Advanced Manufacturing

advertisement

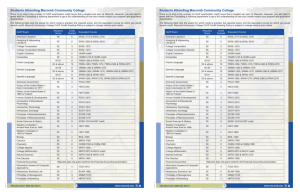

Macomb County, Michigan Targeted Industries Study August 2006 – Presentation to Focus Macomb Targeted Industries Study • Part 1 Targeted Industry Focus • Part 2 Branding and Marketing Macomb 2 “98% want to attract new business, but 70% have no written business attraction plan” International City/County Management Association, Economic Development Survey 2004 Study Objectives …for targeted growth. Business Retention & Expansion Organic Growth Leap Growth … to economic opportunity What industries or business sectors would Macomb be most closely aligned with? Primary & secondary targets Mapping Macomb’s assets… What does Macomb have to offer? What strengths can be leveraged? 4 …for targeted growth. Business Retention & Expansion Organic Growth Leap Growth: *Advanced manufacturing *Alternative Energy *Bio-chemistry *Homeland Security/Defense *Medical/Healthcare “An economic entity that exists on its own, but draws strength from regional partnership and collaboration” (Personal interview/Internal Macomb, 03/06) Macomb County Business Retention & Expansion Organic s Growth Leap Growth 5 Targeted Industries Study Mapping Macomb’s Assets 6 % Distribution of Employment in Macomb County vs. other regions Construction Wholesale trade Transportation & warehousing Finance & insurance Professional, scientific & technical services Educational services Manufacturing Retail trade Information Real estate & rental & leasing Admin, support, waste mgt, remediation services Health care and social assistance Total MI Macomb Wayne Oakland 0% 20% 40% 60% 80% 100% 7 Source: U.S. Census Bureau, U.S. County Business Patterns, 2003 Mapping Current Employment As % of Total Macomb Employment Manufacturing Leverage Healthcare & Social Assistance Retail Trade Professional & Business Srvs., Mgmt. Scientific & Technical Consulting Low Finance, Insurance, Real Estate Develop Construction Wholesale Transportation & Warehousing Information Agriculture U.S. Projected Growth for Industry 8 Mapping Macomb Current Employment As % of Total Macomb Employment Enhance/Expand Leverage Manufacturing Healthcare & Social Assistance Retail Trade Low Finance, Insurance, Real Estate Wholesale Agriculture Construction Develop Professional & Business Srvs., Mgmt. Scientific & Technical Consulting Information Transportation & Warehousing U.S. Projected Growth for Industry 9 Internal Perspectives • A survey of Macomb County business (Mar. 2006) identified key “drivers” in their decision to choose Macomb: 1. 2. 3. 4. Geographic proximity Proximity to markets and customers Availability/cost of land/buildings Skilled workforce (only mentioned by manufacturing segment) • Perceived “good business environment”: 63% of businesses surveyed rated Macomb “very good” to “excellent” as a place to do business. • Optimistic growth outlook: 60% of manufacturing companies anticipate needing “manufacturing skilled trade” and 50% anticipate needing engineering skills for continued growth. 10 How would you rate Macomb as a place to do business? Very good to Excellent 0% M anufacturing Construction 10% 20% 30% Satisfactory 40% 50 Finance Other 60% 70% 80% 90% 40 60 20 Healthcare/Social Assist. Wholesale 50% Not good to poor 80 56 10 20 20 32 73 75 Source: Intellitrends LLC, Macomb County Business Insight Study, 03/06 100% 0 12 27 25 0 0 11 How would you rate Macomb as a place to do business? Very good to Excellent 0 10 20 30 Satisfactory 40 Geographic location 73 Quality of life 72 69 69 Lifestyle infrastructure Proximity to markets Skilled workforce Business services infrastructure Availability of land Support infrastructure Cost of land Grants, other funding 27 25 36 28 29 33 44 36 19 16 11 80 17 24 23 37 35 Cost of labor 70 20 56 52 45 Education infrastructure Availabilty of tax incentives 60 64 61 57 Proximity to suppliers Taxes 50 45 23 25 Source: Intellitrends LLC, Macomb County Business Insight Study, 03/06 90 100 Highest rated: Geographic location Quality of life Lifestyle infrastructure Proximity to