section b - Learning

advertisement

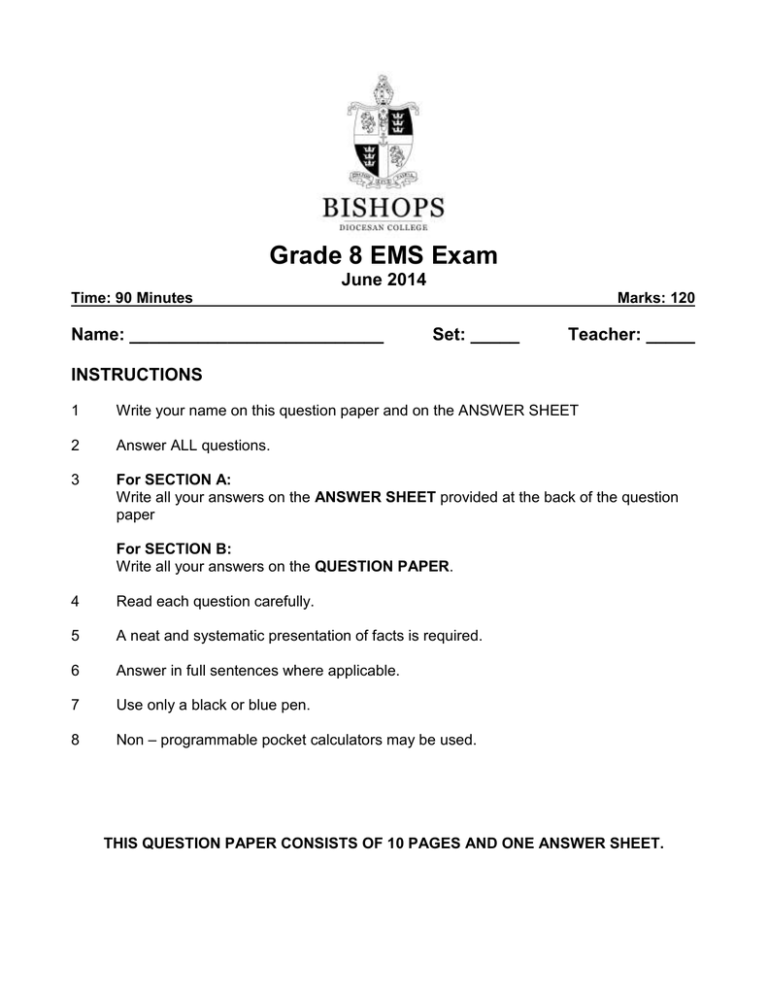

Grade 8 EMS Exam June 2014 Time: 90 Minutes Name: __________________________ Marks: 120 Set: _____ Teacher: _____ INSTRUCTIONS 1 Write your name on this question paper and on the ANSWER SHEET 2 Answer ALL questions. 3 For SECTION A: Write all your answers on the ANSWER SHEET provided at the back of the question paper For SECTION B: Write all your answers on the QUESTION PAPER. 4 Read each question carefully. 5 A neat and systematic presentation of facts is required. 6 Answer in full sentences where applicable. 7 Use only a black or blue pen. 8 Non – programmable pocket calculators may be used. THIS QUESTION PAPER CONSISTS OF 10 PAGES AND ONE ANSWER SHEET. SECTION A: QUESTION 1 For each question there are four possible answers, A, B, C and D. Choose the one you consider correct and record your choice in the appropriate space on the ANSWER SHEET provided. 1.1 Which one of the following concepts is the most fundamental to the study of economics: A. B. C. D. 1.2 Choice is an important element in the basic economic problem because A. B. C. D. 1.3 a centrally planned economy a pure market economy an economy which performs perfectly a mixed market economy When is the budget described as being “in surplus”? A. B. C. D. 1.6 a R10 note a farm a printing machine a teacher The South African economy is: A. B. C. D. 1.5 limited economic resources have many alternative uses high demand leads to higher market prices scarce economic resources are distributed equally wants increase with income What is not a factor of production? A. B. C. D. 1.4 money profit scarcity prices when government spending is smaller than government revenue when exports are smaller than imports when government spending is bigger than government revenue when the demand for money and the supply of money are equal Partnership Deeds or Articles will contain: A. B. C. D. Names and details of partners Dates and times of meetings Main activity of the business Capital contributed by the owners 2 1.7 The public limited company has at least … owners? A. B. C. D. 1.8 The owner and the life of this business are very closely related - the death of the owner will mean the demise of the business in its current form. A. B. C. D. 1.9 one two seven ten Close corporation Private company Sole trader Public company A company made R1m profit and decided to distribute the profits between the 200 000 shares issued to investors. Mr Walsh owns 250 shares in the company, he will thus receive R… in dividends. A. B. C. D. R1 000 R1 250 R8 000 R400 1.10. In a market economy, what does the entrepreneur decide? A. B. C. D. the combination of resources used the demand for the product the equilibrium price of the product the level of profits (20) QUESTION 2 Indicate with a cross (X) on the ANSWER SHEET whether each of the following statements is TRUE or FALSE. 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 2.10 The continuity of the private company is limited to the lifespan of the owners. The current Minister of Finance is Pravin Gordhan Capital goods are goods used in the production of other goods. The company uses the money received from selling shares to develop and grow the business. Wants are goods necessary for survival. Firms are producers of goods and services. In a personal budget variable expenses include items such as groceries, petrol and entertainment The government of a country has five main economic objectives. It is possible for a person to avoid an indirect tax by simply not taking part in the transaction which has been taxed In the free market economy it is the price mechanism which allocates resources. (10) 3 SECTION B QUESTION 4: (Basic Economic Concepts) 4.1 30 marks Provide a brief explanation and example of the following concepts: 4.1.1 Want: _______________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 4.1.2 Demerit good: _________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 4.1.3 Opportunity cost: _______________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) Name the FOUR ‘Factors of Production’ and the ‘Income’ earned by each of them. 4.2 Factor of Production Income 1. 1. 2. 2. 3. 3. 4. 4. (8) 4.3 Making choices involves three basic questions about production. State the three questions. 4.3.1 __________________________________________________________________ (1) 4.3.2 __________________________________________________________________ (1) 4.3.3. __________________________________________________________________ (1) 4 4.4 With reference to the ‘Traditional’ economic system answer the following questions: 4.4.1 Provide another name for the system: ____________________________________ (2) 4.4.2. Complete the table below indicating with an X as to whether there is a high or low expectancy of the economic characteristics listed: Characteristic High Low Specialisation Self Sufficiency High standard of living (3) 4.5 Identify and briefly explain TWO characteristics of a command economy. 