COMPUTING WAGES & SALARIES Payroll Accounting 2009

advertisement

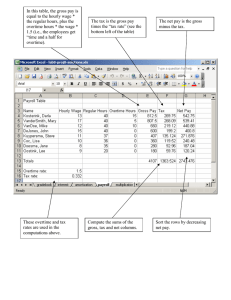

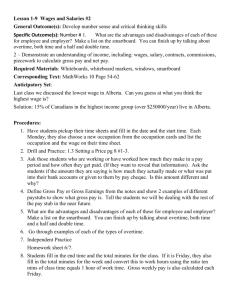

Payroll Accounting 2009 Bernard J. Bieg and Judith A. Toland COMPUTING WAGES & SALARIES Developed by Lisa Swallow, CPA CMA MS Federal Wage & Hour Law provides for two types of coverage Enterprise coverage includes all EE if Two or more work in interstate commerce and $500,000 or more annual gross sales or produce goods for interstate commerce Plus many nonprofits (schools, public agencies, etc.) regardless of annual sales volume OR Individual employee coverage EE whose company may not meet enterprise coverage, but are in a fringe occupation For example: drive for fleet that transports goods, but annual revenues = $225,000 Many family businesses are exempt! An employer is an individual who “acts directly/indirectly in the interest of an employer” in relation to an employee An individual is an employee if he/she performs services in a covered employment Common-law IRS test based on Behavioral control Financial control Relationship between two parties Statutory nonemployees considered selfemployed Direct sellers and licensed real estate agents Domestic help includes nannies, gardeners, chauffeurs, etc. These employees must earn minimum wage and overtime if: Work more than 8 hours/week or if Earn at least $1,000 in a calendar year Live in domestics need not be paid overtime Includes all rates of pay including, but not limited to Commissions Bonuses and severance pay On-call or differential Exceptions to minimum wage Training wage for first 90 calendar days of employment for newly hired EE under age 20 Retail or service establishments and farms employing FT students - 85% FT students employed at their own university - 85% Student learners at Vocational/Technical school - 75% Physically or mentally impaired employees with certification Minimum wage $6.55 until July 24, 2009 then to $7.25 [This text uses $7.25 in all calculations!] Living wage 100+ cities have local laws requiring Employers that do business with government to pay a ‘living wage’ Attempts to keep working poor’s wages on track with cost of living “Tipped employee” regularly averages $30/month in tips Small Business Job Protection Act froze minimum tipped wages at $2.13/hour, therefore tip credit = $5.12/hour EE still must make $7.25/hour when combining tips/wages (7.25 x 40 = $290 minimum weekly gross) Examples of tips received for 40-hour work week #1. Reported tips = $43 Is $85.20* (minimum tipped wage) + $43 > $290 No - ($290 - 43 = $247) so ER must pay additional wages #2. Reported tips = $1189 Is $85.20 + $1189 > $290 Yes - so ER pays $85.20 wages *40 hours x $2.13/hour = $85.20 #3. Reported tips = $111 Is $85.20 + $111 > $290 No - ($290 - 111 = $179) so ER must pay additional wages Credit card tips must be paid out to the employee by the next payday If employee works more than one job, tip credit can only be applied to job that qualifies as ‘tipped’ If a state’s tip credit differs from the federal tip credit, employer must calculate and pay their employees the higher cash wage Tip credit is same in overtime hours ($5.12/hour) Work week established by corporate policy For example 12:01 a.m. Saturday - 11:59 p.m. Friday Seven consecutive 24-hour periods Some states require daily overtime (OT) over 8 hours FLSA sets OT at 1.5 times regular pay Exception 1 - Hospital EE, overtime for 80+ hours in 14 days or over 8 hours in a day Exception 2 - Retail workers earning commission (special rules) Exception 3 - EE in public safety or emergency response can accumulate 320 hours x 1.5 = 480 hours compensatory time instead of OT Exception 4 - EE whose work doesn’t include activities from exception 3, can accumulate 160 hours x 1.5 = 240 hours compensatory time instead of OT “Exempt” means exempt from overtime provisions of FLSA White-collar workers Executives Professional Administrative Highly compensated employees Computer professionals Outside sales (no salary test for this category) To be considered exempt, must be paid at least $455/week Test of exemption Employee must be paid on salary basis See Figure 2-2 (p. 2-10) in text - certain “primary duty” requirements must be met Blue collar workers are always entitled to overtime pay Putting someone on salary doesn’t mean he/she is