FY2008 Budget Powerpoint Presentation

advertisement

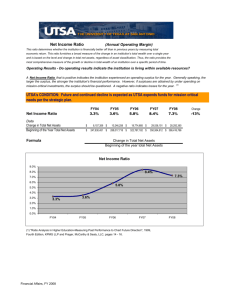

CITY OF MERIDIAN FY08 BUDGET HEARING Mayor – Tammy de Weerd Council President – Joe Borton Council Vice President – Charlie Rountree Council – Keith Bird Council – David Zaremba City of Meridian Total FY08 Budget Request $85,450,320 Carry Forward, $25,662,922, 30% Capital Outlay, $20,533,578, 24% Personnel, $22,708,455, 27% Operating, $16,545,363, 19% Total City of Meridian Est FY08 Revenue $85,450,320 Use of Enterprise Fund Balance 35% Property tax 17% Government Sharing 6% Use of GF Balance 9% Utility Connections 8% Water/Sew er Usage 13% Interest 1% Other 7% Building Permits 4% City of Meridian Total FY08 Personnel & Operating Budget Request $39,253,819 Water/Sewer Operations 37% Development Services 10% City Admin 6% Parks 5% Public Safety 42% City of Meridian Total FY08 New Capital Outlay Request - $20,533,578 City Admin, $6,189,616 Water/Sewer Construction , $11,352,443 Public Safety, $1,399,035 Development Services, $45,848 Parks , $1,546,636 FY08 Carry Forward from FY07 $25,662,922 (Does not include $9 million for City Hall) $25,000,000 $20,000,000 $15,000,000 $22,862,967 $10,000,000 $5,000,000 bl ic Pu p De ve lo $27,000 Sa fe ty $158,000 Se rv ic es in $52,000 Ad m W at er /S ew er $200,000 CI P $2,362,955 Pa rk s $0 General Fund • The City’s general fund is used to provide services such as public safety, parks and recreation and building inspections. The largest component of the General Fund is Public Safety, it is 79% of the City’s General Fund personnel and operating budget. • 63% of the Unrestricted General Fund is from property tax revenue. We still don’t have final property tax numbers from Ada County • Restricted revenue sources include impact fees (restricted by statute), and Development Services revenue (restricted by the City Council) City of Meridian Est FY08 TOTAL General Fund Revenue $36,683,252 Building Permits 9% Impact Fees 5% Other Interest 2% Use of Fund Balance 20% Service Charges 1% 6% Devlp Serv Fees 2% Government Sharing 15% Property tax 40% City of Meridian Est FY08 General Fund Unrestricted New General Fund Revenue $23,230,159 Service Charges 9% Other 2% Interest 2% Property Tax 63% Government Sharing 24% Total Property Tax Revenue Highlighting New Construction Portion $14,000,000 $12,000,000 $10,000,000 $8,000,000 $6,000,000 $4,000,000 $2,000,000 Total Property Tax Revenue Portion of Revenue New Construction New Construction Portion $16,000,000 $2,500,000 Total Property Tax Revenue $18,000,000 $0 $2,000,000 $1,500,000 $1,000,000 $500,000 $0 FY03 FY04 FY05 FY06 FY07 Est FY08 Property Tax City of Meridian Levy Rate History • In spite of the credit for new construction, increases in taxable value have resulted in Meridian’s levy rate decreasing in over the last several years. 