Income Statement: Results from Discontinued Operations

advertisement

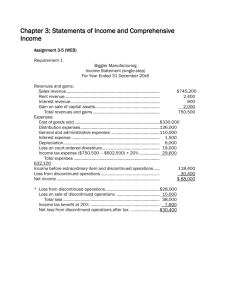

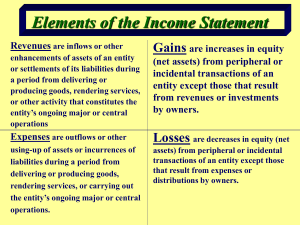

Chapter 5 The Income Statement and Statement of Cash Flows Intermediate Accounting 10th edition Nikolai Bazley Jones An electronic presentation by Norman Sunderman Angelo State University COPYRIGHT © 2007 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. 2 Concepts of Income Capital Maintenance Concept Under this concept, corporate income for a period of time is the amount that may be paid to stockholders during that period and still enable the corporation to be as well off at the end of the period as it was at the beginning. 3 Concepts of Income Capital Maintenance Concept Assume a corporation has net assets of $45,000 at the beginning and $80,000 at the end of the year, and that no additional investments or withdrawals were made. Ending net assets The corporation could Less: Additional payinvestment out $35,000 to Ending net assets excludingand investment stockholders still Less: Beginning net assets be as well off at yearTotal income for the year end. $80,000 0 $80,000 (45,000 ) $35,000 4 Concepts of Income Capital Maintenance Concept Assume a corporation has net assets of $45,000 at the beginning and $80,000 at the end of the year. Stockholders made additional capital investments of $10,000. Ending net assets $80,000 Less: Additional investment (10,000 ) Ending net assets excluding investment $70,000 Less: Beginning net assets (45,000 ) Total income for the year $25,000 5 Concepts of Income Transactional Approach The transactional approach to income measurement is Under this concept, a company records its used in accounting today. net assets at their historical cost, and it does not record changes in the asset and liabilities unless a transaction, event, or circumstance has occurred that provides reliable evidence of a change in value. 6 Concepts of Income Transactional Approach A corporation’s net income for an accounting period currently is measured as follows: Net income = Revenues – Expenses + Gains Losses 7 Conceptual Reporting Guidelines Providing information about its operating performance separately from other aspects of performance. 2. Presenting the results of particularly significant activities or events that predict the amounts, timing, and uncertainty of its future income and cash flows. 3. Providing information useful for assessing the return on investment. 1. The FASB suggests that a company’s Continued income statement can be improved by-- 8 Conceptual Reporting Guidelines Providing feedback that enables users to assess their previous predictions of income and its components. 5. Providing information to help assess the cost of maintaining its operating capability. 6. Presenting information about how effectively management has discharged its stewardship responsibilities regarding the company’s resources. 4. 9 Specific Conceptual Guidelines 1. Those items that are judged to be unusual in amount based on past experience should be reported separately. 2. Revenues, expenses, gains, and losses that are affected in different ways by changes in economic conditions should be distinguished from one another. 3. Sufficient detail should be given to aid in understanding the primary relationships among revenues, expenses, gains, and losses. Guidelines about how to report revenues, expenses, Continued gains, and losses. 10 Specific Conceptual Guidelines When the measurements of revenues, expenses, gains, or losses are subject to different levels of reliability, they should be reported separately. 5. Items whose amounts must be known for the calculation of summary indicators (e.g., rate of return) should be reported separately. 4. 11 Revenues Revenues are inflows (or increases) of assets of a company or settlement of its liabilities during a period . . . 12 Revenues …from delivering or producing goods, rendering services, or other activities that are the company’s ongoing major or central operations. 13 Revenue Recognition Recognition is the process of formally recording and reporting an item in a company’s financial statements when they are earned. 14 Revenues A company usually recognizes revenue at the time goods are sold or services are rendered. 15 Expenses …rendering services, or carrying Expenses are outflows of assets out activities that are the of aother company or incurrences of company’s ongoing majorfrom or liabilities during a period central operations.goods,... delivering or producing 16 Expenses Expenses are assets that have expired or been sold, consumed or used up during the period and have no future benefit to the business. Expenses are from the company’s ongoing major or central operations. 17 Expense Recognition Expenses should be matched or recognized in the same period as the revenues they help generate. 1. Cause and effect (cost of goods sold and commissions) 2. Systematic and rational (depreciation) 3. Immediate recognition (period costs) 18 Cost: Asset or Expense Transaction If a cost results in an economic resource providing future benefits, record it as an... Cost Asset Continue 19 Cost: Asset or Expense Transaction Cost If a cost is a result of providing goods or services in a time period, record it as an... Expense 20 Cost: Asset or Expense If the benefits have been used up, the asset is charged off to an expense. 21 Income Statement Content 1. Income from continuing operations Sales revenue (net) Cost of goods sold Gross profit Operating expenses Income from operations Other items Income from continuing operations before tax Income tax expense related to continued operations Income from continuing operations 22 Income Statement Content 2. Results from discontinued operations a. Income (loss) from operations of discontinued significant components (net of income taxes). b. Gain (loss) from disposals of discontinued significant components (net of income taxes). 