markets Proximity to suppliers Lowest relative rated: Grants, funding Tax incentives Taxes Cost of land Cost of labor 12 Industry Situation: Manufacturing – Going Global Economic Perception of your business over PAST 3 years? Total Business Manufacturing Positive Growth 35% 40% Unchanged 17% 10% Decline 41% 40% Markets 1. Quality products & services 2. Competitive pricing/cost 3. Engineering capabilities 1. Competitive pricing/cost 2. Cost of labor 3. Skilled workers Total Manufacturing 10% Local Michigan 37% 60% serve national/global markets 30% 33% Midwest region 25% National U.S. 13% 35% Global 12% 0% 10% 20% Source: Intellitrends LLC, Macomb County Business Insight Study, 03/06 30% 40% 50% 60% 70% 13 Optimistic Employment Outlook Over the NEXT 3 YEARS, how do you anticipate your Macomb employee base will change? Decrease # of em ployees (decrease in business) Decrease em ployees (increase productivity) No change Will add em ployees 0% Total Manufacturing 20% 12% 7% 15% Finance Healthcare 60% 31% 15% 80% 25% 25% 13% 0% 13% 20% Source: Intellitrends LLC, Macomb County Business Insight Study, 03/06 100% 48% 35% 60% Construction Wholesale 40% 40% 38% 38% 13% 60% 80% 14 What are the primary skill areas you anticipate needing for continued growth? Manufacturing Total 33% Manufacturing skilled trades 60% 37% Technology/IT (CAD, Network, Programming, Tech support) 15% Total Manu. 35% 35% Operations/Planning (Mgmt., Financial, Acct'g, Marketing) 19% Medical 5% Strong 36% 30% Moderate 25% 30% Limited 20% 10% Scarce/Not at all/DK 19% 30% 29% Engineering (R&D, Electrical, Mechanical, Chemical, Civil) 0% How would you assess the current availability of those skills in Macomb’s employee base? 50% 10% 20% 30% 40% 50% Source: Intellitrends LLC, Macomb County Business Insight Study, 03/06 60% 70% 15 Targeted Industries Study External Dynamics 16 Key Drivers for Business Relocation/Development • U.S. CEO’s surveyed in March 2006 identified the 7 most important issues in choosing where to do business: 1. Workforce quality 2. Labor costs (including wages, Healthcare, Workers Comp.) 3. Taxes 4. Regulation 5. Infrastructure 6. Quality of Life 7. Political Environment Source: CEO Magazine, March 2006 17 Geographic Migration of Projects in U.S. New Mfg. as a % of total U.S. Total facilities as a % of total U.S. #1 State in the Region for Growth based on % of total projects New England region 0.7% 0.7% #1 Massachusetts 13.0% Middle Atlantic region #1 Pennsylvania 10.1% 21.8% East North Central region 27.7% 10.0% 8.3% West North Central region #1 Minnesota 23.9% 21.8% South Atlantic region 12.3% West South Central region Pacific region #1 North Carolina 12.7% #1 Alabama 12.6% #1 Tennessee East South Central region Mountain region #1 Ohio #1 Texas 16.1% 2.0% 1.0% #1 Arizona 3.6% #1 Washington 1.7% 18 Geographic Migration of Projects in U.S. Top 10 Total Projects 2005 Top 10 Total manufacturing (NEW & EXPANSION) 1.Texas 2.Ohio 3.Illinois 4.Michigan 5.North Carolina 6.Pennsylvania 7.New York 8.Tennessee 9.Virginia 10.Georgia 1.Ohio 2.Michigan 3.Tennessee 4.North Carolina 5.Texas 6.Kentucky 7.Pennsylvania 8.Alabama 9.New York 10.Georgia Top 10 Total NEW manufacturing Top 10 Total Mfg. (OTHER facilities) 1.Ohio 2.North Carolina 3.Texas 4.Pennsylvania 5.Georgia 6.Michigan 7.New York 8.Illinois 9.Alabama 10.Kentucky 1.Texas 2.Illinois 3.Michigan 4.Ohio 5.North Carolina 6.New York 7.Pennsylvania 8.Virginia 9.Indiana 10.Florida Source: Conway Data Inc.’s New Plant Database/Site Selection On-line, March 2006 *Other facilities includes offices, headquarters, distribution centers, R&D, mixed use facilities & hotels 19 Manufacturing Drivers • NAM Survey (March 2006) • One in two manufacturers plans to increase employment in 2006 • 47% will hire skilled workers for production jobs • In terms of site selection, manufacturing companies globally are also paying more attention to: • • • • Proximity to institutions of higher learning Customized training programs Availability of incentives Keeping workers up to speed with the latest technologies 20 Mapping