Facilities & Administrative Funding

advertisement

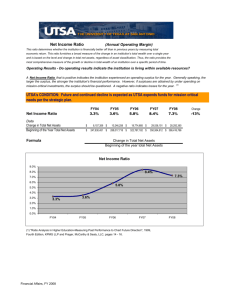

Facilities & Administrative (F&A) Cost Recovery March 5, 2009 What is F&A? OMB Circular A-21 term for what was formerly referred to as indirect cost recovery. Also known as “overhead” Cost recovery mechanism – not a “tax” What is F&A? Facilities & Administrative (F&A) costs are “Costs incurred for common or joint objectives and, therefore cannot be identified readily and specifically with a particular sponsored project, an instructional activity, or any other institutional activity.” Not Direct Costs – direct costs are specifically identified to individual research projects, instructional programs or other major functions. Examples: Salaries, fringe benefits, travel related to project, lab supplies, subcontracts, etc. F&A Cost Basis Universities that receive $10M+ from federal sources must use a modified total direct cost (MTDC) basis for calculating F&A. MTDC includes all project costs except equipment, renovations and subcontract costs in excess of the first $25,000. F&A is recovered as the sponsor’s funds are expended (and billed) for direct cost items allowed per the project budget. How are F&A Rates Calculated? Calculation is a ratio of: F&A costs allocated to Organized Research divided by Organized Research Modified Total Direct Costs F&A Rate Calculation Rate Calculation Process Each indirect cost pool is allocated to major functions (Instruction, Research, etc.) based on Cost Allocation methods Amount allocated to each major function is divided by a ‘base’ – direct operations of the function Resulting % is the indirect cost rate for that function F&A Cost Pools F&A Rate Component Examples General Administrative Costs Department Administration Capped at 26% Central administrative offices (Payroll, accounting, disbursements, purchasing) Academic Departments/Colleges Sponsored Administration VPR / Grants & Contracts Financial Services Operation & Maintenance Repair & maintenance, utilities, custodial, grounds, police Building and Equipment Depreciation Standardized asset classifications and lives Interest Costs on Building & Equipment Debt Service on certain buildings Libraries F&A Rates F&A Costs are recovered based on F&A Rates Rates are developed based on cost studies. UTSA contracted with Huron Consulting Group to develop our most recent cost study. Significant effort. Proposals are submitted to cognizant federal agency for review, audit, negotiation & approval. Once approved, rates are applied to each grant & contract to determine the amount of indirect costs to be charged/recovered. F&A Cost Rate Agreement Recent COGR survey: F&A Cost Rate Agreement F&A payments as a % of total NIH awards was stable at 28.5% for FY0305 accdg to GAO. 2000 Rand study estimated that universities were subsidizing between $700M and $1.5B of F&A F&A rates have held relatively constant at ~51% for the past 6 yrs! FY06 NSF survey showed that universities contribute more than $9B of their own funds to support R&D activities or nearly 20% of total R&D expenditures. Comparison of Cost Study to the negotiated rate 75.6% 80.00% 70.00% 13.90% General Administration 60.00% 13.70% Departmental Administration 44.50% Sponsored Projects Administration 50.00% 9.80% Building Depreciation 9.60% 40.00% 26.00% 12.20% Equipment Depreciation Interest 9.60% 30.00% Operations & Maintenance 5.60% 6.80% 23.50% 20.00% 5.00% Library 4.00% 3.00% 2.00% 10.00% 14.90% 9.00% 0.50% 0.50% 0.00% Actual Negotiated * Administrative Costs are capped at 26%; the Facility rate component is negotiated down to less than half the computed ‘actual’ costs. Why is F&A Recovery Important? Supports the cost of conducting research If sponsors don’t pay, someone else must Important new revenue source to UTSA $7,000,000 $5,703,051 $6,000,000 $5,201,496 $5,000,000 $4,000,000 $6,055,402 $3,933,801 $2,978,543 $3,000,000 $2,000,000 $1,000,000 $FY 04 FY 05 FY 06 FY 07 FY 08 UTSA F&A Revenue - 5 Year History F&A revenue grew by $3.1M over the last 5 years, an increase of 103% Net Effective F&A Rate The net effective F&A rate is computed as follows: TOTAL F&A Recovery Revenue divided by Restricted Sponsored Program Expenditures (Net of F&A) F&A Net Effective Rate Includes all NACUBO Programs FY 07 Basis Net Effective Rate FY 08 Basis Net Effective Rate All Restricted $5,703,051 / $31,442,181 