exempt!! Amended the FLSA Requires men and women performing equal jobs receive equal pay Applies to white-collar workers and outside salespeople as well as nonexempt workers Minimum age for most jobs is 16 Under age 18 cannot work in hazardous jobs Employees age 16 and 17 may work unlimited number of hours each week in nonhazardous jobs Under 16 years old limited to employment in retail and food/gas service: Only 7 a.m. - 7 p.m. (until 9 p.m. allowed in summer) 3 hours per day - 18 hours per week – school year 8 hours per day - 40 hours per week – summer In agricultural occupations an employee as young as 10 can work Only from 6/1 - 10/15 Hand harvest laborers outside school hours only Subject to many strict limitations ER needs to have Certificate of Age on file Violations can result in up to $10,000/offense – can’t discharge an EE whom has filed a wage-hour complaint! Employers are not required to Pay extra for weekend/holiday work Pay for holidays or vacation Limit number of hours of work for persons 16 years of age or over Give holidays off Grant vacation time Grant sick leave Prep at work station is principal activity In some situations changing in/out of protective gear may be part of workday Idle time Travel (when part of principal workday) is compensable On call time is not principal activity if employee can spend time as he/she chooses Rest periods under 20 minutes are principal activities (can’t make EE “check out”) Meal periods are not compensable time unless employee must perform some tasks while eating – generally 30 minutes or longer Work at home is principal activity if nonexempt employee Sleep time is principal activity if required to be on duty less than 24 hours Training (when for ER benefit/required) is compensable Preliminary and postliminary activities Portal-to-Portal Act defines these activities Need not be counted unless customary or contractual For example checking in/out of plant Absences due to illness Tardiness may result in ‘docked’ time, based upon system in place Must be paid for fractional parts of an hour FLSA requires employers to retain time/pay records Employer in traditional office environment can use Time sheet Time cards Computerized time/attendance records, main kinds include Card-generated systems (computerized totals) Badge systems (microchips or bar codes) Cardless or badgeless system - EE enters identification number PC-based system Next generation technology Touch screen (PC screen reads touch input) Internet; wireless transmission (cell phones, Personal Digital Assistants) Biometrics – unique characteristic such as iris scan or whole face Biweekly (26) - same hours each pay period Semi-monthly (24) - different hours each pay period Monthly (12)- different hours each pay period Weekly (52) - same hours each pay period ER can have different pay periods for different groups within same company! There are two methods Most common method Calculate gross pay (40 hrs. x employee’s regular rate) OT rate then calculated by multiplying 1.5 x employee’s regular rate x hours in excess of 40 Other method Calculate gross pay (all hours worked x employee’s regular rate) Then calculate an overtime premium (hours in excess of 40 x overtime premium rate) Hourly rate x ½ = overtime premium rate These methods result in same total gross pay! Annualize salary Calculate “regular” gross Calculate hourly pay Calculate overtime (OT) rate (1.5 x hourly rate) Add OT pay to “regular” gross FACTS: Salary quoted is $1,500/month - paid weekly - 43 hours in one pay period $1,500 x 12 = $18,000 annual $18,000/52 = $346.15 weekly gross $18,000/2,080 hours = $8.65 regular rate $8.65 x 1.5 = $12.98 OT rate $346.15 + ($12.98 x 3) = $385.09 gross FACTS: Salary quoted is $2,000/month – paid semimonthly - 4 hours OT in one pay period $2,000 x 12 = $24,000 annual $24,000/24 = $1,000 semimonthly gross $24,000/2080 = $11.54 regular rate $11.54 x 1.5 = $17.31 OT rate $1,000 + ($17.31 x 4) = $1,069.24 gross FACTS: Salary quoted is $2,000/month for 38 hour work week - paid semimonthly. Two rates in addition to semimonthly gross [regular pay between 38-40 hours/week; 1.5 after 40 hours]. Of 16 hours of OT in one pay period only 12 over 40. $2,000 x 12 = $24,000 annual $24,000/24 = $1,000 semimonthly gross $24,000/ (38 x 52)* = $12.15 regular rate $12.15 x 1.5 = $18.23 OT rate $1,000 + ($12.15 x 4) + ($18.23 x 12) = $1,267.36 gross *Denominator is always number of hours in full time year (may be different between companies) FACTS: Salary quoted is $1,600/month for 35 hour work week paid semimonthly. OT is calculated as regular hourly pay between 35-40 hours/week; 1.5 after 40 hours. Of 16 hours of OT in one pay period, 6 hours are over 40 hours weekly. $1,600 x 12 = $19,200 annual gross $19,200/24 = $800 semimonthly gross $19,200/(35 hours x 52 weeks) = $10.55 regular rate $10.55 x 1.5 = $15.83 OT rate $800 + ($10.55 x 10) + ($15.83 x 6) = $1,000.48 gross FACTS: Salary quoted is $2,200/month paid biweekly - 11.5 hours OT in one pay period $2,200 x 12 = $26,400 annual $26,400/26 = $1,015.38 each biweekly pay period $26,400/2080 = $12.69 regular rate $12.69 x 1.5 = $19.04 OT rate $1,015.38 + ($19.04 x 11.5) = $1,234.34 gross EE and ER may have an agreement that a fluctuating schedule on a fixed salary is acceptable Overtime is calculated by dividing normal salary by total hours worked – same rate each week Then an extra .5 rate is paid for all hours worked over 40 or Can divide fixed salary by 40 hours – gives different pay rate each week Then an extra .5 rate is paid for all hours worked over 40 Alternative – BELO Plan Appropriate for very irregular work schedule Deductions cannot be made for non-disciplinary absences Guaranteed compensation cannot be for more than 60 hours Calculate salary as: wage rate multiplied by maximum number of hours and then add 50% for overtime FLSA requires piecework earners to get paid for nonproductive time Must equal minimum wage with OT calculated one of two ways Note: two methods don’t give same results!! Method A Units produced x unit piece rate = regular earnings Regular earnings/total hours = hourly rate Hourly rate x 1/2 = OT premium Regular earnings + (OT premium x OT hours) = gross pay or Method B (Units produced in 40 hours x piece rate) + [(Units produced in OT) x (1.5 x piece rate)] FACTS: 4,812 units inspected in a 47.25 hour week (600 of those units produced in extra hours). Employee is paid .12 per unit. Calculate gross using both methods. Method A (4,812 x .12) = $577.44 regular piece rate earnings 577.44/47.25 = $12.22 hourly rate $12.22 x .5 = $6.11 OT premium $577.44 + ($6.11 x 7.25 hrs.) = $621.74 gross Method B (4,212 x .12) + [600 x (.12)(1.5)] = $613.44 gross Example #2 - Calculating Piece Rate Gross Pay FACTS: Inspection rate = $.08/unit. An EE inspected 6897 units in 43.5 hours. She inspected 423 of these in overtime. Calculate using both methods. Method A (6897 units x .08) = $551.76 regular piece rate earnings $551.76/43.5 hours = $12.68 hourly rate $12.68 x .5 = $6.34 OT premium $551.76 + ($6.34 x 3.5) = $573.95 gross Method B (6474 x .08) + (423 x .08 X 1.5) = $568.68 gross Special incentive plans are modifications of piece-rate plans Used to entice workers to produce more Computation of payroll is based on differing rates for differing quantities of production Example: .18/unit for units inspected up to 2000 units/week .24/unit for units inspected between 2001-3500 units/week .36/unit for units inspected over 3500 units/week Commission can be used in many combinations With base salary or stand alone As long as minimum wage provisions are met Exception are outside salespeople who are exempt from FLSA FACTS: Sam sold $40,000 of product. His quota is $31,500. He gets 2% in excess of quota. His annual base salary is $30,000. He gets paid biweekly $30,000/26 = $1,153.85 base earnings ($40,000 - $31,500) x .02 = $170 commission $1,153.85 + $170.00 = $1323.85 gross Bonuses that are part of employees’ wage rates must be included for period covered by bonus Those known in advance or set up as incentives must be added to wages for week Then divided by total hours work to get regular pay OT calculated based upon this rate Profit Sharing Plans EE shares in corporate profits – receives his/her share in the form of Cash payment Profits paid into retirement or savings account Profits distributed as stock These payments must meet standards established by Department of Labor Wage and Hour Division oversees employees’ complaints of minimum wage or OT violations Statute of limitation is two years However, if violation was willful Statute is three years “Liquidated damages” can be assessed equal to back pay and OT awards