File

advertisement

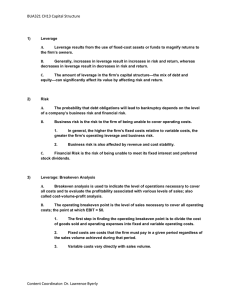

BUA321 CH13 Capital Structure Chapter 13 Study Guide 1. What is the risk return value rule? If risk increases, investors want more returns, so new investors would pay a lower price. Risk up, required return up, value down 2. What is capital structure? Long-term financing 3. What is leverage? The magnification of risk that is realized when we add fixed cost operations and financing to the corporation. a. Describe business risk. The chance that you will be unable to meet the operating obligations of the firm. Created by fixed costs of operations b. Describe financial risk. The chance that you will not be able to meet the financing obligations of the firm. Borrowing and using preferred stock 4. What does break-even mean? Find the point where profits (primarily EBIT) are zero. Helps analyze risk levels of current choices. Can also see what future decisions will have on risk. a. How does this relate to risk? Sets the level of must do performance to get to zero profit. The higher the level the harder to make profit. b. What is contribution margin? P – VC The profit per unit that first covers fixed costs, then designates the profit per unit after FC are covered. Content Coordinator: Dr. Lawrence Byerly BUA321 CH13 Capital Structure 5. The company currently sells the Widget Pro for $17. The variable costs are $12 per unit. The company currently has modest fixed costs of $500. The managers are proposing the purchase of a new piece of machinery that will reduce variable costs to $9. The fixed costs will increase to $2,000. i. What is the break-even point currently? 100 units 100 * 17 - 100 * 12 -500 = 0 Price per Unit Variable Cost per Unit Fixed Costs of Operation Units of Production Interest Expense Preferred Dividends Tax Rate EBIT $ $ $ Break-Even Units ii. What is the proposed break-even? 250 units 6. What is DOL? DFL? DTL? Degree of operating leverage – business risk Degree of financial leverage – financial leverage Degree of total leverage – combined effect Content Coordinator: Dr. Lawrence Byerly 17.00 12.00 500.00 100.00 100.00 BUA321 CH13 Capital Structure Assume that Don Donuts utilizes a new donut hole machine to create edible wonders. This machine will reduce variable costs to 25 cents per hole. The fixed costs of the new operation is $4,000. The donut holes currently sell for 75 cents each. In the last year, Don sold 12,000 Donut holes. What is the new break-even point for the company? What is the estimated EBIT if sales repeat themselves? What is the DOL? Price per Unit Variable Cost per Unit Fixed Costs of Operation Units of Production Interest Expense Preferred Dividends Tax Rate EBIT Break-Even Units $ $ $ 0.75 0.25 4,000.00 12,000.00 $ 2,000.00 15.00% 4,999.81 8,000.00 Content Coordinator: Dr. Lawrence Byerly Degree of Operating Leverage Degree of Financial Leverage Degree of Total leverage 3.00 1.67 5.00 BUA321 CH13 Capital Structure Don’s current interest expense is $2,000. The company’s tax rate is 15%. What is the DFL and DTL? 7. What is the debt ratio? TIE ratio? Amount of debt used to by assets Ability to pay interest expense. 8. What is the goal of the financial manager? Maximize shareholder wealth 9. Describe how a tax shield works. Taxes reduce the amount of taxes that need to be apid. 10. Discuss this formula. V FCF ka Free cash flow Ka = wacc Content Coordinator: Dr. Lawrence Byerly BUA321 CH13 Capital Structure How can you increase the stock price? 