0.003200000 0.003100000 0.003000000 0.002900000 0.002800000 0.002700000 0.002600000 0.002500000 FY03 FY04 FY05 FY06 FY07 Est FY08 City of Meridian Taxable Value History $6,000,000,000 $5,000,000,000 $4,000,000,000 $3,000,000,000 $2,000,000,000 $1,000,000,000 $0 FY03 FY04 FY05 FY06 FY07 Est FY08 POLICE IMPACT FEE REVENUE Fees Collected FY07 Dec 06- July 07 Estimated Fees - August 07- September 07 Total Estimated FY07 Revenue Budgeted FY08 Total Estimated 9/30/2008 $88,243 $25,000 $113,243 $120,000 $233,243 POLICE DEPARTMENT IMPACT FEE ELIGIBLE PROJECTS Not Budgeted Fire Station #5 -Initial Rural Fire Funding $1,200,000 5% $60,000 City Will Spend General Fund and Impact Fees Mobile Command Trailer Spent in FY08 Total Impact Fee Eligible Projects $60,000 $60,000 $1,260,000 31% $18,600 $18,600 $78,600 $0 $113,243 $0 $113,243 10/01/07 Year Fire Fund Bal FY08 Revenue FY08 Budgeted Projects 9/30/08 Fund Balance FY08 YE Fund Bal Post Eligible Projects $113,243 $120,000 $18,600 $214,643 $154,643 10/01/06 Year Police Fund Balance FY07 Projected Impact Fee Revenue FY07 Budgeted Projects 9/30/07 Unbudgeted Fund Balance Cost % Eligible $ Eligible FIRE IMPACT FEE REVENUE Fees Collected FY07 Dec 06- July 07 Estimated Fees - August 07- September 07 Total Estimated FY07 Revenue Budgeted FY08 Total Estimated 10/1/2006 to 9/30/2008 $383,924 $100,000 $483,924 $462,000 $945,924 FIRE DEPARTMENT IMPACT FEE ELIGIBLE PROJECTS Not Budgeted Training Tower - completed FY07 - Initial Rural Funding Eligible FY08 & Budgeted Fire Station #5 -Initial Rural Fire Funding City Will Spend General Fund and Impact Fees Fire Engine Station #5 Fire Station #5 base radio Opticom Mobile Command Trailer Spent in FY08 Total Impact Fee Eligible Projects 10/01/06 Year Fire Fund Balance FY07 Projected Impact Fee Revenue FY07 Budgeted Projects 9/30/07 Unbudgeted Fund Balance Cost $ % Eligible $ Eligible $1,400,000 31% $434,000 $1,200,000 95% $1,140,000 $443,260 $4,900 $18,000 $60,000 $526,160 3,126,160 100% 100% 100% 31% $443,260 $4,900 $18,000 $18,600 $484,760 $2,058,760 $0 $483,924 $0 $483,924 10/01/07 Year Fire Fund Bal FY08 Revenue FY08 Budgeted Projects 9/30/2008 Fund Balance FY08 YE Fund Bal Post Eligible Projects $483,924 $462,000 $484,760 $461,164 ($1,112,836) PARKS IMPACT FEE REVENUE Fees Collected FY07 Oct 06- July 07 Estimated Fees - August 07- September 07 Total Estimated revenue for FY07 Revenue Budgeted FY08 Total Estimated Revenue 10/01/06 - 9/30/2008 $805,620 $156,000 $961,620 $1,262,042 $2,223,662 PARKS DEPARTMENT BUDGETED TO SPEND Messina Meadows Park Construction Season's Park Construction Champion Park Construction Hero's Park Construction Kiwanis Park Construction Settlers Park Youth Baseball Amendment MYB Settlers Park Construction Bear Creek Development Borup Property Construction Adventure Island William Watson Neighborhood Park Settlers Park Maint Building Park Land Purchase Account FY07 Budget $170,500 $153,739 $4,630 $248,809 $355,008 $1,447,899 $172,000 $321,147 $19,246 $10,000 $264,078 FY07 Spent YTD 7/31/2008 FY08 Budget $3,704 $43,384 $909 $46,898 $281,084 $1,633,966 $16,662 $21,802 $262,381 Total Expenses $1,000,000 $4,167,055 $3,351 $2,314,140 $356,000 $274,750 $29,411 $300,000 $960,161 10/01/06 Fund Balance FY07 Projected Impact Fee Revenue FY07 Budgeted Projects 9/30/07 Unbudgeted Fund Balance $3,481,254 $961,620 $4,167,055 $275,819 10/01/07 Fund Balance FY08 Projected Revenue FY08 Budgeted Projects 9/30/08 Unbudgt Fund Bal $275,819 $1,262,042 $960,161 $577,700 City of Meridian FY08 General Fund Personnel and Operating Budget by Department - $20,909,350 Administration 12% Parks 9% Police 48% Fire 31% Public Safety Makes up 42% of the entire City operating budget and 79% of the General Fund operating budget. Police – FY08 operating budget request $9,959,272 Fire – FY08 operating budget request $6,490,931 POLICE DEPARTMENT Operating and Personnel budget request is 48% of total General Fund PC – OE FY08 Budget Request. FY08 Budget Enhancement Request totals $1,267,056 Requested FY08 Personnel Additions to Police Department 5.5 FTE - $404,793 Narcotics Officer Community Services – Sergeant and Services Coordinator Code Enforcement Officer School Resource Officer Part-time Animal Adoption Coordinator FY08 Operating and Capital Requests for Police Department $862,263 • Digital Radios - $305,000 offset $180,000 grant revenue • $250,000 toward Firearms Range • Vehicles for New Positions • Mobile Command Trailer shared with Fire • Various equipment FIRE DEPARTMENT FY08 Operating and Personnel budget request is 31% of the Total General Fund PC – OE Budget Request. FY08 Enhancement Request totals $1,957,269 Requested FY08 Additions to Fire Department Fire Station #5 – Personnel and Operating - $884,856 (reimbursed by Rural Fire District First Year) Fire Engine for Station #5 - $443,260 (Impact Fees) Three Additional Fire Fighters to Increase Staffing and Reduce Overtime - $297,273 Various Equipment - $179,870 ($41,500 impact fees) Various operating equipment - $22,800 PARKS DEPARTMENT FY08 Operating and Personnel budget request is 9% of the total General Fund PC – OE Budget Request. FY08 Enhancement Request totals $1,973,609. Parks Department in includes maintenance and development of parks and also recreation. The recreation department offers a variety of classes, summer camp programs, sports leagues, and special events. Requested FY08 Additions to Parks Department Purchase of Park Land – Impact Fees $300,000 Park Development – Impact Fees - $644,161 Park Development – General Fund - $582,900 Personnel - $205,623 – 3 Park Maintenance and 2 Recreation Positions Various Operating Maintenance Items– General Fund - $108,600 Recreation Program Operating Increases $24,100 CITY ADMINISTRATION Includes Department of Financial Management – Split with Enterprise Fund Human Resources – Split with Enterprise Fund Information Technology – Split with Enterprise Fund Mayor and Council City Clerk – Split 25% with Planning Department Legal – Split with Development Services FY08 Operating and Personnel Budget Request is 12% of the total General Fund PC – OE Budget Request. FY08 Budget Enhancement Request is $6,530,195 Requested FY08 Additions to Administration Personnel - $154,536 – All Split with Other Funds Accounting Specialist IT Help Desk Technician Part- Time Attorney Percentage of Building Maintenance Position Requested FY08 Additions to Administration City Hall - $6,000,000 Training/HR Support - $72,000 – (split with Enterprise) Accounting and IT Software and Support $86,750 – (split with Enterprise) Community Activities - $10,000 Detox Center Seed Money - $56,000 Various Equipment - New City Hall Telephone – Copy Machine Lease GENERAL FUND NEW REVENUE $23,130,159 RE-APPROPRIATED FUND BALANCE TOTAL $5,613,806 $28,743,965 PERSONNEL $16,162,835 OPERATING $4,723,615 CAPITAL OUTLAY $7,609,266 ADDITION TO FUND BALANCE CARRY FORWARD TOTAL $0 $248,249 $28,743,965 - Capital Improvement Fund NEW REVENUE $100,000 RE-APPROPRIATED FUND BALANCE $100,000 TOTAL $200,000 OPERATING CAPITAL OUTLAY CARRY FORWARD TOTAL $200,000 $200,000 Impact Fees - Restricted General