Chp11fof:HR

fundamentals of

Human Resource Management

3 rd by R.A. Noe, J.R. Hollenbeck, B. Gerhart, and P.M. Wright edition

CHAPTER 11

Establishing a Pay Structure

Copyright © 2009 by The McGraw-Hill Companies, Inc. All Rights Reserved.

11-1

McGraw-Hill/Irwin

What Do I Need to Know?

1.

2.

3.

4.

Identify the kinds of decisions involved in establishing a pay structure.

Summarize legal requirements for pay policies.

Discuss how economic forces influence decisions about pay.

Describe how employees evaluate the fairness of a pay structure.

11-2

What Do I Need to Know?

(continued) 5.

6.

7.

8.

Explain how organizations design pay structures related to jobs.

Describe alternatives to job-based pay.

Summarize how to ensure that pay is actually in line with the job structure.

Discuss issues related to paying employees serving in the military and paying executives.

11-3

Your Opinion

1-Strongly Disagree, 3-Neutral, 5- Strongly Agree 1.

Pay decisions should be based on performance, not seniority.

2.

I would like to know what my coworkers get paid.

3.

I would not mind if others knew my salary.

4.

Pay secrecy helps a company stay competitive.

11-4

Introduction

• • • • Pay is a powerful tool for meeting the organization’s goals.

Pay has a large impact on employee attitudes and behaviors.

It influences the kinds of people who are attracted to (or remain with) the organization.

Employees attach great importance to pay decisions when they evaluate their relationship with their employer.

11-5

Decisions About Pay

Job Structure

• The relative pay for different jobs within the organization.

Pay Level

• The average amount the organization pays for a particular job.

Pay Structure

• The pay policy resulting from job structure and pay level decisions.

11-6

Figure 11.1: Issues in Developing a Pay Structure

11-7

Legal Requirements for Pay Equal employment opportunity Minimum wages Pay for overtime Prevailing wages for federal contractors

11-8

Legal Requirements for Pay:

Equal Employment Opportunity

• • • Employers must not base differences in pay on an employee’s age, sex, race, or other protected status.

Any differences in pay must be tied to such business-related considerations as

job responsibilities

or

performance

.

The goal is for employers to provide

equal pay for equal work

.

11-9

• • • Two employees who do the same job cannot be paid different wages because of gender, race, or age.

It would be illegal to pay these two employees differently because one is male and the other is female.

Only if there are differences in their experience, skills, seniority, or job performance are there legal reasons why their pay might be different.

11-10

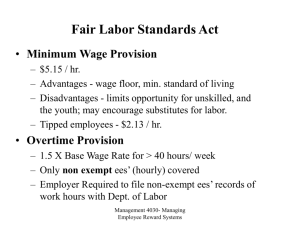

Legal Requirements for Pay:

Minimum Wage

•

Minimum wage –

the lowest amount that employers may pay under federal or state law, stated as an amount of pay per hour.

•

Fair Labor Standards Act (FLSA) –

federal law that establishes a minimum wage and requirements for overtime pay and child labor.

11-11

Minimum Wage

(continued) • • At the federal level, the

FLSA

minimum wage of: – $6.55 per hour as of July 2008 – $7.25 per hour as of July 2009 establishes a The

FLSA

– also permits a lower “training wage” paid to workers under the age of 20 for up to 90 days – approximately 85 percent of the minimum wage

11-12

• • • Legal Requirements for Pay:

Overtime Pay

The overtime rate under the FLSA is 1½ times the employee’s usual hourly rate, including any bonuses, and piece-rate payments.

Exempt employees –

managers, outside salespeople, and other employees not covered by the FLSA requirement for overtime pay.

Nonexempt employees –

employees covered by the FLSA requirements for overtime pay.

11-13

Figure 11.2:

Computing Overtime Pay

11-14

Overtime Pay

(continued) Overtime pay is required, whether or not the employer specifically asked or expected the employee to work more than 40 hours.

Thus, if the employer knows the employee is working overtime but does not pay time and a half, the employer may be violating the FLSA.

