Chapter 2

advertisement

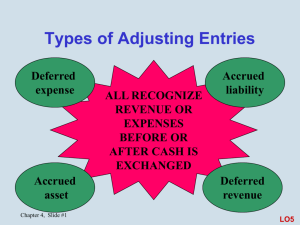

Chapter 2 Dr Cr The Accounting Process Chapter 2--Learning Objectives 1. Analyze transactions based upon the accounting equation Accounting Equation Assets = Liabilities + Equity or Assets - Liabilities = Equity Accounting Equation Assets = Liabilities + Equity Assets Have value Will generate future cash flows Accounting Equation Assets = Liabilities + Equity Assets Factory building Equipment Accounts receivable Accounting Equation Assets = Liabilities + Equity Liabilities Obligations Incurred to Acquire Assets Accounting Equation Assets = Liabilities + Equity Liabilities Accounts Payable Salaries Payable Bonds Payable Accounting Equation Assets = Liabilities + Equity Equity Owner Claim to Assets Assets - Liabilities The Accounting Equation Investments by Owners Distributions to Owners Assets = Liabilities + Equity Revenues - Expenses Gains - Losses Transactions & Events • Affect Balance Sheet only • Affect Balance Sheet & Earnings Transactions affecting the balance sheet • • • • • Investments by owners Distributions to owners Use assets to acquire other assets Use assets to extinguish debt Acquire assets by incurring debt Accounting Equation Assets = Liabilities + Equity Example Purchased a Car for $22,000 Paid $5,000 down Signed a note for the balance Effect on Accounting Equation Assets = Liabilities + Equity Car $22,000 Note $17,000 Cash ( 5,000) Assets $17,000 = Liab $17,000 Transactions affecting Earnings • Earnings = Change in net assets, excluding investments by and distributions to owners • Equity = Net assets • Earnings increase equity • Earnings = Revenues - Expenses + Gains Losses • Earnings increase equity through revenues, expenses, gains & losses Chapter 2--Learning Objectives 2. Interpret the four traditional financial statements Financial Statements 1. Income statement 2. Statement of changes in shareholders’ equity 3. Balance sheet 4. Statement of cash flows Income Statement Elements Revenues Expenses Gains Losses } For the accounting period Statement of changes in shareholders’ equity Investments by owners Distributions to owners Net income or loss } For the accounting period Balance Sheet Elements Assets Liabilities Equity } At the end of the accounting period Statement of cash flows Investing activities Financing activities Operating activities } For the accounting period Relationship of Financial Statements Income Statement Statement of Owner’s Equity Revenue + Gains - Expenses -Losses Net Income Balance Sheet Income Statement Revenue + Gains - Expenses -Losses Statement of Owner’s Equity Balance Sheet R/E Beginning Balance + Net Income - Dividends Net Income R/E Ending Balance } Income Statement Revenue Statement of Owner’s Equity + Gains R/E BB - Expenses + Net Income -Losses - Dividends Net Income R/E EB Balance Sheet Income Statement Revenue Statement of Owner’s Equity Balance Sheet Assets + Gains R/E BB Liabilities - Expenses + Net Income Equity -Losses - Dividends Net Income R/E EB Income Statement Revenue Statement of Owner’s Equity Balance Sheet Assets + Gains R/E BB Liabilities - Expenses + Net Income Equity -Losses - Dividends Net Income R/E EB Income Statement Revenue Statement of Owner’s Equity Balance Sheet Assets + Gains R/E BB Liabilities - Expenses + Net Income Equity -Losses - Dividends Net Income R/E EB Income Statement Revenue Statement of Owner’s Equity Balance Sheet Assets + Gains R/E BB Liabilities - Expenses + Net Income Equity -Losses - Dividends Net Income R/E EB Income Statement Revenue Statement of Owner’s Equity Balance Sheet Assets + Gains R/E BB Liabilities - Expenses + Net Income Equity -Losses - Dividends Net Income R/E EB Income Statement Revenue Statement of Owner’s Equity Balance Sheet Assets + Gains R/E BB