Tactical-AssetAllocation-2002-02-20

advertisement

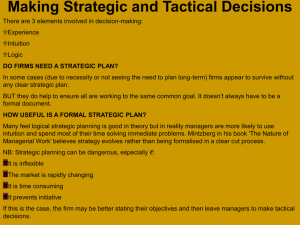

Tactical Asset Allocation Implemented by Hedge Funds Patrik Säfvenblad Tactical Asset Allocation 1 Disclaimer • Do not invest in hedge funds! – At least not without professional advice! – At least not your own money! • Trading yourself is risky, and you are sure to underperform professional investors! Tactical Asset Allocation 2 A Fund With Risk Control? $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0 9312 9406 9412 9506 9512 9606 9612 Tactical Asset Allocation 9706 9712 9806 9812 3 …Or Without? $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0 9312 9406 9412 9506 9512 9606 9612 Tactical Asset Allocation 9706 9712 9806 9812 4 Purpose • Discuss some asset allocation hedge fund styles – Systematic Global Macro – Discretionary Global Macro – Trend Following • Show – how tactical asset allocation is used in practice by hedge fund managers – How trade timing is the key issue – Various solutions to trade timing • Discuss trend following as a pure timing strategy Tactical Asset Allocation 5 My Background • Used to be Assistant Professor at SSE • Now VP Business Development at RPM Risk and Portfolio Management AB • Most of my time goes to – Evaluating trading strategies and managers – Building and evaluating hedge fund portfolios • E-mail: finpsa@hhs.se RPM • Allocates capital to hedge funds (currently 750 MUSD, 20 managers) • Measures and manages risk in hedge fund based products (Currently > 5bn USD) • Mostly futures trading strategies and other asset allocation strategies • 22 employees. Tactical Asset Allocation 6 What is a Hedge Fund? • US – Hedge funds are private unregistered investment pools for wealthy individuals or institutional investors. – Hedge funds invest in a variety of securities and use return enhancing tools such as leverage, derivatives and arbitrage – Legally structured as a private investment limited partnership (LP) or a limited liability corporation (LLC) – Typically charges a management fee (1-3%) and an incentive fee (15-25%) • Europe – A fund management firm that charges an incentive fee. • Looks to create absolute returns, I.e. returns in excess of those predicted by CAPM or other asset pricing models. Tactical Asset Allocation 7 Key Differences Between Hedge Funds and (Usual) Funds • Absolute return objective (10% to 25% per year) versus relative returns (out-performance of an index) • Often clearly stated risk objective, e.g. 20% p.a. • Market volatility presents opportunities since hedge funds can trade from both the long and short of the market • Managers compensation is primarily based on performance, not based on the size of the assets under management (better aligning interests of managers with investors) • Many funds are closed or give an explicit size at which they will close – Limited capacity for most strategies, managers try to grow by steps, e.g. 100 MUSD, 400 MUSD, 1000 MUSD in order to avoid failure – Moore returned 3bn to investors in 2001 Tactical Asset Allocation 8 Hedge Fund Fees • The fee structure is homogenous: – A management fee of a 1-3% p.a. and, – An incentive fee of 10%-30% of profits – Often a reference rate must be met before incentive fees are paid, e.g. 3 month T-bill + 200 bp. • Incentive fee gives incentive and protects from ``earnings dilution'' due to size constraints of a particular strategy • High watermark – The manager only receives the incentive fee on new ``highhighs'‘, typically calculated monthly or quarterly. – Reduces risk taking incentives of managers – Locks in investors when the fund is in ``drawdown’’ (100% participation in first profits) – Gives managers a downside Tactical Asset Allocation 9 Hedge Fund Market Growth Tactical Asset Allocation 10 Hedge Fund Styles by Assets Long/short equity 40% Other 6% Convertible arb 4% Fixed income 7% Managed futures 14% Global Macro 14% Event-driven 15% Tactical Asset Allocation Source: Tass Research arb. 11 The Strategy Universe 40% Aggressive Growth Market Timing 35% Opportunistic S&P 500 30% 25% Market Neutral Macro Event Driven 20% Fund of Funds Distressed Securities Income Convertible Arbitrage 15% MSCI World Equity Equity Arbitrage 10% Emerging Markets Average Bond Mutual Fund 5% Short Selling 0% -5% -10% 0% 5% 10% 15% 20% 25% 30% Source: Van Money Manager Research Tactical Asset Allocation 12 Capital Flows to Global Macro • Not a very popular style recently Tactical Asset Allocation 13 Ja n9 Ap 4 r-9 4 Ju l -9 4 O ct -9 Ja 4 n9 Ap 5 r-9 5 Ju l -9 O 5 ct -9 Ja 5 n9 Ap 6 r-9 6 Ju l -9 O 6 ct -9 Ja 6 n9 Ap 7 r-9 7 Ju l -9 7 O ct -9 Ja 7 n9 Ap 8 r-9 8 Ju l -9 8 O ct -9 Ja 8 n9 Ap 9 r-9 9 Ju l -9 9 O ct -9 Ja 9 n0 Ap 0 r-0 0 Ju l -0 O 0 ct -0 Ja 0 n0 Ap 1 r-0 1 Ju l -0 O 1 ct -0 Ja 1 n02 For good reasons? • It took returns of Global Macro sector 3 years to return to the April 1998 level. (CSFB index) Global Macro 350 300 250 200 150 100 50 0 Tactical Asset Allocation 14 Sources of Returns in Financial Markets 1. Taking a priced risk – Equity risk, Term premium, Liquidity premium – Does not disappear if spotted by investors – Easy - Can often be captured using passive, or systematic trading methods 2. Exploiting a price inefficiency – Pure arbitrage, Statistical arbitrage, Risky arbitrage – Hard to capture, often very information intensive 3. Exploit superior information • Know the impact of events before other investors – Disappears when spotted by investors – Hard to capture, often very information intensive Tactical Asset Allocation 15 Strategy Types • Information Based Strategies – Tries to identify mispricing using analytical work – Long/Short equity – Discretionary trading – Aggressive growth/market timing • Technical Strategies – Tries to discover Mispricing and Risk premia using technical analysis of price patterns – Trend following – Statistical arbitrage • Model Based Strategies – Tries to discover mispricing or risk premia using relative value models – Convertible arbitrage – Merger arbitrage – Relative valuation models – Macro based market timing models Tactical Asset Allocation 16 Global Macro Strategies Return generator Market Investment style Currencies Directional Equity Indices Information Diversified Commodities Model-based Technical Bonds Hedged Intraday trading Equity & options Long only Target and Bidder equity Tactical Asset Allocation 17 Possible Trading Styles, Again Return generator Market Using Manager Skill Currencies Information Investment style Directional Equities Diversified Commodities Capturing Risk Premia Hedged Equity & convertibles Model-based Intraday trading Equity & options Technical Long only Target and Bidder equity Tactical Asset Allocation 18 The Dilemma of Macro Trading "Markets can remain irrational longer than you can remain solvent.” J.M. Keynes Tactical Asset Allocation 19 The Danger of Fundamentals: Nasdaq versus S&P 500 Tactical Asset Allocation 20 Yahoo Stock Price Tactical Asset Allocation 21 Yahoo Stock Price and My Sell Recommendations Tactical Asset Allocation 22 Fundamental trading • Trading on fundamentals is one of the most common ways to profit in financial markets • Market prices can diverge from fundamentals – for several years. – by orders of magnitude • Fundamentally based (arbitrage) trading is therefore very risky and requires very explicit risk controls. – In addition to direct losses there is also opportunity cost • Lower risk for short term strategies than for long term strategies • We address the risk by finding ways to trade selectively. – Technical indicators, multiple time frames, options Tactical Asset Allocation 23 Conclusion Yahoo • The stock price of Yahoo was not related to fundamentals – Therefore trading on fundamentals is very very risky • Wait for an indication of normality before trading on fundamentals • It might make very good sense to trade on technical indicators Tactical Asset Allocation 24 Not Only a Theoretical Problem • In March 2000, Julian Robertson announced the closing of the Tiger funds blaming “irrational markets” for the fund’s poor performance. His statement was: “Earnings and price considerations take a back seat to mouse clicks and momentum”. • At the same time George Soros cut back his $8.5 billion Quantum Fund after having faced huge double-digit losses. Evidently the two largest Macro players were unable to cope with “irrational markets” during the second half of 1999 and first quarter of 2000. [Lars Jaeger]. Tactical Asset Allocation 25 Information Based: Global/Macro Quantum 4000 • • • • • Aims to profit from changes in global economies Leveraged directional bets tend to make the largest impact on performance Participates in all major markets: equities, bonds, currencies and commodities. Typically employ an opportunistic top-down approach Dynamic ``global asset allocation'' style with rapid rotation. 3000 2000 1500 1000 500 200 100 1986 1988 1990 1992 1994 1996 1998 2000 2002 0.4 0.3 0.2 0.1 0 -0.1 -0.2 • Examples: Soros, Tiger, Moore -0.3 -0.4 1986 Tactical Asset Allocation 1988 1990 1992 1994 1996 1998 2000 2002 26 Information Based: Discretionary Trading • Profiles and methods vary from manager to manager – Mostly information based – Often use technical indicators • In spite of this, performance is closely linked to volatility. 