Fund NEW REVENUE $1,962,000 RE-APPROPRIATED FUND BALANCE $1,780,627 $3,742,627 PERSONNEL $0 OPERATING $22,900 CAPITAL OUTLAY $1,424,621 ADDITION TO FUND BALANCE (Police) CARRY FORWARD TOTAL 101,400 $2,193,706 $3,742,627 - Development Services Fund – Those General Fund Functions Related to Serving Development – Funded by Development Fees Building Department – Building Permits Planning Department – Comprehensive Plan Compliance and Assistance Economic Development Any Excess is Transferred to the Capital Improvements Fund For FY08 Moved Street Lights and Code Enforcement - $543,834- back to the General Fund Development Services Revenue History $7,000,000 $6,000,000 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 08 07 B ud E ge tF st F Y Y 06 FY 05 FY 04 FY 03 FY 02 FY FY 01 $0 Residential Building Permit Sales 450 400 350 300 250 200 150 100 50 0 O ct N ov D ec Ja n Fe b M ar A pr il M ay Ju ne Ju ly A ug S ep t Fund is used to account for operations that are directly related to development – Planning Department and Building Department. Revenue is VERY development dependant. Development Services Fund FY2005 FY2006 FY2007 Development Services Revenue to Base Budget Building Department - Revenue to Base Budget $6,000,000 $5,000,000 Revenue $4,000,000 Base $3,000,000 $2,000,000 $1,000,000 $0 Actual FY02 Actual FY03 Actual FY04 Actual FY05 Actual FY06 Projected FY07 Planning Department Revenue - Base Budget $1,800,000 $1,600,000 $1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 Moved Code Enforce and Street Lights back to General Fund for FY08 Revenue Planning Base Other Actual FY02 Actual FY03 Actual FY04 Actual FY05 Actual FY06 Projected FY07 Development Services Fund FY08 Budget Enhancement Requests FY08 Budget Enhancement Request $180,559 Share of Other Fund Enhancements and Share of New City Furniture and Telephone - $165,359 Economic Development - $5,000 GIS Planning Initiative and $10,200 Economic Development Contract Increase DEVELOPMENT SERVICES FUND NEW REVENUE $3,952,000 RE-APPROPRIATED FUND BALANCE TOTAL $44,659 $3,996,659 PERSONNEL $1,243,833 OPERATING $2,548,978 CAPITAL OUTLAY $45,848 ADDITION TO CIP FUND BALANCE CARRY FORWARD TOTAL $0 $158,000 $3,996,659 - Enterprise Fund Fund is used to account for the business functions of the City – those activities that be funded by user charges. Water Sewer Two components within the overall umbrella of providing utility services The operations side – the revenue and cost associated with water and sewer usage. The operations base budget consists of personnel and operations cost needed to provide customers with water and sewer. The construction side – the revenue and cost associated with constructing capital infrastructure such as sewer and water line, wells and the wastewater treatment plant. Operations Revenue and Base • The base budget includes the personnel and operating cost incurred to keep the sewer plant and the water department operating on a day to day basis. • Water utility accounts increased about 5% in the period June 2006 to June 2007. In contrast during the corresponding time period from 2005 to 2006 accounts increased about 15%. Enterprise Fund Utility Sales and Operating Revenue $14,000,000 $12,000,000 $10,000,000 $8,000,000 $6,000,000 Base Budget $4,000,000 Operating Revenue $2,000,000 $0 Actual FY01 