PowerPoint Slides for Chapter 11

advertisement

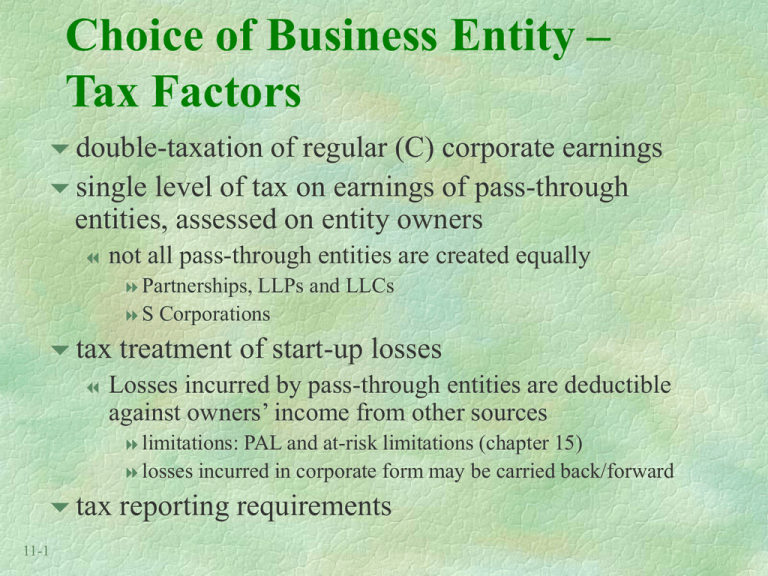

Choice of Business Entity – Tax Factors double-taxation of regular (C) corporate earnings single level of tax on earnings of pass-through entities, assessed on entity owners not all pass-through entities are created equally Partnerships, LLPs S and LLCs Corporations tax treatment of start-up losses Losses incurred by pass-through entities are deductible against owners’ income from other sources limitations: PAL and at-risk limitations (chapter 15) losses incurred in corporate form may be carried back/forward tax reporting requirements 11-1 Choice of Business Entity – Non-Tax Factors legal liability ease and costs of formation cash flow needs of owners Interaction of tax and non-tax factors taxation of income and payment of tax liability taxable versus non-taxable cash flows to owners 11-2 Changes in Ownership and Organizational Form Changes in ownership expanding the business to include additional owners/investors is more complicated in partnership form than in corporate form Changes in organizational form termination of a corporation results in double taxation taxable versus nontaxable restructurings costs of restructuring 11-3 Important Differences between Partnerships and S Corporations S corporations provide limited liability to all shareholders, while partnerships must have at least one general partner LLPs provide general partners protection from liability for malpractice of other general partners Partnerships can make special allocations of taxable items among partners; all S corporation allocations must be based on stock ownership share 11-4 Partnership and S Corporation Differences continued Partners cannot be employees of their partnerships, while S corporation shareholders can be employees of their corporations Partnership guaranteed payments and general partners’ share of partnership ordinary income are subject to SE tax, while S corporation shareholders’ share of corporation income is not 11-5 Partnership and S Corporation Differences continued Partnerships can involve greater numbers and types of owners than S corporations Contributions (distributions) of property to (from) S corporations are more likely to result in taxable gain than contributions (distributions) to (from) partnerships 11-6 LLCs Provide the limited liability not available to general partners, without the participation restrictions of limited partners Membership unrestricted versus S corporation shareholder restrictions Special allocations possible Contributions and distributions of property subject to partnership treatment versus S corporation treatment 11-7 Closely-Held Corporations as Tax Shelters Avoid double taxation by distributing cash flow in tax-deductible or nontaxable ways salary payments, interest and principal on debt Potential benefactors: high-income taxpayers willing to reinvest after-tax cash flow from business activities goal: obtain tax benefit from lower corporate tax rates on initial increments of business taxable income defer second level of tax into the future by avoiding dividend distributions 11-8 Issues for Closely-Held Corporations Constructive Dividends - Indirect distributions of earnings treated as dividends for income tax purposes examples: excessive compensation, loans which are never repaid intent: prevent owners of closely-held corporations from avoiding double taxation by taking cash out of the business disguised as deductible or nontaxable payments 11-9 Issues for Closely-Held Corporations continued Accumulated Earnings Tax - penalty tax on accumulations of earnings beyond ‘reasonable needs’ of the business tax rate of 38.6% intended to discourage retention of funds not reinvested in business activities Personal Holding Company Tax - penalty tax on undistributed income of a PHC tax 11-10 rate of 38.6% PHCs not subject to Accum. Earnings Tax Income Shifting As previously discussed, the progressive nature of our tax rate system creates incentive to shift income to (usually related) taxpayers subject to lower marginal tax rates Strategies for income shifting in closely-held businesses: gift partnership interests or shares of stock to children or other family members employ children/family members in the business activity 11-11 Limits on Income Shifting Assignment of income doctrine - income is taxed to the provider of services or owner of capital generating the income if a partnership business is based on services provided by partners, a gift of a partnership interest to non-service providers will be ineffective Kiddie tax - unearned income of children under 14 taxed at parents’ marginal tax rate 11-12 Limits on Income Shifting continued Controlled groups - corporate progressive rate schedule applied only once to entire group parent-subsidiary controlled group - applies even if consolidated return not filed brother-sister controlled group exists if 5 or fewer individuals control 2 or more corporations Sec. 482 - gives IRS authority to re-allocate income of businesses under common control as necessary to prevent tax evasion 11-13