PowerPoint - Chapter 19

advertisement

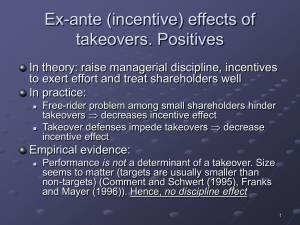

Chapter 19 Analysis of Takeovers Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-1 Learning Objectives • Understand and evaluate suggested reasons for takeovers. • Explain how to estimate the gains and costs of takeovers. • Explain the main differences between cash and shareexchange takeovers. • Outline the regulation and tax effects of takeovers in Australia. • Outline defence strategies that can be used by target companies. • Identify the various types of corporate restructuring transactions. • Outline the main findings of empirical research on the effects of takeovers on shareholders’ wealth. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-2 Fundamental Concepts • Takeovers typically involve one company purchasing another by acquiring a controlling interest in its voting shares. • Also called ‘acquisitions’ and ‘mergers’. • Takeovers involve changes in the ownership of assets. • No simple explanation for the existence of takeover ‘waves’: – Evidence that takeover activity is positively related to the behaviour of share prices. – Periods when share prices are increasing are also periods of optimism for investment. – While companies will increase internal investment, they will also look for external investment (opportunities to take control of existing assets). Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-3 Types of Takeovers • Horizontal takeover: takeover of a target company operating in the same line of business as the acquiring company. • Vertical takeover: takeover of a target company that is either a supplier of goods to, or a consumer of goods produced by, the acquiring company. • Conglomerate takeover: takeover of a target company in an unrelated type of business. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-4 Reasons for Takeovers • Synergy in takeovers is the situation where the performance, and therefore the value, of a combined entity exceeds those of the previously separate components: – The target company is managed inefficiently and is undervalued. – The acquiring and target companies have assets that are complementary. – Results in cost reductions, increased market power, diversification benefits, and tax benefits. – The target company or the acquiring company has excess liquidity or free cash flow. – There are increased earnings per share and price– earnings ratio effects. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-5 Evaluation of the Reasons for Takeovers • The target company is managed inefficiently: – Managers may be inefficient and acting in their own interest rather than shareholders’, thereby reducing market value and inducing takeover offers. • Complementary assets: – Sometimes either or both of the companies can provide the other with needed resources at relatively low cost. • Cost reductions: – Cost savings may be due to economies of scale. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-6 Evaluation of the Reasons for Takeovers (cont.) • Target company is undervalued: – A takeover may also occur when the market value of the target company is less than the sum of the market values of its assets. • Increased market power: – Taking over a company in the same industry may increase the market power of the combined company. • Diversification benefits: – The takeover, it is suggested, enables a company to reduce risk via diversification. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-7 Evaluation of the Reasons for Takeovers (cont.) • Excess liquidity and free cash flow: – A company with excess liquidity may be identified as a takeover target by companies seeking access to funds. • Tax benefits: – Taking over a company with accumulated tax losses may reduce the total tax payable by the combined company • Increased earnings per share (EPS) and price– earnings ratio effects: – While acquiring companies may wish to evaluate the effect of a proposed takeover on their EPS, this is an unreliable approach. It is quite possible that a takeover that produces no economic benefits will nevertheless produce an immediate increase in EPS (bootstrapping). Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-8 Economic Evaluation of Takeovers • Takeovers can take advantage of synergies such as economies of scale or complementarity between assets. • The gain from the takeover can be defined as the difference between the value of the combined company and the sum of their values as independent entities: Gain VAT VA VT • Assuming that cash is used to buy Company T, the net cost is defined as: Net Cost Cash VT – Cost is considered in terms of the premium paid over T’s value as an independent entity. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-9 Economic Evaluation of Takeovers (cont.) • The takeover will have a positive NPV for Company A’s shareholders only if the gain exceeds the net cost: NPVA gain - net cost gain - cash+VT 0 • • If NPVA is equal to zero, then the above equation can be used to find the value of Company T to Company A, VT(A), which is the maximum price A should pay for the target: VT A cash = gain+VT It is necessary to focus on the incremental cash flow effects of the takeover: – Incremental inflows. – Incremental outflows. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-10 Comparing Gains and Costs • The amount of the cash consideration determines how the total gain is divided between the two sets of shareholders. • Every additional dollar paid to the target’s shareholders means a dollar less for the acquirer’s shareholders. • Note that the possible gains from a takeover may already be impounded into the target’s market price. – Management should, therefore, check that the share price of a proposed target has not already been increased by takeover rumours. – Management should also keep their takeover intentions completely confidential until formally announcing the bid. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-11 Estimating Cost for a ShareExchange Takeover • Share-exchange takeover: acquiring company issues shares in exchange for the target’s shares. • The cost will depend on the post-takeover price of the acquiring company’s shares. Net cost b VAT VT where: b the fraction of the combined company that will be owned by the former shareholders of the target company • For a cash offer, the net cost is independent of the takeover gain, whereas for a share-exchange offer, the cost depends on the takeover gain. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-12 Regulation of Takeovers • The main legislation is Chapter 6 of the Corporations Act 2001. • Australian Securities and Investments Commission (ASIC) administers the Corporations Act. • ASIC has some discretion and can apply to the Takeovers Panel if an acquisition is believed to be inappropriate. • The most important aspect of the Corporations Act is that unless the procedures laid down in Chapter 6 are followed, the acquisition of additional shares in a company is virtually prohibited if this would: – Result in a shareholder being entitled to more than 20% of the voting shares or increase the voting shares held by a party that already holds 20–90% of the voting shares of the company. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-13 Regulation of Takeovers (cont.) • Different regulations of takeovers are: – Off-Market Bid. – Market Bids. – Disclosure Requirements. – Creeping Takeover. – Partial Takeover. – Schemes of Agreement. – Tax Effect of Takeover. – Break Fees, Takeovers and Corporate Governance. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-14 Other Controls on Takeovers • Legislation other than the Corporations Act may affect takeovers: – Trade Practices Act — competition. – Foreign Acquisitions and Takeovers Act — Federal Treasurer has the power to prohibit takeovers by foreign companies — for example Shell and Woodside (2001). – Industry-related legislation — media ownership laws, four pillars banking policy. • ASX listing rules — secrecy during takeover discussions, or apply for trading halt, shares cannot be placed (via a private placement) for 3 months after receiving a takeover offer. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-15 Takeover Defences • Takeovers Panel — decisions on takeovers should be made by shareholders. • Takeover defence should be in interests of shareholders. • Defence measures are of two basic types: – Pre-emptive measures aimed as discouraging bids. – Strategies employed after a bid is received. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-16 Takeover Defences (cont.) • Different characteristics of takeover defences are: – Poison pills. – Acquisition by friendly parties. – Disclosure of favourable information. – Claims and appeals. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-17 Takeover Defences (cont.) • Effects of takeover defences: – Directors are faced with a conflict of interest. – It is also important that management ensure that their recommendation is consistent with their responsibilities to shareholders. – Resistance can extract additional value for shareholders but can be in interests of directors maintaining position. – Empirical evidence suggests worst managers are most likely to resist — hard to find a new job. – Even pay packages with termination packages in the event of takeover may not work — directors may recommend a low takeover to get payout. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-18 Corporate Restructuring • Divestitures: – Involve assets, which may be a whole subsidiary, being sold for cash. – It is essentially a reverse merger from the point of view of the seller. – Divestitures create value for the shareholders of selling companies: The assets transferred must be more valuable to the buyer than the seller. The selling company may also benefit by the removal of a unit that was managed poorly, or that had created diseconomies of scale. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-19 Corporate Restructuring (cont.) • Spin-offs: – A single organisational structure is replaced by two separate units under essentially the same ownership. – US research has found significant positive market reaction to spin-offs. – Likely explanations are gains from: Simplifying a complex conglomerate structure. Decentralising decision making. Motivating management more effectively. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-20 Corporate Restructuring (cont.) • Buyouts: – Involve a transfer from public to private ownership of a company through the purchase of its shares by a small group of investors. – A buyout or going private transaction can take several forms: Management buyout: purchase of all of a company’s issued shares by a group led by the company’s management. Leveraged buyout: takeover of a company that is largely financed using borrowed funds — the remaining equity is privately held by a small group of investors. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-21 Empirical Evidence on Takeovers: Target Company • Target company shareholders earn significant positive abnormal returns: – Brown and da Silva Rosa (1997): average abnormal return of 25.5% over the 7-month period around the takeover announcement. – Casey, Dodd and Dolan (1987) reported significant abnormal returns on target company shares around the time that significant shareholding notices were filed. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-22 Empirical Evidence on Takeovers: Target Company (cont.) • The initial increase in wealth of the target company’s shareholders appears to be maintained, even where the bid is unsuccessful. – The bid may have prompted a change in the target company’s investment strategy, which is expected to improve performance. – Information released during the bid caused the market to revalue the shares. – The market may expect a further bid for the target company. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-23 Empirical Evidence on Takeovers: Acquiring Company • On average, the shareholders of acquiring companies earn positive abnormal returns in the years before the takeover bid is made. • This suggests that takeover bids are typically made by companies that have been doing well, and have demonstrated an ability to manage assets and growth. • Many studies have found that around the time of the announcement, the average abnormal returns to shareholders of bidding companies is close to zero and, in some cases, negative. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-24 Empirical Evidence on Takeovers: Acquiring Company (cont.) • Jarrell and Poulsen (1989) identified three general explanations for the negligible wealth effects for acquiring company shareholders: – Takeovers are profitable, but the wealth effects are disguised. – Competition depresses returns to acquirers. – Takeovers are neutral or poor investments. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-25 Empirical Evidence on Takeovers: Acquiring Company (cont.) • The wealth effects of takeovers are disguised: – An acquiring company is typically much larger than a target company, so while there may be a worthwhile dollar gain to shareholders, the gain is small relative to the total value of the company. – When a company has a known strategy of growth by acquisition, the expected gains from this strategy may already be reflected in the company’s share price. – Announcement effects that are small or negative may also reflect market reaction to the financing of the takeover. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-26 Empirical Evidence on Takeovers: Acquiring Company (cont.) • Competition depresses returns to acquirers: – Returns to successful bidders are likely to be lower if a takeover is resisted by target management, or contested by multiple bidders. – Returns to acquiring companies when there are multiple bidders are insignificantly different from zero. – Returns to acquiring companies when there is only one bidder are significantly positive. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-27 Empirical Evidence on Takeovers: Acquiring Company (cont.) • Takeovers are neutral or poor investments: – Roll’s hubris hypothesis — managers of acquiring companies are supremely confident that their ability to value other companies is better than that of the market. – Consequently, they pay more for companies than they are worth. – The large returns to target shareholders represent wealth transfers from the shareholders of acquiring companies. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-28 Empirical Evidence on Takeovers: Are Takeovers Poor Investments? • Bradley, Desai and Kim (1988) – Found an average gain of $117m, or 7.4%, in the combined wealth of shareholders. – Their results support the hypothesis that takeovers yield real, synergistic gains and do not support Roll’s ‘wealth transfer’ hypothesis. However, they found that for some types of acquisitions, there were consistent losses to acquiring company shareholders. • Andrade, Mitchell and Stafford (2001) – US event study, found large abnormal returns to target company shareholders. – No significant effect to bidder company shareholders. – Overall shareholder wealth effect is positive and significant. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-29 Empirical Evidence on Takeovers: Are Takeovers Poor Investments? (cont.) • Long-term abnormal returns – Loughran and Vijh (1997) — US study finds differences between announcement period (short-term) returns and long-term returns to takeovers. – 5-year abnormal returns differed depending on form of payment. – Share offers had returns of 24%, cash offers had returns of +18.5%. – Related to hostility of takeover. – Brown and da Silva Rosa (1998) — Australian study finds no long-term abnormal returns. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-30 Distinguishing between Good and Bad Takeovers • Roll’s hubris hypothesis – Managers pay too much for target companies because they overestimate their ability to run them. • Managers may pursue their own objectives rather than those of their shareholders: – Often the result of free cash flow problems. • Some managers may make unprofitable takeovers simply because they are poor managers: – Such managers are possibly seeking other fields in which they hope to perform better. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-31 Distinguishing between Good and Bad Takeovers (cont.) • Mitchell and Lehn (1990) – Results suggest the stock market is able to distinguish between ‘good’ and ‘bad’ bidders. – Results consistent with the argument that one role of takeovers is to discipline managers who fail to maximise profits, including those that make valuereducing takeovers. • Morck, Shleifer and Vishny (1990) – Found that acquiring companies do systematically pay too much in takeovers in which the benefits for managers are particularly large. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-32 The Net Effects of Takeovers • Some researchers have preferred to use accounting data to assess the effects of takeovers on company performance by examining measures of profitability, risk and growth. • Recent Australian evidence on takeovers in various industries finds little accounting evidence of improved post-acquisition performance. • Healy, Palepu and Ruback (1992): – Used both accounting data and share price data and focused on operating cash flows before interest and tax to minimise the problems with accounting data. – Their results provided further evidence that mergers do result in improved performance. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-33 The Sources of Gains from Takeovers (cont.) • da Silva Rosa and Walter (2004) survey of Australian evidence: – Takeovers initiated by high performing companies that are seeking to continue high performance. – Target shareholders enjoy significant gains that dissipate if takeover is unsuccessful with no follow-up bid. – Shares in acquiring firm tend to under-perform following acquisition. Related to high costs associated with Australian regulatory environment. – Long-run performance of combined entities suggest anticipated benefits often fail to materialise. – Qualify their results by stating that methodological problems make it difficult to arrive at strong conclusions. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-34 Summary • Takeovers are an important part of the market for corporate control. • Like any investment, a takeover should proceed only if it has a positive NPV. • Takeover activity in Australia can be erratic; industry shocks, including deregulation, play an important role. • Three main types of takeover: horizontal, vertical and conglomerate. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-35 Summary (cont.) • Reasons for takeovers include: – Assets can be used more efficiently under new management. – Synergistic gains. – Diversification and EPS benefits dubious. • Takeovers regulated by Corporations Act intend that all parties are treated fairly and have enough information to make a fully informed decision. • Value-enhancing corporate restructures include divestitures, spin-offs and buyouts. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-36 Summary (cont.) • Evidence shows that target company shareholders gain, but bidding company shareholders do not gain as much, if at all. • Takeovers paid for in shares tend to be less successful for the acquiring company, seeming to benefit managers interests, indicating problems with agency costs. • Recent Australian evidence shows that while acquirers are well motivated, main gainers from takeovers are target shareholders, while anticipated benefits for acquirers fail to materialise. Copyright 2009 McGraw-Hill Australia Pty Ltd PPTs t/a Business Finance 10e by Peirson Slides prepared by Farida Akhtar and Barry Oliver, Australian National University 19-37