18.1% $6,055,402 / $34,035,958 17.8% Restricted Federal $5,404,985 / $26,194,640 20.6% $5,753,973 / $27,725,858 20.8% Restricted NonFederal $298,066 / $5,247,542 5.7% $301,429 / $6,310,100 4.8% Restricted Research Only $4,973,465 / $20,283,600 24.5% $5,188,035/ $21,908,637 23.7% We are subsidizing ~50% of the negotiated cost of overhead for restricted research (69% of cost study developed costs) F&A Revenue Recovery by Source FY 04 Federal FY 05 FY 06 FY07 $2,872,068 $3,781,347 $5,032,063 $5,404,985 FY08 $5,753,973 State 31,627 68,132 52,261 65,799 65,992 Local 16,321 17,805 30,175 22,842 37,325 Private 58,527 66,517 86,997 209,425 198,112 $2,978,543 $3,933,801 $5,201,496 $5,703,051 $6,055,402 TOTALS 95% of F&A is from federally sponsored activities. Sources of F&A FY07 Revenue Sources of F&A Revenue FY 2007 Local, $22,842 , 0% Federal 94.8% State 1.2% Local 0.4% State, $65,799 , 1% Private 3.7% TOTAL 100% Federal, $5,404,985 , 95% Federal State Local Private Private, $209,425 , 4% Sources of F&A FY08 Revenue Sources of F&A Revenue FY 2008 Federal 95% State 1.1% Local 0.6% Private Local, $37,325 , 1% 3.3% Private, $198,112 , 3% State, $65,992 , 1% Federal, $5,753,973 , 95% TOTAL 100% Federal State Local Private FY08 F&A (Federal) Sources 0.4% 0.1% 0.2% 0.3% 0.5% 0.6% 0.7% 0.9% 1.2% 3.2% 3.2% 3.3% 4.4% 8.3% 55.1% 17.5% USAID $7,493 HUD $12,370 Interior Energy $17,926 $25,575 EPA $27,770 Labor $32,971 Transportation Agriculture $38,158 $53,283 NASA $71,524 Homeland Sec $181,283 SBA $182,672 Commerce Education $250,513 NSF $476,779 DOD $1,009,757 DHHS $3,173,306 $192,594 F&A Recovery by College, Institute, Center, Program How is F&A Allocated? In FY07, the VPs for Research, Business Affairs and Academic Affairs entered into a formal Memorandum of Understanding (MOU) to document the allocation of F&A. The MOU is: Flexible - has been amended twice with another pending. Transparent FY 2008 F&A Allocations Business Affairs Support, $522,200 , 8% Ctr for Arch Res Vac/Sick Leave, $46,892 , 1% Research Support, $855,580 , 13% Principal Investigators, $519,200 , 8% Ctrs, Institutes & Major Pgms, $511,150 , 7% Bldg Mtnc & Capital Imprvmts, $278,087 , 4% Academic Affairs Support, $875,000 , 13% Faculty Start-Up Costs, $1,000,000 , 14% Colleges , $191,173 , 3% Debt Svc - West Campus (Tobin) Lab, $667,600 , 10% Debt Service - Faculty Startup Loans, $1,348,693 , 19% Allocations to Principle Investigators, Colleges, Centers and Institutes The MOU allocates 10% of actual F&A recovery to PI’s, Colleges, Centers and Institutes based on prior year actual earnings. These funds are allocated on a one-time basis Not part of the recipient’s base budget due to year-to-year fluctuations in earnings. Funds are currently treated as discretionary incentive. Debt Service 29% of FY08 F&A recovery is pledged to debt service: Renovations to West Campus (Margaret Tobin) Lab Facility financed through bond series 2006B will be retired August 15, 2036: FY07 debt service paid $665,350 FY08 debt service paid $667,600 FY09 payment due $666,000 Debt Service Faculty Start-Up Costs Beginning FY04, faculty start-up costs were financed with F&A to service the debt. All debt under this program will be retired August 31, 2012. Remaining payments are: FY09 $1,383,495 FY10 1,251,908 FY11 924,722 FY12 34,795 Building Maintenance & Capital Improvements $300,000 set aside as a reserve for capital requirements and building maintenance for research related facilities. In FY08, funds were used for previously pledged faculty start-up costs to forego incurring additional debt. Unused balances roll forward to reserves. Center for Infrastructure Assurance & Security Lease Costs During FY09, up to $222,000 of the annual lease costs will be paid from F&A to allow CIAS to move off campus (near Main campus). Allocation is subject to annual escalation of 3%. Allows TRIO to move to ITC Allows Business Affairs staff to move from JPL to University Heights Funds are not allocated directly to CIAS. Lease term is 5 years. VP Administrative Overhead The following VP areas receive a base budget allocation to support salaries & related administrative overhead: Academic Affairs $875,000 Research $855,580 Business Affairs $522,200 (14% of FY08 Actual) (14% of FY08 Actual) (9% of FY08 Actual) FY 10 Budget Outlook FY10 Budget will be set 2.5% higher than FY09 (1.6% higher than FY08 actual recovery)