Mergers & Acquisitions

Mergers & Acquisitions

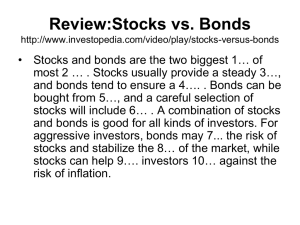

Financing capital: discuss opportunities & threats

• government subsidies

• bank loans

• issuing bonds

• issuing shares acquisitions: buyouts and takeovers

Why?

to reinforce your position to reduce competition to rationalize production to diversify products/markets to gain access to new technology...

→ MK, p 105

Unit 21: Takeovers

Pg 1

• How can companies use their profits?

• Provide synonyms of acquire:

• Explain the difference between takeovers and mergers

• Explain: supply chain

=

• Explain the difference between horizontal and vertical integration

• Explain the difference between forward and backward integration

• 1 Horizontal integration

2 Vertical integration

A enables cost savings

B increases market share and reduces competition

Unit 21: Takeovers

Pg 1

• How can companies use their profits?

• Provide synonyms of acquire: attain, buy, get, purchase, take, take possession of

• Explain the difference between takeovers and mergers

• Explain: supply chain

= distribution chain

• Explain the difference between horizontal and vertical integration

• Explain the difference between forward and backward integration

• 1 Horizontal integration

2 Vertical integration

A enables cost savings

B increases market share and reduces competition

Pg 2

• Explain the difference between a raid and a takeover bid

Advantages Disadvantages

A raid

A takeover bid

● Explain the difference between a friendly and a hostile bid

Vocabulary

• to bid (v irregular: bid, bid)

– to offer to pay a particular price for sth.

The company is bi dd ing 910p a share for control of AB Ports...

The bi dd er is interested in...

• a bid (n)

– a price offered to buy sth. such as goods, property, shares, bonds

(Longman BED)

Takeover bids:

- unwanted / unsolicited / hostile<>friendly bid

Pg. 3

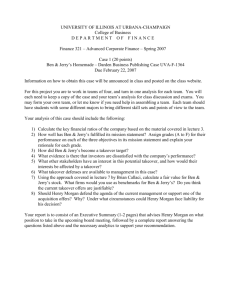

• Why do investment banks encourage companies to take over other companies?

Pg. 4

• Explain conglomerate

• What does LBO stand for?

• L _ _ _ _ _ _ _ d b _ _ _ _ _ s

• Which globally famous Hollywood movie involves a male character who specializes in LBOs?

• Do you remember what it is he does?

Pg. 4 cont.

• Explain: undervalued on the stock market

• Explain: market capitalization

• Explain: leveraged

• Explain: asset-stripping

• Why is the risk involved in LBOs small?

HW: Vocabulary, p 106 & complete

TYPES

1. ACQUISITION / TAKEOVER

2. FRIENDLY TAKEOVER

3. HOSTILE TAKEOVER

4.

MERGER

5. JOINT VENTURE

6. LEVERAGED BUYOUT

7. CORPORATE RAID

Cooperation of two or more individuals or businesses, each agreeing to share profit, loss and control, in a specific enterprise JOINT

VENTURE

Combining two or more companies to form a new one

MERGER

Corporate action in which a company buys most, if not all, of the target company's ownership stakes in order to assume control of the target firm

ACQUISITION / TAKEOVER

A takeover that a company being taken over agrees to.

FRIENDLY TAKEOVER

A takeover that a company taken over does not w ant and doesn’t agree to.

HOSTILE TAKEOVER

Acquisition of another company using borrowed money (bonds or loans) to meet the cost of acquisition. Often, the assets of the company being acquired are used as collateral for the loans in addition to the assets of the acquiring company.

LEVERAGED BUYOUT

• buying a large number of shares in a corporation with undervalued assets to obtain voting rights to increase share value and thus generate a massive return CORPORATE RAID

VOCABULARY to make a takeover bid to merge to use the poison pill to take over to find a white knight to acquire