11-15

Legal Requirements for Pay:

Prevailing Wages

• • Two federal laws govern pay policies of federal contractors: – Davis-Bacon Act of 1931 – Walsh-Healy Public Contracts Act of 1936 Under these laws, federal contractors must pay their employees at rates at least equal to the prevailing wages in the area.

11-16

Legal Requirements for Pay:

Child Labor

• • • • Children aged 16 and 17 may not be employed in hazardous occupations defined by the U.S. Department of Labor.

Children aged 14 and 15 may work only outside school hours, in jobs defined as nonhazardous, and for limited time periods.

A child under age 14 may not be employed in any work associated with interstate commerce.

Exemptions include baby-sitting, acting, and delivering newspapers.

11-17

Economic Influences on Pay

• • •

Product Markets

The organization’s product market includes organizations that offer competing goods and services.

Organizations compete on quality, service, and price.

The cost of labor is a significant part of an organization’s costs.

• •

Labor Markets

Organizations must compete to obtain human resources in labor markets.

Competing for labor establishes the minimum an organization must pay to hire an employee for a particular job.

11-18

• There is currently a strong demand for nurses in the labor market.

•Hospitals will have to pay competitive wages and other perks to attract and retain staff.

11-19

Tech Workers Out-Earn Managers

11-20

Pay Level: Deciding What to Pay

Pay at the rate set by the market Pay at a rate above the market Pay at a rate below the market

11-21

Gathering Information About Market Pay • • • •

Benchmarking –

its own practices against those of a procedure in which an organization compares successful competitors Pay surveys Trade and industry groups Professional groups • • • Bureau of Labor Statistics (BLS) Society for Human Resource Management (SHRM) American Management Association

11-22

Employee Judgments About Pay Fairness

• Employees compare their pay and contributions against three yardsticks: 1.

2.

3.

What they think employees in other organizations earn for doing the same job.

What they think other employees holding different jobs within the organization earn for doing work at the same or different levels.

What they think other employees in the organization earn for doing the same job as theirs.

11-23

Figure 11.3: Opinions About Fairness –

Pay Equity

11-24

Pay Equity

(continued) • • If employees conclude that they are under-rewarded, they are likely to make up the difference in one of three ways: 1.

2.

3.

They might put forth less effort (reducing their inputs).

They might find a way to increase their outcomes (e.g., stealing).

They might withdraw (by leaving the organization or refusing to cooperate).

Employees’ beliefs about fairness also influence their willingness to accept transfers or promotions.

11-25

Test Your Knowledge

• Mariah found out that a friend of hers with a similar job in the same town makes significantly more money than she does. Which of the following is probably not the cause of this? a) Different cost-of-living b) c) d) The companies are in different product markets with different pay strategies Mariah is a poor performer Mariah’s job is non-exempt

11-26

Job Structure: Relative Value of Jobs

•

Job Evaluation

An administrative procedure for measuring the relative internal worth of the organization’s jobs.

•

Compensable Factors

The characteristics of a job that the organization values and chooses to pay for.

– – – – – Experience Education Complexity Working conditions Responsibility

11-27

Table 11.1: Job Evaluation of Three Jobs with Three Compensable Factors

11-28

Job Structure: Defining Key Jobs

• • •

Key Jobs –

jobs that have relatively stable content and are common among many organizations.

Organizations can make the process of creating the job structure and the pay structure more practical by defining key jobs.

Research for creating the pay structure is limited to the key jobs that play a significant role in the organization.

11-29

Pay Structure: Putting It All Together

Job Evaluation Job Structure Define Key Jobs Pay Rates Pay Grades Pay Policy Line Pay Ranges Pay Survey Pay Structure

11-30

Pay Rates

Organization obtains pay survey data for its key jobs.

Pay policy line is established.

Pay rates for non-key jobs are then determined.

11-31

Figure 11.4: Pay Policy Lines

Pay policy line –

a graphed line showing the mathematical relationship between job evaluation points and pay rate.

11-32

Figure 11.5: Sample Pay Grade Structure

Pay grades –

of jobs having sets similar worth or content, grouped together to establish rates of pay.

