Insurance - Maria's Lessons

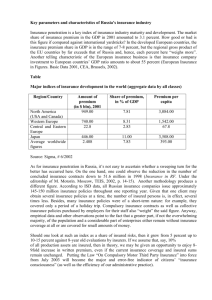

advertisement

Insurance This presentation is based on ARGE Commerce (2003): Insurance, Manz Verlag Schulbuch, Wien Mag. Maria Peer 2 Economic Importance Businesses and individuals face risks – fire, lawsuits, natural disasters, theft, illness, business interruption, accidents, death Control the financial aspects of the future Contractual agreement – one party agrees to compensate the other party for losses Insurer charges the insured a price – the insurance premium Transformation of risks into costs 3 The pooling of risk Insurance based on the idea that a certain risk Occurs only rarely in a lifetime of a single person – amounts to a higher frequence, if you regard 10,000 people The insured pay premium into a common pool – the money collected is used to Pay compensation Cover administrative costs Build up reserves for unforeseeable risks Earn a profit for the insurance company 4 Insurable – uninsurable risks uninsurable insurable No insurance company will agree to cover • specualtive risk • Business risk Covered by an insurance company – meet the criteria: • • • • Loss occurs by chance, beyond the insured‘s control Possible loss must be financially assessable and measurable Financially serious to the insured A large number of cases must be subject to the same peril – insurance companies can predict accurately how many losses will occur in the future 5 The insurance premium What the policy holder has to pay to the insurer for taking on the insurance coverage of a risk. Premium consists of Risk premium Administration costs Organisation costs Safe premium (life insurance) Additional fees 6 How are premiums fixed? How likely is it that a certain damage occurs (e.g. a broken leg in a skiing accident) Probability of loss can be estimated using records The higher the risk, the higher the amount of the premium No coverage of risks arising as a result of war, trading losses or acts of God 7 Re-insurance and Co-insurance Re-insurance: sharing risks which are too large for one insurer – taking out insurance with other insurance companies Co-insurance: sharing risks, a few insurers participate in the issue of one policy together the policy holder is informed about the division of the risk direct insurers are registered in the policy with their shares of the risk They get part of the premium The leading insurance company takes over the management 8 Insurance contract parties Insurer: party who takes on the insurance coverage of a risk against payment of a premium Policy holder: party who wishes the insurance company to take on the insurance coverage – fulfils the duty to pay the premium Insured: policy holder or contract is taken in favour of a third person Beneficiary: with a life or accident insurance, policy holder can appoint one or more persons who should get the compensation Claimant: the person to whom the policy holder must pay the compensation. The policy holder claims coverage from the insurer 9 The policy Document about the insurance contract – piece of evidence that an insurance contract has been taken out + content of the contract Basically an insurance policy shows: • Name and address of the insurer • Insured property or person • Name and adress of the policy holder • • Amount insured Extent of insurance payment • Policy number • Beginning and end of insurance contract • Date of issue of the policy • Premium, method of payment, maturity of the premium • Line of insurance • Reproduction of the signature of the insurer 10 Questions 1. 2. 3. 4. 5. 6. Who can give you information about taking out insurance? What is an insurance policy and what is shown on it? How are premiums calculated? Discuss how re-insurance works and what role it plays in the solvency of the insurance industry? Can all risks be insured? Explain the basic concept of insurance.