20% 20% 15% 15% 10% 10% 5% 5% 0% 0% -5% -5% -10% -10% -15% -20% -15% 95 96 97 98 99 00 01 -20% 95 Tactical Asset Allocation 96 97 98 99 00 01 27 Markets Matter for Global Macro • For both fundamental and technical trading, price volatility is necessary in order to generate profits. • Too high short term volatility triggers stop losses and reduces position size and potential profits. Tactical Asset Allocation 28 A costly false start • September 11 led to a sharp appreciation of the JPY. • This was very costly for ’Carry trades’, i.e. Borrowing JPY to invest in EUR or USD. • The manager below lost significant amounts on the spike and could not participate fully in the later Yen depreciation. Long-Term Currency Strategy 5600 close 5400 400 5200 5000 300 4800 250 4600 200 4400 4200 Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 1997 Tactical Asset Allocation 1998 1999 2000 2001 2002 29 Solution 1: Using a scoring model A scoring model can help a fundamenatl analyst cover and trade more markets, thus diversifying the overall portfolio. Tactical Asset Allocation 30 Solution 2: ‘Asymmetric’ Analysis • Although it is ’easy’ to see where the market is going, it is hard to predict when. • A solution to this dilemma is to try to predict where the market is not going. • That view is often implemented using options – if the analysis is correct, profits will come sooner or later while cost is limited. Tactical Asset Allocation 31 Example of Asymmetric Analysis ``The next chart is merely an enlargement again of this ratio. It shows the Yen at the strongest level versus the Share Index since 1996. The point here is that if traders are buying Yen because of the recent strength of the Index, they may sadly be misjudging the situation. […] The implication is clear: the Index can rally a great deal with a constant Yen to get this ratio back to “normalized” levels. This assumes of course that the Index is about to enter into a bull market. The jury is definitely out on this one. There are strong fundamental reasons to suggest that the banks are not yet fixed. More likely the Index will either fade or begin to range trade. In that case, the Yen would have to weaken on the order of 25-35% to return this ratio to “normal” levels. Of course, there is no way of knowing if the direct correlation will hold up over time. However, there is no reason for me to believe that it is in the process of inverting right now. The point is that buying Yen for the reasons mentioned […] may not be very well thought out.’’ Note negative conclusion! Tactical Asset Allocation 32 Example of Asymmetric Analysis: Graph Tactical Asset Allocation 33 Example of Asymmetric Analysis: Result • In this case the trader made profits from the analysis with approximately a 3 month lag. • September 11 triggered smaller losses than in our first example. Analysis 5600 Macro Trader close 150 Result 5400 5200 125 5000 4800 110 4600 100 4400 2000 4200 Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb 2002 Mar Tactical Asset Allocation 34 Solution 3: Combining Time Frames • By trading with different time horizons some diversification can be achieved. • Use both short-term and longer-term indicators. 109 Returns Trading at Different Frequencies 107 105 103 101 99 Tactical Asset Allocation 35 Example: Six Distinct Trading Frequencies US Bonds Trading signals are generated at six distinct trading frequencies. Signals : Blue=Buy Red=Sell 112 110 108 106 104 TF6 102 TF5 100 TF4 98 TF3 TF2 96 94 Jan/01 TF1 Mar/01 May/01 Jul/01 Sep/01 Tactical Asset Allocation The slowest frequency system trades approximately once a year on average, the fastest once a week. 36 Solution 4: Combining Technical Analysis Fundamental and • Combining time-frames implies betting more when all indicators are aligned. • Combining with fundamental with technical indicators adds an additional level of filtering. Tactical Asset Allocation 37 Combining Technical and Fundamental Signals Value versus Price 2 105 1 Combine Value and Momentum 95 0 2 90 Value + Momentum Position Value Position 100 85 -1 80 -2 75 Momentum versus Price Momentum Position 2 105 100 100 1 95 0 90 85 -1 1 95 0 105 90 -2 80 75 85 -1 -2 80 • At market extremes position risk is reduced 75 Tactical Asset Allocation 38 Combining Technical and Fundamental: USD/JPY Value versus Price 105 Signal 1 95 Price 2 Combine Value and Momentum 2 0 105 -2 Jan 95 Signal 1 75 Feb 95 Mar 95 Apr 95 May 95 95 Price 85 -1 0 Momentum versus Price 2 105 85 -1 Signal 1 95 0 90 Price 100 -2 Jan 95 75 Feb 95 Mar 95 Apr 95 May 95 85 -1 80 -2 Jan 95 75 Feb 95 Mar 95 Apr 95 May 95 Tactical Asset Allocation 39 Momentum trading • Seeks to profits