Chapter Seven

Chapter Seven

Business Organization

The Three Types of Business

Organization

Sole Proprietorship

Partnerships

Corporations

Sole Proprietorship

If you alone own and control the service.

Opportunity Benefits of Sole

Proprietorships

Owner has direct control

Small initial investment

Owner receives all profits

Owner can dissolve business when necessary.

Opportunity Costs of Sole

Proprietorships

All losses are borne by owner

Difficulty in raising financial capital

Limited growth potential

Only one person in authority

Lack of longevity

Unlimited liability

Partnerships

A business owned and controlled by two or more people.

REMEMBER!

Partnerships don ’ t have to be just two people.

JC Penney: The man with a thousand partners.

Two forms of partnerships

General Partnerships:

Equal decision making.

Limited Partnerships:

Partners join as investors, offering capital, but little, if any, role in decision making.

VENTURE

CAPITALISTS

Advantages of Partnerships

Two or more individuals own the business.

Specialization

Losses are shared by partners.

More money is available to invest in business

Sharing management responsibilities

Taxes are shared by partners

Disadvantages of

Partnerships

Division of authority

Unlimited liability.

Difficulty in raising additional capital.

Lack of longevity.

Legal complications when there is a change in ownership.

Advantages of Corporations

Limited liability.

Easy to raise needed capital.

Business owned by a group of individuals.

Responsibilities for running the business divided among many individuals

Easy change in ownership and business continues as long as it makes profits. – LONGEVITY.

Disadvantages of

Corporations

Corporate charters are $$$

Federal and state govts. monitor corporations more.

***Slow process of decision making.

Corporations

Legally distinct from their owners and treated as if individuals.

Corporations can

Own property

Hire workers

Make contracts

Pay taxes

Sue and be sued

Make and sell products.

What kind of companies are organized as corporations?

USUALLY – food, steel, oil companies are corporations.

Insurance companies, supermarket chains, major companies.

Forming a corporation

When expansion calls for more than adding more partners.

GET A LAWYER!

Forming a corporation:

Lawyer applies for a state license:

ARTICLES OF

INCORPORATION.

Reviewed by state officials. If all in order they grant

CORPORATE

CHARTERS

Corporate Structure

The corporate charter identifies the officers.

Chairman of the board – symbolic head of the corporation.

CEO – Chief

Executive Officer – the REAL power.

Corporate Structure

Board of Directors – people from inside or outside the company.

Key decision making body.

Decide on product lines.

Hires / fires corporate officers to do the day-today running of the corporation.

Sees that boards policies are carried out.

Corporate Finances

Most common way to raise money is selling STOCK.

STOCK – represents ownership of the firm.

Ownership is issued in portions called

SHARES.

Corporate finances

If you buy 100 shares of stock in a company, you own

100 pieces of that company. If that company has a total of 10,000 shares available – you own

1% of the company.

Why own stock?

DIVIDENDS – profits on your investment.

PREFERRED

STOCK – guarantees dividends.

COMMON STOCK – potential for dividends.

Why own stock?

SOMETIMES can make more money for you.

The “ fun ” of being involved with a corporation or a product.

Benefits for stockholders

Flexibility of ownership.

Limited liability.

Can ’ t be sued for corporate problems.

If the corporation folds, you only lose what you invested.

Private assets can ’ t be seized.

The trade-off

Common stock ownership allows a

“ voice ” on how the company is run.

Preferred stock does not.

IMPORTANT ADVICE TO FUTURE

CORPORATE HEADS!!!

ALWAYS hold or directly control 51% of your company ’ s stock.

OR have a lack of control at annual shareholder meetings.

You can lose your job!

Other disadvantages!

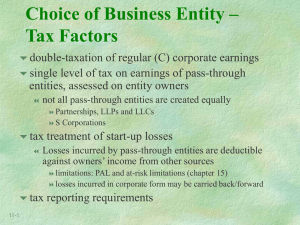

If you own stock, corporate profits are taxed twice.

You pay taxes as being a member of the corporation.

You pay taxes on the profits / dividends you take.

The corporation raises money

If there are thousands of shareholders, there is enormous amounts of money through the sale of stock.

eBay has 6,643,058 shares available.

Other ways corporations raise

$$.

Corporate bonds.

You loan your money to the company.

You DO NOT own the company.

Repaid the principal and the interest.

Principal – the actual money borrowed.

Interest – the price you gave to that principal.

Example of Corporate Bonds

You hold a 1 year

$1,000 bond.

At the end of the year you are paid back the $1,000 principal AND the

5% ($50) interest.

Corporate Combinations

Most corporations seek to expand.

Build new facilities

Legally combines with another enterprise.

MERGERS!

Three types of Mergers

(corporate combinations)

Horizontal

Vertical

Conglomerate

Horizontal Combination

Buying up companies involved in the same industry.

THINK STANDARD

OIL – John D.

Rockefeller.

Horizontal combinations

All the companies merging do the same thing.

Standard Oil: all the companies

Rockefeller bought, processed oil into gas.

Vertical Combination

A merger between two or more companies involved in different production phases of the same good or service.

THINK US STEEL /

Andrew Carnegie.

Conglomerate Combinations.

Merger of companies producing unrelated products.

Subsidiaries.

Started in the

1960s.

B H

Acme Brick Company

Ben Bridge Jeweler

Johns Manville

Jordan's Furniture

Benjamin Moore & Co.

Justin Brands

Berkshire Hathaway Group Larson-Juhl

Berkshire Hathaway

Homestates Companies

McLane Company

Borsheim's Fine Jewelry

MidAmerican Energy

Holdings Company

Buffalo NEWS, Buffalo NY MiTek Inc.

Clayton Homes

CORT Business Services

Nebraska Furniture Mart

NetJets®

The Pampered Chef®

CTB Inc.

Fechheimer Brothers Company Precision Steel Warehouse, Inc.

FlightSafety

Fruit of the Loom®

Garan Incorporated

RC Willey Home Furnishings

Scott Fetzer Companies

See's Candies

GEICO Direct Auto

Insurance

General Re

Shaw Industries

Helzberg Diamonds

Star Furniture

United States Liability

Insurance Group

H.H. Brown Shoe Group

Wesco Financial

Corporation

International Dairy Queen,

Inc.

XTRA Corporation

Opportunity Benefits of

Combinations

Efficiency – centralized decision making.

Potential lower costs.

Easier to acquire financial capital.

Opportunity Costs of

Combinations

Can lead to unemployment

(don ’ t need to double the jobs)

Reduced competition in the market place.

MONOPOLIES.

Franchises

One company agrees – for a fee – to let another person or group set up a

FRANCHISE.

Have to uphold the reputation of the parent company.

Get training and advertising.

Cooperatives

Co-ops – businesses owned by their members.

Membership gives privileges.

Cooperatives

Nonprofit Organizations

Does not focus on financial gain and profits.

Business organization but pursues other goals.

Income isn ’ t taxed.

D