Macomb Attributes Differentiator •1.) Skilled Workforce/Resources, 2.) Infrastructure; 3.) Business Environment and 4.) Government Support Cost of labor Branding Initiatives Specific manufacturing skills Grants, funding, tax incentives Ability to attract scientists & engineers/research universities Importance to Site Selection Media Attention Parity Focus Opportunities Development Initiatives Partnerships with education Skilled manufacturing talent Regional Resources Low taxes County economic health Geographic proximity to Strong Automotive Image customers, markets, suppliers Recognized business & Training to meet needs Availability of land/bldgs industry champion Technology transfer Utilities cost & capacity Gov’t willing to Avg. educational Levels collaborate/work with Coordination with regional Ability to attract & business partner/collaboration retain youthful population Strong work ethic Dedicated funding for economic development Significant Customer Segments (TACOM, Defense) Population gain Zoning Vision Quality of life (housing, low cost of living, low crime) Presence of small support businesses Progressive culture – outlook/understanding Evaluation of new markets, opportunities Local competition Pursuit of funding for training, growth Eliminating hurdles Perceived Weakness Strong support for startups/small business Longevity of residents Racial/religious diversity Macomb Attribute Targeted Marketing Perceived Strength Targeted Industries Study Vision & Synergies in Growth 22 Projected Growth & Emerging Sectors U.S. Dept. of Labor: High Employment Growth Industries Key Industries in Michigan (MEDC) Automation Alley Technology Clusters Advanced Manufacturing Advanced Manufacturing Advanced Manufacturing Aerospace Advanced Automotive Advanced Automotive/ Automotive Plastics Chemical & Materials Biotechnology Life Sciences Info Technology Construction Chemicals & Materials Life Sciences (Biotech, Pharma) Alternative Energy Agriculture Homeland Security Financial Food Processing Alternative Energy Healthcare Homeland Security Homeland Security Info Technology Geospatial 23 Regional Resources in Macomb Macomb employment in each sector as a % of 8 county region sector employment Macomb is 30 •14% of total employment in the 8 county region •16% of total employment in the 8 county region Technology Cluster 25 20 15 10 5 0 % of 8 county sector Total employment Total "Technology Industry" Advanced Automotive Advanced Manufacturin g Chemical & Material 13.9 15.8 19.3 22.5 15.4 Information & Life Sciences Technology 5.4 8.9 Other Technologies 19.3 Source: 2003 County Business Patterns, U.S. Census Bureau/Anderson Economic Group, Automation Alley’s First Annual Technology Industry Report, 2005 24 Collaborating and Differentiating within the Region Collaborate Regionally Presence in 8 county Region (employment contribution to cluster) Supporting Areas Advanced Automotive Alternative Energy Information Technology Geographic Niche Clusters Primary Differentiation for Macomb Life Sciences/ Defense Biotechnology Advanced Manufacturing Chemicals & Materials Homeland Security Presence in Macomb County (employment contribution to cluster) 25 Advanced Manufacturing Macomb % contribution to the 8 County Region Technology Cluster : 23% Advanced Manufacturing 3329 Other Fabricated Metal Product Manufacturing 3331 Agriculture, Construction, and Mining Machinery Manufacturing 3332 Industrial Machinery Manufacturing 3333 Commercial and Service Industry Machinery Manufacturing 3336 Engine, Turbine, and Power Transmission Equipment Manufacturing 3339 Other General Purpose Machinery Manufacturing 3345 Navigational, Measuring, Electro-medical, and Control Instruments Manufacturing 3353 Electrical Equipment Manufacturing 3359 Other Electrical Equipment and Component Manufacturing 3364 Aerospace Product and Parts Manufacturing 3369 Other Transportation Equipment Manufacturing Sources: www.doleta.gov/BRG •2003 survey of U.S. manufacturing employers found that 80% of respondents said that they had a serious problem finding qualified