Advanced Accounting

by Debra Jeter and Paul Chaney

Chapter 20: Accounting for

Nongovernment Nonbusiness

Organizations: Colleges and

Universities, Hospitals, and Other

Health Care Organizations

Slides Authored by Hannah Wong, Ph.D.

Rutgers University

20 - 0

Sources of Accounting Standard

First level of priority

FASB

APB

Statement and Interpretations

Opinions

AICPA

Accounting Research Bulletins

Second level of priority

FASB

Technical Bulletins

AICPA

Guides

Industry Audit and Accounting

20 - 1

Sources of Accounting Standard

Third level of priority

Consensus

positions of the FASB emerging

issues task force

AICPA

AcSec Practice Bulletins

Fourth level of priority

AICPA

Accounting Interpretations

Implementation

Industry

guides

practices

20 - 2

Basic Financial Statements

Statement of financial position

Asset

categories:

Unrestricted net assets

Temporarily restricted net assets

(donor imposed restriction)

Permanently restricted net assets

(endowments)

Statement of activities

Statement of cash flows

20 - 3

Basic Funds

Current fund

unrestricted

restricted

fund (general fund - hospitals)

fund (special purpose fund - hospitals)

Plant fund

Endowment fund

Loan fund

Agency or custodial fund

Annuity and life income fund

20 - 4

Restricted VS Unrestricted Funds

Current unrestricted funds

financial

resources that may be expended

at the discretion of the governing board

Current restricted funds

resources

restricted

because of legal,

contractual, or

external restrictions

on their use

20 - 5

Board Designated Funds

Part of current unrestricted fund

resources designated by governing board for

specific purposes, projects, or investment

to limit discretion of management

governing board can modify designations at

will

= assets whose use is limited in hospitals

20 - 6

Mandatory VS Nonmandatory

Transfers

Unique to colleges and universities

Mandatory transfers

transfers

from the current funds group to other

fund groups arising from

binding legal agreements

grant agreements

Nonmandatory transfers

transfers

from the current funds group to other

fund groups at the discretion of the governing

board

20 - 7

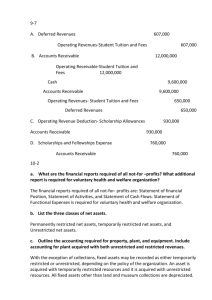

Contributions

Pledges

Pledges receivable

300,000

Revenue - contributions

300,000

To record gross amount of campaign pledges

Estimated Uncollectible Pledges

Expenses - Provision for uncollectible pledges

Allowance for uncollectible pledges

45,000

45,000

To record provision for estimated uncollectible pledges

20 - 8

Contributions

Donated Services

Management and general expense

Donated services revenue

21,000

21,000

Donated services are recognized only if the services received:

(1) require specialized skills

(2) are provided by individuals possessing those skills and

(3) would need to be purchased if not provided by donation

20 - 9

Plant Funds - Colleges

4 Self-balancing subgroups:

unexpended plant fund

resources

used to purchase property, plant

and equipment

similar

to capital project fund in

governmental accounting

funds for renewals and replacements

similar

to capital project fund in

governmental accounting

20 - 10

Plant Funds - Colleges

funds for retirement of indebtedness

resources

to be used to retire or pay interest

on debt incurred in acquisition of property

similar

to debt service fund in governmental

accounting

Investment in plants

property,

plant and equipment, related debt,

and net investment in plan

similar

to a combination of the account

groups in governmental accounting

20 - 11

Plant Funds - Colleges

Current Unrestricted Fund

Nonmandatory Transfer to plant fund

50,000

Cash

50,000

To record transfer to plant fund

Unexpended Plant Fund

Cash

750,000

Notes payable

500,000

Revenue - contributions - restricted

200,000

Fund balance - unrestricted

50,000

To record receipt of resources

20 - 12

Plant Funds - Colleges

Unexpended Plant Fund

Land

750,000

Cash

750,000

To record acquisition of land

Fund balance - restricted

Fund balance - unrestricted

200,000

50,000

Notes payable

500,000

Land

750,000

To transfer assets and liabilities to investment in plant fund

20 - 13

Plant Funds - Colleges

Investment in Plant Fund

Land

750,000

Notes payable

500,000

Net investment in plant

250,000

To record acquisition of land and related indebtedness

from the unexpended plant fund

Funds for Retirement of Indebtedness

Fund balance - restricted

200,000

Cash

Interest expense

Cash

200,000

20,000

20,000

To record payment of principal and interest on indebtedness

20 - 14

Plant Funds - Colleges

Investment in Plant Fund

Notes payable

Net investment in plant

200,000

200,000

To record reduction in indebtedness

Depreciation expense

Accumulated depreciation

235,000

235,000

To record depreciation on property, plant and equipment

included in the assets of the investment in plant fund

20 - 15

Plant Funds - Hospitals

PPE transactions of hospitals are recorded

in the general fund

contributed resources restricted for

acquisition of PPE are recorded in a plant

replacement and expansion (restricted)

fund

upon expenditure, the assets acquired and

the plant fund balance are transferred to

the general fund

20 - 16

Endowment Funds

Endowment Fund

Cash

400,000

Due to unrestricted fund

250,000

Due to restricted fund

150,000

To record receipt of dividend and interest

Current Unrestricted Fund

Due from endowment fund

250,000

Unrestricted income

250,000

To record unrestricted endowment fund income

20 - 17

Endowment Funds

Current Restricted Fund

Due from endowment fund

Restricted income

150,000

150,000

To record restricted endowment fund income

Research expense

100,000

Cash

100,000

To record payment of research grant

20 - 18

Accounting for Investments

Cash

800,000

Revenue - contributions - unrestricted

800,000

To record unrestricted contribution

Equity investments

800,000

Cash

800,000

To record purchase of marketable securities

20 - 19

Accounting for Investments

Cash

30,000

Investment income - unrestricted

30,000

To record receipt of dividend

Equity investments

20,000

Unrealized gain on investment - unrestricted

20,000

(1) investment in equity securities with readily determinable

fair values and all debt securities should be recorded at market value

(2) unrealized gains and losses are recognized

20 - 20

Loan Funds

To account for

loans

to students and staff of colleges,

loans

to employees of hospitals

loans

to beneficiaries of the interests of

certain ONNOs

revenues and expenses must be

recognized on an accrual basis

generally revolving

20 - 21

Annuity and Life Income Funds

Annuity funds

the

organization receives contribution of

assets and makes periodic payments of a

stated amount to a beneficiary

Life income funds

amount of payment

varies depending on the

the

earnings of the fund

20 - 22

Annuity Funds

Investments

Annuity payable

325,000

268,400

Revenue - contributions- permanent restriction

56,600

To record establishment of fund

Cash

26,000

Annuity payable

26,000

To record investment income

Annuity payable

Cash

26,000

26,000

To record annual annuity payment

20 - 23

Issues Relating to Hospitals

Charity care

Contractual allowances

Capitation revenues

malpractice

20 - 24

Advanced Accounting

by

Debra Jeter and Paul Chaney

Copyright © 2001 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in Section 117 of

the 1976 United States Copyright Act without the express written permission of

the copyright owner is unlawful. Request for further information should be

addressed to the Permissions Department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use only and not for

distribution or resale. The Publisher assumes no responsibility for errors,

omissions, or damages, caused by the use of these programs or from the use

of the information contained herein.

20 - 25