Classifying Support Staff as Volunteers

Classifying Support Staff as Volunteers

AASBO Spring Conference 2013

Presented by Brad Nassif, Business Manager

Glendale Union High School District

Thanks to

Doug Vaughan

Business Manager

Pinon Unified School District #4

Provided me the initial information at a AASBO Payroll

Workshop in 2012

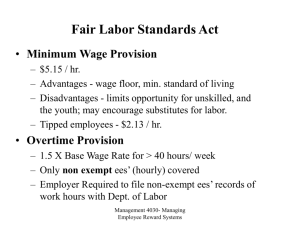

A look at FLSA

Strict interpretation of FLSA limited school districts on how to manage Support Staff Employees and Coaching

Assignments

Not allowed to participate at all

Volunteer but not paid

Paid hourly rate and overtime

Blend hourly rate and minimum wage and limit hours

Etc….

FLSA – CFR Title 29

www.ecfr.gov

Title 29 Labor

Section 553.30 Occasional or sporadic employment-section

Section 553.106 Payment of expenses, benefits, or fees

FLSA – CFR Title 29

CFR Title 29 § 553.30

(b) Occasional or sporadic. (1) The term occasional or sporadic means infrequent, irregular, or occurring in scattered instances .

There may be an occasional need for additional resources in the delivery of certain types of public services which is at times best met by the part-time employment of an individual who is already a public employee. Where employees freely and solely at their own option enter into such activity, the total hours worked will not be combined for purposes of determining any overtime compensation due on the regular, primary job. However, in order to prevent overtime abuse, such hours worked are to be excluded from computing overtime compensation due only where the occasional or sporadic assignments are not within the same general occupational category as the employee's regular work .

FLSA – CFR Title 29

CFR Title 29

§ 553.30

(5) In addition, any activity traditionally associated with teaching

(e.g., coaching, career counseling, etc.) will not be considered as employment in a different capacity . However, where personnel other than teachers engage in such teachingrelated activities, the work will be viewed as employment in a different capacity, provided that these activities are performed on an occasional or sporadic basis and all other requirements for this provision are met. For example, a school secretary could substitute as a coach for a basketball team or a maintenance engineer could provide instruction on auto repair on an occasional or sporadic basis.

FLSA – CFR Title 29

CFR Title 29 § 553.106 Payment of expenses, benefits, or fees

(a) Volunteers may be paid expenses, reasonable benefits, a nominal fee, or any combination thereof, for their service without losing their status as volunteers .

(f) Whether the furnishing of expenses, benefits, or fees would result in individuals' losing their status as volunteers under the FLSA can only be determined by examining the total amount of payments made (expenses, benefits, fees) in the context of the economic realities of the particular situation.

FLSA – US Code 29

29 USC § 203 (e) (4)

(A) The term “employee” does not include any individual who volunteers to perform services for a public agency which is a State, a political subdivision of a State, or an interstate governmental agency, if —

(i) the individual receives no compensation or is paid expenses, reasonable benefits, or a nominal fee to perform the services for which the individual volunteered; and

(ii) such services are not the same type of services which the individual is employed to perform for such public agency

FLSA - Summary

Key questions are:

Is the assignment voluntary?

Is the assignment different than regular job assignment?

How much is a nominal fee?

A look at the Courts

4th Circuit Court of Appeals

Purdham v. Fairfax County School Board

Just Google it and you will find many links to this court case

NSBA (National School Boards Association) even filed a Friend of the Court brief

The Courts – Case Facts

Fairfax County Schools had previously classified Support

Staff (nonexempt) employees as “volunteers” for the purpose of coaching assignments

The stipend paid to support staff employees was considered a

“nominal fee”

Based on strict FLSA interpretation, the school district for one year classified support staff coaches as non-exempt and paid those assignments on an hourly/overtime basis as per FLSA regulations

The Courts – Case Facts

Upon seeking further clarification from the Dept. of

Labor (DOL) and receiving a letter from the DOL, the school district returned to the previous practice of interpreting support staff as “volunteers” and paying a “nominal fee” for coaching assignments

The Courts – Case Facts

James Purdham, a long time security assistant and golf coach, sued the school district maintaining that he should be considered an “employee” and not a “volunteer” for the coaching assignment

The plaintiff claimed that he spent 350 to 450 hours per year coaching which violated FLSA as the stipend amount of about $2000 fell below minimum wage standards

The Courts - Court Conclusions

4 th Circuit Court of Appeals found in favor of Fairfax County

Schools

The fact that the school district had changed it’s policy for one year had no bearing on the decision as the district was acting according to FLSA as it was interpreted

The Courts - Court Conclusions

The Court looked to the statutory and regulatory language defining “volunteer” for a public agency. According to the

Court, an exempt volunteer is one who “receives no compensation or is paid expenses, reasonable benefits, or a nominal fee to perform” the volunteered services; and the services provided are not the same type performed as an employee of the public agency. Charitable reasons are a motivator of the services, and that the individual offers his services without coercion.

Goddard, Vanessa. “Charity Begins at … the Golf Course!”

Steptoe & Johnson Blog. 28 March 2011. Web. 15 March 2013

Things to Remember

DOL regulations and Court decision only apply to public employers like school districts

Coaching assignment must be completely voluntary

Coaching assignment must unlike employee’s regular job assignment

Things to Remember

Team performance has no correlation to stipend amount and job evaluation

Not going to get more or less of a stipend if team makes or doesn’t make playoffs

Not going to get fired from maintenance job if team doesn’t make the playoffs

Stipends paid are considered a “nominal fee” and in no way correlate to time spent on the assignment

Plan of Action

Study relevant FLSA regulations

Title 29 Sections 553.30 and 553.106

29 USC § 203 (e) (4)

Google “FLSA2005-51”

DOL Letter

DOL does not indicate that a “nominal fee” of $1000’s is unrealistic

Google “ Purdham v. Fairfax County School Board”

Plan of Action

Add Volunteer Fee Schedule to Support Staff Salary

Schedule

Can be a copy from the Certified Staff Schedule

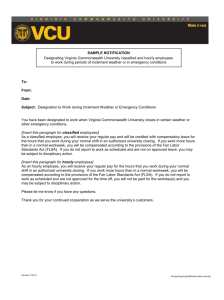

Develop a Support Staff Volunteer Form

Include language that the assignment is voluntary

Include language that any stipend paid is a nominal fee

Include language that the there is no correlation between stipend amount and team performance

Plan of Action

Seek the advice of your district’s attorney to make sure that you are not missing anything

Inform current support staff coaches of the change in classification/policy

Questions???

Thanks

Contact Information

Brad Nassif

Business Manager

Glendale Union High School District

Brad.Nassif@guhsdaz.org

(623) 435-6085