candidates for the highly technical world of modern manufacturing (National Association of Manufacturing) 26 Advanced Manufacturing • • • • • • • • • • • • • • • Advanced manufacturing technologies (AMTs) involve new manufacturing techniques and machines combined with the application of information technology, micro electronics and new organizational practices within the manufacturing sector. Flexible manufacturing cells or systems Robotics High-speed machining Supervisory control and data acquisition (SCADA) Automated sensor-based inspection/testing systems Automated vision systems Lasers used in material processing Distributed control systems Rapid prototyping systems Computer-aided design/engineering software (CAD/CAE) Programmable logic controllers (PLCs) Use of inspection data in manufacturing control MRP or Enterprise Resource Planning (ERP) software Automated parts identification (i.e. bar coding) Modeling or simulation techniques 27 Advanced Manufacturing Employment 2003 Advanced Manufacturing employment in Macomb - % distribution within sector (compared to Michigan) 40% Michigan Macomb 40% of employment in this cluster is “machinery manufacturing” 35% 30% 25% 20% 15% 10% 5% 0% O t her F ab r i cat ed M et al Pr o d uct A g r i cul t ur e, C o nst r uct i o n, and M i ni ng I nd ust r i al M achi ner y M anuf act ur i ng C o mmer ci al and Ser vi ce I nd ust r y Eng i ne, T ur b i ne, and Po w er O t her G ener al Pur p o se M achi ner y N avi g at i o nal , M easur i ng , El ect r o med i cal M i chi g an 19 . 7% 2 .8 % M aco mb 3 4 .9 % 1. 9 % El ect r i cal Eq ui p ment M anuf act ur i ng O t her El ect r i cal Eq ui p ment and A er o sp ace Pr o d uct and Par t s O t her T r ansp o r t at i o n Eq ui p ment 9 . 1% 2 . 7% 10 . 0 % 2 5. 8 % 7. 2 % 2 .2 % 4 .3 % 2 7. 0 % 12 . 6 % 4 . 5% 5. 5% 4 .9 % 2 .4 % 3 .3 % 10 . 5% 2 . 1% 4 .2 % 2 .4 % Source: 2003 County Business Patterns, U.S. Census Bureau/Anderson Economic Group, Automation Alley’s First Annual Technology Industry Report, 200528 Machinery & Equipment Industry Business Location Drivers • Rising shipping costs, particularly for sectors that must transport massive machines, will see many firms investing in plants closer to the customer • Finding the right work force will play an equally important role • Factories now need highly trained workers – decisions could hinge on a state of locality’s commitment to work force training – New York State and St. Louis region are two areas that have made a significant commitment to the type of technical workforce training initiatives that machining and equipment manufacturing firms will need n the 21st center Sources: www.siteselection.com, On the Rebound, March 2005 29 Advanced Automotive Advanced Automotive has been identified as the new sector, defining an industry not by what is made but how it is made. This new advanced automotive sector is defined by hundreds of advanced technology initiatives in energy, safety and materials that improve vehicle quality, safety and extend longevity. •Pinpointed as one of the President’s High Growth Employment Industries Advanced Automotive 3361 Motor Vehicle Manufacturing 3362 Motor Vehicle Body and Trailer Manufacturing 3363 Motor Vehicle Parts Manufacturing •Employment is expected to grow more rapidly in firms that manufacture motor vehicle parts, bodies and trailers than in firms that make complete vehicles •Creates 6.6 million direct and spin-off jobs. For every worker directly employed by an automaker, nearly 7 spin-off jobs are created Macomb % contribution to the 8 County Region Technology Cluster : 19% 30 Advanced Automotive • Body & Exterior – Lightweight materials, Unit body construction – Paint/Coatings/Adhesives – Lighting • Power train – Enhanced fuel economy: Fuel cell, Hybrid electric, Hydrogen fueled – Advanced batteries, Emissions control • Ride & handling – Brake & Gas – Low rolling resistance tires • Safety systems – Sensing systems – Safety features • Interiors – Seating – HVAC – Navigation 31 Advanced Technologies Market Penetration 2004 - 2030 Market