Liabilities - Expenses + Net Income Equity -Losses - Dividends Net Income R/E EB Chapter 2--Learning Objectives 3. Understand the accounting model including the purpose of journals and ledgers Journals • Journals - Books of Original Entry – Record transactions or events • i.e, Journal entries – In chronological order – Complete record of effects of transaction on accounts – Accounts and amounts debited /credited Sample Transaction Paid $1,000 on Account to XYZ Supplies Journal Entry Accounts Payable Cash 1,000 1,000 Ledgers • Ledgers - Contain Accounts – General Ledger • Contains accounts for financial statement elements Posting • From Journal to General Ledger Account Journal Entry Accounts Payable 1,000 Cash 1,000 Accounts Payable Debit Credit 10,000 1,000 9,000 Types of Journal • General Journals • Special Journals Special Journals • • • • Cash Receipts Journal Cash Disbursements Journal Purchases Journal Sales Journal Cash Receipts Journal • Record All receipts of Cash – ie, deposits to the bank • Examples: – Cash sales – Received Cash on account – Sold company truck for cash Cash Disbursements Journal • Record All payments of Cash – ie, checks written • Examples: – Paid supplier on account – Purchased truck for cash – Made mortgage payment Sales Journal • Record All Sales on Account – When sale is made and no cash is received Purchases Journal • Record All Purchases of merchandise on Account – When purchases are made and no cash is paid – Purchases of items other than merchandise are recorded in the general journal General Journal • For All other Journal Entries • Examples: – Adjusting – Closing – Sales & purchase returns Chapter 2--Learning Objectives 4. Perform the steps in the accounting process Accounting Cycle Transactions Events Record Inputs Source Docs Accumulate in Accounts Outputs Financial Statements During the Accounting Period 1 Identify transactions & events to record 2 Journalize transactions & events 3 Post from journals to ledgers At the end of the accounting period 4 5 6 7 8 9 Prepare Unadjusted Trial Balance Journalize & Post adjusting entries Prepare Adjusted Trial Balance Prepare Financial Statements Journalize & Post closing entries Prepare Post Closing Trial Balance At beginning of next accounting period 10 Journalize & Post reversing entries Adjusting Entries - Types Deferrals Accruals Estimated Items Inventory Deferrals Prepaid Expenses Unearned revenues Typical Deferred Expenses Supplies Prepaid Rent Bookkeeping Approaches Record transaction as expense Record transaction as asset Accounting Approach Original debit to expense – Adjusting Entry Debit Prepaid Credit Expense Example: 12/1/x1: Paid 3 month rent in advance, $3,000 Journal Entry Rent Expense Cash 3,000 3,000 Year End - 12/31 $1,000 has expired = Expense $2,000 is unexpired = Asset Have on Books Want on Books Rent Expense 1,000 Rent Expense 3,000 Prepaid Rent 2,000 Adjustment Rent Expense 3,000 2,000 Prepaid Rent 2,000 1,000 Adjusting Entry Prepaid Rent Rent Expense 2,000 2,000 Accounting Approach Original debit to Asset – Adjusting Entry Debit Expense Credit Prepaid Example: 12/1/x1: Paid 3 month rent in advance, $3,000 Journal Entry Prepaid Rent Cash 3,000 3,000 Year End - 12/31 $1,000 has expired = Expense $2,000 is unexpired = Asset Have on Books Want on Books Rent Expense 1,000 Prepaid Rent 3,000 Prepaid Rent 2,000 Adjustment Prepaid Rent 3,000 Rent Expense 1,000 1,000 2,000 Adjusting Entry Rent Expense Prepaid Rent 1,000 1,000 Unearned Revenues Obligations to perform services for which money has already been received Typical Unearned Revenues Rent Received in Advance Subscriptions Received in Advance Bookkeeping Approaches Record transaction as revenue Record transaction as liability Accounting Approach Original credit to Revenue – Adjusting