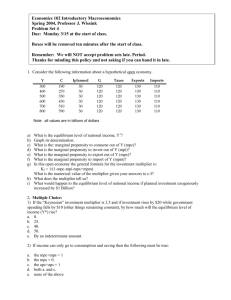

16 Macroeconomics equilibrium

advertisement

Macroeconomic Equilibrium Chapter 16 Short run equilibrium Equilibrium is established when aggregate supply equals aggregate demand Make sure you remember to use Y’s instead of Q’s Long run equilibrium There is disagreement among economists as to the shape of the long run AS curve According to new classical economists the economy will always move towards its long run equilibrium at the full employment level of output (Yf) Long run equilibrium (neo or new classical) According to this perspective any change in AD will only affect the price levels An increase in AD1 to AD2 results in an increase in the average price level (inflation) from P1 to P2 The new classical economists believe the economy will move automatically to its long run equilibrium Automatically means without government intervention They believe in free markets Long run equilibrium (neo or new classical) This diagram shows a combination of short run and long run AS Initially the economy is at its long run equilibrium at Yf If there is an increase in AD due to an increase in any of the components in the short run there will be an increase to Y1 How if the productive potential is Yf? Paying existing workers overtime This can only happen in the short term There is an inflationary gap from Yf to Y1 (positive output gap) In their efforts to increase output firms are competing for scare labour and capital pushing average price levels up Long run equilibrium (neo or new classical) In their efforts to increase output firms are competing for scare labour and capital pushing average price levels up from P1 to P2 The rise in price level means an increase in costs to all firms (prices of labour, raw materials and capital) Making more (increasing output) didn’t give any real gain Firms decide to supply less and go back to the original output (shifts the SRAS from SRAS1 to SRAS2) Output returns to its full employment level but at a higher price level Long run equilibrium (neo or new classical) If AD were to drop from the original equilibrium of Yf The economy would be facing a deflationary gap (negative output gap) Long run equilibrium (neo or new classical) As AD falls so does the average price levels This means that costs of production fall Suppliers will supply more shifting the SRAS Output will go back to Yf at a lower price level The important factor in this theory is that the long run equilibrium level of output is equal to the full employment level of output The market changes automatically No government intervention is required The economy should be left to market forces rather than trying to manage levels of AD Long run equilibrium (Keynesian) According to Keynesian economists equilibrium level of output may occur at different levels Equilibrium can happen at a level of output below the full employment level if there is spare capacity The level of output depends on the level of AD Aggregate supply can be perfectly elastic because there is spare capacity (there are high levels of unemployment) There is a deflationary gap (negative output gap) This can also be illustrated with a PPC diagram The economy is not creating to its productive potential The deflationary/output gap is the distance between the PPC and A Long run equilibrium (Keynesian) It is possible from this perspective to get an increase in AD and not get a rise in the price levels This depends on how much spare capacity is available (the size of the output gap) Producers can use unused factors of production to increase output with no increase in costs so there is no inflationary pressure Long run equilibrium (Keynesian) If AD increases further to AD3 the economy may start to experience inflationary pressure Factors of production are becoming scarcer Price levels increase because firms’ costs increase but the increases are relatively small Long run equilibrium (Keynesian) If the economy is operating at full employment and there is an increase in AD the outcome will be purely inflationary There is no increase in output There is a large increase in price levels Aggregate demand cannot be satisfied with the existing resources The important point here is that government can intervene to close the gap by increasing aggregate demand These are called expansionary policies Contractionary policies are used to reduce the inflationary gap Changes in Long-Run AS Changes in the LRAS are caused by increases in factors of production or improvement in quality of FoPs This is the equivalent of the PPB shifting There is an increase in productive potential This can be illustrated two ways Use the one you are most comfortable with The neoclassical version is good to show how inflationary pressure can be reduced Time to draw! Draw the following 1. An economy in recession where AD is starting to increase 2. An economy in boom where there is high inflation (large changes in average price levels 3. An economy that is growing by improving the quality of factors of production e.g. more training and development 4. An economy that has shrunk due to an earthquake 5. An economy that is experiencing short run negative growth due to sharp rises in the price of oil 6. An economy that is growing without inflation Complete Essay Question P202 1 a) Explain the components of aggregate demand (10 marks) 1 b) Evaluate the extent to which an increase in AD is beneficial for an economy (15 marks) Plan and then complete under timed conditions (30 mins) HL Bit!! Multiplier Several key terms will appear They will disappear after 30 seconds (do not