SCM seminar UN

advertisement

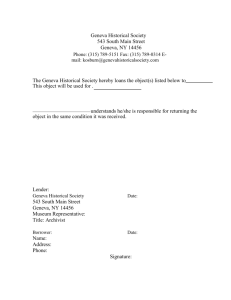

Capacity Building Workshop on Trade Facilitation Implementation: Tools, Techniques & Methodologies Supply Chain Efficiency & Trade Facilitation Geneva, October 18th 2004 Olivier Aba Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 1 Workshop Agenda 1. What is a Supply Chain, “SC”, & Supply Chain Management, “SCM”? 2. Benefits of Supply Chain Management 3. E-business & Supply Chain – opportunities 4. E-commerce & Trade Facilitation: how to improve Supply Chain efficiency & competitiveness? Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 2 What is a Supply Chain? P&G or other manufacturer Plastic producer Chemical manufacturer (e.g. Oil Company) Supermarket or 3rd party DC Supermarket Chemical manufacturer (e.g. Oil Company) Tenneco packaging Paper manufacturer Customer wants detergent and goes to Supermarket Timber industry Source: Chopra & Meindl 2001 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 3 What is a Supply Chain? Every company is involved in one or more Supply Chains A supply chain can be defined as “the sequence of suppliers that contribute to the creation and delivery of a good or service to end customers. This encompasses virtually all aspects of a business—sales processing, production, inventory management, material supply, distribution, procurement, forecasting, and customer service, and several other areas…” Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source :Aglira & al. , 1999 4 Components of a Supply Chain PLAN Demand & Supply Planning Oct04 BUY MAKE Sourcing & Supplier Management Manufacturing Capacity Building Workshop UN SCM Geneva slides Olivier Aba MOVE Storage & Transportation SELL Customer & Order Management 5 Logistics vs. Supply Chain Supply Chain is NOT logistics… Supply Chain is MORE THAN logistics covers the coordination of most activities & flows upstream: • from suppliers to manufacturing and activities & flows downstream: • from manufacturing to end-customer Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 6 Logistics Costs in Europe (as a % of revenues) 1998 Transportation: 40% Warehousing: 26% Inventory: 18% Admin: 16% Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: ELA, Insight to Impact, 1999 7 Logistics Costs Worldwide Region Country North America Mexico 15.3 USA 10.5 Belgium 11.4 France 12.0 Germany 13.1 Greece 12.6 Spain 14.7 China 16.5 India 15.4 Brazil 15.0 Europe Asia/Pacific South America Oct04 Logistics as % of GDP (1997) Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Bowersox, Closs, Cooper, 2002 8 Flows in a Supply Chain? There are 3 types of flows to consider in a Supply Chain: Material flows Financial flows Information flows Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 9 What is an Internal Supply Chain? A company’s “internal” Supply Chain is made of the material, information and financial flows between the company and its direct business partners. Material flows SUPPLIER MANUFACTURER CUSTOMER Financial flows Information flows Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 10 Integrated or Extended Supply Chain Need to take into account the supplier’s suppliers and the customer’s customers because they generally have an impact on the overall Supply Chain performance. Material flows 2nd tier suppliers 1st tier suppliers Manufacturer Wholesaler Retailer End-customer Financial flows Information flows Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 11 Porter’s Value Chain SUPPORT ACTIVITIES Oct04 ITC Capacity Building Workshop UN SCM Geneva slides Olivier Aba Margin PRIMARY VALUE-ADDING ACTIVITIES Inbound Outbound Marketing Production Service Logistics Logistics & Sales IT systems Human resources management & training Research & development Purchasing & contracting Finance, planning, etc. Source: ITC, 2002 12 Supply Chain Sources: plants vendors ports Manufacturers, Regional warehouses: stocking points Field warehouses: stocking points Customers, demand centers Supply Material Production/ purchase costs Manufacturing/ Inventory & warehousing costs Transportation Transportation costs costs Inventory & Source: Simchi-Levi & al, 2000 warehousing costs SCOR 5 Processes: Overview Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Supply Chain council, 2003 14 SCOR 5 Processes (1) Plan: Processes that balances aggregate demand & supply to develop a course of action which best meets sourcing, production & delivery requirements Source: Processes that procure goods and services to meet planned or actual demand Make: Processes that transform product to a finished state to meet planned or actual demand Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Supply Chain council, 2003 15 SCOR 5 Processes (2) Deliver: Processes that provide finished goods and services to meet planned or actual demand, including order management, transportation management, and distribution management Return: Processes associated with returning or receiving returned products for any reason. These processes extend into post-delivery customer support. Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Supply Chain council, 2003 16 What is Supply Chain Management? “Supply Chain Management is a set of approaches utilized to efficiently integrate suppliers, manufacturers, warehouses, and stores, so that merchandise is produced and distributed at the right quantities, to the right locations, and at the right time, in order to minimize system wide costs while satisfying service level requirements.” Source: Simchi-Levi & al, 2000 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 17 Drivers of Supply Chain Performance Inventory Transportation Facilities Information Source: Chopra & Meindl 2001 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 18 Drivers of Supply Chain Performance Competitive Strategy Supply Chain Strategy Efficiency Responsiveness Supply Chain Structure Inventory Transportation Facilities Drivers Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Information Source: Chopra & Meindl 2001 19 Considerations for Supply Chain Drivers Driver Inventory Efficiency Cost of holding Transportation Consolidation Responsiveness Availability Speed Facilities Consolidation / Dedicated Information What information is best suited for each objective Proximity / Flexibility Source: Chopra & Meindl 2001 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 20 Drivers of Supply Chain Performance Inventory: Role of inventory in the Supply Chain: Anticipation of future demand Production and distribution costs reduction • economies of scale Source: Chopra & Meindl 2001 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 21 Drivers of Supply Chain Performance Transportation: Role of transportation in the Supply Chain: Transportation moves the product between different stages in a Supply Chain • Transportation choices impact the responsiveness and the efficiency of the Supply Chain Source: Chopra & Meindl 2001 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 22 Drivers of Supply Chain Performance Facilities: Role of facilities in the Supply Chain: Where inventory is transformed into another state - manufacturing facility Where inventory is stored before being shipped warehousing facility • Choices such as number of facilities or capacity impact the Supply Chain Source: Chopra & Meindl 2001 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 23 Drivers of Supply Chain Performance Information: Role of Information in the Supply Chain: Serves as the connection between the Supply Chain’s various stages (allows coordination of actions) Allows daily operations of each stage of the Supply Chain (ex. : a production scheduling system needs information) Source: Chopra & Meindl 2001 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 24 SC Nokia Nokia’s frequent & rapid product introduction, major contributors to fast revenue & profit growth are: supported by a very flexible & efficient SC Nokia has put in place: rapid response manufacturing, quick-ship logistics, global SC web that links Nokia’s suppliers & plants, supports Vendor Managed Inventories and collaborative planning Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Accenture, 2003 25 SC Zara (1) Global clothing manufacturer/retailer – 44 countries Focused on time to market, costs, order fulfillment & customer satisfaction Zara owns 630 retail stores worldwide Store managers send customer feedback directly to Zara’s in-house designers via handheld devices designers are kept abreast of fast-changing trends & demands gives Zara vital information on sale of lessdesirable merchandise better managed inventories Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Accenture, 2003 26 SC Zara (2) Zara acquires fabrics in only 4 colors & postpones dyeing & printing until close to manufacturing reducing waste and minimizing need to clear unsold inventories Zara can deliver new styles in 3 to 6 weeks, compared with up to 5 months for competitors Source: Accenture, 2003 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 27 SC Henkel Multinational manufacturer of consumer & industrial products Put in place collaborative planning, forecasting & replenishment (CPFR) with Condis, a Spanish supermarket & several packaging suppliers for laundry & home care products Involves daily interchange for key items, coordinates business planning (combined promotions & collaborative forecasts) & jointly defined & measured key performance indicators. Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Accenture, 2003 28 The “Best” Supply Chains “They are not just fast & cost effective. They are also: Agile Adaptable and they ensure that their companies’ interests stay aligned.” Hau L. Lee, Harvard Business Review, October 2004 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 29 Supply Chain & SCM Benefits Reduction of SC costs non-transport costs transport costs Lower inventories Improved delivery time Improvement in service quality Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 30 SC Champions: Service vs. Costs Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 31 SC Champions – Costs & Performance Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 32 The e-Business e-Business is a collection of business models and processes motivated by Internet technology, and focusing on improving the extended enterprise performance: e-commerce is part of e-Business Internet technology is the driver of the business change The focus is on the extended enterprise: • Intra-organizational • Business to Consumer (B2C) • Business to Business (B2B) Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 33 e-Business and e-Commerce e-Commerce definition: Is often referred to as “buying and selling using the Internet” e-Business definition: The transformation of key business processes through the use of Internet technologies (IBM) Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 34 Barriers to e-Business Adoption For customers: A large proportion of current non-Internet users • Look at your country The poor understanding of the benefits For companies: No tangible benefits Not relevant to the business Technology costs too high and difficult to understand Concern about fraud Concern about confidentiality Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 35 Introducing B2B and B2C Business Consumer Oct04 Business Consumer B2B www.dell.com B2C www.amazon.com C2B www.priceline.com C2C www.ebay.com Capacity Building Workshop UN SCM Geneva slides Olivier Aba 36 e-Business Environment Environment today has more influence & impact Global Environment International, economic factors, Legal constraints, cultural factors Local Environnent Technologies, innovation used by global competitors Supplier organization Customer Technologies Local Competitors Society Public opinion Media Moral… Intermediates, Channels Country specific, economic factor, legal constraints, cultural factor Look at the top 100 companies from 50 years ago, less than a quarter of them remain in the top 100, many have ceased to exist. Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 37 e-Business Processes In this context, e-Business specifically refers: Product to “the planning and execution of the front-end and back-end operations in a chain using the Internet” Supplier Oct04 Manufacturer Wholesalers Capacity Building Workshop UN SCM Geneva slides Olivier Aba Retailers Customer 38 B2B & B2C Transactions Supplier Intermediaries, Retail channels Channel organization Technologies Consumer customers B2C Organization or business customers Technologies B2B Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 39 Disintermediation or “cutting out the middle man” Consumer Wholesaler Retailer Producer Don’t kill your traditional sales channels but help them in new way of sales Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 40 e-Business & the Supply Chain Very broad impact of e-business on the Supply Chain: upstream: sourcing, procurement inbound & outbound logistics: links & use of third parties downstream: ordering, warehousing & distribution… Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 41 The Role of e-Business in a Supply Chain Supply Chain transactions which can be performed over the Internet: Providing information across the Supply Chain Negotiating prices and contracts with customers and suppliers Allowing customers to place orders Allowing customers to track orders Filling and delivering orders to customers Receiving payment from customers Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 42 e-Business Opportunities & SC Reduce facility costs Eliminate retail/distributor sites Reduce inventory costs Apply the risk-pooling concept • Centralized stocking • Postponement of product differentiation Use dynamic pricing strategies to improve SC performance Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Chopra & Meindl 2001 43 e-Business Opportunities & SC Supply Chain Visibility: Reduction in the “Bullwhip Effect” • Reduction in inventory • Improved service level • Better utilization of resources Improve Supply Chain performance • Provide key performance measures • Identify and alert when violations occur • Allow planning based on global supply chain data Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Chopra & Meindl 2001 44 Potential Revenue Opportunities from e-Business & SC Oct04 Direct sales to customers 24 hour access for order placement Information aggregation Information sharing in supply chain Flexibility on pricing and promotion Price and service discrimination Faster time to market Efficient funds transfer - reduce working capital Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Chopra & Meindl 2001 45 Potential Cost Opportunities from e-Business & SC Direct customer contact for manufacturers Coordination in the supply chain Customer participation Postpone product differentiation to after order is placed Downloadable product (software) Reduce facility costs Geographical centralization and resulting reduction in inventories Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Chopra & Meindl 2001 46 Potential Cost Disadvantages of e-business Increased transportation cost due to inventory aggregation