the reciprocal of the reserve ratio: M = 1/R • With a reserve ratio of R = 20% or 1/5, • The multiplier is 5. • Example: In this case, if the Fed prints a fresh dollar bill and buys a government bond with it, the money supply may increase by as much as $5.00! THE MONETARY SYSTEM 31 1. The Fed prints $100 of new cash and uses it to buy a government bond from Astoria Bank. M1 +0 2. Astoria Bank lends $100 to Betty. Betty buys a shirt from Chris with the money. Chris deposits $100 in his account in Delaware Bank. M1 +100 3. 4. 5. As the required reserve ratio is 10%, Delaware Bank adds $10 to its reserves and lends $90 to Eddie. Eddie buys a pair of shoes with the money from Frank. Frank deposits $90 in his account in Georgia Bank. M1 +90 Georgia Bank adds $9 to its reserves and lends $81 to Harry. Harry buys a winter coat with the money from Inez. Inez deposits $81 in her account in Japan Bank. M1 +81 Japan Bank adds $8.10 to its reserves and lends $72.90 to Kelly. M1 +72.90 … 2. Therefore, loans, deposits, and M1, the money supply, must all increase by $1000. Loans Deposits M1 Required Reserves Excess Reserves +100 Event 2 +100 +100 +10 +90 Event 2 Event 2 Event 3 Event 3 +90 +90 +90 +9 +81 Event 3 Event 3 Event 3 Event 4 Event 4 +81 +81 +81 +8.10 +72.90 Event 4 Event 4 Event 4 Event 5 Event 5 ⋮ ⋮ ⋮ ⋮ ⋮ ⋮ ⋮ ⋮ ⋮ ⋮ +1000 +1000 +1000 +100 +900 3. This should not be a surprise because the money multiplier is m = 1/R = 1 / 0.10 = 10. 1. Ultimately all of the newly printed cash must end up as required reserves. 32 Financial Crisis of 2008–2009 • Bank capital • Resources a bank’s owners have put into the institution • It is used to generate profit 33 Financial Crisis of 2008–2009 • Leverage • Use of borrowed money to supplement existing funds for purposes of investment • Leverage ratio • Ratio of assets to bank capital • Capital requirement • Government regulation specifying a minimum amount of bank capital 34 Financial Crisis of 2008–2009 • If bank’s assets – rise in value by 5% • Because some of the securities the bank was holding rose in price • $1,000 of assets would now be worth $1,050 • Bank capital rises from $50 to $100 • So, for a leverage rate of 20 • A 5% increase in the value of assets • Increases the owners’ equity by 100% 35 Financial Crisis of 2008–2009 • If bank’s assets – fall in value by 5% • Because some people who borrowed from the bank default on their loans • $1,000 of assets would be worth $950 • Value of the owners’ equity falls to zero • So, for a leverage ratio of 20 • A 5% fall in the value of the bank assets • Leads to a 100% fall in bank capital 36 Financial Crisis of 2008–2009 • Banks in 2008 and 2009 • Shortage of capital • After they had incurred losses on some of their assets • Mortgage loans • Securities backed by mortgage loans • Reduce lending (credit crunch) • Contributed to a severe downturn in economic activity 37 Financial Crisis of 2008–2009 • U.S. Treasury and the Fed • Put many billions of dollars of public funds into the banking system • To increase the amount of bank capital • It temporarily made the U.S. taxpayer a part owner of many banks • Goal: to recapitalize the banking system • Bank lending could return to a more normal level • Occurred by late 2009 38 Fed’s Tools of Monetary Control • Influences the quantity of reserves • Open-market operations • Fed lending to banks • Influences the reserve ratio • Reserve requirements • Paying interest on reserves 39 Fed’s Tools of Monetary Control • Open-market operations • Purchase and sale of U.S. government bonds by the Fed • To increase the money supply • The Fed buys U.S. government bonds • To reduce the money supply • The Fed sells U.S. government bonds • Used more often 40 Fed’s Tools of Monetary Control • Fed lending to banks • To increase the money supply • Discount window • At the discount rate • Term Auction Facility • To the highest bidder 41 Fed’s Tools of Monetary Control • The discount rate • Interest rate on the loans that the Fed makes to banks • Higher discount rate • Reduce the money supply • Smaller discount rate • Increase the money supply 42 Fed’s Tools of Monetary Control • Term Auction Facility • The Fed sets a quantity of funds it wants to lend to banks • Eligible banks bid to borrow those funds • Loans go to the highest eligible bidders • Acceptable collateral • Pay the highest interest rate 43 Fed’s Tools of Monetary Control • Reserve requirements • Regulations on minimum amount of reserves • That banks must hold against deposits • An increase in reserve requirement • Decrease the money supply • A decrease in reserve requirement • Increase the money supply • Used rarely – disrupt business of banking 44 Fed’s Tools of Monetary Control • Paying interest on reserves • Since October 2008 • The higher the interest rate on reserves • The more reserves banks will choose to hold • An increase in the interest rate on reserves • Increase the reserve ratio • Lower the money multiplier • Lower the money supply 45 Problems in Controlling the Money Supply • The Fed’s control of the money supply is not precise. • The Fed must wrestle with two problems that arise due to fractional-reserve banking. • The Fed does not control the amount of money that households choose to hold as deposits in banks. • The Fed does not control the amount of money that bankers choose to lend. THE MONETARY SYSTEM 46 The Federal Funds Rate • The Federal Funds Rate is the interest rate that banks charge for overnight loans to one another • When the federal funds rate rises or falls, other interest rates often move in the same direction • When interest rates change they affect the behavior of consumers and businesses. • This, in turn, has short-run effects on the economy THE MONETARY SYSTEM 47 The Federal Funds Rate • In recent years, the Fed has used its policy tools to control the Federal Funds Rate • From time to time the Fed announces a target level for the federal funds rate • The Fed then uses its monetary policy tools to push the federal funds rate to the target rate • The theory of how the Fed can control interest rates and why it does so will be discussed further when we discuss the short run THE MONETARY SYSTEM 48 The Federal Funds Rate The Federal Funds Rate Summary • The term money refers to assets that people regularly use to buy goods and services. • Money serves three functions in an economy: as a medium of exchange, a unit of account, and a store of value. • Commodity money is money that has intrinsic value. • Fiat money is money without intrinsic value. THE MONETARY SYSTEM 51 Summary • The Federal Reserve, the central bank of the United States, regulates the U.S. monetary system. • It controls the money supply through openmarket operations or by changing reserve requirements or the discount rate. THE MONETARY SYSTEM 52 Summary • When banks loan out their deposits, they increase the quantity of money in the economy. • Because the Fed cannot control the amount bankers choose to lend or the amount households choose to deposit in banks, the Fed’s control of the money supply is imperfect. THE MONETARY SYSTEM 53