4.5.1 Characteristic 1: _______________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 4.5.2 Characteristic 2: _______________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 4.6 Identify and explain TWO advantages of a market economy. 4.6.1 Advantage 1: __________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 4.6.2 Advantage 2: __________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 5 QUESTION 5: (Budgeting) 5.1 30 marks Provide a brief explanation of the following concepts: 5.1.1 Budget: ______________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 5.1.2 Direct tax: ____________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 5.1.3 Fiscal policy: __________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 5.1.4 Budget deficit: _________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 5.2 When we analyzed the national budget for 2014 we saw the four largest components of government expenditure were: Education: R253.8 billion General Public services: R180.0 billion Health: R145.7 billion Social protection: R144.5 billion Looking at these components, what do you think government is trying to achieve with this spending? __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (4) 6 5.3 In 2014/15, the government expects to receive R1 099.2 trillion in revenue. With the aid of the pie chart below, calculate how much of that will be raised through VAT. Show all your working. __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (4) 5.4 Examine the table below and answer the questions which follow: Taxable Income (R) 0 – 174 550 174 551 – 272 700 272 701 – 377 450 377 451 – 528 000 528 001 – 673 100 673 101 and above SARS Tax tables 2014 – 2015 Rate of Tax (R) 18% of taxable income 31 419 + 25% of taxable income above 174 550 55 957 + 30% of taxable income above 272 700 87 382 + 35% of taxable income above 377 450 140 074 + 38% of taxable income above 528 000 195 212 + 40% of taxable income above 673 100 5.4.1 South Africa follows a “progressive” income tax system. Using the information in the table to assist you, explain what this means. _________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (4) 7 5.4.2 Do you think it is a fair system considering the South African context? Explain your answer. ______________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (4) 5.4.3 Calculate how much tax a person would pay if they earn R600 000 per year. Show your working. __________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (4) 5.4.4 Give one example of a South African tax designed to change behaviour rather than to raise revenue: ______________________________________________________ (2) QUESTION 6: (Entrepreneurship and Forms of Ownership) 6.1 30 marks Provide a brief explanation of the following concepts: 6.1.1 Entrepreneur: _________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 6.1.2 Notice of incorporation: __________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 6.1.3 Dividends: ____________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 8 6.2 Identify FOUR characteristics usually associated with successful entrepreneurs: Characteristic 1. 2. 3. 4. (4) 6.3 Identify and briefly explain TWO advantages and ONE disadvantage of a being an entrepreneur. 6.3.1 Advantage 1: __________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 6.3.2 Advantage 2: __________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 6.3.3 Disadvantage 1: _______________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (2) 6.4 Explain why it is important to develop entrepreneurship in South Africa_____________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ __________________________________________________________________________ ________________________________________________________________________ (4) 9 6.5 Complete the table below with regards to the characteristics of a partnership and a private company. Characteristic Partnership Private Company Minimum and maximum number of owners? Liability of owners? Documents associated with starting the business? Name requirements for the business? Legal autonomy? (10) TOTAL: /120/ 10 Grade 8 EMS Exam June 2014 ANSWER SHEET Name: __________________________ Set: _____ 1.1 A B C D 1.2 A B C D 1.3 A B C D 1.4 A B C D 1.5 A B C D 1.6 A B C D 1.7 A B C D 1.8 A B C D 1.9 A B C D 1.10 A B C D 2.1 TRUE FALSE 2.2 TRUE FALSE 2.3 TRUE FALSE 2.4 TRUE FALSE 2.5 TRUE FALSE 2.6 TRUE FALSE 2.7 TRUE FALSE 2.8 TRUE FALSE 2.9 TRUE FALSE 2.10 TRUE FALSE Teacher: _____ 11