Vocabulary-capital markets_2

advertisement

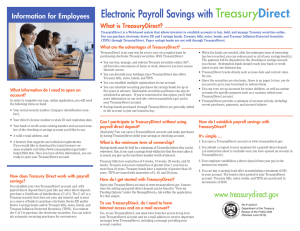

capital markets Capital markets are the electronic and physical markets in which bonds and other financial instruments such as stocks and commodities are sold to investors. Institutions such as governments and corporations use the capital markets to raise money through public offerings of bonds and stocks or through private placements of securities to institutional investors such as pension funds and insurance companies. Capital Capital’s Role in Growing the U.S. Economy In the context of the securities industry, capital describes the funding needed by businesses to help them grow and expand. The securities industry helps raise these funds for businesses by selling investment tools (such as stocks and bonds) to investors. Capital markets refer to the marketplace in which capital-raising transactions take place and these financial tools are traded. The securities industry performs two unique functions that are vital to economic development. First, it serves as an intermediary to match those who have capital with those who seek it. Those who seek capital use it to grow and expand their businesses, in turn creating jobs and providing other benefits to the U.S. economy. Second, the industry advises clients and investors on how to manage their capital investments—helping them raise their living standards by reaching financial goals related to housing, education, retirement, and other important areas. Securities firms also bring liquidity into the market through their role as market-makers. Liquidity matters because it lets investors convert assets into cash easily without creating volatility (a measure of stability) in the market. This efficiency in turn allows corporations and government agencies to readily raise long-term capital at fair prices. A high level of liquidity is one foundation of an effective, efficient market. bond (1) The written evidence of debt, bearing a stated rate or stated rates of interest, or stating a formula for determining that rate, and maturing on a date certain, on which date and upon presentation a fixed sum of money plus interest (usually represented by interest coupons attached to the bond) is payable to the holder or owner. A municipal bond issue is usually comprised of many bonds that mature over a period of years; (2) For purposes of computations tied in to “per bond,” a $1,000 increment of an issue (no matter what the actual denominations are); (3) Bonds are long-term securities with a maturity of greater than one year. broker A firm or person who acts as an intermediary by buying and selling securities to dealers on an agency basis rather than for its own account. commission The fee paid to a dealer when the dealer acts as agent in a transaction, as opposed to when the dealer acts as a principal in a transaction (see “net price”). Commissions differ in how they are calculated, such as a percentage of the value of a transaction or flat fee amount, and including whether the investor is using a bank, brokerage or online firm. Investors should be sure to ask and to understand what commission or other sales fees are charged by a broker or agent to make an investment transaction, including if such information is not provided in writing). common stock A share representing participation in the ownership of an enterprise, generally with the right to participate in dividends and in most cases to vote on major matters affecting stockholder interests. economic indicator Statistical measures of current conditions in an economy. “Leading” economic indicators such as those that track consumer confidence, factory orders, or money supply may signal short term economic strength or weakness. “Lagging” economic indicators such as business spending or unemployment figures move up or down as the economy strengthens or weakens. Economic indicators together provide a picture of the overall health of an economy or economic zone and how bond prices and yields might be affected. economic risk Economic risk describes the vulnerability of a bond to downturns in the economy. For example, virtually all types of high-yield bonds are vulnerable to economic risk. In recessions, high-yield bonds typically lose more principal value than investment-grade bonds. If investors grow anxious about holding low-quality bonds, they may trade them for the higher-quality debt, such as government bonds and investment-grade corporate bonds. This “flight to quality” particularly impacts high-yield issuers. inflation The rate of increases in the price of goods and services usually measured on an annualized basis. market price or market value For securities traded through an exchange, the last reported price at which a security was sold; for securities traded "over-the-counter," the current price of the security in the market. marketability A measure of the relative ease and speed with which a security can be purchased or sold in the secondary market. preferred stock An equity security that is junior to the issuing entity’s debt obligations but senior to common stock in the payment of dividends and the liquidation of assets. The dividend can be fixed or floating and is usually stated as a percentage of par value. Preferred stock usually has no voting rights and frequently has a mandatory or optional redemption provision. Treasury Securities U.S. Treasury securities are debt obligations of the U.S. government. These include bills, notes, bonds, TIPS, and Savings Bonds. When you buy a Treasury security, you are lending money to the federal government for a specified period of time. Treasury bills are short-term instruments with maturities of no more than one year. Treasury notes are intermediate- to long-term investments, typically issued in maturities of two, three, five, seven and ten years. Treasury bonds cover terms of more than ten years and are currently issued in 30-year maturities. Interest is paid semiannually. For more information on buying Treasury securities see the government's website www.treasurydirect.gov. U.S. Savings Bond U.S. Savings Bond A non-marketable bond issued by the U.S. Treasury in face value denominations designed for individual investors. Since savings bonds are direct obligations of the U.S. Government, the credit quality is the highest available. Each bond is a registered security for which a record is maintained by the Bureau of the Public Debt. Interest from savings bonds are exempt from state and local taxes, and unlike most investments no federal tax is due until the bond is redeemed. Two categories of bonds are currently available for purchase-Series EE and series I. For more information on purchasing savings bonds go to www.treasurydirect.gov. volatility The propensity of a security's price to rise or fall sharply.