Actual FY02 Actual FY03 Actual FY04 Actual FY05 Actual FY06 Est FY07 Construction Revenue and Budgeted Capital Outlay Waterlines Sewer lines Wastewater Treatment Plan Lift Stations Wells Reservoirs Enterprise Fund Capital Projects Revenue and Budgeted Capital Projects $20,000,000 $18,000,000 Capital Proje cts Re v e nue $16,000,000 $14,000,000 Capital Proje cts Budge t $12,000,000 $10,000,000 $8,000,000 $6,000,000 $4,000,000 $2,000,000 $0 Actual FY01 Actual FY02 Actual FY03 Actual FY04 Actual FY05 Actual FY06 Est FY07 City of Meridian Enterprise Fund Total Proposed FY08 Budget - $48,767,067 Public Works 5% Utility Billing 1% Carryforward 47% WWTP 28% Water 19% City of Meridian - Enterprise Fund Total FY08 Budget Request $48,767,067 $20,000,000 $18,000,000 $16,000,000 Base Budget $14,000,000 Capital $12,000,000 Carryforward $10,000,000 $8,000,000 $6,000,000 $4,000,000 $2,000,000 $0 Public Works Utility Billing Water WWTP Public Works Department – FY08 Budget Enhancement Request $245,210 Engineering Technician - $62,179 Building Maintenance Technician – ½ of cost - $14,213 – partial year New City Hall Phone – Work Stations – Misc Supplies - $168,818 Water Department – FY08 Budget Enhancement Request - $3,981,559 Staff - (1.5) - $124,593 – Water Operator IV and Part Time Receptionist to Full Time Phase II Additional Water Building Construction Funding - $775,000 Well/Waterline Construction - $1,715,000 Consulting - $105,000 Expand Retrofit Meters to Radio Read - $90,800 New Ground Reservoir - $1,000,000 Other - $171,166 Waste Water Treatment Plant – FY08 Budget Enhancement Request - $7,954,100 Tertiary Filters - $2,000,000 Plant Optimization - $1,130,000 Addition to South Area Trunk and Lift Station $1,900,000 Black Cat Trunk Phase #4 - $1,500,000 Reuse Program- $650,000 Additional Staff- Pretreatment Inspector and WWTP Mechanic - $147,134 Equipment, Line Extensions, Misc - $ 626,966 ENTERPRISE FUND NEW REVENUE $18,876,725 RE-APPROPRIATED FUND BALANCE $29,890,343 TOTAL $48,767,068 PERSONNEL $5,270,832 OPERATING $9,280,822 CAPITAL OUTLAY $11,352,447 ADDITION TO FUND BALANCE CARRY FORWARD TOTAL $0 $22,862,967 $48,767,068 - GENERAL FUND FY07 BUDGET AMENDMENT Increase Revenue $888,587 Increase Personnel Expense $53,896 Increase Operating Expense Decrease Operating Expense $310,418 $718,520 Increase Capital Outlay $630,883 Net Change to Fund Balance $611,910 Noteworthy $700,000 not spent Locust Grove Overpass $590,000 Parks Donations IMPACT FEE FY07 BUDGET AMENDMENT Increase Revenue Increase Capital Outlay Net Change to Fund Balance $0 $632,363 -$632,363 DEVELOPMENT SERVICES FUND FY07 BUDGET AMENDMENT Increase Revenue Increase Operating Expenses Net Change to Fund Balance $7,712 -$7,712 $0 ENTERPRISE FUND FY07 BUDGET AMENDMENT Increase Revenue $0 Increase Personnel Expense $34,303 Increase Operating Expense $3,712,441 Increase Capital Outlay $1,487,030 Net Change to Fund Balance Noteworthy -$5,199,471 Developer sewerline reimbursements $3.7 million Construction project costs increased $7.9 million Reduced FY06 Carryforward $6 million Prepared by the City of Meridian Department of Financial Management and Planning For More Information call City Hall at 888 – 4433, email us at kilchens@meridiancity.org or check out our City of Meridian website at www.meridiancity.org – Finance Department