penetration of advanced technologies: • Lightweight materials Improved pumps • Improved aerodynamics Low rolling resistance tires • Engine friction reduction • Unit body construction 32 Homeland Security: Michigan Homeland Security • Majority of homeland security is performed in the private sector, with 85% of all critical infrastructures privately controlled; 35% of all U.S. companies plan to invest in and expand security programs (ASIS International Foundation Trends Report, 2005) • Approximately $33 billion of federal funding in FY 2005 with heavy emphasis on developing new technology to assist the four main parts of effective preparedness: – Prevention: Biometrics, vaccines, intelligent systems, cargo screening systems – Detection: Bio and radiation sensors, training – Reaction: EMS equipment, communications, computer modeling – Recovery: Bioremediation, decontamination Source: www.michigan.org/medc/ttc/HomelandSecurity/ 33 Defense • Michigan companies already play a lead role in development and production of equipment and expertise: improved body armor producers, concrete strengthening systems, portable tracking and communications systems and advanced detection systems • Strong R&D and manufacturing capabilities make Michigan a natural leader in emerging areas Technology Information analysis and infrastructure protection Emergency preparedness and response Threat assessment tools and strategies 34 Defense Industry: TACOM Defense Number of Contracts Awarded by State 16 CA 14 12 10 NJ PA AL 8 GA IL MI NY OH FL 6 IN MO TN MD SC 4 WI IA 2 ME AK AZ KS LA MA RI SD OR KY VA TX VT 0 Contract Types Awarded to Michigan Companies from 09/04 - 03/06 Electric wire & power & distribution equipment 11% 11% Electrical and electronic equipment components 11% Engines, turbines & components 22% General purpose information technology equipment 11% 33% Vehicular equipment components Weapons 35 Source: TACOM LCMC Advanced Planning Briefing to Industry – Tacom2005.ppt - 26-28 Oct 05 Defense Industry: TACOM Defense Percentage of Total Dollars by Contract Type Awarded to Michigan Companies from 09/04 - 03/06 Electric wire & power & distribution equipment Electrical and electronic equipment components 2% Engines, turbines & components 3% 87% 3% 2% General purpose information technology equipment 4% Vehicular equipment components Weapons 36 Source: TACOM LCMC Advanced Planning Briefing to Industry – Tacom2005.ppt - 26-28 Oct 05 Targeted Industries Study Macomb County Opportunities What’s next? 37 Industry Expansion and Targeting Strong Industry Potential High Support Industries to Develop Advanced Automotive Information Technology Alternative Energy Strong Industry Differentiation Defense Advanced Manufacturing Homeland Security 38 Targeted Industries Study Trends in Economic Development Strategy 39 Current Trends and Issues in Business Attraction & Development Economic Development Survey 2004 & 2005 Focus of economic development activities: Business attraction/recruitment = 44% Business retention = 41% Top business retention activities: Partnering with other non-governmental organizations = 81% Local government representative calls on local company = 78% Top promotional activities used to attract business: Website = 86% Working with Chamber of Commerce = 84% Offer high quality of life = 74% Promotional and advertising activities = 63% Average local budgets for economic development in 2004 = $753,161 40 Source: ICMA. Economic Development 2004 Common Characteristics of Winning Organizations in attracting business • Every winning agency used a state of the art Web-site • On-line databases of available buildings and sites • Work-force training initiatives moved to the top of the “to do list” • The ability to quantify and deliver a trained work force in specialized skillset categories • “Partnerships”: The ability to bring together diverse groups under one effort to market and promote a geographical area “won more projects than stand-alone cities and counties” Without the region as a whole, we wouldn’t be where we are today. Creating new jobs