PPT - California Association of Realtors

advertisement

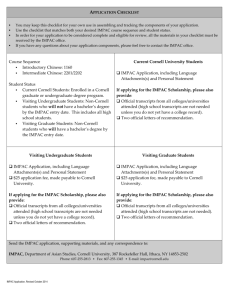

GAD Institute August 21, 2015 Alexander E. Creel Senior Vice President/Chief Lobbyist California Association of REALTORS® What is the RAA? (REALTOR® Action Assessment) Established in 2010, the REALTOR® Action Assessment (RAA) is a $49.00 assessment paid by members with their annual dues. The RAA CREPAC, CREIEC & LCRC; OR at the member’s option non-candidate political purposes. What is the RAF? (REALTOR® Action Fund) RAF is raised voluntarily REALTOR® political action committees (PACs) support candidates for elected office and issues, ballot measures and propositions. In 2015: RAF used 70% for NAR Fair Share requirements and provided 30% to local LCRC/IMPAC sub-accounts. RAF Member Participation 180,000 20% 18% 18% 175,000 16% 170,000 14% 12% 165,000 12% 12% 11% 11% 10% 160,000 8% 6% 155,000 4% 150,000 2% 157,262 160,173 168,025 175,243 171,976 2011 2012 2013 2014 2015 145,000 0% Total Membership RAF % Member Participation RAF Fundraising Standardized Template Forms • Beginning in November 2016, all AORs must use one of the Standardized Template Forms for all forms of fundraising, including in-person fundraisers and sweepstakes/contests. • If the AOR would like to repeat the same fundraiser from last year (without any changes), the AOR may do so; otherwise, the AOR must follow one of the Standardized Template Forms. An application is still required. • All fundraising applications are available at raf.car.org. • All fundraising efforts must go through C.A.R. staff (no exceptions). This includes videos, new orientation activities, fundraisers, add-on fundraising activities to existing events, etc. RAF Dues Billing Statement (DBS) DBS Audit • C.A.R. will be conducting another DBS Audit from October 1, 2015 to November 5, 2015 (If an AOR plans to send its DBS prior to October 1, please contact Lisa Edwards directly at lisae@car.org to review the DBS). • AORs must submit both paper and online screens shots to ensure compliance with the following: • “Above the Line” requirement • All RAF and RAA disclosure requirements • For more information on DBS compliance, please review the membership webinars under the AE Resource Page (car.org/members/localassociations). • Please submit DBS directly to dbs@car.org. RAA/RAF Funding Flow Chart REALTOR® Action Assessment (RAA) $49** RAA Funded Political Programs 70% CREPAC/CREIEC 30% CREPAC- in LCRC sub-accounts **$9.00 of the $49 RAA is used for program costs and the remainder is split 70/30 Voluntary Personal REALTOR® ACTION FUND (RAF) $1/$200 State PACs 70% CREPAC/FederalC.A.R. $201/$5000 CREPAC/FederalC.A.R. 30% CREPAC - in LCRC sub-accounts California Real Estate Independent Expenditure Committee (CREIEC) California Real Estate Political Action Committee (CREPAC) Local Candidate Recommendation Committee (LCRC) * This chart only reflects personal contributions to RAF What is State IMPAC? IMPAC is an issues mobilization political action committee with funding to support issue advocacy and legislative/public education efforts at state and local levels. What is Local IMPAC? Local IMPAC is a subaccount of IMPAC. Local association dollars can be used to support or oppose local policy initiatives and certain other local government affairs activities. IMPAC Funding Flow Chart Political Activities Fund (PAF) $10 per member PAF allocation to IMPAC: 10% to local IMPAC* 5% to State IMPAC** C.A.R. Annual Dues Total $184 * PAF $ allocated to local IMPAC subaccounts = 10% of a local AOR’s collection of state RAF dollars: local AORs receive $.10 of every state RAF dollar collected (e.g., local AOR X collects 10,000 state RAF dollars; local AOR X would receive $1,000). ** 5% of the state RAF dollars. *** Assume C.A.R. collects $1,000,000 ($200,000 admin. costs). The balance of $800,000 is split 70% (state)/30% (local). Giving local AORs $240,000 dollars to split based upon their membership (e.g., local AOR X has 10% of C.A.R.’s total membership; local AOR X would receive 10% of the $240,000 or $24,000). Issue Action Fund (IAF) $10 per member IAF pays ALL administrative costs for IMPAC & CREPAC/LCRC 70% of remaining IAF to state IMPAC; 30% to local IMPAC*** Uses for Local IMPAC • Ballot measure campaigns • REALTOR® issue mobilization campaigns • Dues & contributions to coalitions, receptions, events and conferences • Advocacy & policy education • Policy research & consulting services • Travel, meals & receptions associated with supporting or opposing an issue. Local IMPAC DON’TS Local IMPAC funds cannot be used: • To contribute to candidates for office • For routine local association business expenses PACs/Funds/ Assessment Overview Political Activities Fund (PAF) C.A.R. Annual Dues Total $184 ($115 + $69) $10 per member PAF allocation to IMPAC: 10% to local IMPAC 5% to State IMPAC Issue Action Fund (IAF) $10 per member REALTOR® Action Assessment (RAA) $49 RAA Funded Political Programs 70% CREPAC/CREIEC IAF pays ALL administrative costs for IMPAC & CREPAC/LCRC 70% to state IMPAC 30% to local IMPAC 30% LCRC NAR’s REALTOR® Political Party Initiative Independent Expenditure (IE) Funds RPPI provides funds to state and local associations to fund IEs for political candidates. • Total available: $796,091 +/- • Available to locals: $398,046 +/(first come first serve?) Local Candidate Recommendation Committee (LCRC) Do Local AORs have their Own PAC? No! LCRC accounts are subaccounts of CREPAC using the same tax identification entity for purposes of state and federal political laws. LCRCs are governed under the CREPAC State Bylaws. C.A.R. takes care of all government required reporting responsibilities as well as insuring compliance with established reporting regulations on the state and local level. Each local association’s LCRC subaccount balance can be accessed online at: http://www.car.org/members/localassociations C.A.R. Sponsored Legislation 2015-2016 Sponsored Bills Sponsored Bills Moving Through the 1st House: • AB --- Dept./Sec. of Housing - Governor’s Cabinet • AB 237 (Daly) Parcel Tax Vote Notification Sponsored Bills Moving Through the 2nd House: • AB 685 (Irwin) Real Estate Law Cleanup • AB 807 (Stone) Private Transfer Fees • SB 474 (Wieckowski) Credit Bids 2015-2016 Sponsored Bills (Cont.) Sponsored Bills Signed into Law by the Governor: • AB 345 (Frazier) Continuing Education Signed into law on July 13, 2015 • SB 146 (Galgiani) Team Names Signed into law on July 16, 2015 • AB 607 (Dodd) Bonds for Non-Licensees Signed into law on August 17, 2015 AB 1335 (Atkins) AB 1335 (Atkins) Recording Tax • Establishes affordable housing trust fund • Places a flat $75 per document recording tax on non-transfer real estate related documents • Maximum cap of $225 per transaction/parcel AB 1335 (Atkins) Recording Tax C.A.R. amendments: • Establish a governing board for the affordable housing trust fund to review and approve all trust fund expenditures. • Governing Board must include real estate industry representatives. • Specify that 20 percent of the trust fund must be devoted to affordable owner-occupied workforce housing. C.A.R. Opposes SCA 5 (Hancock and Mitchell) Split Roll • Assess commercial and industrial real property based upon the fair market value of the property as of the date the property tax bill is issued beginning with the 2018-19 fiscal year. • Exempts single-family and multifamily residential properties from the proposed requirements. C.A.R. Opposes: Pending hearing. SB 8 (Hertzberg) Service Taxes Imposes a tax on services which would include real estate transaction services. Transaction services: home inspection, structural pest control inspection, title insurance, escrow services, disclosure reports, brokerage, loan origination. C.A.R. Opposes: Cannot move forward this year. SB 364 (Leno) Ellis Act Dramatically weakens private property rights by allowing San Francisco to mandate a 5-year "hold period" before the purchaser of a rental unit can convert it to another use or withdraw it from the market. C.A.R. Opposes: Defeated for this year. SB 602 (Monning) Seismic safety: CA Earthquake Authority • Allows a property owner to opt into a “PACE-type” contractual assessment to finance seismic retrofitting of their property • Encourages the use of voluntary assessments by giving those assessments super-priority over other recorded obligations C.A.R. Opposes: Will not move forward this year. 2015-2016 Federal Legislative Issues • Real Estate Tax Incentives • Mortgage Interest Deduction • 1031 Exchanges • Mortgage Finance • Changes to FHA (e.g., loan limits) • Elimination of Government Guarantee • G-Fee Revenue Source Emerging Issues • Parcel Tax • Split Roll Initiative • Private Transfer Tax • Service Tax • M.I.D. Emerging Issues (Cont.) • Federal Mortgage “Reform” Privatizing the GSEs • Point of Sale mandates - Energy, water, sewers Questions?