write anything in this time) Your task: (1)List the terms + (2) Define them (8 mins to get as many as possible) GDP per capita Interest Rates Consumption Fiscal policy injection Balance of Payments Deficit Over to you! Multiplier effect Where an increase or decrease in spending leads to a larger than proportionate change in the national income An initial change in AD can have a much greater change in national income (GDP) injections of new demand for goods and services into the circular flow of income can stimulate further rounds of spending in other words ‘one person’s spending is another's income’ – and this can lead to a bigger eventual effect on output and employment. Multiplier effect – an increase or decrease in spending leads to a larger than proportionate change in national income Multiplier effect Consider a £300 million increase in capital investment for example created when an overseas company decides to build a new production plant in the UK This may set off a chain reaction of increases in expenditures. Firms who produce the capital goods and construction businesses who win contracts to build the new factory will experience an increase in their incomes and profits. If they and their employees in turn, collectively spend about 3/5 of that additional income, then £180m will be added to the incomes of others. At this point, total income has grown by (£300m + (0.6 x £300m) = 480m. The sum will continue to increase as the producers of the additional goods and services realize an increase in their incomes, of which they in turn spend 60% on even more goods and services. The increase in total income will then be (£300m + (0.6 x £300m) + (0.6 x £180m). 588m Each time, the additional rise in spending and income is a fraction of the previous addition to the circular flow. The Multiplier and Keynesian Economic The concept of the multiplier process became important in the 1930s when Keynes suggested it as a tool to help governments to maintain high levels of employment. This “demand-management approach” was designed to help overcome a shortage of capital investment It measured the amount of government spending needed to reach a level of national income that would prevent unemployment. The higher the propensity to consume domestically produced goods and services, the greater is the multiplier effect The government can influence the size of the multiplier through changes in direct taxes. For example, a cut in the rate of income tax will increase the amount of extra income that can be spent on further goods and services. Evaluation If people are given extra money do you think they are guaranteed to spend it? No, it depends on their propensity to consume (or their propensity to save) In 2010 Obama gave Americans a tax holiday but it didn’t help growth much because they just used it to pay debt and to bolster their savings In 2011 he extended the tax holiday arguing that it would prevent the US economy from going into a recession He was managing demand; increasing AD by increasing consumption The success of this policy will depend on? The Americans’ propensity to consume Factors affecting the size of the multiplier - evaluation Another factor affecting the size of the multiplier effect is the propensity to purchase imports. If, out of extra income, people spend their money on imports, this demand is not passed on in the form of fresh spending on domestically produced output. It leaks away from the circular flow of income and spending, reducing the size of the multiplier. The UK has a large propensity to consume imports The multiplier process also requires that there is sufficient spare capacity in the economy for extra output to be produced. If there is little spare capacity the multiplier will just cause demand pull inflation Factors affecting the size of the multiplier - evaluation The multiplier effect will be larger when 1.The propensity to spend extra income on domestic goods and services is high 2.The marginal rate of tax on extra income is low 3.The propensity to spend extra income rather than save is high Time lags (evaluation) It is important to remember that the multiplier effect will take time to come into full effect. A good example is the fiscal stimulus introduced into the US economy by the Obama government. They have set aside many billions of dollars of extra spending on infrastructure spending but these sorts of capital projects can take months if not years to be completed. Delays in sourcing raw materials, components and finding sufficient skilled labour can limit the initial impact of the spending projects. Multiplier effect The value of the multiplier can be calculated by using either the marginal propensity to consume (mpc) or the value of the marginal propensity to withdraw (mpw) mpw = mps plus mpm plus mrt mps is the marginal propensity to save mpm is the marginal propensity to import mrt = marginal rate of taxation The multiplier equals 1/(1-mpc) or 1/mps +mpm + mrt or 1/mpw Complete the student workpoint 16.3 P202 Marginal propensity to consume – the extra consumption induced from extra income Marginal propensity to withdraw – the extra withdrawals induced from extra income Marginal propensity to save – the extra saving induced from extra income Marginal propensity to import – the extra imports consumed induced from extra income Multiplier effect How do we draw the multiplier effect? Just show 3 lots of AD The first shift is the rise after the initial injection The second shift is the final rise Use arrows to show the direction of the movement Complete the 10 mark HL question on P202