Cash

advertisement

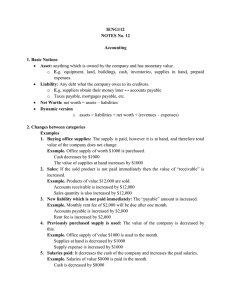

King Abdul-Aziz University Faculty of Economics and Administration Accounting Department SET "A" ACCT 117 First Exam First Term, 1431/1432 Time: 90 Minutes Name: ____________________________ ID: _______________________________ Section No.: _______________________ Question I II III IV V Total Maximum 5 6 4 5 5 25 Score (Good Luck) 1 I .( 5 Points) (1) The total Assets of a company is $50000 and liabilities is $10000.What is the amount of owners equity? (2) What are the accounts involved in these transactions: (a) Purchased supplies on credit $1000. (b) Services performed on credit to customers $15000. 2 II. (6 Points) Moiyyad decides to open a cleaning and laundry service near the local college campus that will operate as a sole proprietorship. Analyze the following transactions for the month of December in terms of their effect on the basic accounting equation. Record each transaction by increasing (+) or decreasing (–) the dollar amount of each item affected. It is necessary to identify the cause of changes in owner's equity. Transactions (1) Moiyyad invests $20,000 in cash to start a cleaning and laundry business on December 1. (2) Purchased laundry equipment for $5,000 paying $3,000 in cash and the remainder due in 30 days. (3) Received a bill from Campus News for $300 for advertising in the campus newspaper. (4) Cash received from customers for cleaning and laundry amounted to $1,500. (5) Paid $300 in cash to Campus News for advertising that was previously billed in Transaction 3. (6) Moiyyad withdrew $900 in cash from the business for personal expenses. Cash Equipment Accounts Payable Capital 3 III. (4 Points) Journalize the following business transactions in general journal form. Identify each transaction by number. You may omit explanations of the transactions. 1. Purchased office equipment for $8,000, paying $2,000 in cash and signed a 30-day, $6,000, note payable. 2. Paid $700 in cash for the current month's rent. 3. Billed customers $2,200 for service performed. 4. Eyad (owner) withdrew $1,200 in cash from the business for personal expenses. 4 IV. (5 Points) Selected transactions from the journal of Mohammad Zaid, consultant engineer, are presented below: Date Accounts and Explanation Ref. debit credit Nov. Cash 6,000 1 Mohammad Zaid, Capital 6,000 (owner’s investment of cash in business) Cash 10 4,800 Service revenue (received cash for services provided) Office Equipment 12 Cash Notes Payable (purchased office equipment for cash and notes payable) 4,800 10,000 2,000 8,000 25 Accounts Receivable Service Revenue (billed for services provided) 3,200 30 Cash 1,800 3,200 Accounts Receivable (receipt of cash on account) 1,800 Required: Post the related transactions to the "Cash" account only and determine its balance: 5 V. (5 Points) The following is the trial balance of "X" Enterprise on October 31, 2010: Account Titles Debit Credit Cash $13,000 Accounts Receivable 1,700 Supplies 300 Land 19,000 Buildings 26,000 Accounts Payable $ 2,400 Notes Payable 3,000 X, Capital 10/1/2010 53,100 X, Drawings 1,500 Service Revenue 9,500 Rent Expense 1,800 Salaries Expense 4,200 Insurance Expense 500 Total 68,000 68,000 Required: Prepare, in good form, an income statement, owner's equity statement, and balance sheet for "X" Enterprises for the month ended October 31, 2010. Income Statement For October 2010 Revenues: Expenses: 6 Owner's Equity Statement For October 2010 Balance Sheet October 31, 2010 Assets Liabilities Owner's Equity (Good Luck) 7