Document

advertisement

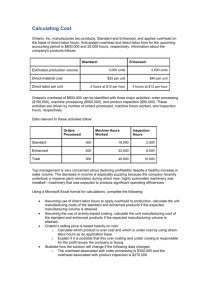

12-1 Introduction to Product Costing Prepared by Douglas Cloud Pepperdine University 12-2 Objectives Describe the flow of costs for manufacturers After reading this and service providers. chapter, you should Describe three types of manufacturing be able to: processing and their related costing requirements. Describe and illustrate job-order costing. Determine product costs using actual and normal costing systems. Continued 12-3 Objectives Analyze misapplied overhead into budget and volume variances. Develop ABC overhead rates and apply them to job-order costing companies. Discuss the role of overhead application in pursuing strategies. 12-4 Absorption Costing Sometimes called full costing Includes fixed overhead costs in per-unit inventory calculations Must use for financial reporting and income tax purposes Can give misleading results for short-term decisions 12-5 Product versus Period Costs Product costs are manufacturing costs that are expensed (cost of goods sold) when the product is sold. 12-6 Product versus Period Costs Period costs are the selling and administrative costs which are expensed in the period incurred. 12-7 Three Types of Inventory in a Manufacturing Firm Materials and purchased parts/components—consisting of the various materials and components that go into a finished product, but have not been put into production. 12-8 Three Types of Inventory in a Manufacturing Firm Work in process inventory, consisting of semifinished units, that is, product on which some, but not all, work has been done. 12-9 Three Types of Inventory in a Manufacturing Firm Finished goods inventory, consisting of units ready for sale. This inventory is equivalent to a merchandiser’s inventory. 12-10 Flow of Costs in a Manufacturer Action Purchase materials Pay direct laborers Cost Collected Initially Cost Flow To and Through Materials Inventory Direct Labor Incur Manufacturing overhead Overhead costs Work in Process Inventory Finished Goods Inventory Cost of Goods Sold 12-11 Cost per Unit of Product Cost per unit = of product Total production costs Total units processed Example: 10,000 units were produced at a total production cost of $150,000. 12-12 Job-Order Costing Job-order costing keeps track of the cost of materials and labor used on each job and then applies, absorbs, or assigns some amount of manufacturing overhead to each job. 12-13 Actual Costing Under actual costing, the overhead incurred during a period is applied to all jobs that were in process during the period. To assign all of the overhead costs to jobs, we calculate the overhead rate by dividing total actual overhead by the total amount of the relevant input factor. 12-14 Actual Costing Total manufacturing overhead Overhead rate = Overhead rate = Total manufacturing activity $105,000 10,500 Overhead rate = $10 per machine hour 12-15 Actual Costing Overhead Direct materials Direct labor Total cost of job J-1 $30,000 20,000 10,000 $60,000 Job Number J-2 $50,000 15,000 20,000 $85,000 J-3 $25,000 10,000 15,000 $50,000 12-16 Actual Costing ZyCo May Total overhead costs: $50,000 + (10,000 x $4) $55,000 + (5,000 x $4) Machine hours Overhead rate per machine hour December $90,000 10,000 $9 $75,000 5,000 $15 12-17 Actual Costing ZyCo ZyCo does two similar jobs in May and December, each requiring 100 machine hours, $500 in direct labor, and $300 in materials. Actual costs are-May December Materials $ 300 $ 300 Direct labor 500 500 Overhead, 100 hours at $9 and $15 900 1,500 Totals $1,700 $2,300 12-18 Normal Costing Budgeted manufacturing overhead for year Predetermined = overhead rate Budgeted production activity for year Overhead rate = $1,080,000 120,000 Overhead rate = $9 per machine hour 12-19 Normal Costing Budget allowance Variable Amount cost per x of unit of activity activity Fixed = costs + Predetermined