and investing capital investment in our community takes a cooperative effort on behalf of local governments, businesses and citizens.” Melanie O’Connell Underwood Executive Director/Mooresville, NC Chamber (2005 = $302m/1,125 jobs) 41 Top U.S. Economic Growth Areas 2005 Location 2005 Success Initiatives Message Broomfield County, CO Pop: 48000 5 corporate HQs/ 1 divisional HQ Expanded available data on web-site (real estate information, demographics, links to state information on taxes, transportation, labor & incentives) Large pool of highly trained & available tech labor Elgin/Kane Counties, IL Pop: 150,000 16 projects of $1m or greater Web-site enhancement, Expansion of Work-force training efforts Joint effort with state allowing developers and brokers to electronically update building & site availability Location/Proximity to I-90 toll way Central location Easy access for good labor force Large pool of highly trained & available tech labor Grant County, IN Pop: 71,000 5 projects: $260m/2,000 jobs Partnered with regional workforce investment board, local community college & 2 liberal arts colleges to develop training programs Location Within 400 mile truck drive or 1 day of 12 major markets Dallas/Ft. WorthArlington, TX 12 county area 309 projects: $3.4b Promotion of existing company expansions in the area “Telecom Corridor” 50 technology companies/sq. mile Houston, TX 12 county area 214 projects Promotion of reputation as fast growing technology center Promotion of younger than average workforce 2.6 million workforce 51 of world’s 100 large non-U.S. Corps Port of Houston is world’s 6th largest Mobile, AL Pop: 400,000 25 projects: $800m Maintains buildings & sites database for the area (photo, characteristics, map) Hub, linking major U.S. markets and emerging markets in Central & South America Mooresville, NC Pop: 25,000 37 projects: $307m/1,125 jobs Regional partnership (16 county region) New branding campaign/strategic direction Availability of land Adaptability of workforce Continued education/training Covington, KY Pop: 350,000 41 projects: $444m/2,997 jobs Redesign of web-site for buildings & sites database Greensboro, NC Pop: 1.5 m 42 projects Piedmont Triad Partnership focused on hightech & advanced manufacturing Source: Site Selection On-line, March 2006 Construction costs 30% below avg. Lower cost of living Quality of life (cultural, sports, 42 recreational) State tax credits for R&D Industry Retention & Expansion, Growth & Targeting Macomb County’s Opportunities Macomb Industry % of Employment Base Manufacturing 23.4% Growth ’00-’04: (-11%) Retention & Expansion (Issues re: growth) Demand by primary customer’s industry Pressure on margins Cost of raw materials Cost of labor Healthcare & Social Assistance 10.7% Growth ’00-’04: +10% Finance & Insurance 4.0% Growth ’00-’04: +23% Organic Growth (Hot areas of growth) Computer & electronics Plastics & rubber products Machinery manufacturing Transportation manufacturing -Motor parts -Aerospace Advanced Automotive Advanced Manufacturing -Medical Devices Defense Assisted Living Residential Care facilities Outpatient/Ambulatory Research and Ancillary Services Medical devices & equipment Admin/Support services (Temporary staffing) Computer systems/design related Management/Technical consulting services Homeland Security High technology medical treatment facilities Demand by primary customers industry Competitive nature of industry Professional & Scientific 8.6% Growth ’00-’04: (-19%) Construction 5.5% Growth ’00-’04: (-.3%) Demand by primary customer’s industry Availability of skilled workers Competitive industry Cost of labor Non-residential -remodeling of industrial plants -nursing care facilities Wholesale Trade 4.2% Growth ’00-’04: +.8% Demand by primary customers industry Competitive nature of industry Physical capacity for expansion Productivity enhancing tech. Supply & distribution services e-commerce Information 1.6% Growth ’00-’04: +3% Leap Growth (Emerging Sectors) Software publishing Internet & other information services Communications equipment 43