11. Scenario a. World with NO taxes i. Who cares? ii. What happens if we change the capital structure? No one cares. No taxes. If a company pays you $100, do you care if they call it a dividend payment or an interest payment? What about the company? As we switch to less expensive debt, the cost of equity keeps pace and the WACC dos not change. b. World with Corporate Taxes i. Who cares? ii. What happens if we change the capital structure? Corporate taxes. If a company pays you $100, do you care if they call it a dividend payment or an interest payment? What about the company? The tax shield provides a benefit to the company. 12. How does the chance of bankruptcy change the amount of debt a company will take? This adds a cost to borrowing. It increases as we borrow more. Content Coordinator: Dr. Lawrence Byerly BUA321 CH13 Capital Structure 13. Capital Structure problem a. The Sunshine Vacation Company, is preparing to make a capital structure decision. It has obtained estimates of sales and the associated levels of earnings before interest and taxes (EBIT) from its forecasting group: There is a 30% chance that sales will total $600,000, a 40% chance that sales will total $900,000, and a 30% chance that sales will total $1,200,000. Fixed operating costs total $300,000, and variable operating costs equal 40% of sales. These data are summarized, and the resulting EBIT calculated, in the following table: b. Currently the company has no debt and $1,000,000 in common stock. There are 40,000 shares selling at $25. Taxes are currently 40% at the margin. What does the current capital structure look like? c. Show the range of capital structures that are possible. Est Capital Structure (000's) Debt Ratio Total Assets Debt Equity Shares 0.00% $1,000,000 $0 $1,000,000 40000.00 10.00% $1,000,000 $100,000 $900,000 36000.00 15.00% $1,000,000 $150,000 $850,000 34000.00 30.00% $1,000,000 $300,000 $700,000 28000.00 45.00% $1,000,000 $450,000 $550,000 22000.00 50.00% $1,000,000 $500,000 $500,000 20000.00 60.00% $1,000,000 $600,000 $400,000 16000.00 d. The company has been given the following interest rate structure for borrowing. Prepare an interest expense schedule. Debt ratio 0 10 15 30 45 50 60 Content Coordinator: Dr. Lawrence Byerly Cost of debt 0% 6% 8% 10% 13% 15% 17% BUA321 CH13 Capital Structure Interest Rates Debt Ratio Debt Rate Interest Expense 0.00% $0 0.00% 0.000 10.00% $100,000 6.00% 6,000.000 15.00% $150,000 8.00% 12,000.000 30.00% $300,000 13.00% 39,000.000 45.00% $450,000 13.00% 58,500.000 50.00% $500,000 15.00% 75,000.000 60.00% $600,000 17.00% 102,000.000 e. What is the worst-case scenario for EPS? Average? Best? CTRL+SHIFT+B = MAIN MENU Lawrence Byerly PhD © 2013 Worst Debt Ratio Interest Expense EBT Taxes NI EPS 0.00% $0 $60,000.00 $24,000.00 $36,000.00 $0.9000 10.00% $6,000 $54,000.00 $21,600.00 $32,400.00 $0.9000 15.00% $12,000 $48,000.00 $19,200.00 $28,800.00 $0.8471 30.00% $39,000 $21,000.00 $8,400.00 $12,600.00 $0.4500 45.00% $58,500 $1,500.00 $600.00 $900.00 $0.0409 50.00% $75,000 -$15,000.00 -$6,000.00 -$9,000.00 -$0.4500 60.00% $102,000 -$42,000.00 -$16,800.00 -$25,200.00 -$1.5750 Average Debt Ratio Interest Expense EBT Taxes NI EPS 0.00% $0 $240,000.00 $96,000.00 $144,000.00 $3.60 10.00% $6,000 $234,000.00 $93,600.00 $140,400.00 $3.90 15.00% $12,000 $228,000.00 $91,200.00 $136,800.00 $4.02 30.00% $39,000 $201,000.00 $80,400.00 $120,600.00 $4.31 45.00% $58,500 $181,500.00 $72,600.00 $108,900.00 $4.95 50.00% $75,000 $165,000.00 $66,000.00 $99,000.00 $4.95 60.00% $102,000 $138,000.00 $55,200.00 $82,800.00 $5.18 Best Debt Ratio Interest Expense EBT Taxes NI EPS 0.00% $0 $420,000.00 $168,000.00 $252,000.00 $6.30 10.00% $6,000 $414,000.00 $165,600.00 $248,400.00 $6.90 15.00% $12,000 $408,000.00 $163,200.00 $244,800.00 $7.20 30.00% $39,000 $381,000.00 $152,400.00 $228,600.00 $8.16 45.00% $58,500 $361,500.00 $144,600.00 $216,900.00 $9.86 50.00% $75,000 $345,000.00 $138,000.00 $207,000.00 $10.35 60.00% $102,000 $318,000.00 $127,200.00 $190,800.00 $11.93 Content Coordinator: Dr. Lawrence Byerly BUA321 CH13 Capital Structure EPS Debt Ratio Worst Average $0.90 $3.60 $6.30 10.00% $0.90 $3.90 $6.90 15.00% $0.85 $4.02 $7.20 30.00% $0.45 $4.31 $8.16 45.00% $0.04 $4.95 $9.86 50.00% -$0.45 $4.95 $10.35 60.00% -$1.58 $5.18 $11.93 0.30 0.40 0.30 Probability f. Best 0.00% Utilize the following table of costs of equity to complete the capital structure question. The company has a steady cost of equity until a breaking point at 30%. Debt ratio 0 10 20 30 40 50 60 Cost of equity 12% 12% 12% 13% 14% 16.5% 19% g. What is the optimal capital structure for the firm? Is that level also the maximum EPS? What is the risk level at that point? Debt Ratio Expected EPS Standard Deviation Coefficient of Var. Est. Share Price 0.00% $3.60 $ 2.091 $ 0.581 $30.000 10.00% $3.90 $ 2.324 $ 0.596 $32.500 15.00% $4.02 $ 2.460 $ 0.612 $33.529 30.00% $4.31 $ 2.988 $ 0.694 $33.132 45.00% $4.95 $ 3.803 $ 0.768 $35.357 50.00% $4.95 $ 4.183 $ 0.845 $30.000 60.00% $5.18 $ 5.229 $ 1.010 $27.237 This is an important table. What is the debt ratio for maximized profit? Maximized value? Shows that maximizing profit does not necessarily maximize stock price. Content Coordinator: Dr. Lawrence Byerly BUA321 CH13 Capital Structure 14. Describe asymmetric information. Unequal information. Who should know most about what goes on in the corporation. What things would we like to know but do not want to know?? 15. How do managers send signals? What does borrowing say about the future? What does issuing stock say? Content Coordinator: Dr. Lawrence Byerly BUA321 CH13 Capital Structure BUA321 CH13 exercise HW (47 points) _______ Internet (15 points) ______ Use the EPS – EBIT worksheet to complete the information below: Worst Average Probability Sales Best 0.15 0.5 0.35 $70,000 $100,000 $150,000 VC is 40% of sales; fixed costs are $15,000 Interest Rates Debt Ratio Current Capital Structure (000's) Rate 0.00% 0.00% 10.00% 6.00% 15.00% 8.00% 30.00% 10.00% 45.00% 13.00% 50.00% 15.00% 60.00% 17.00% Long Term Debt Common Stock Book Value of Stock Taxes Content Coordinator: Dr. Lawrence Byerly $450,000 $5.50 35.00% Debt Ratio (weight) Cost of Equity a. (3) $0 0.00% 10.00% 10.00% 10.00% 15.00% 10.00% 30.00% 12.00% 45.00% 14.00% 50.00% 16.00% 60.00% 19.00% BUA321 CH13 Capital Structure Probability 0.30 0.40 0.30 EBIT b. (5) Debt Ratio Amount of Debt Amount of Equity Amount of Debt Before Tax Cost of Debt Number of Shares of Common Stock* 0% 15% 30% 45% 60% c (5) Debt Ratio 0% 15% 30% 45% 60% d. (9) Cut and paste table from Excel Worst Scenario Average Scenario Best Scenario Content Coordinator: Dr. Lawrence Byerly Annual Interest BUA321 CH13 Capital Structure e. statistics and share price (5) cut and paste from excel Debt ratio Expected EPS Standard deviation CV Price 0 15 30 45 60 f. (10) (1) copy and paste graph with EBIT and EPS (2) create a graph showing the relationship between the debt ratio and the EPS. Copy and paste here. g) (10) describe what the 2 graphs are illustrating. Content Coordinator: Dr. Lawrence Byerly BUA321 CH13 Capital Structure BUA321 CH13 Research 1) Debt in companies. (15) Go to www.smartmoney.com Enter your company’s ticker symbol and go to key statistics. IN the table below record the data. Then repeat the exercise for the other companies listed> Name Ticker symbol ROE LT Debt to Equity Your company DIS AIT MRK LG LUV TAP GE BUD PFE What conclusions do reach about the amount of debt for these companies and the return to the shareholders? Content Coordinator: Dr. Lawrence Byerly BUA321 CH13 Capital Structure 2) Using the financial statements you gathered in Chapter 1. (6) Company name Ticker Symbol Calculate the company’s DOL, DFL DTL Content Coordinator: Dr. Lawrence Byerly