Increased handling cost if customer participation is reduced Large initial investment in information infrastructure Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 47 Fromages.com Founded in 1997 Sale of French cheeses overseas: USA: 70%, Europe: 15%, Asia: 15% Reseller, not a producer No inventory Key elements: quality & logistics 65% of costs: cheese, packaging, express delivery 85% of orders delivered in 24 hrs… Average sale: 70/80 euros Selling price includes transportation costs Partnerships: Cheese producer & ripener in Loire-Atlantique Shipper – FedEx Sales (2003): estim - 1 M euros – profitable since 2000 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 48 Aquarelle.com (1) Founded in 1997 Online sale of flower bouquets in France, Europe, USA, Japan, South Korea & Venezuela 20 theme bouquets, as per the season Craft work & Just in Time Flowers purchases: 80% from Netherlands Centralized flower assembly north of Paris 25 assembly florists Customer can « see » what he is purchasing Key success factors: availabiliyt, freshness, leadtime & quality Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 49 Aquarelle.com (2) Downstream logistics critical: transport, delivery, & followup: Paris deliveries– E-liko Delivereies in France - Chronopost Specific packaging designed & used for the flower bouquets Delivery fee added on customer bill: 9 euros Investment in information systems: 4 M euros – online purchasing system for suppliers, supply chain mangement & order management application Local partnerships Sales (2003) : about 8 M euros – profitable since 2002 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 50 ChateauOnline (1) Founded in 1998 50 people Sales: 50% France – 50% export: Germany, UK, Belgium, Netherlands, Italy, Switzerland, Luxemburg 70% of sales made with existing customers Stakes: customer retention, develop sales, improve quality of service, reduce operating costs Approach: Emphasis on processes & use of information systems Focus on the customer relationship management - CRM integrated with information system Continuous process improvements & integrated inventory management • Automated E-mail for customer order acknowledgment • Customer order status available on the site • Handling of customer problems & anomalies – workflow process between call-center, sales, logistics & accounting Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 51 ChateauOnline (2) 2000 products from 15 different countries Deliveries in France: 5/10 days, overseas: 7/24 days. Logistics platform (2000 m2) handled by Easydis (Casino subsidiary) 800 references, 85 000 bottles Transportation towards end customer handled by UPS Alliance in 2003 with Henri Maire. Maire is responsible for logistics: wine storage, order preparation & delivery Average sale: 200 euros Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 52 ChateauOnline (3) European leader of online wine sales Honored many times as the best ecommerce website Sales (2003) estim – 10 M euros – profitable since end 2003 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 53 ChateauOnline Supply Chain Information systems PLAN BUY Sales forecasting & Purchases planning Purchases & Supplier Management Professional Buyers, buying direct in France & overseas Oct04 MOVE SELL Order handling & payment Storage Upstream Logistics with partners. Storage & platform Online order management. Promotions, coupons… Secured payment. Capacity Building Workshop UN SCM Geneva slides Olivier Aba Transport & delivery Outside partners. Transportation Cost billed to customers. 95% of deliveries within leadtime. 54 LeShop.ch First on-line supermarket in Switzerland Created in 1998 75 people Sales: 15.2 M CHF in 2003; 27 M CHF in 2004 (planned) 16 000 regular customers Average basket: CHF 193 vs 34 in a supermarket > 50% market share Strategic alliance with Migros in September 2003 & with a common & new online website in January 2004: find Migros as well major brand articles offer an excellent price/quality ratio Major items sold: Fruits & vegetables (bananas, carots, apples…) Delicatessen (chicken, ham) Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 55 LeShop.ch Supply Chain CUSTOMERS La Poste Suppliers Logistics Center Suppliers Suppliers Oct04 La Poste La Poste Capacity Building Workshop UN SCM Geneva slides Olivier Aba 56 Logistics (1) « Ordered today, delivered tommorow” Distribution center in Bremgarten (close to Zurich) 7000 m2 6 000 products – 80% fresh products 300/450 orders/day Delivery cost billed to customer: CHF 12/delivery Specific packaging: delivery box returned & isotherm for fresh produce Transportation in refrigerated trucks from the LeShop.ch logisitics center to the Swiss Post distribution centers Goods delivered by Expresspost at the address given at order time, directly at the customer door Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 57 Logistics (2) Own logistics center (not outsourced) 30 people Products stored as per the nature of goods, process sequence, & items turnover Specifics: customer requests items