Entry Debit Revenue Credit Unearned Revenue Example: 12/1/x1: Received 3 month rent in advance, $3,000 Journal Entry Cash 3,000 Rental Revenue 3,000 Year End - 12/31 $1,000 is earned = Revenue $2,000 is unearned = Liability Have on Books Want on Books Rental Revenue 1,000 Rental Revenue 3,000 Rent Received in Advance 2,000 Adjustment Rental Revenue 3,000 2,000 Rent Received in Advance 2,000 1,000 Adjusting Entry Rental Revenue 2,000 Rent Rec’d in Adv 2,000 Accounting Approach Original credit to Liability – Adjusting Entry Debit Liability Credit Revenue Example: 12/1/x1: Received 3 month rent in advance, $3,000 Journal Entry Cash 3,000 Rent Received in Advance 3,000 Year End - 12/31 $1,000 in earned = Revenue $2,000 is unearned = Liability Have on Books Rent Rec’d in Advance Want on Books Rental Revenue 1,000 3,000 Rent Rec’d in Advance 2,000 Adjustment Rent Rec’d in Advance Rental Revenue 3,000 1,000 1,000 2,000 Adjusting Entry Rent Rec in Adv 1,000 Rental Revenue 1,000 Accruals Accrued Expenses – Payables Accrued Revenues – Receivables Typical Accrued Expenses Salaries Payable Interest payable Taxes Payable Most Common Accrued Revenue Interest Receivable Typical Estimated Items Depreciation Bad Debt Expense Pension Expense Inventory Adjustment Close Beginning Inventory Close Purchases Insert Ending Inventory Difference = Cost of Goods Sold Cost of Goods Sold Beginning Inventory + Purchases Goods available for Sale - Ending Inventory Cost of Goods Sold Example Beginning Inventory Purchases Ending Inventory 10,000 95,000 7,000 Cost of Goods Sold Beg Inv + Purchases 10,000 95,000 Available 105,000 - End Inv 7,000 CGS 98,000 Have on Books Want on Books Inventory Inventory 10,000 Purchases 7,000 Cost of Goods Sold 98,000 95,000 Inventory 10,000 Purchases 95,000 CGS Inventory Purchases 95,000 CGS 10,000 Inventory Purchases 95,000 CGS 10,000 Inventory Purchases 95,000 CGS 10,000 Inventory Purchases CGS 10,000 95,000 Inventory 7,000 Purchases CGS 10,000 95,000 7,000 Inventory 7,000 Purchases CGS 10,000 95,000 98,000 7,000 Inventory 10,000 Account Inventory Purchases CGS 95,000 Debit Credit 10,000 Inventory Account Purchases Inventory Purchases 95,000 CGS Debit Credit 95,000 10,000 Inventory Purchases 7,000 Account Inventory Cost of Goods Sold Purchases Inventory CGS 98,000 Debit Credit 7,000 98,000 95,000 10,000 Inventory Purchases CGS 10,000 10,000 95,000 95,000 7,000 98,000 7,000 98,000 Account Inventory Cost of Goods Sold Purchases Inventory Debit Credit 7,000 98,000 95,000 10,000 Closing the Books The only thing left Balance Sheet Assets Liabilities Permanent Accounts Equity Income Statement Revenue Statement of Owner’s Equity + Gains R/E BB - Expenses + Net Income -Losses - Dividends Net Income R/E EB T e m p o r a r y Income Statement Revenue Statement of Owner’s Equity + Gains R/E BB - Expenses + Net Income -Losses - Dividends Net Income R/E EB Close to R/E Closing Close all income statement accounts to the Income Summary Close Income Summary to R/E Close Dividends to R/E Adjusted Trial Balance Debits Credits Current Assets 40,000 Current Liabs 15,000 Investments 15,000 Long Term Liabs 65,000 Plant Assets 90,000 Common Stock 27,000 Dividends 2,000 Retained Earnings CGS 45,000 Net Sales Adm Expenses 11,000 Interest Revenue Selling Expense 14,000 Interest Expense 4,000 Total 221,000 Total 6,000 100,000 8,000 221,000 Close Income Statement Accounts Debit Net Sales Interest Revenue CGS Admin Expenses Selling Expense Interest Expense Income Summary Credit 100,000 8,000 45,000 11,000 14,000 4,000 34,000 Close Income Summary Account Debit Income Summary Retained Earnings Credit 34,000 34,000 Close Dividends Debit Retained Earnings Dividends Credit 2,000 2,000 Income Summary Retained Earnings 6,000 34,000 38,000 34,000 0 Dividends 2,000 