23 Income Statement Content 3. Extraordinary items (net of income taxes) 4. Net income 5. Earnings per share That’s it! 24 Operating Expenses Operating expenses are those primary recurring costs (other than cost of goods sold) incurred to generate sales revenue. 25 Gains and Losses Gains and losses are reported net (not net of tax) in contrast to revenues and expenses, which are reported gross. They appear in the Other section of a multiple step income statement. 26 Income Tax Expense Income tax expense is matched against the following: 1. Income from continuing operations 2. Income (loss) from the operations of a discontinued component 3. Gain (loss) from the disposal of a discontinued component 4. Extraordinary items 5. Any prior period adjustments 6. Any items of other comprehensive income 27 Income Tax Expense Interperiod tax allocation involves allocating a corporation’s income tax obligation as an expense to various accounting periods because of temporary (timing) differences between its taxable income and pretax financial income. 28 Income Tax Expense Intraperiod tax allocation involves allocating a corporation’s total income tax expense for a period to the various components of its net income, retained earnings, and other comprehensive income. 29 Discontinued Operations What is a component? A company may decide to “discontinue” some of its operations and sell a component of these operations. 30 Discontinued Operations A component may be a subsidiary, an operating segment or an asset group. A component of a company involves operations and cash flows that can be clearly distinguished, operationally and for financial purposes, from the rest of the company. 31 FASB Statement No. 144 requires that all of the following criteria be met to qualify for “held for sale”: 1. Management has committed to a plan to sell the component. 2. The component is available for immediate sale in its present condition. 3. Management has begun an active program to locate a buyer. 4. The sale is probable within one year. 5. The component is being marketed for sale at a price that is reasonable in relation to component’s fair market value. 6. It is unlikely that management will make significant changes to the plan. Held for Sale 32 Income Statement: Results from Discontinued Operations Examples from APB No. 30 The sale by a diversified company of a major division that represented the company’s only activities in the electronic industry. 33 Income Statement: Results from Discontinued Operations Examples from APB No. 30 The sale by a meat packing company of its 20% interest in a professional football team. 34 Income Statement: Results from Discontinued Operations Income from continuing operations $93,000 Results from discontinued operations: Reported net of taxes Income from operations of discontinued Division X (net of $2,880 income taxes) $ 6,720 Loss on disposal of Division X (net of $6,000 income tax credit) (14,000 ) (7,280 ) Income before extraordinary items $85,720 Reported net of taxes 35 Income Statement: Results from Discontinued Operations Note that discontinued operations are reported on the income statement after the continuing operations, but before extraordinary items. 36 Income Statement: Results from Discontinued Operations Income from continuing operations $93,000 Results from discontinued operations: Income from operations of discontinued Division X (net of $2,880 income taxes) $ 6,720 Income before extraordinary items Element 1: operating income (loss) $85,720 37 Income Statement: Results from Discontinued Operations Income from continuing operations $93,000 Results from discontinued operations: Income from operations of discontinued Division X (net of $2,880 income taxes) $ 6,720 Loss on disposal of Division X (net of $6,000 income tax credit)(14,000 ) (7,280 ) Income before extraordinary items $85,720 Element 2: gain or loss on disposal 38 Income Statement: Results from Discontinued Operations Sale Illustration On September 30, 2007, Duvall Company sells Division C (a component of its operations) for $102,000 and incurs $2,000 of legal fees and closing costs. At the time of the sale, the book values of Division C’s assets and liabilities are $150,000 and $80,000, respectively. Duvall Company is subject to a 30% income tax rate. Continued 39 Sale Illustration Net cash received ($102,000 – $2,000) $100,000 Book value of net assets of Division C: Assets $150,000 Liabilities Net book value Pretax gain Income tax (30%) After-tax gain (80,000 ) (70,000 ) $ 30,000 (9,000 ) $ 21,000 40 Income Statement: Results from Discontinued Operations Held-for-Sale Illustration Elmo Company classifies Division M as “held for sale” at the end of 2007. Elmo Company expects to sell Division M in 2008 and estimates the fair value of the division is $200,000. At the end of 2007, the book value of Division M is $240,000. The company is subject to a 30% income tax rate. Continued 41 Fair value of Division M $200,000 Book value of net assets of Division M: Assets $330,000 Liabilities (90,000 ) Net book value (240,000 ) Pretax loss $ (40,000 ) End of 2007 Loss on Write-Down of Held-For-Sale Division M (pretax) Assets of Division M 40,000 40,000 42 Income Statement: Results from Discontinued Operations Disclosures Required by FASB Statement No. 144 A description of the facts and circumstances leading up to the sale, and, if held-for-sale, the expected manner and timing of the sale. The revenues and pretax income (loss) of the component included in its operating income (loss) reported in the results of discontinued operations section of the company’s income statement. Continued 43 Income Statement: Results from Discontinued Operations Disclosures Required by FASB Statement No. 144 If not reported separately on its income statement, the gain (loss) on the sale and the caption on the income statement that includes the gain (loss). If not separately reported on its balance sheet, the book value of the major classes of assets and liabilities. 