overhead rate = $600,000 + $4 x 120,000 = $9 120,000 12-20 Normal Costing Overhead Direct materials Direct labor Total cost of job J-1 $27,000 20,000 10,000 $57,000 Job Number J-2 $45,000 15,000 20,000 $80,000 J-3 $22,500 10,000 15,000 $47,500 12-21 Normal Costing Under actual costing Actual hours Overhead assigned = worked on x to job job Total actual overhead Total actual hours Under normal costing Total budgeted Actual hours Overhead assigned overhead = worked on x to job Total budgeted job hours 12-22 Misapplied Overhead Overhead Applied to Jobs Using Actual Costing Normal Costing Job J-1 Job J-2 Job J-3 Total $ 30,000 50,000 25,000 $105,000 $27,000 45,000 22,500 $94,500 12-23 Overhead Variances ZyCo’s July Results The budget formula for annual overhead cost is $600,000 fixed costs ($50,000 per month) plus $4 per machine hour variable. July’s flexible budget based on 10,500 hours is as follows: Actual costs, fixed and variable $105,000 Budgeted costs [$50,000 + ($4 x 10,500 hours) 92,000 Budget variance, unfavorable $ 13,000 12-24 Overhead Variances ZyCo’s July Results ZyCo planned 120,000 machine hours for the year (monthly average, 10,000 hours). ZyCo worked 10,500 hours of machine time in July. Budgeted overhead (from Slide 12-23) Applied overhead ($9 x 10,500 hours) Volume variance, favorable $92,000 94,500 $ 2,500 12-25 Overhead Variances ZyCo’s July Results Variable Portion Fixed Portion Budgeted cost (10,500 x $4) Applied cost: 10,500 x $4 10,500 x $5 Volume variance (500 hours x $5) $42,000 $50,000 42,000 52,500 ---- $ 2,500 12-26 Overhead Variances Volume = variance Total budgeted Total applied manufacturing – manufacturing overhead overhead Total budgeted Total applied fixed Volume – manufacturing fixed = variance manufacturing overhead overhead Budgeted Actual Predetermined Volume = overhead rate x production – production variance for fixed costs activity activity 12-27 Overhead Variances Actual Budgeted Applied Overhead Overhead Overhead $50,000 + ($4 x 10,500) $9 x 10,500 $105,000 $92,000 $94,500 $2,500 F 13,000 U Budget variance Volume variance $10,500 U Total underapplied overhead 12-28 Income Statements, Actual and Normal Costing ZyCo Income Statements for July Sales Normal cost of sales Plus underapplied overhead Cost of sales Gross profit Selling and administrative Profit Normal Costing $110,000 Actual Costing $110,000 67,500 $ 42,500 30,000 $ 12,500 60,000 $ 50,000 30,000 $ 20,000 $57,000 10,500 12-29 Activity-Based Overhead Rates Cool pools might consist of costs of departments or costs related to such activities as material use, number of setups, cycle time, or engineering changes. 12-30 Income Statements, Actual and Normal Costing ZyCo Normal Costing Income Statements for July Sales Normal cost of sales Normal gross profit Variances: Unfavorable budget variance Favorable volume variance Gross profit Selling and administrative expenses Profit $110,000 57,000 $ 53,000 $13,000 2,500 10,500 $ 42,500 30,000 $ 12,500 12-31 Activity-Based Costing Example Tricomm Company Direct Labor Setups Total Budgeted overhead costs Budgeted direct labor hours Budgeted number of setups $800,000 100,000 $400,000 $1,200,000 Rates $8.00 per dlh 2,000 $200.00 per setup If only direct labor hours are used to allocate overhead, the rate is $12. 12-32 Calculated Price for Two Jobs Using One Rate Tricomm Company Direct labor hours Materials hours Direct labor cost ($10) OH applied ($12) Total cost Price Job A 800 $10,000 8,000 9,600 $27,600 x 1.5 $41,400 Job B 200 $10,000 2,000 2,400 $14,400 x 1.5 $21,600 12-33 Calculated Price for Two Jobs Using Activity-Based Rates Direct labor hours Materials hours Direct labor cost ($10) Overhead: Labor-related ($8) Setup-related ($200) Total cost Price Job A Job B 800 $10,000 8,000 200 $10,000 2,000 6,400 400 $24,800 x 1.5 $37,200 1,600 5,000 $18,600 x 1.5 $27,900 12-34 Chapter 12 The End 12-35