2,000 2,000 38,000 Reversing Entries Reverse certain adjusting entries Dated: Beginning of next accounting period Facilitate the bookkeeping process What entries to reverse? All Accruals Those deferrals that increased balance sheet accounts – i.e., returns amounts to expense & revenue accounts Accrual Example Salaries are $1,000/day. The year ended on Tuesday. Salaries are paid each Monday for the previous week. Year end adjustment (for 2 days) Salary Expense 2,000 Salaries Payable 2,000 Accounting Approaches Make reversing entry Don’t make reversing entry Payment of the Salaries: Assume no reversing entry is made When the salaries are paid the following Monday Salaries Payable 2,000 Salary Expense 3,000 Cash 5,000 At year end Salary Expense 2,000 Salaries Payable 2,000 Adjusting Entry Salary Expense 2,000 2,000 Salaries Payable 2,000 Closing Entry Beginning of next accounting period Salary Expense Salaries Payable 2,000 Salary Expense 3,000 Salaries Payable 2,000 2,000 Pay Salaries Account balances after payment Salary Expense 3,000 Salaries Payable Assume instead: The following reversing entry was made Salaries Payable 2,000 Salary Expense 2,000 Payment of the Salaries • When the salaries are paid the following Monday Salary Expense Cash 5,000 5,000 At year end Salary Expense 2,000 Salaries Payable 2,000 Adjusting Entry Salary Expense 2,000 2,000 Salaries Payable 2,000 Closing Entry Beginning of next accounting period Salary Expense 2,000 Salaries Payable 2,000 2,000 Reversing Entry Pay Salaries Salary Expense 5,000 Salaries Payable 2,000 3,000 End result is the same Deferrals Adjusting Entry Increases Asset or Liability Reverse Adjusting Entry Decreases Asset or Liability Don’t Reverse Deferrals: Example - Deferred Expenses Original = Debit to Expense Original = Debit to Asset Adjusting Entry Adjusting Entry Debit Prepaid Debit Expense Credit Expense – Reverse Credit Prepaid – Don’t Reverse Example: 12/1/x1: Paid 3 month rent in advance, $3,000 Original entry to expense Journal Entry Rent Expense Cash 3,000 3,000 Adjustment Rent Expense 3,000 2,000 Prepaid Rent 2,000 1,000 Adjusting Entry Prepaid Rent Rent Expense 2,000 2,000 Year End Balances Rent Expense 1,000 1,000 Prepaid Rent 2,000 Closing Entry Beginning of Next Year Rent Expense 2,000 Prepaid Rent 2,000 Reversing Entry 2,000 Example: 12/1/x1: Paid 3 month rent in advance, $3,000 Original entry to asset Journal Entry Prepaid Cash 3,000 3,000 Adjustment Prepaid 3,000 Rent Expense 1,000 1,000 2,000 Adjusting Entry Rent Expense Prepaid Rent 1,000 1,000 Year End Balances Rent Expense 1,000 1,000 Prepaid Rent 2,000 Closing Entry Beginning of Next Year Rent Expense Prepaid Rent 2,000 Don’t Reverse Exercise • Given: Adjusting Entries • Determine whether each AJE relates to – Accrual (A) – Deferral (D) • If a deferral, Did the entry Increase a Balance Sheet Account? • Reverse AJE? SALARY EXPENSE SALARIES PAYABLE Accrual (A) or Deferral (D) Reverse? Yes or No SUPPLIES EXPENSE SUPPLIES Accrual (A) or Deferral (D) Increase Balance Sheet Account? Yes or No Yes or No Reverse? SUPPLIES SUPPLIES EXPENSE Accrual (A) or Deferral (D) Increase Balance Sheet Account? Yes or No Yes or No Reverse? INTEREST EXPENSE INTEREST PAYABLE Accrual (A) or Deferral (D) Reverse? Yes or No RENT RECEIVED IN ADVANCE RENTAL REVENUE Accrual (A) or Deferral (D) Increase Balance Sheet Account? Yes or No Yes or No Reverse? RENTAL REVENUE RENT RECEIVED IN ADVANCE Accrual (A) or Deferral (D) Increase Balance Sheet Account? Yes or No Yes or No Reverse? Other Adjusting Entries Estimated Items Cost of Goods Sold Should they be reversed? NEVER DEPRECIATION EXPENSE ACCUMULATED DEPRECIATION Reverse? Yes or Estimated Item Never Reverse No INVENTORY COST OF GOODS SOLD PURCHASES Reverse? Yes or Cost of Goods Sold Never Reverse No