44 Sale in a Later Accounting Period When a company classifies a significant component as held for sale, it records and reports the component at the lower of (1) its book value (book value of assets minus book value of liabilities) or (2) its fair value (the amount at which the assets and liabilities as a whole could be sold in a current single transaction) less any cost to sell. 45 Sale in a Later Accounting Period Elmo Company classifies Division M (a significant component of its operations) as “held for sale” at the end of 2007. Elmo Company expects to sell Division M in 2008 at its fair value of $200,0000 (consisting of assets with a fair value of $300,000 and liabilities with a fair value of $100,000). At the end of 2007, the book value of Division M is $240,000 (assets book value, $330,000; liabilities book value, $90,000). The company is subject to a 30% income tax rate. Continued 46 Fair value of Division M $200,000 Book value of net assets of Division M: Assets $330,000 Liabilities (90,000 ) Net book value (240,000 ) Pretax loss $ (40,000 ) End of 2007 Loss on Write-Down of Held-For-Sale Division M (pretax) Liabilities of Division M Assets of Division M 40,000 10,000 30,000 47 Extraordinary Items An extraordinary item is an event or transaction that is both unusual in nature and infrequent in occurrence. Unusual nature--the underlying event or transaction possesses a high degree of abnormality and is of a type clearly unrelated to, or only incidentally related to, the ordinary and typical activities of the company. Infrequency of occurrence--the underlying event or transaction is of a type that is not reasonably expected to recur in the foreseeable future. 48 Extraordinary Items Events that the APB Opinion No. 30 identified as not qualifying as extraordinary: The write-down or write-off of receivables, inventories, equipment leased to others, or intangible assets. 2. Gains or losses from exchanges or transactions of foreign currency. 3. Gains or losses from the disposals of a business component. 1. Continued 49 Extraordinary Items Events that the APB Opinion No. 30 identified as not qualifying as extraordinary: Other gains or losses from the sale or abandonment of property, plant, or equipment. 5. The effects of a strike. 6. The adjustment of accruals on long-term contracts. 7. The effect of a terrorist attack. 4. 50 Extraordinary Items One other item is required to be reported as an extraordinary item. As prescribed by FASB Statement No. 141, when a company purchases another company and pays less than the fair value of the other company, it reports the difference as an extraordinary gain. 51 Extraordinary Items Event No Report Gain (Loss) As Unusual? or No Infrequent? Income from Continuing Operation (Other Items section) 52 Extraordinary Items Event No Unusual? Yes and Infrequent? Yes or No Report Gain (Loss) As Extraordinary Item 53 Change in Accounting Estimate Because companies present financial information on a periodic basis, accounting estimates are necessary, and changes in these estimates frequently occur. When a company changes an accounting estimate, it accounts for the change in the current year, and in future years if the change affects both. 54 Statement of Retained Earnings Retained earnings is the link between a corporation’s balance sheet and its income statement. 55 Statement of Retained Earnings Beginning retained earnings Plus (minus): Prior period adjustment (net of $2,400 income taxes) Adjusted beginning retained earnings Plus (minus): Net income (loss) Minus: Dividends (specifically identified, including per share amounts) Ending retained earnings $59,200 5,600 $64,800 22,300 $87,100 (9,400) $77,700 56 Comprehensive Income Recall that the FASB now requires companies to report their comprehensive income (or loss) for the accounting period. A company’s comprehensive income consists of two parts: net income and other comprehensive net income. Currently, there are four items of a company’s other comprehensive income: Continued 57 Comprehensive Income 1. Any unrealized increases (gains) or decreases (losses) in the market value of investments in available-for-sale securities. 2. Any change in the excess of its additional pension liability over unrecognized prior service costs. 3. Certain gains and losses on “derivative” financial instruments. 4. Any transaction adjustment from converting the financial statements of a company’s foreign operations into U. S. dollars. 58 Comprehensive Income The FASB allows a company to report its comprehensive income under three alternatives: On the face of its income statement. In a separate statement of comprehensive income. In its statement of changes in stockholders’ equity. The company must display the statement containing the comprehensive income as a major financial statement in its annual report. 59 Comprehensive Income In reporting its comprehensive income, a company must add its other comprehensive income to net income. The other comprehensive income items may be reported at their gross amounts or net of tax. If each item is reported at its gross amount, then the total pretax amount of other comprehensive income must be reduced by the related income tax expense. A company is not required to report earnings per share on its comprehensive income. 60 Chapter 5 Task Force Image Gallery clip art included in this electronic presentation is used with the permission of NVTech Inc.