2-unit_2_ip_chat

advertisement

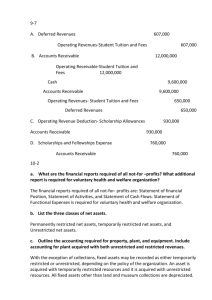

UNIT 2 IP TOPICS COVERED IN TODAY’S CHAT Hints and tips for completing the Unit 2 IP assignment Reviewing Net Asset Classifications Accounting for Contributions Accounting for donated services Accounting for Pledges Conclusion UNIT 2 IP ASSIGNMENT You are believer that new employees should practice their accounting skills before "throwing them into the fire." Therefore, you have listed a series of transactions that require journal entries and updating of T-Accounts. You know that preparing nonprofit journal entries are easy, so you ask the new employee to prepare, side by side, the correct journal entry for the identical transaction: once for a nonprofit entity once for a for-profit company include notes for each transaction UNIT 2 IP ASSIGNMENT Transaction 1: Assume a nonprofit has a restricted fund for capital asset purchases. Compare the journal entries for the cash purchase of a $10,000 computer by the nonprofit, to how the journal entry would look for this for-profit. Transaction 2: Assume that a nonprofit has a need for $80,000 for a particular new marketing expenditure, and a for-profit entity needs to raise an additional $80,000 to pay for some unanticipated marketing expenses. How would the journal entities look at the acquisition of the funds and the subsequent spending of the funds? Transaction 3: The for-profit entity sells $120,000 with net 30-day terms, while the nonprofit entity has a fund raising drive for which they receive pledges of $120,000. How do the two journal entries look? GRADING RUBRIC Grading Criteria 30% 0-30 pts 30% 0-30 pts 30% 0-30 pts 10% 0-10 pts For Transaction 1, prepare, side by side, the correct journal entry for a nonprofit entity and a for-profit company. For Transaction 2, prepare, side by side, the correct journal entry for a nonprofit entity and a for-profit company 1. For Transaction 3, prepare, side by side, the correct journal entry for a nonprofit entity and a for-profit company. All Notes in the journal entries are correct. REMEMBER THE THREE NET ASSET CLASSIFICATIONS ? Unrestricted funds Used for general operations of the organization or may be designated by the Board for a special purpose Temporarily restricted funds restricted through donor imposed criteria that will be satisfied either by a specific action or through the passage of time Permanently restricted funds The donor stipulates that the principal (corpus) being donated must remain intact and only the proceeds that result from the investment (i.e., interest income and/or dividends) can be used for a specific purpose CLASSES OF NET ASSETS Net Asset Class Permanently Restricted Temporarily Restricted Unrestricted Types of Restrictions Donor-imposed Permanent in nature Not removable by organization Donor-imposed or implied Met by 1. Passage of time 2. Use of resources for restricted purpose No donor-imposed restriction Examples Permanent endowments Required preservation of assets (art, land) Assets restricted to use (research, capital assets) Assets restricted for use for time certain Pledges receivable in future All other net assets Board-designated resources not donorrestricted ACCOUNTING FOR CONTRIBUTIONS A donor contributes $50,000 to a NPO to sponsor an event scheduled for next year. Should the event not occur, the donation will be forfeited and given back to the donor. Since there is an condition (the holding of the event) the NPO would record the cash received as an asset with a corresponding temporarily restricted support. When the condition is met, FAS No. 117 requires a 2 step process ACTUAL SPENDING UNDER FAS NO. 117 1. 2. Record the release the funds from the restriction Record the actual use of the released funds Step 1: Record the release of the fund from restriction 06/01/XX Resources released from temporarily restricted account $ 50,000 Cash To record the use of the cash per the restricted fund requirements $ 50,000 Step 2: Record the actual use of the released funds 06/01/XX Expenses related to annual conference event Resources released from restriction To show annual conference event expense from a restricted fund $ 50,000 $ 50,000 T Pharmacy donated $10,000 to host a dinner at the Physicials Annual Meeting. Step 1: Record the release of the fund from restriction What account $ 10,000.00 What account $ 10,000.00 To record the release of the cash restricted for dinner at the Annual Mtg Step 2: Record the actual use of the released funds What account $ 10,000.00 What account To show the dinner expense form a restricted fund $ 10,000.00 USING A RESTRICTED FUND FOR A CAPITAL EXPENDITURE The Church of the Holy General Ledger (a religious NFP) had a restricted fund (generated from a fund raising event) specifically created to purchase a RV (a capital asset) which will drive to bring the mass to shut aged accountants. Create the JE to purchase the RV $350,000. Nonprofit 1/1/2010 Resources released from Restricted Capital Fund $350,000 Cash $350,000 Note: Release restricted fund for purchase of RV 1/1/2010 RV – capital asset Resources released from Restricted Capital fund Note: Record the expenditure to purchase the RV $350,000 $350,000 SERVICE CONTRIBUTIONS When people volunteer their time (services), this is usually not recorded. Volunteer services (FASB 116) can be recorded only if they are professional in nature & the NPO would have to pay for the service otherwise. Assume an accountant donates his/her services to audit a NPO, valued at $10,000. This would be recorded (unrestricted) as: Expense-Professional Services10,000 Revenue-Contributed Services 10,000 Jeff, an electrician, donates his time to rewire the church which has old knob and tube wiring. Jeff usually charges $25,000 to rewire a building of the church’s size. He also helped serve dinner for 2 hours in the Church’s homeless shelter. What is the journal entry? PLEDGES Pledges are unconditional promises to contribute cash or other assets or services in the future. Based on FASB 116, unrestricted pledges are reported as revenue in the period received, based on present value (estimated future cash flows discounted for relative risk). Pledges expected to be collected within one year need not be discounted. PLEDGES JOURNAL ENTRIES Pledges of $100,000 are received. We will record in the pledge in the year it is made. It also happens that $60,000 will be collected this year: Unrestricted Fund Pledges Receivable 60,000 Revenue from Contributions Cash 60,000 Pledges Receivable 60,000 60,000 PLEDGES JOURNAL ENTRIES (2) $40,000 of the pledges will not be collected this year, of which $10,000 is expected to be uncollectible: Temporarily Restricted Fund Pledges Receivable 40,000 Allowance for Uncollectible Pledges 10,000 Revenues from Contributions 30,000 How would a NFP calculate an allowance for uncollectible pledges? Do you think a NFP should be able to record revenue when a pledge is made even though the cash may be received much later or throughout the year, why? DEPRECIATION Depreciation on capital assets must be recognized as expense for NPs (FASB 93). The expense is unrestricted, even if the capital assets are restricted. Assume a foundation records annual depreciation of $5,000. The entry is (unrestricted): Depreciation Expense 5,000 Accumulated Depreciation 5,000 Would a NFP ever have intangible assets? What form would those intangible assets take? CONCLUSION Net Asset Classifications – 3 different funds Accounting for Contributions – No restrictions vs. restrictions (2 step process) Accounting for donated services - Volunteer services (FASB 116) can be recorded only if they are professional in nature & the NPO would have to pay for the service otherwise Accounting for Pledges - unrestricted pledges are reported as revenue in the period received Conclusion QUESTIONS Call me at 630-337-1808