Options for Organizing Small and Large Businesses

advertisement

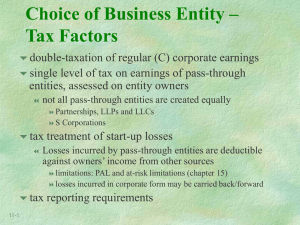

Chapter 5 Sections 5.6 – 5.10 Small Business and Forms of Business Ownership Learning Objectives 1 Discuss why most businesses are small businesses. 5 Outline the forms of private business ownership. 2 Determine the contributions of small businesses to the economy. 6 Describe the public and collective ownership of business. 3 Discuss why small businesses fail. 7 Discuss organizing a corporation. 4 Identify the available assistance for small businesses. 8 Explain what happens when businesses join forces. Chap 5 Sec 1-5 Chap 5 Sec 6-10 Franchising Using another company’s established business model Can reduce the amount of time and effort to succeed Agreements can be complicated Initial start up fees & set up costs SUBWAY $116,000 McDonald’s $1,000,000 Franchise fees – set amount or percentage Restrictions to pricing and offerings Discuss Anytime Fitness Takes Top Franchise Spot from page 127 Forms of Private Business Ownership Figure 5.4 Forms of Business Ownership Sole Proprietorship Pros Cons Simplest Personally responsible for all debts & liabilities Most flexible Owner could lose personal & business assets Easiest to start Partnership Pros Cons All partners share profits equally All partners share losses equally Partners can agree to different Each partner is fully distribution responsible for all liabilities One partner can bind the other partners in contracts Corporation Pros Cons The corporation makes the money and pays the taxes The corporation loses and owes the money The corporation is liable – not The corporation owns the assets – the individual owners not the individual owners Owners cannot lose more than they actually invest Expensive to start up – need approval from the state More accounting and double taxation Types of Corporations • For Profit & Not-for- Profit • Domestic – chartered in a particular state • Foreign – does business in one state but is chartered in another state • Alien – chartered in another nation May choose to incorporate in a different state for simplicity or tax incentives Types of Corporations S Corporation Limited Liability Companies Employee-Owned Corporations Read pages 145-147 Corporate Charter Organizing a Corporation Stockholders – acquire stocks in exchange for ownership Preferred Stock & Common Stock May receive dividends Board of Directors – elected by stockholders to oversee corporation – they also decide if/when to distribute dividends Corporate Officers & Management – make major corporate decisions and handle ongoing operations Read Solving an Ethical Controversy: Do Some CEPs Earn Too Much? On page 151 When Businesses Join Forces Mergers and Acquisitions (M&A) Merger – combination of two or more firms to form one company Acquisition – procedure in which one firm purchases the property and assumes the obligations of another Joint Venture – partnership between companies for a specific purpose Seventh Generation Show End of Chapter Video Forms of Business Assignment Review Questions - pg 156 Answer questions 6 and 7 Projects and Teamwork Applications – pg 156 Answer question #2 Web Assignments – pg 156 Answer question #1 or #3 Type your answers to the four questions. Include the section and question number. You do not need to include the actual question.