Shareholder interest hypothesis

advertisement

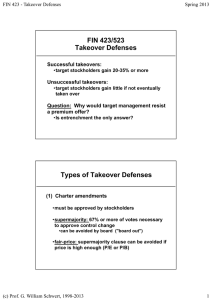

Ex-ante (incentive) effects of takeovers. Positives In theory: raise managerial discipline, incentives to exert effort and treat shareholders well In practice: Free-rider problem among small shareholders hinder takeovers decreases incentive effect Takeover defenses impede takeovers decrease incentive effect Empirical evidence: Performance is not a determinant of a takeover. Size seems to matter (targets are usually smaller than non-targets) (Comment and Schwert (1995), Franks and Mayer (1996)). Hence, no discipline effect 1 Ex-ante (incentive) effects of takeovers. Negatives Short-termism (boosting current profits at the detriment of long-term interests) (Stein (1988)) Reduction of firm-specific investments by management and workers (Shleifer and Summers (1988)) Managerial entrenchment (Shleifer and Vishny (1989)) Takeover defenses Concentration of control (more relevant for countries with weak shareholder protection – see later) 2 Takeover defenses Poison pills (e.g. rights to current shareholders to buy new stock at a discount) Golden parachutes Staggered boards (only a fraction of board can be reelected each year) White knights (“friendly” acquirers who are invited to overbid the raider) Question: are takeover defenses (and any resistance in general) beneficial or harmful for the target shareholders? 3 Reasons why management may resist a takeover Management believes they can generate greater long-term value than the acquirer’s bid price Management does not want to lose their job/control over company 4 Empirical evidence on the effect of takeover defenses on shareholder value Two hypotheses: Management entrenchment hypothesis Shareholder interest hypothesis Managerial entrenchment hypothesis: takeover defenses (anti-takeover devices) are installed with the purpose to “entrench” management reduce disciplinary force of takeovers Shareholder interest hypothesis: takeover defenses prevent value-decreasing takeovers, improve the target’s bargaining position in takeover negotiations, discourage inefficient short-termism and encourage firm-specific investment 5 Empirical evidence on takeover defenses In favor of “shareholder interest”: Firms that have defensive mechanisms receive higher premiums in takeovers (Comment and Schwert (1995), Varaiya (1987), Heron and Lie (2007)) This can be interpreted as higher bargaining power of firms with anti-takeover arrangements On average, improvement in post-adoption performance (e.g. Field and Karpoff (2006)) Evidence on reduction of short-termism (more R&D investment) is mixed 6 Empirical evidence on takeover defenses In favor of “managerial entrenchment”: Generally negative stock price reaction to adoption of anti-takeover devices (Ryngaert (JFE 1988), Malatesta and Walking (JFE 1988), DeAngelo and Rice (JFE 1983)) Effect is quite small, usually < 1% Caution: adoption of a defense is endogenous Presence of anti-takeover provisions has negative impact of firm value (Gompers, Ishii and Metrick (QJE 2003)) Why? Because some potentially value-increasing takeovers are deterred 7 Empirical evidence on antitakeover statutes Mostly negative effect on stock returns (e.g. Karpoff and Malatesta (1989)) Negative effect on TFP (Betrand and Mullainathan (2003)) Less investment and less disinvestment, i.e. managers become more passive (Betrand and Mullainathan (2003)) 8 Overall: Evidence on takeover defenses is inconclusive Evidence on anti-takeover laws is also mixed, but overall suggests that shareholders are likely to lose from them 9 So, are hostile takeovers an effective corporate governance mechanism? Maybe not so much… Ex-post problems: Free-rider problem impedes efficient takeovers Agency problem inside the acquirer: takeovers may be done for empirebuilding purposes Recall: no or negative long-run stock returns, no improvement in operating performance Firms with more excess cash are more likely to make bad acquisitions (Harford (JF 1999), Lang et al (JFE 91)) Takeover gains: creation of value or redistribution from stakeholders (e.g. workers)? Ex-ante problems: Same free-rider problem reduces managerial discipline Takeover defenses too Managerial short-termism under a takeover threat Reduced incentives to do firm-specific investment under a takeover threat 10