in small quantities, not full boxes or palets need for different temperature storage areas: from -18 to + 20 degrees centigrades need for maximum handling care: fruits & vegetables, bottles… Order handling: 33 minutes on average Order cost: CHF 24 95% of orders delivered as per customer order Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 58 LeShop.ch: challenges Increase the amount fo the average basket & frequency of purchases Increase the margin Increase the efficiency of the order handling Reduce distribtuion & delivery costs Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 59 SC Collaboration Material flows Financial flows Information flows Suppliers - Manufacturers - Distributors - Retailers - Customers Processes Oct04 Organizational structures Capacity Building Workshop UN SCM Geneva slides Olivier Aba Enabling technologies Source, INSEAD, 2002 60 Supply Chain Trends (1) Focused towards customers: move from push - by firm to pull - by customer more “personalized” logistics chain to take into account need for global coherence, thus rationalization… global process allowing for reactivity… Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 61 Supply Chain Trends (2) Integration & synchronization of the logistic network: demand driven sharing of demand data between customers & suppliers integration of incompatible information systems set up of appropriate production flexibility for the firms & its partners permanent synchronization efforts between internal & external logistic chain Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 62 Supply Chain Trends (3) Partnership strategy on the way up: move from risk reduction approach to balanced relationship focus on core competencies, brand, customers, new product introduction outsourcing of “non-strategic activities”, such as delivery, transport, storage Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 63 SC Transformations Oct04 From From From From From functions to processes profit to performance products to customers inventory to information transactions to relationships Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Christopher, 1998 64 The SC of the Future Changes Leading to From functions to Integral management of materials & goods flow processes From profit to performance Focus on key performance drivers of profit From products to customers Focus on markets & creation of customer value From inventory to Demand based replenishment & quick response systems information From transactions SC partnerships to relationships Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Christopher, 1998 65 Supply Chain SCM is more than just technology & information systems SC is vital especially for e-commerce SC implies a process and transversal approach across functions One of the key drivers is information Emphasis is placed on collaboration & coordination Requires substantial investment in information systems Agility & adaptability Integrated SC and SCM require major organizational transformations The human dimension remains essential: People & change management Partnerships management Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 66 Example: Supply Chains in Tunisia Analysis of Supply Chains in 5 export related sectors: Garement Automotive components Dates Olive Oil Arts & craft e-commerce The selected companies are considered as « best in class » in Tunisia Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: MKC, 2003 67 Tunisia SC case studies Sector Oct04 Status Product Sourcing (1) Target Market Garement SME Local International Local Garement ME Local International Local/international Garement Large Off-shore International International Automotive components Off-shore International International Dates Local Local International Olive Oil Local Local International E-commerce craft Local Local International Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: MKC, 2003 68 Tunisia SC Case studies (2) The analysis clearly identified functional & structural weaknesses that have a major impact on the SC costs Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 69 SC Costs Non-transport costs ordering & admin costs load/unload inventory carrying cost storage cost losses/damages stock outs emergency shipment costs Transport costs truck airfreight ship Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 70 Tunisia SC Case Studies SC performance (1) Sector Incoterms SC costs as % SC costs as % of sales of Value Added Garement SME EXW 17 47 Garement ME EWW 14 37 Garement Large CIF 13 25 Automotive components CIF 18 25 Dates CIF 24 Olive Oil CIF 14 26 E-commerce craft CIF 26 80 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Non transport 53 costs: 9.7 % Source: MKC, 2003 71 Tunisia SC case studies SC Performance (2) Sector Incoterms SC costs as % SC costs as % of sales of Value Added Garement SME EXW 17 47 Garement ME EWW 14 37 Garement Large CIF 13 25 Automotive components CIF 18 25 Dates CIF 24 53 Olive Oil CIF 14 E-commerce craft CIF 26 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Non transport 26 12.4 % costs: 80 Source: MKC, 2003 72 Tunisia SC Case Studies SC Performance (3) Sector Incoterms SC costs as % SC costs as % of sales of Value Added Garement SME EXW 17 47 Garement ME EWW 14 37 Garement Large CIF 13 25 Automotive components CIF 18 25 Dates CIF 24 53 Olive Oil CIF 14 26 E-commerce craft CIF 26 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Non transport costs: 6.8 % 80 Source: MKC, 2003 73 Tunisia SC Case Studies SC Performance (4) Sector Incoterms SC costs as % SC costs as % of sales of Value Added Garement SME EXW 17 47 Garement ME EXW 14 37 Garement Large CIF 13 25 Automotive components CIF 18 25 Dates CIF 24 53 Olive Oil CIF 14 26 E-commerce craft CIF 26 Oct04 Source: MKC, 2003 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 80 Non transport costs: 10.3 % 74 Tunisia SC Case Studies SC Performance (5) Sector Incoterms SC costs as % SC costs as % of sales of Value Added Garement SME EXW 17 Garement ME EXW 14 Non transport costs: 37 8 % Garement Large CIF 13 25 Automotive components CIF 18 25 Dates CIF 24 53 Olive Oil CIF 14 26 E-commerce craft CIF 26 80 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 47 Source: MKC, 2003 75 Tunisia SC Case Studies SC Performance (6) Sector Incoterms SC costs as % SC costs as % of sales of Value Added Garement SME EXW 17 47 Garement ME EWW 14 37 Garement Large CIF 13 Automotive components CIF 18 25 Dates CIF 24 53 Olive Oil CIF 14 26 E-commerce craft CIF 26 80 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Non transport 25 6.8 % costs: Source: MKC, 2003 76 Supply Chain Cycle Time Product Coffee Garments Potatoes Garments Okra Yemen to Germany Yemen to Japan Egypt to USA Egypt to Germany Jordan to USA Jordan to UK Ordering process, sourcing & manufacturing 2.47 114 65 16 57 3.67 Goods preparation .29 7 2 1 1 .08 Transportation up to final destination 2.20 31 27 12 21 .71 Total # of days 4.96 152 15.4 29 87 4.46 Oct04 Tuna (in days) Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Delvin & Yee World Bank, 2002 77 Supply Chain Costs Product Tuna Coffee Garments Potatoes Garments Okra Yemen to Germany Yemen to Japan Egypt to USA Egypt to Germany Jordan to USA Jordan to UK Non Transport SC costs in % 38 76 20 41 12 11 Transport costs in % 62 24 80 59 88 89 Main modes of transportation used truck & air truck & ship truck & air truck & ship truck & air truck & air SC costs as % of landed price 54.9 7.2 15.4 26 6.7 48 Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: Delvin & Yee World Bank, 2002 78 Tunisia SC analysis: First Findings Lack of coherence in the practices of the parties involved in the export process Lack of links & access to international markets Costly & inequitable border control process Insufficient intermodal transfer infrastructure Not harmonized processes & documents Deficiencies in road transport & multimodal transport underdeveloped Lack of institutional coordination Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba Source: MKC, 2003 79 Implications for Trade Facilitation & Policy Decision Makers Most companies have the same objectives: Improve response time Reduce inventory Reduce costs: • transport costs • non-transport costs Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 80 Food for thought… Supply Chain is a critical element of the companies as well as country’s performance in any economy… What can be done to improve the global logistics & SC performance of companies & of the country? Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 81 Questions for Policy Decision Makers… (1) What is the state of the Supply Chain & Trade Facilitation in your country? How does it serve domestic as well as foreign trade actors (import & export)? What is the impact of the logistical system in the performance of the domestic economy & foreign trade? What are the hurdles & obstacles to an improved performance? Can the performance of import and export companies be improved significantly? How? Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 82 Questions for Policy Decision Makers… (2) What are the plans to improve the links & interrelationships within the SC & Trade Facilitation? In what way can the current regulatory environment be amended to allow for a development of the SC? Note that Supply Chain & Trade Facilitation are related to transversal processes, linking many different sectors & actors and thus under no direct control by any government institution… Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 83 Implications for Trade Facilitation & Policy Decision Makers Information Flow: Telecom infrastructure Basic skills & access to IT technology & PC’s Access to & development of use of Internet Inventory: Port, road infrastructure Efficiency & dependability in admin procedures Transport & dependable logistics: Port, road infrastructure Skills & knowledge (import/export/logistics) Coordination Management of information flow Regulatory environment: Responsive & efficient Work by exception – customs Listen to “customers” Oct04 Capacity Building Workshop UN SCM Geneva slides Olivier Aba 84