How to start investing

advertisement

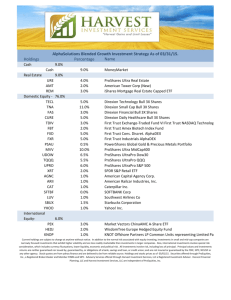

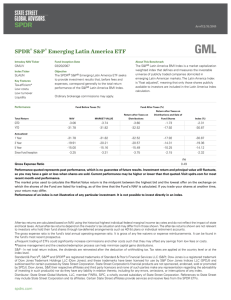

How to Start Investing Presenter Ana Forssman Date 1 What is a share? • If you own a share, you own part of a company – Your slice of the company pie! • Someone who owns shares is called a shareholder • Shareholders may receive part of the profit (dividends) if the company performs well – Check the company dividend policy • Shareholders can vote on company matters • You can also call a share, ‘equity’ or ‘stock’. 2 2 What is the share price? • The price at which a particular share can be bought or sold Factors affecting the share price • When there are more buyers than sellers, the share price rises • With more sellers than buyers, the share price falls • Some share prices rise while others fall. It’s all about supply and demand. • If a company is very profitable, a share will rise as more people think it is a good investment • Factors such as economic and political events also influence share prices 3 3 How do I know which company to invest in? • Do research on the stock market: read financial literature, attend investment courses, get expert advice (eg from a stockbroker) • Assess the company’s financial wellbeing: read their financial statements or newspaper articles and analyst reports – This will enable you to make educated decisions 4 4 How do I know which company to invest in? • Decide how much risk you want to take on, how much return (profit) you expect and which products meet your needs – Get advice from broker • Be committed to this objective. Be patient • Invest for the long run, eg 5 years • Decide how long you are prepared to wait for a return • Invest with money you can afford to lose • Although you can make a profit, remember the risk of losing money in the short run 5 5 Are there different types of shares and investment products? • There are various types of shares and investment products to suit different individual needs, eg – conservative or “safe” shares – riskier shares • Basic share investment products • Ordinary shares • Preference shares • Exchange Traded Funds 6 6 What is RISK? • Risk is the possibility of losing part or all of your initial investment • Different products have different levels of risk • Lower risk investments include: • • Cash in a money market account that earns interest; • Government bonds (too expensive for most; generally R1m each!); • ETFs (Exchange Traded Funds) Higher risk securities include: • Shares, warrants, derivatives and corporate bonds 7 7 Is there a risk involved when investing in shares? • Investing on the stock market is riskier than some other investments – Share prices rise and fall as economic forces change • Lets talk ETF’s eg.: New Gold / Top 40 / Div + • Share trading normally does not make you rich overnight – Treat it as a long term investment 8 8 Can I minimize the risk of my investment? • You can minimize your investment risk by diversifying your investment – This means to invest in a variety of different investments – When one investment doesn’t perform well, another’ s could • Choose your investments from several sectors, companies and investment products • If you can’t afford that, choose an ETF 9 9 Is it difficult to manage my investment portfolio? • Certain investment products require little or no management. However, always be aware of how your investments are performing • Stockbrokers offer services to help you manage your investments: • Discretionary – investment decisions made by the stockbroker without checking with you, but in line with agreed aim • Non-discretionary – investment decisions made by you, after stockbroker has given advice 10 10 Is it difficult to manage my investment portfolio? • Managing a portfolio can be tricky for many people • Inexperienced investors can use a single investment product that offers you exposure a ‘basket’ of shares • This product is known as an Exchange Traded Fund (ETF) • ETFs offer lower costs and can spread risk across a variety of shares • Note: ETFs do not offer you voting rights • Note: you don’t always get cash dividends 11 11 Do I need a lot of money to start investing? • You don’t need a lot of money to start investing • Some products, like ETFs, offer investment plans – Monthly debit order (minimum of R300) – Once-off lump sum (minimum of R1,000) • Stockbrokers don’t always require a minimum investment amount – Through online share trading, and ETF platforms you can invest any amount via the internet – Approach your bank for details • Remember: stockbrokers charge fees • The JSE website has a list of stockbrokers, list of all ETF’s & ETF Issuers dealing with individual investors 12 12 How do I gain access to the stock market? • To buy or sell shares on the JSE, you need to open a brokerage account with a stockbroker • To find out how to open a brokerage account, see our website • You don’t need a broker to buy and sell ETFs. Contact the ETF provider directly or ETF platforms (ETFSA / iTransact) • Owning a brokerage account allows you to invest in all investment products, not only ETFs 13 13 Some things to consider • Invest an amount that makes sense in comparison to the amount of brokerage fees that you’ll be paying • Plan your investment objective, exercise self-discipline and monitor your investment performance • Don’t borrow money to invest • Be patient • Don’t get emotionally attached to your investments. Some days they will go up and other days, down • Ensure that you diversify your portfolio 14 14 JSE Liberty Life Investment Challenge • Introduces learners to real life economics and commerce • Enables learners to learn about investment through simulated trading • Open to all universities • Runs from March to September every year • Students participate in teams • Team creates virtual portfolio of R1 million • Great prizes: First: R25,000 and trip to overseas stock exchange; Second: R20,000; Third: R15,000 • 15 Game is played online Here’s to successful investing! 16 16