11-33

Pay Ranges

•

Pay ranges –

a set of possible pay rates defined by a minimum, maximum, and midpoint of pay for employees holding a particular job or a job within a particular pay grade.

• •

Red-circle rate –

pay at a rate that falls above the pay range for the job.

Green-circle rate –

pay at a rate that falls below the pay range for the job.

11-34

Test Your Knowledge

• To correct a Red-circled employee, I would…..

a) b) c) d) Give them a raise Demote them Give them a bonus, but no raise Move them to a job with a higher pay range

11-35

Pay Differentials

• • •

Pay differential –

adjustment to a pay rate to reflect differences in working conditions or labor markets.

Many businesses in the United States provide pay differentials based on geographic location.

The most common approach is to move an employee higher in the pay structure to compensate for higher living costs.

11-36

• Night hours are less desirable for most workers.

• Therefore, some companies pay a differential for night work to compensate them.

11-37

Alternatives to Job-Based Pay

• • • •

Delayering

Reducing the number of levels in the organization’s job structure.

More assignments are combined into a single layer.

These broader groupings are called broad bands.

More emphasis on acquiring experience, rather than promotions.

• •

Skill-Based Pay Systems

Pay structures that set pay according to the employees’ levels of skill or knowledge and what they are capable of doing.

This is appropriate in organizations where changing technology requires employees to continually widen and deepen their knowledge.

11-38

Figure 11.6: IBM’s New Job Evaluation Approach

11-39

Pay Structure and Actual Pay

• • • • Pay structure represents the organization’s policy.

However, what the organization actually does may be different.

The HR department should compare actual pay to the pay structure, making sure that policies and practices match.

Compa-ratio

is the common way to do this.

11-40

Figure 11.7:

Finding a Compa-Ratio

• • • •

Compa-Ratio (CR) –

the ratio of average pay to the midpoint of the pay range.

If the average equals the midpoint, CR is 1.

If CR is greater than 1, the average pay is above the midpoint.

IF CR is less than 1, the average pay is below the midpoint.

11-41

Current Issues in Pay

• • Pay During Military Duty – How should companies handle employees who are called for active duty in the military for extended time periods?

– The Uniformed Services Employment and

Reemployment Rights Act (USERRA)

Pay for Executives – Based on equity theory, how does executive compensation affect employees?

11-42

Figure 11.8: Median CEO Compensation at 350 Large U.S. Companies

11-43

Summary

• • • Organizations make decisions to define a job structure, or relative pay for different jobs within the organization. Organizations also must establish pay levels, or the average paid for the different jobs.

These decisions are based on the organization’s goals, market data, legal requirements, and principles of fairness.

Together, job structure and pay level establish a pay structure policy.

11-44

Summary

• • • To meet the standard of equal employment opportunity, employers must provide equal pay for equal work, regardless of an employee’s age, race, sex, or other protected status.

Differences in pay must relate to factors such as a person’s qualifications or market levels of pay.

Under the Fair Labor Standards Act (FLSA): • The employer must pay at least the minimum wage established by law.

• Overtime pay for hours worked beyond 40 in each week must be paid.

11-45

Summary

(continued) • • • To remain competitive, employers must meet the demands of the product and labor markets.

• Limit their costs as much as possible.

• Pay at least the going rate in their labor markets.

According to equity theory, employees think of their pay relative to their inputs – training, experience, and effort.

To decide whether their pay is equitable, they compare their outcome (pay)/input ratio with other people’s outcome/input ratios.

11-46

Summary

(continued) • • • The traditional approach to building a pay structure is to use a job-based approach.

Alternatives to the traditional approach include broad banding and skill-based pay.

The Uniformed Services Employment and Reemployment Rights Act (USERRA) requires employers to make jobs available to any of their employees who leave to fulfill military duties for up to five years.

11-47

Summary

(continued) • • • Executive pay has drawn public scrutiny because top executive pay is much higher than average workers’ pay.

The great difference is an issue in terms of equity theory.

Employees’ opinions about the equity of executive pay can have a large effect on the organization’s performance.

11-48