from large moves (trends) in financial markets. • Typically ‘gives back’ 20-40% of profits when a trend ends • Suffers so called ‘whip-saw’ losses when markets trade in a range. Large Loss (Give-back) Small (Whipsaw) Losses Small Loss Tactical Asset Allocation 40 Fundamental Trading • Uses fundamental and relative price analysis to forecast future prices • Profits from large price moves, but loses from ‘overextended trends’. Large Loss Large Profit No Position Neutral Tactical Asset Allocation 41 As a result • Momentum trades – capture part of the upside of fundamental trading – avoid (negative capture) the losses of momentum trades. • Fundamental trades – capture part of the upside of momentum trading – avoid (negative capture) the losses of momentum trades. Tactical Asset Allocation 42 If Timing is so Important, Why Bother about Fundamentals? Trend Following as Rational Response Tactical Asset Allocation 43 Trend following • It is hard to time the market – Therefore there is room for specialists only timing the market. – These traders are typically called trend followers • Seeks capital appreciation from movements in the value of futures contracts or other exchange traded securities • Participates in all major commodities markets (equities, fixed income, currencies, metals, energies and agricultural) • Often uses high leverage to accentuate the impact of market moves • Examples: John Henry, Dunn, Eckhardt, Campbell, … Tactical Asset Allocation 44 A Trend Following CTA • Diversified directional bets on futures markets. Similar to buying a straddle on each market. • Often up to 100 positions at any one time 20% 15% 250 10% 200 5% 0% 150 -5% -10% 100 -15% 95 96 97 98 99 00 01 -20% 95 Tactical Asset Allocation 96 97 98 99 00 01 45 Some straddle examples, Nat Gas and Crude Tactical Asset Allocation 46 A portfolio of 10 straddles • OMX, Crude, Natural Gas, Cotton, S&P, Cattle, Lumber • Sharpe 0.25. Tactical Asset Allocation 47 Sector Positions Trend followers wait for large moves in markets. In this case, the trader profited from a bond market rally, a stock market fall and a yen depreciation. Other markets mostly showed small losses. Tactical Asset Allocation 48 Actual JPY position, beginning 2002 • As the JPY trend ends, short positions are gradually reduced. 5600 Transtrend - position imm j-yen close 77.5 5400 5200 77 Price 5000 4800 76.5 JPY 4600 4400 76 4200 Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 75.5 75 74.5 Position 74 0 -200 -400 5000 P&L 0 -5000 12/23 12/30 01/06 01/13 01/20 01/27 02/03 02/10 Tactical Asset Allocation 02/17 02/24 49 Diversification • Definition: Take on several independent elements of risk – The risk is reduced by approximately 1/sqrt(n) – Diversification can reduce risk to zero if there are many assets • Often diversification is only available across correlated assets. – A diversified stock portfolio never escapes the stock market risk – Statistical trading rules are often triggered in several markets at the same time • But many statistical systems may only have a small fraction of possible positions open at any one time. • Technical Analysis is easy to apply on many markets, fundamental analysis is not Tactical Asset Allocation 50 Diversification across Markets A Technical Trader Commodity 10% Stock indices 25% Currency 17% Fundamental traders tend to be specialists, while technical traders are generalists. A Fundamental Trader Metals 8% Energy 9% Stock indices 88% Interest Rates 31% Tactical Asset Allocation 51 The Value of Diversification • With diversification, Stop Loss is less necessary, meaning that future returns can be captured • This is illustrated below where A is a more focused trader with stop loss, while B uses diversification for risk control. A B Tactical Asset Allocation 52 Conclusion Tactical Asset Allocation 53 What Did We Learn? • The main problem in tactical asset allocation is timing – Risk of direct losses – Opportunity cost, I.e. missing out on other opportunities. – Risk of being stopped out from profitable trades • Ways to reduce this problem include – Trade filters such as technical filters, multiple time frames, scoring models. – Asymmetric exposure, e.g. options. • Global Macro often suffers from a lack of diversification – Analysts are specialists by definition • Pure trade timing, Trend following, is less precise than fundamental analysis, but provides better diversification. Tactical Asset Allocation 54 Patrik Säfvenblad finpsa@hhs.se +46-8-4403644 RPM Risk & Portfolio Management AB Stureplan 15 SE-111 45 Stockholm Thanks to Lars Jaeger, Richard Conyers, Warren Naphtal, Owen Brown. Tactical Asset Allocation 55